- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Trump backs tax hike on rich but says GOP probably shouldn't do it

Posted on 5/11/25 at 10:08 pm to mmmmmbeeer

Posted on 5/11/25 at 10:08 pm to mmmmmbeeer

quote:

They own 2.5% of American wealth. They don't matter, frankly. 67,000,000 households essentially shut out of the wealth generated by the American economy.

Oof. Percentiles aren't people.

Those aren't the same people over time. That's new people entering the lowest rung while the others move out to higher ones.

You can actually track this on the income side using individual income taxes over time to dispel this oft repeated falsehood.

This post was edited on 5/11/25 at 10:10 pm

Posted on 5/11/25 at 10:14 pm to SquatchDawg

Yep,

Also, it’s important to remember that most billionaire wealth is illiquid and, frankly, not obtainable to distribute to others.

Musk’s net worth is so high because he has a crap ton of shares in Tesla.

If the govt were to tomorrow force him to liquidate half his share and pay the sum to the govt, the govt would only get a fraction of that money, because the stock price would fall as musk liquidated

Also, it’s important to remember that most billionaire wealth is illiquid and, frankly, not obtainable to distribute to others.

Musk’s net worth is so high because he has a crap ton of shares in Tesla.

If the govt were to tomorrow force him to liquidate half his share and pay the sum to the govt, the govt would only get a fraction of that money, because the stock price would fall as musk liquidated

Posted on 5/11/25 at 10:15 pm to Teddy Ruxpin

quote:

Oof. Percentiles aren't people.

Those aren't the same people over time. That's new people entering the lowest rung while the others move out to higher ones.

You can actually track this on the income side using individual income taxes over time to dispel this oft repeated falsehood.

Another fantastic point.

Many of the people with the lowest net worths are new doctors and lawyers with lots of student debt

Would anyone argue these people are not “sharing in the wealth generated by America” as mmmmmmcreampie claims

This post was edited on 5/11/25 at 10:20 pm

Posted on 5/12/25 at 2:59 am to HailHailtoMichigan!

Yes keep the money for disabled at birth and purge the my 23 year old is disabled for life because he stubbed his big toe

Posted on 5/12/25 at 5:06 am to mmmmmbeeer

quote:That is not Laffer's premise. His premise is tax policy impacts commerce and GDP. Period. Full stop.

Few mainstream economists agree with his premise that cutting taxes leads to increased tax receipts.

His correlate is that at some point, tax associated GDP reduction is significant enough to counter revenue inflow tied to tax increase. IOW at some point, a bigger piece of a smaller pie does not equate to a larger serving size. Clinton's luxury tax was a microcosm exemplification.

Antithetically, a commonly mistaken economic assumption is increased tax rates across a wide spectrum reliably equate to increased federal revenue. Especially as those rates target more fungible assets, it's a dubious premise.

quote:As I pointed out, the targeting of fungible assets w/ tax rate increases is often ineffective at best.

Serious question, why do some folks white knight for fricking billionaires? I just don't get it.

Try to target Bezos's income with a 90%+ bizillionaire tax, and he simply draws no more "income." Instead he borrows against his assets to suit his income needs, pays interest on the note, and pays not 1¢ in tax. Legislate against that, and he finds another tax avoidance loophole, and another, and another. As the size of the Bezos trap increases, it ensnares others as collateral damage.

When those brilliant changes in soak-the-rich tax law yield poor results, the income threshold is lowered into brackets where money is not as fungible. Suddenly your boss is having to pay the taxes supposedly targeting bizillionaires, which lends him less likely to award employee payraises. All the while, you scream for more taxation of bizillionaires, and as the Red October line goes, "You arrogant arse! You've killed us!"

Posted on 5/12/25 at 7:06 am to bigjoe1

I can understand why there’s resistance on this hike, as it can impact small businesses. That being said, they could carve small business out if they wanted to.

The item that really annoys me is republicans resistance to eliminating the carried interest loophole. It’s a handout to private equity, and Trump is fine with eliminating it. I’ve watched both Thune and Scalise be asked about this on CNBC, and neither could defend why they support keeping it. It’s obvious-they don’t want to piss off their big donors.

The item that really annoys me is republicans resistance to eliminating the carried interest loophole. It’s a handout to private equity, and Trump is fine with eliminating it. I’ve watched both Thune and Scalise be asked about this on CNBC, and neither could defend why they support keeping it. It’s obvious-they don’t want to piss off their big donors.

Posted on 5/12/25 at 7:49 am to HailHailtoMichigan!

quote:

Hmmm, that data doesn’t seem to jive with the tax policy center data I have been referencing lately. I wonder if there is something I am missing?

Oh man. Well what you linked is trying real hard to twist itself into a pretzel to say well actually the wealthy really aren’t even benefitting that much here. It knows it’s doing this because, it spends nearly 75% of the article, not talking about their own methodology or research, but instead talking about how you can’t actually believe anyone else’s reporting on this and that their interpretation is the only true representation of this data….CATO Institute was founded and is funded by the Koch Brothers so not really surprised that’s the bent here.

Anyways, their premise is that it doesn’t matter if magnitudinally by both % and dollar amount the TCJA reduces tax liability for the top earning quintiles significantly more then the other groups. That apparently tells you nothing about who benefits most. Instead you have to take the reduction in tax liability divided by the total individual tax burden, then use that % to show who actually benefits most. Given our progressive tax system, the highest quintile will always have the highest tax burden (and thus a much higher denominator), so would need significantly larger cuts to their tax liability(the numerator) relative to other quintiles for this equation to ever show the top quintiles benefiting most. It’s really disingenuous.

Ex. Someone with a 4% effective tax rate gets a 1% cut they received a 25% reduction. Someone with a 30% effective tax rate received a 3% cut they received a 10% reduction. The person with the 3% cut “benefits the least”.

This post was edited on 5/12/25 at 7:53 am

Posted on 5/12/25 at 8:06 am to NC_Tigah

quote:

That is not Laffer's premise. His premise is tax policy impacts commerce and GDP. Period. Full stop.

Note also that almost every single western nation has significantly lower top marginal rates than they did in the 1970s. It was a worldwide acknowledgment that yes, marginal tax rates were so high, they were actually causing revenue loss due to economic damage.

Posted on 5/12/25 at 8:45 am to TigerTalker142

quote:You seem to be attempting a point, facts be damned. Let's try this again.

Ex. Someone with a 4% effective tax rate gets a 1% cut they received a 25% reduction. Someone with a 30% effective tax rate received a 3% cut they received a 10% reduction. The person with the 3% cut “benefits the least”.

1980 (last Carter year)

The top 1% paid 19% of all federal income taxes.

The bottom 50% paid approximately 7%.

2012 (Obama)

The top 1% paid 38.1% of all federal income taxes.

The bottom 50% paid approximately 2.8%.

2021 (Present)

The top 1% of earners paid 45.8% of all federal income taxes.

The bottom 50% contributed 2.3%.

Posted on 5/12/25 at 8:45 am to NC_Tigah

quote:

That is not Laffer's premise. His premise is tax policy impacts commerce and GDP. Period. Full stop.

To the point that - regardless of marginal rates - the economy resists taxation outside of about 18.5% to 21% - so, you can get the marginal rates up to 99.99% and your overall policy will not scoop up more than about 1/5 of GDP. Such high rates at the very least put a ceiling on GDP. There is literally no incentive for decisionmakers to make a single penny more.

Which is why, despite all the doom and gloom at the time, the Reagan cuts (which were revolutionary) did not reduce receipts to the government. The GDP grew at a dramatic rate, thus lower rates on a larger economy was a benefit to everyone in that economy.

Maggie explained the Marxists' attitude about "income disparity" perfectly:

This post was edited on 5/12/25 at 8:46 am

Posted on 5/12/25 at 8:47 am to NC_Tigah

quote:

Likely the same economists who advised Bill Clinton the imposition of a luxury tax was economically sound policy? Most economists are academic leftists and approach "truths" in their field through a leftist lense.

“Most experts in that field don’t agree with my politics so I can’t put any stock in the work they do and are lauded for professionally and won’t bother to have a conversation on the merits.” Love that rational, real grounded.

quote:

Regarding our "wealth and income disparity," US MEDIAN income is the 5th highest in the world out of ~170 nations. That does not point to hardships associated with wealth disparity. Quite the opposite.

This entire conversation and certainly any policy changes stemming from the Op’s post is about wealth disparity in the US. Trying to expand the conversation to say yea well we’re rich compared to other countries is just a whataboutism to try and pivot away from the problem at hand.

Our citizen can be richer then the median citizen in other countries and our country can have deepening wealth inequality and income inequality within our own borders. The flip side of that equation is while we have high income we also have higher cost of living in many areas compared to most other countries. So on a relative basis a dollar earned doesn’t go as far. Another disingenuous argument.

quote:

Meanwhile, our tax code has become more progressive over time. 1980 (last Carter year) The top 1% paid 19% of all federal income taxes. The bottom 50% paid approximately 7%. 2012 (Obama) The top 1% paid 38.1% of all federal income taxes. The bottom 50% paid approximately 2.8%. 2021 (Present) The top 1% of earners paid 45.8% of all federal income taxes. The bottom 50% contributed 2.3%.

We literally covered this ad nauseam with that other guy on the prior page. This conversation feels pointless.

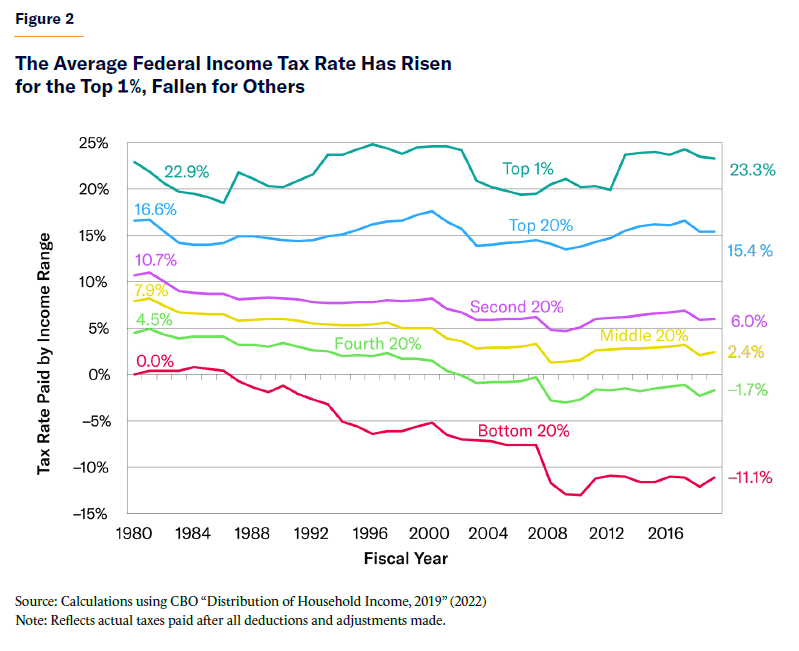

Tax rates have decreased relative to the other quintiles for the top earners, and yet their share of overall tax revenue grows. This is literally demonstrating income inequality. Their income is growing at such a fast rate compared to other groups that even though their tax rates have decreased more then other groups their share of taxes paid are actually increasing relative to the rest of the population.

Posted on 5/12/25 at 9:07 am to TigerTalker142

quote:

Tax rates have decreased relative to the other quintiles for the top earners

Wrong

And to your larger point, top marginal tax rates dropped 20% between 1959 and 1979, yet that groups tax receipts grew as a % of gdp *and* that period saw no increase in income inequality.

There has been no correlation between the top income-tax bracket and total income-tax revenues because tax-rate increases have sacrificed some of the revenue to tax evasion, tax avoidance, macroeconomic losses, and various tax preferences.

Posted on 5/12/25 at 9:14 am to theballguy

quote:

while billionaires and large corporations use loopholes to avoid paying more.

Posted on 5/12/25 at 10:37 am to TigerTalker142

quote:

This conversation feels pointless.

Just let 'em keep white knighting. They've been brainwashed by right wing, supply side bullshite their entire adult lives, slurping up every bit of it until it makes up their entire being. They're dirt poor in relation to the top 1% but, in some perverse manner, believe everyone will think they're rich, too, being they stand up for the wealthiest people in the world. There is no fact-based argument to be had with people who don't think for themselves...parrots can talk, doesn't mean they can reason.

Posted on 5/12/25 at 10:57 am to mmmmmbeeer

quote:

Billionaires should be paying an ungodly tax on every dollar they make over $1B/year. Like 90% kind of ungodly. Those people at that level don't give a single frick about the money itself, it's nothing more than a game at that point. frick 'em.

Its just not so simple to tax billionaires. Youd have to tax their wealth, not their income as they dont show lots of income.

Posted on 5/12/25 at 11:17 am to mmmmmbeeer

quote:

Just let 'em keep white knighting. They've been brainwashed by right wing, supply side bullshite their entire adult lives, slurping up every bit of it until it makes up their entire being. They're dirt poor in relation to the top 1% but, in some perverse manner, believe everyone will think they're rich, too, being they stand up for the wealthiest people in the world. There is no fact-based argument to be had with people who don't think for themselves...parrots can talk, doesn't mean they can reason.

You are in the top 1% of the world in terms of income earned yearly.

So, if a Sierra Leone citizen said to your face that he thinks you have way too much wealth, what would your response be?

Posted on 5/12/25 at 12:22 pm to TigerTalker142

quote:

Likely the same economists who advised the imposition of a luxury tax was economically sound policy? Most economists are academic leftists and approach "truths" in their field through a leftist lense.

------

“Most experts in that field don’t agree with my politics so I can’t put any stock in the work they do and are lauded for professionally and won’t bother to have a conversation on the merits.” Love that rational, real grounded.

This is not a political issue. "My politics" are irrelevant. It is an economic issue. ITR, you seem unburdened by the past. The reason for raising the Luxury Tax is with it we have a known outcome.

The Luxury Tax heavily targeted rich people's stuff: expensive cars, pleasure boats, jewelry, furs, private planes, etc.

Economists at the time thought it was pure, soak-the-rich, brilliance. It aligned perfectly with principles of "fair share" taxation. The consensus in academic circles was the LT would basically not impact the "middle and working class" at all. Further, it would have only minimal impact upon wealthy consumption. Afterall, the wealthy could "afford it." Press coverage was supportive and borderline giddy.

But the luxury tax backfired economically. The yacht industry was devastated. Domestic manufacture and sales plummeted. Thousands of related industry workers lost their jobs. Wealthy consumers either stopped buying luxury boats, or simply bought them abroad. LT costs far exceeded revenue. Three years later Congress had little choice but to admit error and repeal it.

quote:Wait!

Trying to expand the conversation to say yea well we’re rich compared to other countries is just a whataboutism to try and pivot away from the problem at hand.

The median disposable income per person here, adjusted for purchasing power parity (i.e., adjusted for cost of living internationally), exceeds that of the EU 2-fold!

If you're making twice what your first world colleagues are, WTF does it matter to you that Buffett, Gates, Ellison, Bezos, Zuckerberg, Musk, Brin, Page, etc have made billions? Those billions BTW, and the companies at their core, have enabled your comparative wealth. It seems the alternative, to be living on half the income sans the existence of those über-rich folks, would be an awful downfall.

This neo-American woe-is-me crap is beyond old.

Posted on 5/12/25 at 1:05 pm to mmmmmbeeer

quote:

They're dirt poor in relation to the top 1% but, in some perverse manner, believe everyone will think they're rich

Back to top

1

1