- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: This could be something....Look beyond equities, Silver to be the next short squeeze

Posted on 2/3/21 at 3:03 pm to Jag_Warrior

Posted on 2/3/21 at 3:03 pm to Jag_Warrior

I cashed out the rest of my AG calls yesterday to keep a hefty profit. Just used some of the proceeds to buy some later dated calls at close here after this multi-day beat down.

Hoping for a resurgence bounce soon if Silver can retest the 30's.

Who knows if this is still a play, but I'm jumping back in while it's relatively cheap again.

Hoping for a resurgence bounce soon if Silver can retest the 30's.

Who knows if this is still a play, but I'm jumping back in while it's relatively cheap again.

Posted on 2/4/21 at 9:40 am to rintintin

this silver play isnt any fun anymore

Posted on 2/4/21 at 10:07 am to DawgCountry

quote:

this silver play isnt any fun anymore

Yup. Got in AG at $18ish last week. Couldn't sell on Monday because of unsettled funds.

Posted on 2/4/21 at 11:19 am to DawgCountry

quote:

this silver play isnt any fun anymore

shite I think the fun is just getting started, the COMEX /JPM is doing everything they can to suppress the market and we are still up 10% from last week. We should be up 30% but they are throwing everything they have at the market to keep the price down hoping new investors will head for the exits

Posted on 2/4/21 at 11:33 am to FredsGotSlacks

high physical bullion premium and long wait time for physical may drive a short term 10-15 percent upside if there is no risk off market event. Beyond that I'm not sure where we go. I would like to see physical premiums increase further and lead times increase longer before I start levering back in.

Posted on 2/5/21 at 8:34 am to misterc

quote:

shite I think the fun is just getting started, the COMEX /JPM is doing everything they can to suppress the market and we are still up 10% from last week. We should be up 30% but they are throwing everything they have at the market to keep the price down hoping new investors will head for the exits

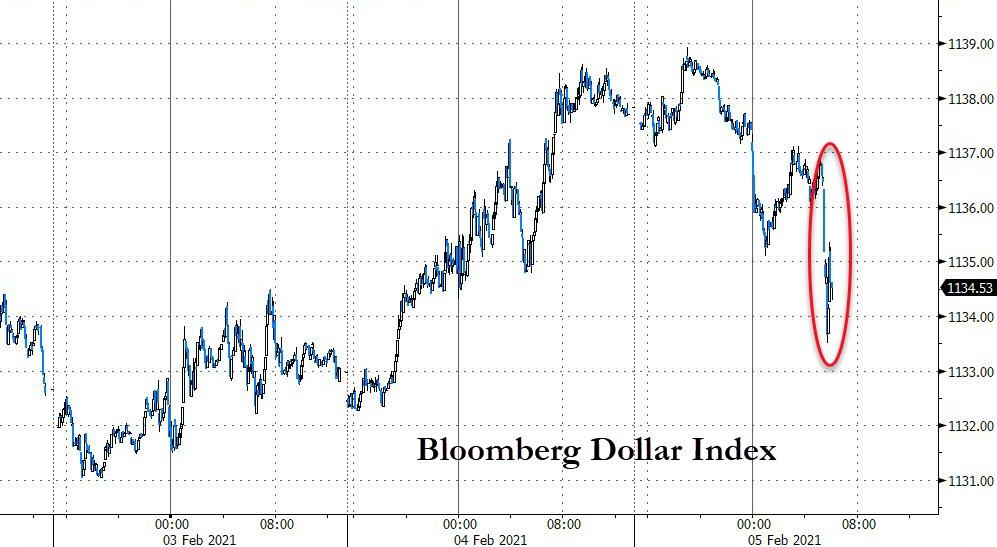

questionable jobs data = increased stimulus = a spike in UST Yields ...

and we know two things:

1) the Dollar Index will plunge due to the Yield spike (see chart)

2) today, Precious metals will begin a slow run-up because the Dollar is sliding

disclosure: long PHYS, PSLV, KGC

PHYS - accumulating below $14.21

PSLV - accumulating below $8.80

KCG - accumulating below $7.00

This post was edited on 2/5/21 at 8:36 am

Posted on 2/7/21 at 6:17 pm to Jag_Warrior

After hour trading and information.

JM Bullion

Gave my grandchildren some bars. Fishing pole off the deck.

JM Bullion

Gave my grandchildren some bars. Fishing pole off the deck.

Posted on 2/7/21 at 6:27 pm to nuwaydawg

quote:

nuwaydawg

Premium on coins have gone way up

$40 per silver eagle

Posted on 2/7/21 at 6:38 pm to thelawnwranglers

BGASC has ASE’s in stock for $11 premium .... while they last. G/L

https://www.bgasc.com/product/2021-american-silver-eagle-coins/silver-eagles-brilliant-uncirculated

https://www.bgasc.com/product/2021-american-silver-eagle-coins/silver-eagles-brilliant-uncirculated

This post was edited on 2/7/21 at 6:40 pm

Posted on 2/12/21 at 10:36 am to cadillacattack

For those still on this trade, I'm not an avid chartist but the Silver daily chart appears to be forming a long cup and handle dating back to Aug. This was always expected to take a while to play out if it indeed is a play.

Interesting pop this morning also with no news.

I still have AG calls.

Interesting pop this morning also with no news.

I still have AG calls.

This post was edited on 2/12/21 at 10:38 am

Posted on 2/12/21 at 12:46 pm to rintintin

quote:

For those still on this trade, I'm not an avid chartist but the Silver daily chart appears to be forming a long cup and handle dating back to Aug. This was always expected to take a while to play out if it indeed is a play.

Interesting pop this morning also with no news.

I still have AG calls.

No news is good news, spot price still has a long way before it meets retail pricing. I’m sure the miners have been raising hell that they’ve been losing out on 20/30% more money because of the COMEX’s antics. If I were them I would withhold inventory, claim it’s because of COVID and then watch the COMEX scramble to try and source silver for delivery. The 1000 oz bars are running low already so the fun is just getting started.

Posted on 2/12/21 at 1:06 pm to FredsGotSlacks

Many of the larger mining operations closed last summer and had limited crews for maintenance/repairs. Many have since reopened on a limited basis, to take advantage of low fuel costs and elevated spot prices.

They're slowly bringing their workforce back up to full capacities ... assuming the government doesn't impede their plans.

There's no shortage of physical silver, .... there's just a shortage of people willing to sell it ....

They're slowly bringing their workforce back up to full capacities ... assuming the government doesn't impede their plans.

There's no shortage of physical silver, .... there's just a shortage of people willing to sell it ....

Posted on 2/15/21 at 7:58 pm to cadillacattack

Futures are moving. If we break and hold 27.80 we could test 30 again.

If this holds through the night, Silver stocks will gap up in the morning.

If this holds through the night, Silver stocks will gap up in the morning.

Posted on 2/15/21 at 8:10 pm to rintintin

I’ve been buying physical silver (1oz rounds) of about 10 years now. Seems like the price has been about the same. Sure, I’ve seen over $40 per ounce and recently under $15 or so.

It seems for most part Silver has held avg in the $25 range. All the while people are saying $50-$100 is coming.

Who knows. Just hasn’t seem to be gaining much. Keep on stacking

It seems for most part Silver has held avg in the $25 range. All the while people are saying $50-$100 is coming.

Who knows. Just hasn’t seem to be gaining much. Keep on stacking

Posted on 2/15/21 at 8:26 pm to Crawdaddy

Where is the best place to buy 1 oz rounds?

Posted on 2/15/21 at 8:33 pm to Crawdaddy

Not sure how much you've been following this thread, but the recent interest is based on a WSB thread that was started during the GME circus.

It made some waves early and a few people here, including myself, profited nicely off of it early on. It could be all for naught at this point with how difficult it is to move the Silver market, but the run on physical silver is real.

If we test the 30's again it will be a nice payday. If it blows past 30 then it will be a fricking grand payday.

It made some waves early and a few people here, including myself, profited nicely off of it early on. It could be all for naught at this point with how difficult it is to move the Silver market, but the run on physical silver is real.

If we test the 30's again it will be a nice payday. If it blows past 30 then it will be a fricking grand payday.

Posted on 2/15/21 at 9:02 pm to rintintin

I hope so.

Most of my rounds came from apmex

Most of my rounds came from apmex

Posted on 2/15/21 at 10:02 pm to Crawdaddy

Over 28 now, we're moving here.

Posted on 2/15/21 at 10:19 pm to rintintin

This is slowly gaining traction. I think the silver movement will be disruptive. A lot more people stacking silver who was never interested or aware of it That includes me.

Posted on 2/16/21 at 7:34 am to Odinson

So much for that holding until open.

Popular

Back to top

1

1