- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Mom invested in silver - concerned about a few things

Posted on 8/20/24 at 6:16 pm

Posted on 8/20/24 at 6:16 pm

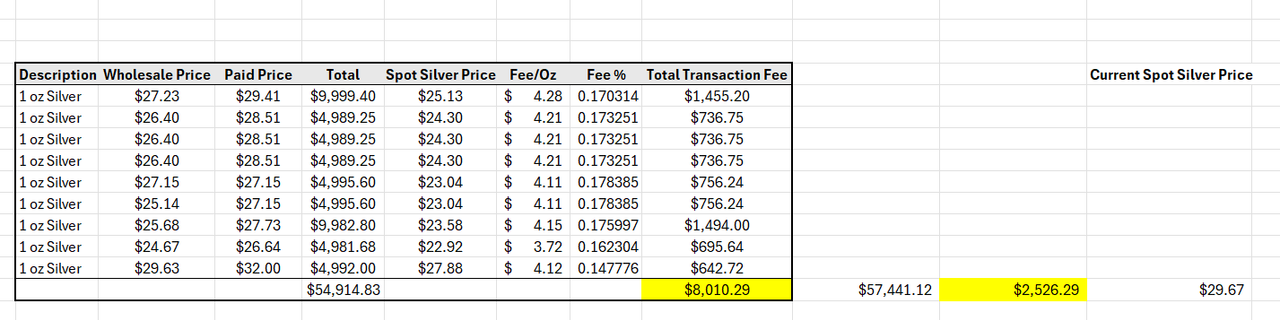

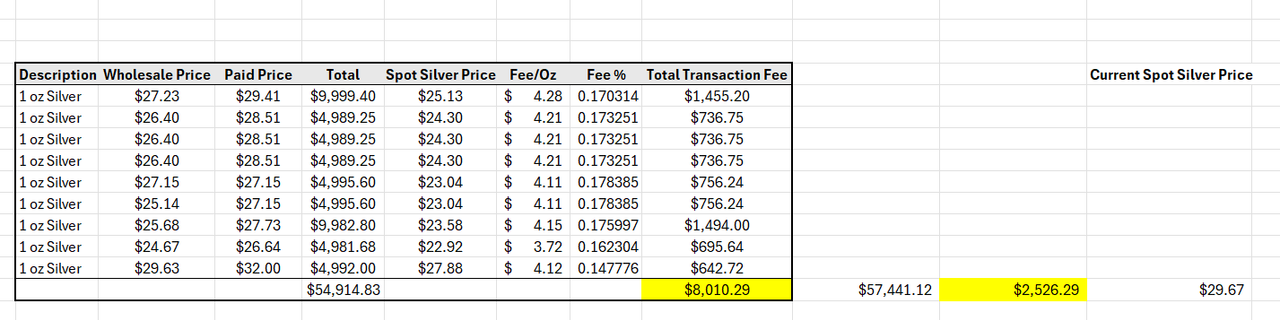

I'm helping my mom with her investments, and I'm a bit concerned about a couple of things from this chap she has purchased from (we'll call him K.E.) who pushes the silver (seemingly on religious / conservative women over the age of 70). I don't disagree with her that precious metals makes for a nice hedge (especially with some of the warning signs that we've been seeing), but as I was reviewing these purchases, it seems that K.E. is charging somewhere between a 12% and 17% premium on each silver transaction (depending on whether he pays the spot silver rate or a wholesale silver rate).

Here are a couple of screenshots of the math I did. K.E. made over $8K on $55K worth of transactions and my mom is only up $2.5K right now (this is physical silver that she stores in a safe deposit box) assuming she could re-sell at this current spot silver price of $29.50 or whatever.

Further, she rolled another $90K+ into an IRA from this same chap and on paper it was a good investment. She bought last year when the spot silver price was only $18.75 and today it's $29.50 or thereabouts. On paper her portfolio should be worth $130K+, but when I logged into her account it's only worth $90K and the advisor we spoke with on the phone said that the actual value would have to be determined by a silver broker / melter (of which this same K.E. is their recommended source).

I'm very new to this world, but thought I'd run this by you lads to see what we should do and if these high commissions are as egregious as they seem to me? Assuming we wanted to exit and invest in precious metals through a more legitimate source, I know there are resources on this board that I could explore as well.

Thanks in advance, you lads are quite a vaulable resource and I appreciate you all so very much

Here are a couple of screenshots of the math I did. K.E. made over $8K on $55K worth of transactions and my mom is only up $2.5K right now (this is physical silver that she stores in a safe deposit box) assuming she could re-sell at this current spot silver price of $29.50 or whatever.

Further, she rolled another $90K+ into an IRA from this same chap and on paper it was a good investment. She bought last year when the spot silver price was only $18.75 and today it's $29.50 or thereabouts. On paper her portfolio should be worth $130K+, but when I logged into her account it's only worth $90K and the advisor we spoke with on the phone said that the actual value would have to be determined by a silver broker / melter (of which this same K.E. is their recommended source).

I'm very new to this world, but thought I'd run this by you lads to see what we should do and if these high commissions are as egregious as they seem to me? Assuming we wanted to exit and invest in precious metals through a more legitimate source, I know there are resources on this board that I could explore as well.

Thanks in advance, you lads are quite a vaulable resource and I appreciate you all so very much

This post was edited on 8/20/24 at 6:20 pm

Posted on 8/20/24 at 7:15 pm to SirWinston

I might see a lawyer about ole KE. Don’t know what the paperwork or any contract looks like, but this dude is taking advantage of the elderly.

Next, review the overall state of her finances. I doubt it makes sense for her to be investing so much in precious metals.

Next, review the overall state of her finances. I doubt it makes sense for her to be investing so much in precious metals.

Posted on 8/20/24 at 9:14 pm to SirWinston

Nearly same As you

I started a thread last week about how a famous actor on TVs Gold Company got my father real good. As in they charged him $3600 per ounce, and then bought it back from him two years afterward at $1800 an ounce. He is a dementia patient and I am not sure what my course of action is here.

I started a thread last week about how a famous actor on TVs Gold Company got my father real good. As in they charged him $3600 per ounce, and then bought it back from him two years afterward at $1800 an ounce. He is a dementia patient and I am not sure what my course of action is here.

Posted on 8/20/24 at 9:23 pm to SirWinston

14-17% premiums seem high for 1oz silver …. are these American Silver Eagles?

Premiums for credit card purchases are typically much higher than the cash prices.

And if the coins are graded and slabbed, they could well be within the standard range of premiums at 15%.

Most of the online dealers charge 7.5 - 8% premium as their “retail price “ for cash transactions , … but patient buyers will catch sales prices with premiums of 1.5 % to 2.5%, including shipping.

Hope that helps, let me know if you need more info. Cheers!

Premiums for credit card purchases are typically much higher than the cash prices.

And if the coins are graded and slabbed, they could well be within the standard range of premiums at 15%.

Most of the online dealers charge 7.5 - 8% premium as their “retail price “ for cash transactions , … but patient buyers will catch sales prices with premiums of 1.5 % to 2.5%, including shipping.

Hope that helps, let me know if you need more info. Cheers!

This post was edited on 8/20/24 at 9:27 pm

Posted on 8/20/24 at 11:44 pm to cadillacattack

Thanks I'll upload a pic of the silver tomorrow were going to get it out of the safe deposit box

Posted on 8/21/24 at 6:57 am to SirWinston

Unfortunately precious metals aren’t regulated in the same way as other investments tend to be. It’s a bit of the Wild West out there, but fraud and misrepresentation are still against the law, so an attorney is probably worth a call.

Posted on 8/21/24 at 8:01 am to SirWinston

At least you have something in hand for the physical silver as there probably isn’t much you can do on the past premiums paid. See what she has and find somebody locally if you can that can verify it’s real.

I’d be more concerned with the IRA account as this is paper earnings. Have the advisor give you a hard number as to what the current account value is.p and if you liquidated the position what you would receive. My guess is the premium to sell will negate a lot of the increase in spot value because that’s where they make their money. Hopefully there will be some earning though and you can get out ASAP.

TL/DR keep the physical or evaluate if you can resell to a 3rd party but get out of the paper IRA if possible and you can convince her to do it.

I’d be more concerned with the IRA account as this is paper earnings. Have the advisor give you a hard number as to what the current account value is.p and if you liquidated the position what you would receive. My guess is the premium to sell will negate a lot of the increase in spot value because that’s where they make their money. Hopefully there will be some earning though and you can get out ASAP.

TL/DR keep the physical or evaluate if you can resell to a 3rd party but get out of the paper IRA if possible and you can convince her to do it.

Posted on 8/21/24 at 8:32 am to cadillacattack

Here's a picture of some of the silver

Posted on 8/21/24 at 8:32 am to SquatchDawg

Thanks I agree with your take.

Posted on 8/21/24 at 9:36 am to SirWinston

quote:

Here's a picture of some of the silver

Put about three times that much in a pillow case and whoop the sellers arse with it.

Hope it’s real at least.

Popular

Back to top

5

5