- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Your money earning more money than you do?

Posted on 9/21/25 at 10:39 am to Artificial Ignorance

Posted on 9/21/25 at 10:39 am to Artificial Ignorance

quote:

Expenses come down significantly over those 20yrs (at least in terms of kids…no more tuition, insurance, clothes, etc) that creates opportunity to invest more, as well.

Yes after the college years expenses generally come down unless you buy the 1MM+ lake house for the yacht you always wanted. College was covered by putting funds in a 529. In fact we got a pay raise when my boys left private high school and entered a state U.

Posted on 9/21/25 at 11:04 am to Artificial Ignorance

quote:

And $1,000,000 to multiple millions. Picasso-like are Exponential curves!

Hope the early career MT (and all) make this a priority. Earlier the better. Don’t fall for the “I can’t afford to live below my means” consumerism that rips financial independence from your grips before you even think about it.

Income - Investments = expenses

Your future selves will thank you.

this.

Posted on 9/21/25 at 11:50 am to NBR_Exile

quote:

I love the enthusiasm but one would have to earn over 12% per year to go from 1MM for 10MM in 20 years. That's hard to do. With additional contributions that number comes down but going from 1 to 10 would need some serious luck.

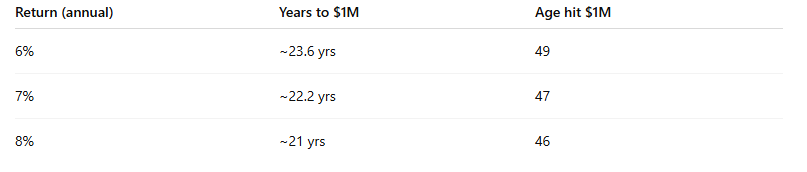

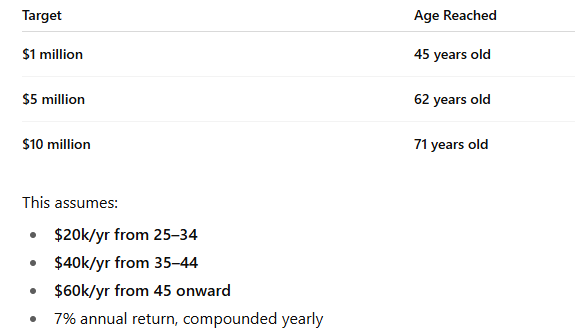

You can only roll with the averages, but if starting from age 25 and investing $20,000 year

Anything extra along the way helps.

Math works to $5 million by mid 60s only doing $20,000/year

Increase you investments as your age

$20,000 from 25-34, $40,000 from 35-44 and $60,000 from 45 and up.

Hitting 8 digits in 60s would be top end, but not impossible in anyway. Any inheritance ($100,000+) along the way can shave off 1-5 years of this time frame.

At least this is what AI says

Posted on 9/21/25 at 12:31 pm to DarthRebel

Leveraged funds have improved my rate of return exponentially for the past 8 years. I reject the notion of being conservative in retirement, except for ensuring you have enough funds to weather a long-term down market.

Posted on 9/21/25 at 2:12 pm to RoyalWe

quote:

Leveraged funds have improved my rate of return exponentially for the past 8 years. I reject the notion of being conservative in retirement, except for ensuring you have enough funds to weather a long-term down market.

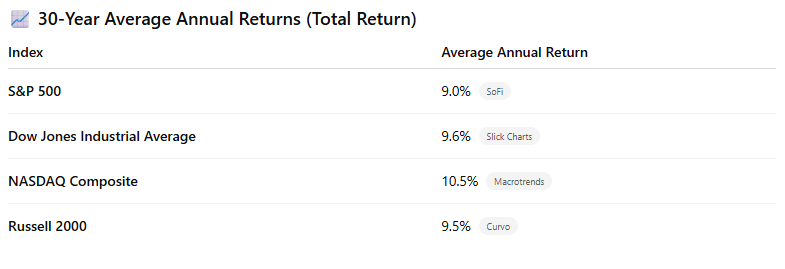

100% agree. There is really no good reason to go conservative as you get older, unless you just have enough and do not care. It always averages out

Posted on 9/21/25 at 3:40 pm to Artificial Ignorance

I went back to last year and did some math, our investments earned about 35% what our gross income was. So that’s a nice chunk, but no where close to earning more than our annual household income. We still have a long ways to go though too.

Posted on 9/22/25 at 10:56 am to Artificial Ignorance

quote:

quote:

I don't subscribe to the conventional wisdom on the stocks/bonds mix in your portfolio during retirement. At least not in the early years of retirement.

That’s a universal statement.

Retirement time horizon (period length from retirement start to end of life) matters, no? If retirement at 55yo (hear you). If retire at 65yo or later (shorter retirement length), asset allocation (AA) matters more as does sequence of returns risk.

I think AA hugely matters and depends, as always, on personal context.

quote:

Absolutely. What is the 20 year average of the s&p? The entire stock market?

Curious, have you lived through “black swan” event(s) in your investing life (eg, 2008-10)? Suspect COVID years did not leave any scar tissue on your expected returns sentiment of which I applaud.

You are correct that retirement time horizon matters. As well as numerous other factors. Amount of wealth is another in that wealthier folks can sustain risk more than others.

I began investing in the 80s and have seen some rough years. I have been fortunate enough to never need to spend any of my invested money during down years, and used those years as an opportunity to accumulate more shares.

The advice in this thread from you and others is good stuff. I am biased in saying that because it aligns with my financial principles.

Posted on 9/22/25 at 1:53 pm to Artificial Ignorance

Retired at 55. I lost 2 siblings and both parents and received a very large inheritance. Retired with a very large pension from law enforcement after 38 years. The only negative is working at anything is a a huge tax problem, I average approx $2000-4000 a day in interest and dividends. I reinvest all off it. It’s really harder than you think to radically change your spending habits after 55.

Posted on 9/22/25 at 2:30 pm to Mayhem3524

quote:If the very large pension was taken as a lump sum into a Traditional IRA, since you have so much passive taxable income, I would recommend that you aggressively convert it to Roth each year staying in the 32% and under tax bracket.

Very large inheritance plus very large pension.

If you are retired and get a large monthly pension payment and have a very large high yield savings account plus very large quantities dividend paying stocks in a taxable brokerage account, then you're pretty much stuck with high taxes indefinitely with no way to invest and convert to Roth and HSA accounts.

If you have any Traditional IRA accounts, I would aggressively convert them to Roth even if that takes several years or more so that you can have some balance of Roth versus taxable accounts.

You should also consider converting some of your dividend stocks to growth stocks if that helps you stay under the next tax bracket.

This post was edited on 9/22/25 at 3:36 pm

Back to top

0

0