- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Prediction for the S & P Index

Posted on 4/5/19 at 7:57 am to lynxcat

Posted on 4/5/19 at 7:57 am to lynxcat

quote:

People forget about a person’s #1 asset: future cash flows from human capital. Human capital acts more like a bond-like asset with each paycheck being a realization of that human capital value.

i'm a pussy when it comes to long term investing but i do think about this specific issue (as a person who is self employed). i really started considering it when i was playing poker a lot a few years ago and equity calculations were in my head all the time

if i invest $20k in my business, it's very likely i can get well above a 10% return in a year. if i crush the investment (like super-targeted ads) i could 5x that in 6 months easily.

it just adds another variable that has me keep my money in savings. i look at my savings and i calculate (stupidly) what i could have gotten if i had invested it at x date compared to now and get upset. i just need to suck it up, grow a pair of balls, and make a decision

Posted on 4/5/19 at 8:16 am to SlowFlowPro

So you are a poker player with no balls?

I want to play you.

I got 35k(80k shares) dumped into lnglf...I’m 4 to the nut flush and just need the river card to hit(fid and tolling aggreements).

If the flush hits I retire at 55, if it doesn’t....it was just a really expensive poker hand.

I want to play you.

I got 35k(80k shares) dumped into lnglf...I’m 4 to the nut flush and just need the river card to hit(fid and tolling aggreements).

If the flush hits I retire at 55, if it doesn’t....it was just a really expensive poker hand.

This post was edited on 4/5/19 at 8:17 am

Posted on 4/5/19 at 10:09 am to L S Usetheforce

quote:

So you are a poker player with no balls?

no. however, for an apt comparison, i don't play over my bankroll and i have very small balls about making that mistake (for good reason)

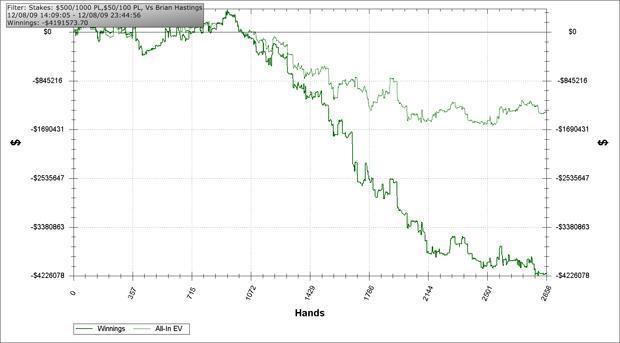

i will never see or experience this

or this

Posted on 4/5/19 at 10:42 am to SlowFlowPro

Just messing with ya slow...

I’ve been dabbling in some plo @ prime in Houston.....want to talk about wild times....what a roller coaster that game is.

I’ve been dabbling in some plo @ prime in Houston.....want to talk about wild times....what a roller coaster that game is.

Posted on 4/5/19 at 12:25 pm to L S Usetheforce

you likely play with a bunch of guys i used to play with here in LC

Posted on 4/5/19 at 2:16 pm to CharleyLake

Somehow I confused another poster's response with being yours so I did not realize that you were retired. My apology.

I simplify 'risk' into two buckets. Bonds are 'safe'. Stocks are 'risky'. If you want to be 100% risky, be completely in the market. If you want to be 100% safe, be completely into bonds (or other safe securities).

I use a strategy that has a base allocation of 80% stock and 20% bonds. Having said that, the strategy becomes 'less risky' as you approach retirement as well as after you become retired. With 'adequate funds' (i.e. if one believes that they do not need to take additional risk because they believe they will have enough money until they die), then the schedule my strategy suggests is:

Years to Retirement - Stock % - Bond %

More than 10 yrs - 80% - 20%

5 to 10 - 70% - 30%

0 to 5 - 60% - 40%

Retirement - 50% - 50%

Retirement +5 yrs - 40% - 60%

Retirement +10 - 30% - 70%

Retirement +15 - 20% - 80%

Is this right for you? Who knows? It depends on where you think you are in your finances. People who don't properly prepare need to take more risk. Those who do repair can afford to take less, so your mileage may vary. In any case, it's something to think about.

I simplify 'risk' into two buckets. Bonds are 'safe'. Stocks are 'risky'. If you want to be 100% risky, be completely in the market. If you want to be 100% safe, be completely into bonds (or other safe securities).

I use a strategy that has a base allocation of 80% stock and 20% bonds. Having said that, the strategy becomes 'less risky' as you approach retirement as well as after you become retired. With 'adequate funds' (i.e. if one believes that they do not need to take additional risk because they believe they will have enough money until they die), then the schedule my strategy suggests is:

Years to Retirement - Stock % - Bond %

More than 10 yrs - 80% - 20%

5 to 10 - 70% - 30%

0 to 5 - 60% - 40%

Retirement - 50% - 50%

Retirement +5 yrs - 40% - 60%

Retirement +10 - 30% - 70%

Retirement +15 - 20% - 80%

Is this right for you? Who knows? It depends on where you think you are in your finances. People who don't properly prepare need to take more risk. Those who do repair can afford to take less, so your mileage may vary. In any case, it's something to think about.

Posted on 4/5/19 at 5:48 pm to RoyalWe

Thank you very much for taking time to respond again. This is the kind of guidance that I was seeking. I will get a composite of my retirement accounts and see what stock/bond ratio that I have at this time. I think that my funds are 'adequate' and I should be able to assume less risk than what I have at this time.

Posted on 4/5/19 at 6:46 pm to SlowFlowPro

quote:Well this is what you should be doing, although I suggest messing around with backtesting and Monte Carlo simulation options on some place like Portfolio Visualizer to get a more complete picture of historical and expected returns with the ups and downs of the market over time.

i look at my savings and i calculate (stupidly) what i could have gotten if i had invested it at x date compared to now and get upset

Backtest Asset Classes

Backtest Portfolio

Monte Carlo Simulations for Potential Returns

quote:I guess it seems strange that someone who plays poker and is also an entrepreneur would have a such an extreme risk aversion to investing in a broad market (not picking a riskier stock or two) with strong and reliable returns over the long-term.

i really started considering it when i was playing poker a lot a few years ago and equity calculations were in my head all the time

Not to mention, unlike gambling, there are various tax benefits that one can utilize for long-term investing (tax deductions, tax-free growth, etc.), especially as a self-employed individual (various retirement account types). And you've posted before about heath insurance costs looking at high-deducitible, HSA eligible plans. If you're utilizing those, then you can have the triple-tax benefits of an HSA while also utilizing it as a long-term investment to maximize growth.

This post was edited on 4/5/19 at 6:48 pm

Posted on 4/5/19 at 7:37 pm to CharleyLake

quote:Dating back to 1972 (47 full years), 78.7% (37) of the years large cap stocks had positive returns, with 62.4% of the months having positive retuns.

however I think that others that comment on this forum recognize that the market has returned to near historical highs

And looking at the end of the year value of a portfolio (price gains and dividends), in 31 of those years, almost 2/3rds, a portfolio would be at record levels. And that's even accounting for the fact that only 2 of the 12 years from 2000 to 2011 had record high finishes.

In other words, the fact that we're near record highs, in and of itself, is irrelevant. In fact, as the data have shown, given the compounded annual growth rate over that time is 10.23% (with standard deviation of 15.07%), we would expect to be at or near record highs far more often than not. So if when only invests in market when it’s not near record highs, then they will only be in the market during (when price is falling) and following a pull back until it’s back to pre-drop levels,

So not only is this logic flawed, I think it would end up leading to lower returns and increased risk. This is why timing the market is not recommended, especially when it has little consideration for the Marco conditions and the underlying fundamentals.

It’s also why the recommendations of one’s portfolio risk isn’t based on the market levels, it’s based on the time horizon and goals of the investment, whether 20 and just starting to invest or 70 and in the middle of retirement. The recommendations of being less exposed to riskier investments near or in retirement, have already built in potential drawbacks, without the risky crapshoot of “timing” the market.

This post was edited on 4/5/19 at 7:44 pm

Posted on 4/5/19 at 8:57 pm to buckeye_vol

What you are saying makes a great deal of sense to me. I have been investing in the market when it dropped from record highs and taking gains when it returned to pre-drop levels. Exactly as you described.

I have beaten my returns from my three (formally six) traditional IRAs and market averages for seven years (excluding the 2018 S & P return. Maybe I have been lucky because I am not greedy or maybe I am intuitive.

I will start to focus on a time horizon and focus on a realistic goal.

Your comments are much appreciated. CL

I have beaten my returns from my three (formally six) traditional IRAs and market averages for seven years (excluding the 2018 S & P return. Maybe I have been lucky because I am not greedy or maybe I am intuitive.

I will start to focus on a time horizon and focus on a realistic goal.

Your comments are much appreciated. CL

Posted on 4/5/19 at 9:06 pm to buckeye_vol

quote:Agree 100%. How did we get to 'near record highs'? By surpassing all prior 'highs'.

In other words, the fact that we're near record highs, in and of itself, is irrelevant.

Posted on 4/5/19 at 9:43 pm to blackoutdore

quote:But the whole point of MPT is to maximize the expected return while minimizing risk. As with MPT, one way to do that is through diversification.

You should take a look at modern portfolio theory. It is generally accepted in the professional investment world that 100% equities is not an efficient portfolio.

But you know what else maximizes expected teurrn and minimizes risk? Increasing the time in the market., especially if one has a diversified equity portfolio (indexes usually), which is also aligned with MPT.

Let's say a person has 35-40 years until retirement, and is either going to choose an 80% US large cap, 20% US Total Bond Market portfolio or 100% portfolio for the first 30 years with $1,000 invested every month (similar to how most people invest).

Here is the historical performance of the two portfolios (80/20 is second).

As you can see the 80/20 portfolio has lower returns but also lower volatility, so as a result it has slightly better risk-adjusted returns (e.g., Sortino, Sharpe, etc). While those show the benefit of more diversified portfolio, they are flawed for the purpose of a 30 year investment with smaller contributions throughout the duration of the investing (essentially DCA). Specifically they measure risk on an annualized basis (standard deviation, downside deviation), but like any standard measure of variation around an estimator, the larger the sample, the smaller the standard error around the estimator. Furthermore, these measures don’t account for the minimization of volatility/risk with a DCA approach.

In order to see how the length of the investment impacts the performance and risk, I’ve done two Monte Carlo simulations based on the statistical returns over 30 years. Below are the expected returns at the 10th, 25th, 50th, 75th, and 90th percentiles.

The first one is 100% large cap portfolio, and the second one is the 80/20 portfolio. .

Now unfortunately it only provides the time-weighted rate of return (TWRR) at the top, and the final balance is based on the money-weighted rate of return (MWRR) given the monthly contributions (which minimizes volatility). But as you can see 80/20 portfolio underperforms the all stock portfolio across all intervals using the MWRR, and only outperforms it at the 10th percentile on the TWRR by 0.13% annually (which is 3.7% across 30 years).

So to say someone should never be 100/0 and should be 80/20, without taking into account the time horizon and the contribution breakdown, is just nonsense when the expected value is 21.4% (TWRR) to 31.8% (MWRR) higher for the 100/0 portfolio over 30 years.

Posted on 4/5/19 at 10:35 pm to CharleyLake

quote:I also think it’s important to realize most major drawdowns/crashes don’t typically happen overnight save for Black Monday in 1987 (20.5% drop) and the two day drop in October of 1929 (21.2% across two days) during the Great Depression. Since Black Monday the markets have put in “circuit breakers” to minimize this so the worst one day drop was 9.0% in 2008.

I will start to focus on a time horizon and focus on a realistic goal.

In general, the more extreme crashes took longer to happen (16 months during mortgage crisis and 25 months during Dotcom bubble pop). So it’s not like one couldn’t minimize risk during that time.

Not mention, if you’re already say 50/50 given you’re in retirement, the impact wouldn’t be as dramatic anyways.

I mean if you retired the month before the crash started in November of 2007 with a million in retirement and took $6,000 a month for your income (138 months), you would have withdrawn $828,000 but still have $577,000 remaining. And that’s despite one of the longest and most extreme crashes in history, and as a result the portfolio’s TWRR of 6.27% underperforming the historical return of 8.39%. And even if the return stayed at that level, you would he able to keep that income level for about another 22 years before running out of retirement funds.

This post was edited on 4/5/19 at 10:35 pm

Posted on 4/5/19 at 11:12 pm to RoyalWe

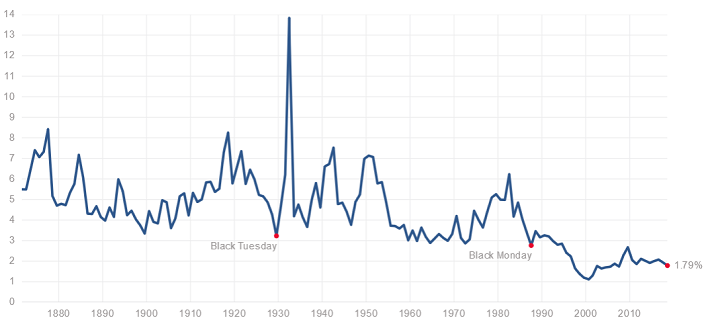

quote:And another thing people fail to consider is that the S&P 500 historical dividend yield is like 4.3% but in recent years its been a bit under 2% as companies are more likely to do stock buybacks than ever before. In fact, until the early 90’s, it rarely dropped below 3%, and since then it’s rarely come close to 3%.

Agree 100%. How did we get to 'near record highs'? By surpassing all prior 'highs'.

So just looking at the prices without considering the dividends doesn’t give the complete picture of the total returns, and in this case makes the recent increases in price compared to historical prices seem more extreme when it’s not a true apples to apples comparison.

Posted on 4/6/19 at 6:54 am to buckeye_vol

Yeah, I my files indicate taking a big hit in 2007 but I never changed anything and eventually recovered.

Last question. Given that my portfolio my portfolio/age will allow me to accept less risk as you previously mentioned and recognizing the "circuit breakers" would you advise me to do anything? "So it's not like one couldn't minimize risk at that time." Lets assume I have balanced to 50/50 by that time.

Last question. Given that my portfolio my portfolio/age will allow me to accept less risk as you previously mentioned and recognizing the "circuit breakers" would you advise me to do anything? "So it's not like one couldn't minimize risk at that time." Lets assume I have balanced to 50/50 by that time.

Posted on 4/6/19 at 3:19 pm to buckeye_vol

quote:

I guess it seems strange that someone who plays poker and is also an entrepreneur would have a such an extreme risk aversion to investing in a broad market (not picking a riskier stock or two) with strong and reliable returns over the long-term.

control freak + scared of new things were barriers to entry

quote:

And you've posted before about heath insurance costs looking at high-deducitible, HSA eligible plans. If you're utilizing those, then you can have the triple-tax benefits of an HSA while also utilizing it as a long-term investment to maximize growth.

going to likely hit this next year 100%

Posted on 4/7/19 at 8:30 am to TDsngumbo

quote:

I've done quite well since opening it in 2011.

Everyone has.

Popular

Back to top

2

2