- My Forums

- Tiger Rant

- LSU Score Board

- LSU Recruiting

- SEC Rant

- SEC Score Board

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Posted on 9/11/23 at 1:19 pm to chalmetteowl

Wife and I want to build in 3-5 years on our land.

Recession may help that price if the timing works out.

Recession may help that price if the timing works out.

Posted on 9/11/23 at 1:22 pm to BoogaBear

A recession doesn’t necessarily mean lower rates and quite frankly I don’t think they will be able to significantly lower rates for several years if they truly want to tame inflation

Posted on 9/11/23 at 1:34 pm to weadjust

quote:

quote:I’m a home builder. I have a buildup of customers who are waiting for rates to fall. If and when they fall, my pricing will skyrocket. It they are waiting for sub 5% mortgage rates they may live long enough to build a new home. If homeowners with 40% debt get in financial trouble. They are going to quit paying student loans, credit card debt and auto loans before defaulting on the mortgage.

I don’t think they are waiting on sub 5. Probably sub six. They would be better off building now and refi later, even with the costs associated. 2 are signing. The others probably will. If rates were to go to 5 my costs would skyrocket.

Keep in mind I’m a builder, not a real estate company. 80% of my business is presale on customers property. 20% speculative. I don’t get too wrapped up in subdivisions or McMansions. It’s a more stable model than trying to compete with Horton.

Posted on 9/11/23 at 1:34 pm to chrome_daddy

quote:

I think the better question for you is, why do you post these articles?

I find it interesting and enjoy other's opinions on the subject. There are a ton of successful people posting here and many of whom I respect what they have to say on certain topics.

quote:

Does it impact your business?

Yes, it can. We stay busy no matter what but to stay busy I have to adjust to market trends to keep leading things in the right direction.

quote:

what say you about how your fellow OT'ers should act on all this news?

If I knew the answer to that I would be Elon Musk level wealthy as would anyone. Even the people who called the sub-prime mess months before it happened are at a loss to explain why things are able to keep trucking along right now.

Posted on 9/11/23 at 1:37 pm to ronricks

quote:

No housing market crash.

Inventory just can't keep up with demand. Now, there should be an uptick in supply when the big Boomer "die off" begins in earnest over the next ten years, but it will not be a massive surge all at once, more like a slow pressure release valve.

Posted on 9/11/23 at 1:40 pm to SPT

This was one of the 5 posts you'll make this year?

Posted on 9/11/23 at 2:07 pm to wileyjones

quote:

DR Horton is on a fricking tear despite this

Dr Horton has figured out that instead of building spec homes they can build rental neighborhoods. They will co tinie to do well.

Posted on 9/11/23 at 2:17 pm to XenScott

quote:

I’m a home builder. I have a buildup of customers who are waiting for rates to fall. If and when they fall, my pricing will skyrocket.

Due to demand?

Posted on 9/11/23 at 2:26 pm to TigerCoon

quote:

This was one of the 5 posts you'll make this year?

And? What’s that have to do with anything? Some people don’t live and die by Tigerdroppings!

Posted on 9/11/23 at 2:31 pm to baobabtiger

DR Horton is going to learn that long term the renting model is a loser and it will drive down the value of his neighborhoods. It doesn’t matter what you build but especially cheap, vinyl siding rentals, tenants will not take care of them in low income areas which is where he generally builds

Posted on 9/11/23 at 3:35 pm to SECdragonmaster

quote:

I think the reckoning is getting closer. I saw where the Saudi’s are getting out of holding US treasury securities.

Their jumping into BRICS has me concerned as well.

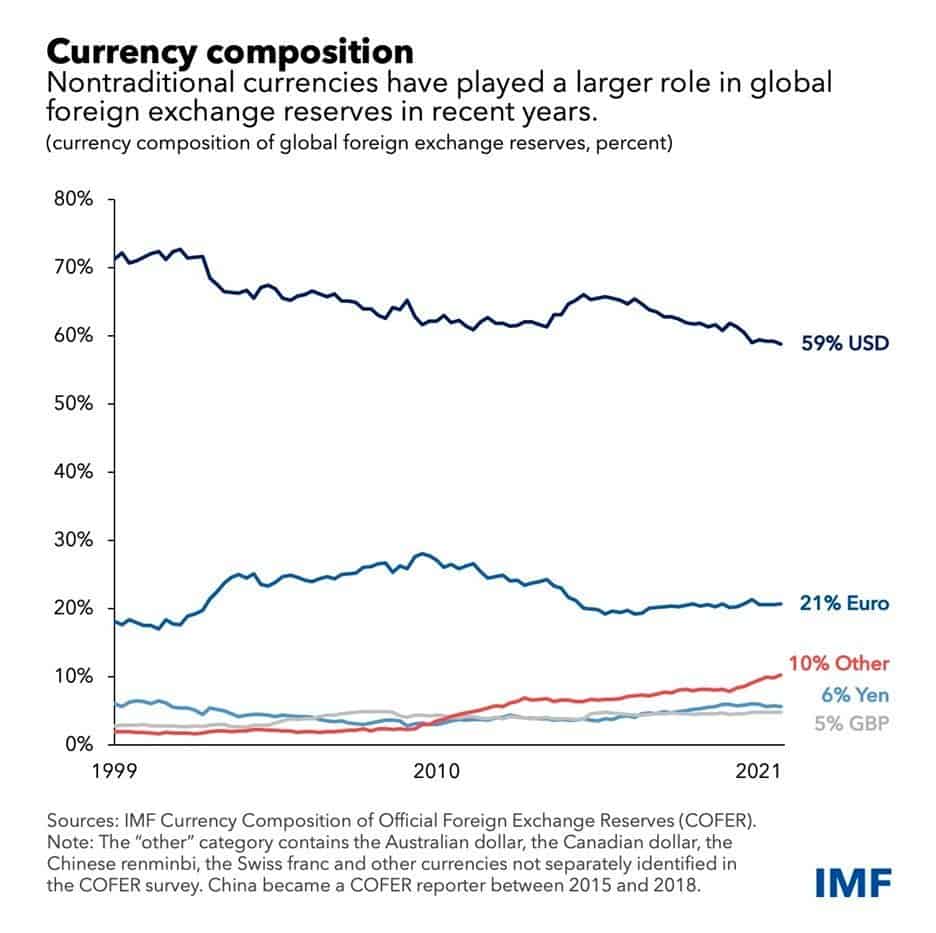

With the USD being a fiat currency, part of its value comes from being the world's primary reserve currency. Part of that reserve currency status comes from the dominance of the petrodollar (oil being traded internationally with Dollars). If BRICS is able to actually pull off creating their own petro-currency, the Dollar's value would plummet as BRICS represents the majority of world oil production (80%), a sizeable amount of total oil exports (~40% if all of the currently applying countries were to be approved) and a nearly equal amount of oil imports (BRICS countries account for ~33% of all oil imports).

Even if they just mandate trading on their own currency among member nations, that's any oil traded between Russia, China, India, Brazil, South Africa, UAE, Saudi Arabia, Argentina (but that may change), Egypt, Iran and Ethiopia. Waiting in the wings (countries who have applied formally to join but aren't in yet) are Algeria, Bahrain, Bangladesh, Belarus, Bolivia, Cuba, Honduras, Kazakhstan, Kuwait, Palestine, Senegal, Thailand, Venezuela and Vietnam.

With that, Afghanisan, Angola, Comoros, DR Congo, Gabon, Guinea-Bissau, Nicaragua, Pakistan, Sudan, Syria, Tunisia, Turkey, Uganda and Zimbabwe have all expressed interest in possible membership.

While that's not the EU, Canada and Mexico, it's still enough that it should cause concern, especially if a majority of them follow the Saudi lead in getting out of US securities. Those two things would create a lot of excess USD's just sitting around doing nothing (nothing but lowering value, that is).

I'm not sure what the crew in DC have been doing since FY1999 to keep the USD dominant, but it's not working.

Right now we're the skinniest kid at fat camp, but some others are losing weight while we're sneaking out to double-down on buffets at the Golden Corral.

Posted on 9/11/23 at 5:20 pm to SDVTiger

quote:

Loans were all stated income

No they weren't. A lot yes.

But what no one talks about is the fact that someone with 20% equity would use that to pay off their credit card debt.

Their mortgage would go from $850 a month to $1050 a month. Erasing $550 a month of Credit Card debt.

What NO ONE and I mean no one seems to mention is that people would run those credit cards right back up. The mortgage lenders would pay off those credit cards and PEOPLE DID NOT CLOSE THEM. THEY SIMPLY RAN THEM RIGHT BACK UP.

So now they have a year later, $1050 Mortgage and $550 credit card debt. That really had more to do with crashing the economy then no income verification loans. It all played apart.

I worked in the industry for years. I watched it all happen

Popular

Back to top

1

1