- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

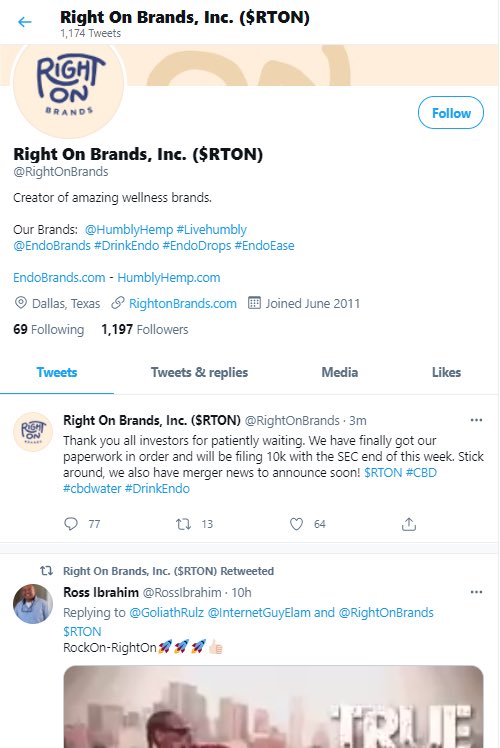

re: RTON is making a huge move today (Weed stock)

Posted on 4/1/21 at 8:49 am to Who_Dat_Tiger

Posted on 4/1/21 at 8:49 am to Who_Dat_Tiger

quote:

RTON is making a huge move today (Weed stock)

It’ll go to .004 for no reason at all today. Gonna have some arse whoopins to hand out when that happens

I can promise you guys one thing and that is .004 ain't happening anytime soon. It is now down to .0028

Posted on 4/1/21 at 8:51 am to MrLSU

Yeah the updates are really slow, it looked to me like it was still sitting at .0034, but just saw it below .003

Posted on 4/1/21 at 8:51 am to MrLSU

I'd not make that promise quite yet. Have you looked at market depth and support and resistance? Not to say that doesn't change by the second, butr I don't see a huge blood bath right now.

Posted on 4/1/21 at 8:55 am to MrLSU

Got my 300k shares out this morning at .035. Was in at .004. Fun while it lasted baws.

Posted on 4/1/21 at 8:57 am to Who_Dat_Tiger

Yeah I had a stop at 003 that picked up. Oh well im glad to be free of this goat. I moved everything I had from it and threw it in WDLF. I'll just forget about it for a while now

Posted on 4/1/21 at 9:03 am to Stagliano

quote:

I moved everything I had from it and threw it in WDLF.

Did you read their latest 10k filing? Not a rosy picture of that company's finances at all.

Posted on 4/1/21 at 9:05 am to Iowa Golfer

quote:

Not to say that doesn't change by the second, butr I don't see a huge blood bath right now.

It’s not as bad as I expected...yet. I don’t blame you guys for getting out at all, but I’m going to give it some time. I’m “only” holding 225k shares.

Posted on 4/1/21 at 9:09 am to MrLSU

I didn't know it had released. I had just seen they had an investor call set up for 4/5. I like this team and company. How bad was it?

Posted on 4/1/21 at 9:11 am to Stagliano

i linked it in the WDLF thread last night

Posted on 4/1/21 at 9:16 am to Logician

You linked RTON? I don't see this?

Posted on 4/1/21 at 9:16 am to Stagliano

quote:

How bad was it?

Really ugly

"Our independent registered public accounting firm has issued a going concern opinion; there is substantial uncertainty that we will continue operations in which case you could lose your investment."

Posted on 4/1/21 at 9:18 am to MrLSU

How bad is what? Someone needs to link tehir filing. If it is even released. Also, this statement is on almost all penny stocks.

We need to get some facts here, not emotion.

We need to get some facts here, not emotion.

Posted on 4/1/21 at 9:19 am to MrLSU

Isn't this statement made on almost all penny stocks filings?

Posted on 4/1/21 at 9:19 am to Iowa Golfer

I brought up WDLF sorry. Wasn't talking about RTON

Posted on 4/1/21 at 9:29 am to Stagliano

"Going Concern

The accompanying consolidated financial statements have been prepared on a going concern basis, which assumes that we will be able to realize our assets and discharge our liabilities and commitments in the normal course of business for the foreseeable future. We had an accumulated deficit of $31,766,214 at December 31, 2020, had a net loss of $202,720 and used net cash of $422,337 in operating activities for the twelve months ended December 31, 2020. These factors raise substantial doubt about our ability to continue as a going concern. Our ability to continue as a going concern is dependent upon our generating profitable operations in the future and/or to obtain the necessary financing to meet our obligations and repay our liabilities arising from normal business operations when they come due. Our management intends to finance operating costs over the next twelve months with existing cash on hand. While we believe that we will be successful generating revenue to fund our operations, meet regulatory requirements and achieve commercial goals, there are no assurances that we will succeed in our future operations."

EPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Report of Independent Registered Public Accounting Firm

To the shareholders and the board of directors of Social Life Network, Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of Social Life Network, Inc. as of December 31, 2020 and 2019, the related statements of operations, stockholders' equity (deficit), and cash flows for the years then ended, and the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2020 and 2019, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States."

"Substantial Doubt about the Company’s Ability to Continue as a Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has suffered recurring losses from operations and has a significant accumulated deficit. In addition, the Company continues to experience negative cash flows from operations. These factors raise substantial doubt about the Company's ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty."

The accompanying consolidated financial statements have been prepared on a going concern basis, which assumes that we will be able to realize our assets and discharge our liabilities and commitments in the normal course of business for the foreseeable future. We had an accumulated deficit of $31,766,214 at December 31, 2020, had a net loss of $202,720 and used net cash of $422,337 in operating activities for the twelve months ended December 31, 2020. These factors raise substantial doubt about our ability to continue as a going concern. Our ability to continue as a going concern is dependent upon our generating profitable operations in the future and/or to obtain the necessary financing to meet our obligations and repay our liabilities arising from normal business operations when they come due. Our management intends to finance operating costs over the next twelve months with existing cash on hand. While we believe that we will be successful generating revenue to fund our operations, meet regulatory requirements and achieve commercial goals, there are no assurances that we will succeed in our future operations."

EPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Report of Independent Registered Public Accounting Firm

To the shareholders and the board of directors of Social Life Network, Inc.

Opinion on the Financial Statements

We have audited the accompanying consolidated balance sheets of Social Life Network, Inc. as of December 31, 2020 and 2019, the related statements of operations, stockholders' equity (deficit), and cash flows for the years then ended, and the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2020 and 2019, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States."

"Substantial Doubt about the Company’s Ability to Continue as a Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company has suffered recurring losses from operations and has a significant accumulated deficit. In addition, the Company continues to experience negative cash flows from operations. These factors raise substantial doubt about the Company's ability to continue as a going concern. Management's plans in regard to these matters are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty."

Posted on 4/1/21 at 9:35 am to MrLSU

I’m a little confused now. Is all of that referencing WDLF or RTON?

Posted on 4/1/21 at 9:48 am to High C

WDLF

RTON did not release their 10k

RTON did not release their 10k

Posted on 4/1/21 at 9:50 am to Iowa Golfer

quote:

I just bought a bunch more.

Based on support and resistance, not emotion. We'll see.

Posted on 4/1/21 at 10:00 am to Iowa Golfer

RTON just tweeted this and deleted it five minutes later.

Popular

Back to top

3

3