- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Another shaky sign of a lost generation: Welcome to the #YOLO economy

Posted on 5/15/21 at 6:59 am

Posted on 5/15/21 at 6:59 am

NYT

THIS next passage is the truly scary part and the one that should resonate:

THAT AIN'T GOOD GUYS. But their argument has a lot of truth to it. This generation of people about 28-40 (the "millennials") have had their economic future destroyed, effectively. Now, with the pandemic economy, basic staples like housing are being dragged out of reach. The traditional path has been largely eliminated so what is there? Incredibly risky, debt-reliant gambling, effectively.

The nihilism is scary, but even scarier is what happens when the "crazy" being rewarded crashes down and closes another door for these people? The economy no longer makes rational sense anymore. Luck (primarily based on timing) is the predominant factor in wealth accumulation right now and the flip side is that as these bubble economies crash, the unlucky will find themselves in dire situations.

This is some legitimate dystopian black comedy stuff unfolding in real time.

Don't fight it son. Confess quickly! If you hold out too long you could jeopardize your credit rating.

quote:

Something strange is happening to the exhausted, type-A millennial workers of America. After a year spent hunched over their MacBooks, enduring back-to-back Zooms in between sourdough loaves and Peloton rides, they are flipping the carefully arranged chessboards of their lives and deciding to risk it all.

quote:

They are emboldened by rising vaccination rates and a recovering job market. Their bank accounts, fattened by a year of stay-at-home savings and soaring asset prices, have increased their risk appetites. And while some of them are just changing jobs, others are stepping off the career treadmill altogether.

THIS next passage is the truly scary part and the one that should resonate:

quote:

Individual YOLO decisions can be chalked up to many factors: cabin fever, low interest rates, the emergence of new get-rich-quick schemes like NFTs and meme stocks. But many seem related to a deeper, generational disillusionment, and a feeling that the economy is changing in ways that reward the crazy and punish the cautious.

THAT AIN'T GOOD GUYS. But their argument has a lot of truth to it. This generation of people about 28-40 (the "millennials") have had their economic future destroyed, effectively. Now, with the pandemic economy, basic staples like housing are being dragged out of reach. The traditional path has been largely eliminated so what is there? Incredibly risky, debt-reliant gambling, effectively.

The nihilism is scary, but even scarier is what happens when the "crazy" being rewarded crashes down and closes another door for these people? The economy no longer makes rational sense anymore. Luck (primarily based on timing) is the predominant factor in wealth accumulation right now and the flip side is that as these bubble economies crash, the unlucky will find themselves in dire situations.

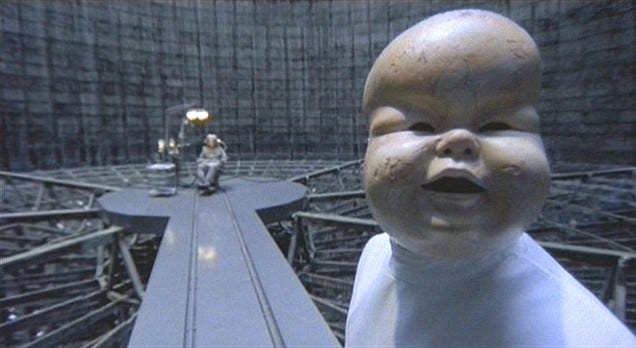

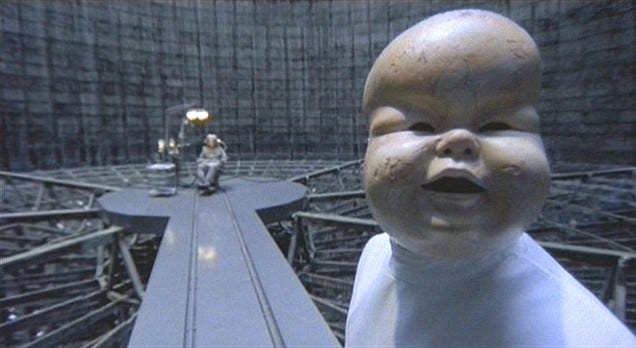

This is some legitimate dystopian black comedy stuff unfolding in real time.

Don't fight it son. Confess quickly! If you hold out too long you could jeopardize your credit rating.

Posted on 5/15/21 at 7:02 am to SlowFlowPro

quote:

This generation of people about 28-40 (the "millennials") have had their economic future destroyed, effectively. Now, with the pandemic economy, basic staples like housing are being dragged out of reach. The traditional path has been largely eliminated so what is there? Incredibly risky, debt-reliant gambling, effectively.

That's not really true unless you got a useless degree like gender studies and saddled yourself with tremendous debt.

Posted on 5/15/21 at 7:07 am to SlowFlowPro

quote:

Luck (primarily based on timing) is the predominant factor in wealth accumulation right now and the flip side is that as these bubble economies crash, the unlucky will find themselves in dire situations.

A lot of the problem is everyone wants it RIGHT NOW! Hardly anyone wants to build wealth slowly and steadily over time.

Leaving college with tons of debt only to find that their new skills and zero experience aren't worth more than $40K per year probably creates some of that urgency too. Another factor is social media has greatly increased the fear that you are behind your peers.

I still think the best course for many is to learn a trade. Trades are a dying breed and as that happens more and more the demand will only go up. Tons of tradesmen get out of trade school after a year or two with no debt and have a faster path to 6 figures than a lot of college degrees. A/C, plumbers, and electricians have been making bank in SWLA from the storms.

This post was edited on 5/15/21 at 7:08 am

Posted on 5/15/21 at 7:09 am to SlowFlowPro

That’s fine.

I’ll be okay in a decade after my ETFs weather the storm.

I’ll be okay in the next few years when everyone spends their extra inflated money and I continue my same savings plan and cut back on extraneous spending because the prices are too damn high.

I’m 36 BTW.

I’ll be okay in a decade after my ETFs weather the storm.

I’ll be okay in the next few years when everyone spends their extra inflated money and I continue my same savings plan and cut back on extraneous spending because the prices are too damn high.

I’m 36 BTW.

Posted on 5/15/21 at 7:10 am to SECSolomonGrundy

quote:

That's not really true unless you got a useless degree like gender studies and saddled yourself with tremendous debt.

This article isn't about the unsuccessful. This is about people with useful degrees who were making it, in spite of the 2008 crash's effect on their future, who then face the Covid-crash of 2020.

Posted on 5/15/21 at 7:13 am to SlowFlowPro

quote:

This is about people with useful degrees who were making it, in spite of the 2008 crash's effect on their future, who then face the Covid-crash of 2020.

I may be cynical because I deal a lot with foreclosures but many of those people didn't learn a lesson the first time and still had a huge debt load this time around.

Posted on 5/15/21 at 7:13 am to SlowFlowPro

quote:

The nihilism is scary, but even scarier is what happens when the "crazy" being rewarded crashes down and closes another door for these people

I think these people are the unmarried and childless.

And they are typically that way for a reason. What percentage of millennials are in this situation vs Gen X or Boomers when they were in their 30s?

Posted on 5/15/21 at 7:16 am to stout

quote:

A lot of the problem is everyone wants it RIGHT NOW! Hardly anyone wants to build wealth slowly and steadily over time.

I do agree with this, and it extends to more than just wealth. Housing (and even more, decorating that house) has this same pattern. Nobody wants "starter homes" these days and it's all about over-buying super nice housing. Then you have to have perfect decoration with matching blah blah blah.

But, on the flip side, these people have had their prospects decimated by 2, 100-year events back to back. And they see people who do get rich "right now" and it's hard to not want to dangle your toes in those waters.

Posted on 5/15/21 at 7:19 am to OleWar

quote:

What percentage of millennials are in this situation vs Gen X or Boomers when they were in their 30s?

The entire point is that you can't compare the generations. In terms of economic growth/stability, Millennials have it incredibly worse. Older millennials like me are absolutely fricked, long-term.

Posted on 5/15/21 at 7:20 am to StringedInstruments

quote:

I’ll be okay in a decade after my ETFs weather the storm.

I’ll be okay in the next few years when everyone spends their extra inflated money and I continue my same savings plan and cut back on extraneous spending because the prices are too damn high.

You see the disillusioned referenced in OP would tell you the impending inflation is going to wreck this, so what's the point?

Posted on 5/15/21 at 7:24 am to SlowFlowPro

quote:

Older millennials like me are absolutely fricked, long-term.

Not true. There are still opportunities even in the face of disasters. You just have to be smart enough to take advantage.

I stopped thinking I would rely on social security and 401ks a long time ago and have begun dumping more money into more rental units. IMO, RE is still the best wealth builder for the average American. There's a reason that before the dot com boom real estate had created more millionaires than any other industry.

Posted on 5/15/21 at 7:26 am to SlowFlowPro

quote:

ways that reward the crazy and punish the cautious

Depends solely on location.

I live in a low COL area, and my wife and I have been greatly rewarded by being extremely risk averse and "conservative" in our living.

Graduate high school

Graduate college

Get full time jobs

Work hard

Buy a starter home

Save for retirement

Have a kid after all of the above

Our income is purely middle class, but we have leapt over tons of our neighbors and peers simply by not spending money on frivolous bullshite.

No vacations every year

No $800/mo car note

No kids before we got married

No new clothes every season

No cigarettes or drugs

No weekly or nightly bar tab

Christmas and Birthdays combined cost < $500

Do you have any idea how many people I know that make double what I do and live paycheck to paycheck because they make the stupidest fricking financial decisions possible?

My boss once traded in 4 cars in 4 years, financing the negative equity every time, until she ended up with an $850 car note on a $45k car. That's more than my mortgage. She makes double my salary and has 0 assets except her car. Could have bought a house on her own 6-7 years ago and be +100% in equity.

I couldn't tell you how many part time workers I have that make $1200/mo and spend $300-400 on smokes and booze and weed. No career prospects, no education, no initiative. When you throw away all your actual resources, I guess it makes sense to make stupid gambles.

Also, since when was "getting rich" the primary aspirational goal of society? If you value stability and family and ownership of your future, you can still control that far more easily than getting to some specific number of zeroes in your bank account.

This post was edited on 5/15/21 at 7:29 am

Posted on 5/15/21 at 7:27 am to stout

quote:

RE is still the best wealth builder for the average American.

Right now is a pretty shitty time to be buying a starter home or being a first time home buyer. Wild market, and jacked up material cost

Posted on 5/15/21 at 7:27 am to SlowFlowPro

Wypipo.

This author isn’t talking about the urban black male.

This author isn’t talking about the urban black male.

Posted on 5/15/21 at 7:29 am to Dire Wolf

quote:

Right now is a pretty shitty time to be buying a starter home or being a first time home buyer. Wild market, and jacked up material cost

I agree but the market will adjust accordingly in due time.

Posted on 5/15/21 at 7:30 am to SlowFlowPro

quote:

The entire point is that you can't compare the generations. In terms of economic growth/stability, Millennials have it incredibly worse

If we are not comparing generations, then why are you using the comparative term for bad?

And if you are fricked, it probably has more to do with a whole bunch of other factors as opposed to when you are born, but not saying that is not a partial factor.

Posted on 5/15/21 at 7:31 am to SlowFlowPro

quote:

You see the disillusioned referenced in OP would tell you the impending inflation is going to wreck this, so what's the point?

The economy ebbs and flows. We’ve had fricked up moments in the past. If we aren’t going to recover, then we have bigger issues than saving or not saving. Smart investments or dumb ones.

I’ll continue to believe that we can figure these issues out and the millennials who participate in the YOLO economy will crash and burn and struggle when they’re ready to retire.

Posted on 5/15/21 at 7:34 am to SlowFlowPro

They are still the poors. Masks or not

Posted on 5/15/21 at 7:35 am to stout

quote:

There are still opportunities even in the face of disasters. You just have to be smart enough to take advantage.

On an individual level I agree. I haven't given up and while I have lots of regrets for not believing in certain get rich quick schemes that would have had me set for life, I'm still grinding. But on the mass-level? Yeah it's bad for the entire group. Real bad.

quote:

IMO, RE is still the best wealth builder for the average American.

You see that cat is out of the bag right now, at least for the short term. RE investing is driving housing inflation right now in a major way. If interest rates ever rise, this will come crashing down and will return to the realm of normal people, but right now? Very tough and risky. Basically crypto-gambling

Posted on 5/15/21 at 7:35 am to Muthsera

So, in other words, you and your wife were responsible. There is not a lot of that these days. I still know folk who live within their means, but I will say the younger "immediate gratification" crowd is spending a shite ton of money they don't have.

Back to top

28

28