- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

What is the OT’s opinion on service charges on the west side of the river?

Posted on 4/26/19 at 12:11 pm

Posted on 4/26/19 at 12:11 pm

Apparently businesses in Port Allen and Plaquemine banded together and started charging a 4% service charge for using a credit card. I talked to one of the owners and he told me that every time he swipes a credit card the processing company charges him 4% of the purchase. Personally, I think should be a cost of operating a business. Maybe the moratorium should be lifted allowing bigger businesses. There is nothing on the west side of the river. Every time that it seems like I need a special item I have to travel to Baton Rouge.

Posted on 4/26/19 at 12:12 pm to Bow dude72

Wtf are you talking about?

Tons of small businesses do this

Tons of small businesses do this

Posted on 4/26/19 at 12:12 pm to Bow dude72

You see this with truck stops and diesel, and I’ve heard of minimum transaction limit for cards, but I thought cc companies charged a set amount per transaction. I guess I was wrong

This post was edited on 4/26/19 at 12:13 pm

Posted on 4/26/19 at 12:14 pm to X123F45

The mom and pop businesses are doing this I’ve used the same place for service to my vehicle. I bought some tires and was charged $36.00 credit card service fee. That was the first time I have ever been charged this fee. That’s what prompted my conversation with the owner.

Posted on 4/26/19 at 12:16 pm to Oilfieldbiology

I was thinking the same thing

Posted on 4/26/19 at 12:19 pm to Bow dude72

They are getting screwed if they are paying 4% on card present transactions. And that would only apply to credit cards, debit fees were capped by the durbin amendment.

Posted on 4/26/19 at 12:20 pm to Bow dude72

That practice is likely in violation of their merchant agreements with the credit card companies. If notified, the card companies would rebuke them and eventually end their services.

This post was edited on 4/26/19 at 12:21 pm

Posted on 4/26/19 at 12:21 pm to PuntBamaPunt

quote:

debit fees were capped by the durbin amendment.

Can you elaborate on this because I used a debit card and was charged $36.00?

This post was edited on 4/26/19 at 12:22 pm

Posted on 4/26/19 at 12:22 pm to Bow dude72

This is what you get for not shopping Wal-Mart or Amazon

It's like the fee the non bank account holders have to pay at the check cashing place.

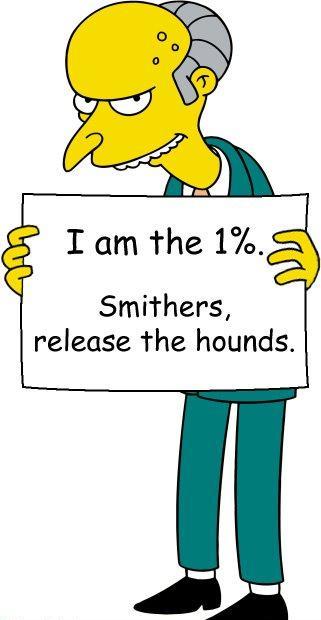

In essence, you are a poor

It's like the fee the non bank account holders have to pay at the check cashing place.

In essence, you are a poor

Posted on 4/26/19 at 12:28 pm to Bow dude72

They like cash

Easier to hide cash from uncle sam

Easier to hide cash from uncle sam

Posted on 4/26/19 at 12:30 pm to SwatMitchell

quote:

That practice is likely in violation of their merchant agreements with the credit card companies. If notified, the card companies would rebuke them and eventually end their services.

Anymore they are generally fine in the merchant's agreements, they just have to have a notice at the POS and it has to be clearly defined on the receipt. They are legal in most states.

It has to be either the actual charge or 4% whichever is lower. It is not charged on debit cards.

BTW these are different and have different rules from convenience fees which are allowed for alternate payment methods outside the norm.

Posted on 4/26/19 at 12:31 pm to danfraz

Nope I’m definitely not poor. I just thought it would be an interesting conversation.

Posted on 4/26/19 at 1:08 pm to Bow dude72

quote:

Can you elaborate on this because I used a debit card and was charged $36.00?

unless you put in your pin number, it was likely run as a credit card and not debit. Most bank debit cards function as both for user convenience.

Posted on 4/26/19 at 1:13 pm to Bow dude72

quote:

Personally, I think should be a cost of operating a business.

this is such silly logic. Of course it's a cost of doing business. A cost that is then redirected to the consumer, as are ALL "costs of doing business". They are simply charging it as a distinct line item because it's subjective based on the transaction amount. I suppose they could just increase all the prices on the shelf by 4% but then they'd be overcharging, and subsequently losing, cash customers. Consumers are gullible and ignorant, generally speaking of course.

This post was edited on 4/26/19 at 1:13 pm

Posted on 4/26/19 at 2:06 pm to Bow dude72

Every business does this.

Posted on 4/26/19 at 2:17 pm to Bow dude72

quote:

Can you elaborate on this because I used a debit card and was charged $36.00?

For debit trx, the fees that acquirers can charge the business are regulated by congress and are essentially pennies. (debit = swipe + PIN / chip + PIN)

For credit trx, it's somewhat of the wild west and 4% isn't unheard of (though odd for retail). The US market is so saturated with acquirers that fees are pretty similar across industry unless it's High Risk business.

TL;DR The business probably paid the processor ~$0.50 for the transaction that they charged you an extra $36 on.

This post was edited on 4/26/19 at 2:18 pm

Posted on 4/26/19 at 2:23 pm to Bow dude72

quote:

I used a debit card and was charged $36.00?

quote:

Q. Can I assess a surcharge on both credit and debit card purchases? No. The ability to surcharge only applies to credit card purchases, and only under certain conditions. U.S. merchants cannot surcharge debit card or prepaid card purchases.

Bold mine

VISA

Posted on 4/26/19 at 2:46 pm to Oilfieldbiology

quote:

I thought cc companies charged a set amount per transaction. I guess I was wrong

Credit card fees are usually a per swipe plus a % fee. For instance, 30 cents per swipe plus 2.5-3%. That's why you'll see a $5 min on credit card purchases.

As mentioned earlier, it is only a debit card transaction if you put in your PIN. That's why merchants don't mind you getting cash back on a debit card, because they only pay a per swipe fee on it.

Posted on 4/26/19 at 3:30 pm to Bow dude72

If they are paying 4% tonthe processing companies, they are getting ripped off. And a lot of times, their contract with the processing companies have language that do not allow these fees

Posted on 4/26/19 at 3:33 pm to CubsFanBudMan

quote:they are usually a per swipe OR a percentage. If you are getting charged both, you are getting fricked

Credit card fees are usually a per swipe plus a % fee. For instance, 30 cents per swipe plus 2.5-3%. That's why you'll see a $5 min on credit card purchases.

Popular

Back to top

10

10