- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

My credit keeps dropping.....

Posted on 3/28/21 at 9:42 pm

Posted on 3/28/21 at 9:42 pm

Has always been right at 800, or slightly above

Nothing has changed, but it keeps dropping every month.

The last several months, I have made a concerted effort to completely pay-off my credit card before my statement date. I have never been late paying off any of my credit cards, and now I’m even making sure to pay off all recent charges before my statement date, and I’ve even gone as far to make sure I don’t even have a pending charge leading up to the statement date. It still just keeps dropping little by little each month. It’s not terrible yet, but I don’t want it getting down to 700. Any advice?

Nothing has changed, but it keeps dropping every month.

The last several months, I have made a concerted effort to completely pay-off my credit card before my statement date. I have never been late paying off any of my credit cards, and now I’m even making sure to pay off all recent charges before my statement date, and I’ve even gone as far to make sure I don’t even have a pending charge leading up to the statement date. It still just keeps dropping little by little each month. It’s not terrible yet, but I don’t want it getting down to 700. Any advice?

Posted on 3/28/21 at 9:54 pm to UFownstSECsince1950

Perhaps lowered limits and/or credit history changes from unused lines?

Posted on 3/28/21 at 10:41 pm to UFownstSECsince1950

Credit scores fail from inactivity as well as poor payments.

Try letting something report on one or two cards each month.

Also, figure out which cards do not require a hard pull to increase your limit.

Request a limit increase every 6 months.

The additional revolving availability will boost your score.

I have four cards now that have higher limits than my yearly salary. Each are only set to auto pay utilities, a bennys membership, or a drift scented air freshener.

I use the amex platinum to pay everything else to farm points/get free product insurance.

My citi black card provides a sub 9% loan up to the limit. Anything under 10k I finance on it and pay off in under 12 months. I pay slightly more in interest but do not have the credit pull or have to move money.

At the very least, try to 50k available in revolving. After five years of constantly requesting bumps, I have... A shocking amount

You need at least one installment account that can be left open for at a minimum of 18 months at any given time.

When I was mortgage free, I used toys. Atvs or side by sides financed at sub 4%. It wasn't ideal, but it kept the score rising. Now with a large land loan, I let it do the heavy lifting.

I went from a ghost a few years ago to where I am now.

ETA: I wanted to add, thr amex platinum has a 3.99 flex pay option for 12 months for other items. I just realized it this morning and will no longer be using the citi card for that purpose.

Try letting something report on one or two cards each month.

Also, figure out which cards do not require a hard pull to increase your limit.

Request a limit increase every 6 months.

The additional revolving availability will boost your score.

I have four cards now that have higher limits than my yearly salary. Each are only set to auto pay utilities, a bennys membership, or a drift scented air freshener.

I use the amex platinum to pay everything else to farm points/get free product insurance.

My citi black card provides a sub 9% loan up to the limit. Anything under 10k I finance on it and pay off in under 12 months. I pay slightly more in interest but do not have the credit pull or have to move money.

At the very least, try to 50k available in revolving. After five years of constantly requesting bumps, I have... A shocking amount

You need at least one installment account that can be left open for at a minimum of 18 months at any given time.

When I was mortgage free, I used toys. Atvs or side by sides financed at sub 4%. It wasn't ideal, but it kept the score rising. Now with a large land loan, I let it do the heavy lifting.

I went from a ghost a few years ago to where I am now.

ETA: I wanted to add, thr amex platinum has a 3.99 flex pay option for 12 months for other items. I just realized it this morning and will no longer be using the citi card for that purpose.

This post was edited on 3/29/21 at 2:05 pm

Posted on 3/29/21 at 6:20 am to UFownstSECsince1950

quote:

The last several months, I have made a concerted effort to completely pay-off my credit card before my statement date.

About 6 months ago, I paid off all of my credit card debt. At that point, I started paying off credit card purchases almost immediately. The only reason I used credit cards was either for miles or the cash back feature.

My credit rating went down 26 points in one month. I was in shock. I thought that my credit would go up if I didn't carry any credit card debt.

One of the services I have allows you to look at WHY your score has gone up or down. According to the service, my score dropped because I wasn't using ENOUGH of the total credit that I had and said I should use about 3-5% of the total credit available to me.

I'm still in a little shock. But, I started carrying a small amount of credit card debt and my score has started drifting upwards. About a week ago, it just went back above 800.

Posted on 3/29/21 at 6:40 am to UFownstSECsince1950

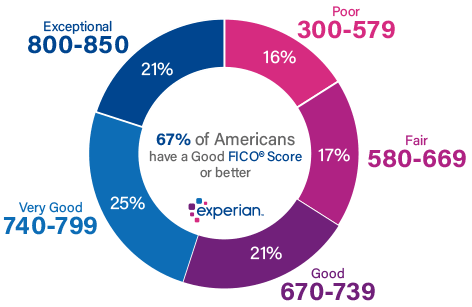

Im not sure why people need 850 scores.

The whole point of good credit is so that you can live life as you please and use credit when needed.

When you are paying interest unnecessarily in order to boost an 800+ score, i think you are letting the tail wag the dog. Just an opinion

The whole point of good credit is so that you can live life as you please and use credit when needed.

When you are paying interest unnecessarily in order to boost an 800+ score, i think you are letting the tail wag the dog. Just an opinion

Posted on 3/29/21 at 6:58 am to meansonny

Yep. Once you hit that 740-760 mark you're getting the best rates. I'd rather keep at that level than be in some dick measuring contest about having an 800 or higher score.

Posted on 3/29/21 at 7:58 am to VABuckeye

I guess some of us prefer not to settle for anything less than perfection

Posted on 3/29/21 at 8:40 am to MMauler

quote:

According to the service, my score dropped because I wasn't using ENOUGH of the total credit that I had and said I should use about 3-5% of the total credit available to me.

Which is why FICO scores are a crock of shite. Why would I use credit if I don't need it?

Posted on 3/29/21 at 8:58 am to UFownstSECsince1950

I've had >800 score for years. I haven't paid interest on credit cards for more than a decade. I did watch it dip below 800 recently, and I think it was due to checking out a refi on my mortgage. A handful of different credit pulls, I thought gave me a ding.

My AMEX Platinum app shows my FICO score, which recovered to low 800s, but when I went to buy a car last month they pulled both my wife's and my credit and we were both 870. Obviously, different credit agencies the score must vary by 10% or so, because I still show 803 on AMEX FICO.

My AMEX Platinum app shows my FICO score, which recovered to low 800s, but when I went to buy a car last month they pulled both my wife's and my credit and we were both 870. Obviously, different credit agencies the score must vary by 10% or so, because I still show 803 on AMEX FICO.

Posted on 3/29/21 at 9:03 am to UFownstSECsince1950

I've had >800 score for years. I haven't paid interest on credit cards for more than a decade. I did watch it dip below 800 recently, and I think it was due to checking out a refi on my mortgage. A handful of different credit pulls, I thought gave me a ding.

My AMEX Platinum app shows my FICO score, which recovered to low 800s, but when I went to buy a car last month they pulled both my wife's and my credit and we were both 871. Obviously, different credit agencies the score must vary by 10% or so, because I still show 804 on AMEX FICO.

My AMEX Platinum app shows my FICO score, which recovered to low 800s, but when I went to buy a car last month they pulled both my wife's and my credit and we were both 871. Obviously, different credit agencies the score must vary by 10% or so, because I still show 804 on AMEX FICO.

Posted on 3/29/21 at 9:09 am to whiskey over ice

You can prefer what you want but it simply isn't necessary and is not something to lose sleep over.

Posted on 3/29/21 at 9:12 am to slacker130

quote:

I went to buy a car last month they pulled both my wife's and my credit and we were both 870

I got a 1620 on my SAT.

Posted on 3/29/21 at 9:39 am to rocket31

quote:

but when I went to buy a car last month they pulled both my wife's and my credit and we were both 871

Weren't you the guy that was never getting married?

Posted on 3/29/21 at 10:46 am to rocket31

slacker130

rocket31

Wait.. What's going on here?

quote:

I've had >800 score for years. I haven't paid interest on credit cards for more than a decade. I did watch it dip below 800 recently, and I think it was due to checking out a refi on my mortgage. A handful of different credit pulls, I thought gave me a ding.

My AMEX Platinum app shows my FICO score, which recovered to low 800s, but when I went to buy a car last month they pulled both my wife's and my credit and we were both 871. Obviously, different credit agencies the score must vary by 10% or so, because I still show 804 on AMEX FICO.

rocket31

quote:

I've had >800 score for years. I haven't paid interest on credit cards for more than a decade. I did watch it dip below 800 recently, and I think it was due to checking out a refi on my mortgage. A handful of different credit pulls, I thought gave me a ding.

My AMEX Platinum app shows my FICO score, which recovered to low 800s, but when I went to buy a car last month they pulled both my wife's and my credit and we were both 871. Obviously, different credit agencies the score must vary by 10% or so, because I still show 804 on AMEX FICO.

Wait.. What's going on here?

Posted on 3/29/21 at 11:19 am to Triple Bogey

It's not as funny when you point it out....

Posted on 3/29/21 at 11:38 am to VABuckeye

quote:

Once you hit that 740-760 mark

Makes sense.

When i was in the mortgage biz 20 years ago, 720+ was the magic number (most often, 680 was the best rate option but occassionally 720+ would overlook rating factors like LTV, cash out, or waiving escrows).

With so many companies boosting scores and monitoring fico by the minute, i could see 740-760 being the new mark.

Posted on 3/29/21 at 12:28 pm to VABuckeye

quote:

Yep. Once you hit that 740-760 mark you're getting the best rates. I'd rather keep at that level than be in some dick measuring contest about having an 800 or higher score.

To be fair wanting to keep an 800+ score is not a bad thing. My mother had a score above 800 and when she bought a new car she got 0.99% interest rate...this was 3 years ago so before covid

Posted on 3/29/21 at 12:38 pm to UFownstSECsince1950

High Impact Factors:

- Payment History - Did you miss a payment? Is it possible one of your creditors thinks you missed a payment.

- Credit Card Utilization - Did an old card that you don't use get cancelled?

- Derogatory Remarks - Did you have a bill get turned over to collections?

Medium Impact Factors:

- Credit Age - Did an older card get closed due to inactivity pushing your average age down?

Low Impact Factors:

- Total Accounts

- Hard Inquiries

Create a free account on credit karma and see what is going into each of these variables. Many credit cards also offer this service.

- Payment History - Did you miss a payment? Is it possible one of your creditors thinks you missed a payment.

- Credit Card Utilization - Did an old card that you don't use get cancelled?

- Derogatory Remarks - Did you have a bill get turned over to collections?

Medium Impact Factors:

- Credit Age - Did an older card get closed due to inactivity pushing your average age down?

Low Impact Factors:

- Total Accounts

- Hard Inquiries

Create a free account on credit karma and see what is going into each of these variables. Many credit cards also offer this service.

Popular

Back to top

12

12