- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Borrowers stopped paying mortgage in June '07. Bank didn't foreclose until May '23

Posted on 10/5/23 at 8:01 am

Posted on 10/5/23 at 8:01 am

16 years of no rent or mortgage must have been nice. No wonder they fought to keep it by saying the statute of limitations had run out.

LINK

If only they had documented June 1st as the default date and filed an answer

quote:

The Honorable Natalie White out of the 56th Circuit recently refused to enter a judgment on the pleadings as requested by the defendant-borrowers in a foreclosure action filed in Livingston County, Kentucky. JPMorgan Chase Bank, National Assoc. v. Mary Quertermous, etc., Livingston Circuit Court Case No. 23-CI-00042. The borrowers asserted in their motion for judgment that they were entitled to release of the mortgage and dismissal of all claims since JPMorgan’s foreclosure action was barred by the 15-year statute of limitations codified at Ky. Rev. Stat. Ann. § 413.010.

The borrowers argued that the statute of limitations barred the foreclosure of their mortgage since the payment default was June 1, 2007, and JPMorgan filed its foreclosure action on May 23, 2023, more than 15 years from the date of the borrowers’ original payment default. The bank countered that procedurally the motion for judgment was premature. The pleadings were not formally closed as required by Kentucky’s Civil Rule 12.03 because the borrowers failed to file a timely answer to the complaint.

JPMorgan also argued substantively that the borrowers failed to sustain their burden of proof on their statute of limitations defense. JPMorgan demonstrated that the borrowers failed to demonstrate from the pleadings that the 15-year statute of limitations started running on June 1, 2007, rather than a later date.

Judge White agreed with the bank on both grounds and entered an order denying the borrowers’ motion for judgment on the pleadings. This was a correct interpretation of the law and provides an opportunity for the matter to be resolved on the merits.

Ky. Rev. Stat. Ann. § 12.03 reads in pertinent part: “After the pleadings are closed but within such time as not to delay the trial, any party may move for judgment on the pleadings …”

LINK

If only they had documented June 1st as the default date and filed an answer

This post was edited on 10/5/23 at 8:03 am

Posted on 10/5/23 at 8:06 am to stout

I'm sure their 401k is stacked after 16 years with no mortgage

Sarcasm [ON] OFF

Sarcasm [ON] OFF

Posted on 10/5/23 at 8:10 am to stout

Take a look at HI foreclsoure process. Takes years

Knew many locals that didnt pay for years and collected huge rents

Then it ended up getting modified

Knew many locals that didnt pay for years and collected huge rents

Then it ended up getting modified

Posted on 10/5/23 at 8:13 am to stout

I’ve never not paid my bills so don’t understand how all this works. They just kept paying the taxes I’d assume, what about the insurance?

Posted on 10/5/23 at 8:14 am to SDVTiger

quote:

Take a look at HI foreclsoure process. Takes years

Knew many locals that didnt pay for years and collected huge rents

Then it ended up getting modified

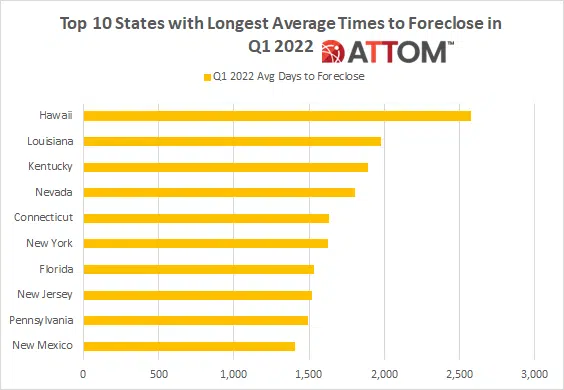

LA is up there for the length of time needed to complete a foreclosure

Let me see if I can find the list of the top ten but we are pushing like 5 years on average in LA

ETA:

List from 2022 but LA is still up there in 2023 last I saw

LINK

ETA 2 list from 2023 LA still ranked at the top

quote:

States with the longest average foreclosure timelines for homes foreclosed in Q2 2023 were Michigan (2,601 days); Louisiana (2,252 days); New York (1,966 days); Hawaii (1,934 days); and Kentucky (1,921 days).

States with the shortest average foreclosure timelines for homes foreclosed in Q2 2023 were Wyoming (104 days); Minnesota (145 days); Montana (160 days); Texas (162 days); and Missouri (170 days).

LINK

This post was edited on 10/5/23 at 8:19 am

Posted on 10/5/23 at 8:17 am to stout

So its close to 7yrs for the Islands

This post was edited on 10/5/23 at 8:19 am

Posted on 10/5/23 at 8:20 am to SDVTiger

quote:

So its close to 7yrs for the Islands

See my second edit for 2023. HI is moving the average down now since they changed. LA is still at 5+ years.

MI moved up because they didn't foreclose on anything during CV19 and courts are backed up.

This post was edited on 10/5/23 at 8:21 am

Posted on 10/5/23 at 8:32 am to SDVTiger

I don't cover WY but I cover TX and the process there is quick. Constables handle evictions in TX and will have your shite in the front yard before you know what is happening.

Then all the Mexican neighbors steal your shite before you can get it to a storage unit. We have done evictions and advised people to leave one person standing guard or else they will have nothing left. It's like a swarm of ants as soon as the constable leaves and stuff is left unguarded.

They all drive around like vultures watching just waiting for the constable to leave.

Then all the Mexican neighbors steal your shite before you can get it to a storage unit. We have done evictions and advised people to leave one person standing guard or else they will have nothing left. It's like a swarm of ants as soon as the constable leaves and stuff is left unguarded.

They all drive around like vultures watching just waiting for the constable to leave.

Posted on 10/5/23 at 8:40 am to SDVTiger

quote:

So its close to 7yrs for the Islands

hell, it would be almost off your credit by that point

Posted on 10/5/23 at 8:43 am to stout

How the frick does something like this happen?

I figure that the bank didn’t push foreclosure hard in 2008 for obvious reasons but they just fell through the cracks after that?

I figure that the bank didn’t push foreclosure hard in 2008 for obvious reasons but they just fell through the cracks after that?

Posted on 10/5/23 at 8:49 am to teke184

Livingston County is a small county out near Paducah. So my guess is the original Judge either made an incorrect ruling or it’s just sat in courts waiting.

Posted on 10/5/23 at 8:50 am to BluegrassBelle

That somewhat answers my question… the problem is likely with the courts and not with the bank just letting it slide.

Posted on 10/5/23 at 8:52 am to teke184

quote:

but they just fell through the cracks after that?

Very possible. There were so many foreclosures during that 4-year span that a lot of mistakes were made. There are people whose houses were secured by the bank that were never even in foreclosure. A lot of those cases were settled quietly but one got a judgment against the bank who never paid so they showed up at the local branch to foreclose on it.

A Florida Couple 'Forecloses' On Bank Of America

Posted on 10/5/23 at 8:55 am to stout

Can only imagine how fat my bank account would be if i didnt have a mortgage to pay for 16 years.

Posted on 10/5/23 at 9:00 am to stout

JPMorgan has clearly had bigger fires to put out over that timeframe.

Posted on 10/5/23 at 9:53 am to FLObserver

quote:

an only imagine how fat my bank account would be if i didnt have a mortgage to pay for 16 years.

Reduced mine significantly a few months ago and I can attest, it doesn’t take long to stack it

Posted on 10/5/23 at 10:08 am to stout

I had a home in Bossier City. My next door neighbor got caught banging a neighbor and nasty divorce ensued. He, soon to be ex wife and kids all moved out and told the bank they were defaulting on the loan. A year later the grass was getting out of control and I called him and asked what bank so I could get them to mow.

Called Wells Fargo and they said they hadn't started the paperwork yet. Called Clerk of Court and property was still in my neighbors name. Called him and told him to call the bank. They told him he was welcome to move back into the home and maintain it in the interim. It was almost two more years before they finished the proceedings and he had to leave.

Called Wells Fargo and they said they hadn't started the paperwork yet. Called Clerk of Court and property was still in my neighbors name. Called him and told him to call the bank. They told him he was welcome to move back into the home and maintain it in the interim. It was almost two more years before they finished the proceedings and he had to leave.

Posted on 10/5/23 at 10:27 am to stout

quote:

16 years of no rent or mortgage must have been nice. No wonder they fought to keep it by saying the statute of limitations had run out.

You’d think after 16 years of no mortgage they would be able to afford better lawyers

Posted on 10/5/23 at 10:30 am to FLObserver

quote:

Can only imagine how fat my bank account would be if i didnt have a mortgage to pay for 16 years.

Knowing my dumbass, probably the exact same as I’d just spend it. I have a reserve I feel comfortable with so after deposits to 401K, investment funds, savings, and kids’ investment funds, it’s no holds barred

Popular

Back to top

18

18