- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

"What we learn from history is that people don't learn from history." - Warren Buffett

Posted on 3/13/25 at 4:29 pm

Posted on 3/13/25 at 4:29 pm

Berkshire up almost 2 percent today, near All Time High, while the rest of the market melts down.

People that ignored the fact that he was dumping stocks at an unprecedented rate are paying the price now, well unless they own Berkshire Hathaway

I don't know why people couldn't see this coming, all of the signs were there.

People that ignored the fact that he was dumping stocks at an unprecedented rate are paying the price now, well unless they own Berkshire Hathaway

I don't know why people couldn't see this coming, all of the signs were there.

Loading Twitter/X Embed...

If tweet fails to load, click here. This post was edited on 3/13/25 at 4:30 pm

Posted on 3/13/25 at 4:32 pm to Dumpster Diver

quote:But he started dumping those stocks over a year ago. And in that time, even with the current pull back, the stock market is UP over 15%.

People that ignored the fact that he was dumping stocks at an unprecedented rate are paying the price now,

Posted on 3/13/25 at 4:38 pm to LSURussian

quote:

But he started dumping those stocks over a year ago. And in that time, even with the current pull back, the stock market is UP over 15%.

You mean he didn't sell $250 Billion of stock in one day ?

Posted on 3/13/25 at 4:41 pm to LSURussian

Warren Buffett's Berkshire Hathaway is beating the S&P 500 over these periods:

• 1M, YTD, 6M, 1Y, 3Y, 5Y, 10Y, 20Y, and since inception.

Is that all you got ?

• 1M, YTD, 6M, 1Y, 3Y, 5Y, 10Y, 20Y, and since inception.

Loading Twitter/X Embed...

If tweet fails to load, click here. : Is that all you got ?

Posted on 3/13/25 at 5:01 pm to Dumpster Diver

Is this pop because he is shopping the RE to Compass maybe?

Posted on 3/13/25 at 7:07 pm to Dumpster Diver

Over 50% of the funds total weight is in just 3 stocks, BAC, Apple, Amex.

Posted on 3/13/25 at 7:32 pm to Dumpster Diver

Since you are so smart and have the crystal ball, why didn’t you create an account sooner to warn us all?

Posted on 3/13/25 at 8:45 pm to Dumpster Diver

I saw it coming before you did and made a ton of money on the trade. It was even more obvious than you realized.

Posted on 3/13/25 at 8:48 pm to Dumpster Diver

Beating the S&P was cool when I was 12. There is a rock that people buy at Costco that has been beating the shite out of the S&P. Come to think of it, if your entire portfolio was 50% Costco and 50% of the rock you can buy on your way to the checkout at Costco, you’d be killing Buffet, the S&P and 99% of the people that post here.

This post was edited on 3/13/25 at 8:53 pm

Posted on 3/13/25 at 9:08 pm to Dumpster Diver

Op is an alter. Dude won’t be here when stocks recover.

Posted on 3/13/25 at 9:09 pm to beaverfever

quote:

There is a rock that people buy at Costco that has been beating the shite out of the S&P.

Oh really?

Posted on 3/13/25 at 9:15 pm to slackster

I’m not a Costco member unfortunately, but that’s what I hear.

Posted on 3/13/25 at 9:17 pm to beaverfever

Are you talking about gold?

Posted on 3/13/25 at 9:20 pm to slackster

Yeah that’s what it’s called.

Posted on 3/13/25 at 9:59 pm to notiger1997

quote:

Since you are so smart and have the crystal ball, why didn’t you create an account sooner to warn us all?

He did. This is his 8th account in the last 12 months.

Posted on 3/13/25 at 11:18 pm to beaverfever

quote:

Yeah that’s what it’s called.

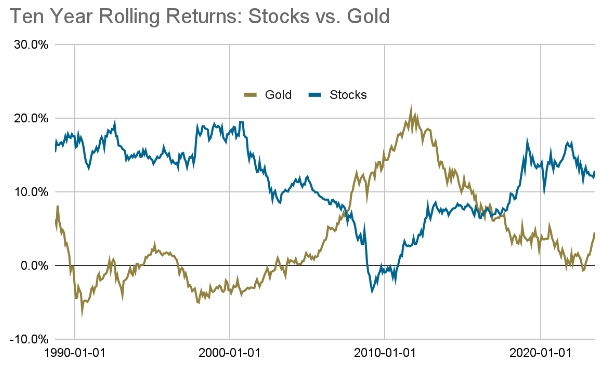

And over what time is it supposed to be out stripping the S&P500?

Stocks beat the shite out of gold in the vast majority of 29 year rolling periods, and it’s not particularly close in those periods.

Posted on 3/13/25 at 11:32 pm to slackster

Gold has taken 5 out of the last 6 years from the S&P and the recent trends are concerning IMO. I’d also argue that when you adjust for risk, it’s probably the better investment at this point in time. Don’t get me wrong, I’d own my fair share of equities but there is a tangible move towards hard assets that is underway.

The never ending waves of global liquidity have bastardized equities IMO. I know it’s a fringe take but that’s my gut.

Last thing, the GFC and Covid were both transformational events within the context of this discussion. I’m not sure you can compare 2025 to 1996.

The never ending waves of global liquidity have bastardized equities IMO. I know it’s a fringe take but that’s my gut.

Last thing, the GFC and Covid were both transformational events within the context of this discussion. I’m not sure you can compare 2025 to 1996.

This post was edited on 3/13/25 at 11:45 pm

Popular

Back to top

6

6