- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Is this one of the worst times to retire?

Posted on 5/19/22 at 7:02 am

Posted on 5/19/22 at 7:02 am

With interest rates rising, some corporations who offer a lump sum tied to bond interests rates are decreasing the lump sum around 8% from 2nd quarter to 3rd quarter. That's around 100k for 30 plus years of employees in the retirement age. So, many are jumping ship by May 31.

I had a financial advisor tell me: "Don't retire at the wrong time." Using 2007 as an example (yeah, hindsight is everything.

If a person retires now, where to park the lump sum? Most people need to pull from their money for monthly income. Would it make more sense to weather the storm and retire at a more stable time (where investments are in a more secure environment). Or, take the money and run?

I had a financial advisor tell me: "Don't retire at the wrong time." Using 2007 as an example (yeah, hindsight is everything.

If a person retires now, where to park the lump sum? Most people need to pull from their money for monthly income. Would it make more sense to weather the storm and retire at a more stable time (where investments are in a more secure environment). Or, take the money and run?

Posted on 5/19/22 at 7:06 am to Enadious

If you’ve got a good plan, retiring with a lump sum in a down 20% market can be quite a blessing.

Posted on 5/19/22 at 7:10 am to Enadious

My dad just retired two months ago.

My parents are pulling $6000/month with 12 years left on a house note. He’s got $45k in a 401k he doesn’t want to touch until he has to.

I worry about them.

My parents are pulling $6000/month with 12 years left on a house note. He’s got $45k in a 401k he doesn’t want to touch until he has to.

I worry about them.

Posted on 5/19/22 at 7:13 am to StringedInstruments

quote:

My parents are pulling $6000/month with 12 years left on a house note. He’s got $45k in a 401k he doesn’t want to touch until he has to. I worry about them.

So they’ve got $6k/mth in income?

That $45k 401k is peanuts compared to their income.

Posted on 5/19/22 at 7:13 am to slackster

quote:

If you’ve got a good plan, retiring with a lump sum in a down 20% market can be quite a blessing.

Under ordinary conditions, I might find this sound. However, I don't think this analysis is 100% valid in a hyperinflationary environment.

If you exceeded your return targets by 20%, sure, you will probably be okay (you were going to be okay, regardless). You're suggesting that you're in retirement, on a fixed income/finite resources and having the surplus funds is a "blessing", meaning you're going back into equities, which then have to not lose AND beat inflation to stay even.

I'm not sure I'd be crazy about that environment in retirement.

Posted on 5/19/22 at 7:18 am to Enadious

You don’t have to worry about retirement if you never quit working.

Nobody likes a quitter.

Nobody likes a quitter.

Posted on 5/19/22 at 7:23 am to Enadious

Sure, conditions are not ideal. But regardless, you retire on schedule. You should have planned for an annual 4% max draw on your lump sum, through market ups and downs. Oh, and there's this. I retired a few years ago and am having a lot more fun living than when I was working.

Posted on 5/19/22 at 7:24 am to Ace Midnight

quote:

I'm not sure I'd be crazy about that environment in retirement.

I've had other financial advisors point out that the first few years after retirement dictates the success or failure of a retirement plan. It would seem the best move is to keep working until we at least find something of a bottom.

Posted on 5/19/22 at 7:26 am to sawtooth

quote:

You don’t have to worry about retirement if you never quit working.

Nobody likes a quitter.

You sound like me now. I've watched many younger employees retire before me. I was the second to youngest guy when I hired on and now I'm the old guy.

Posted on 5/19/22 at 7:27 am to Enadious

quote:

It would seem the best move is to keep working until we at least find something of a bottom.

Sure, but some folks don't have this as an option. They've wound things down pretty far, already filed paperwork, etc.

There is always a risk your retirement timing will be bad. The best insulator against that is to balance risk and phase yourself out of gains/losses over those last 4 or 5 years, pre-retirement.

Posted on 5/19/22 at 7:28 am to Ace Midnight

I’m suggesting you can get sound returns on fixed income and you’re able to buy equities at a steep discount.

Retiring now is substantially better than retiring a year ago.

Retiring now is substantially better than retiring a year ago.

Posted on 5/19/22 at 7:46 am to slackster

quote:

I’m suggesting you can get sound returns on fixed income and you’re able to buy equities at a steep discount.

Retiring now is substantially better than retiring a year ago.

So, are we at the bottom?

Posted on 5/19/22 at 7:56 am to Enadious

quote:

worst times to retire?

I’d argue Sept 1929 or Nov 2007, so far.

With all of this volatility, it truly depends on what you’ve been invested in. If you’ve stuck to a truly diversified portfolio of stocks & bonds; yes, you are down, but you’re down 10-15% at most.

If 10-15% volatility breaks your ability to fund your retirement, then you’re cutting it too close to actually retire. Save for another couple of years.

Look at it this way.. now retirees can get paid a little something as a saver or with their low-risk assets (bonds & treasuries). Prior to Q1 of this year, retirees had been essentially forced to play equity markets.

Posted on 5/19/22 at 9:13 am to LSUcam7

quote:

I’d argue Sept 1929 or Nov 2007, so far.

Actually the historical data says 1966 was the worst year to retire for a diversified (60/40) portfolio. Exact AA could dictate a slightly different answer but generally between 1966-1969 is considered the worst the time to retire. I think 2000 was actually worse than 2007 to retire. I only say this because it generally surprises people.

This post was edited on 5/19/22 at 9:19 am

Posted on 5/19/22 at 9:18 am to Enadious

quote:

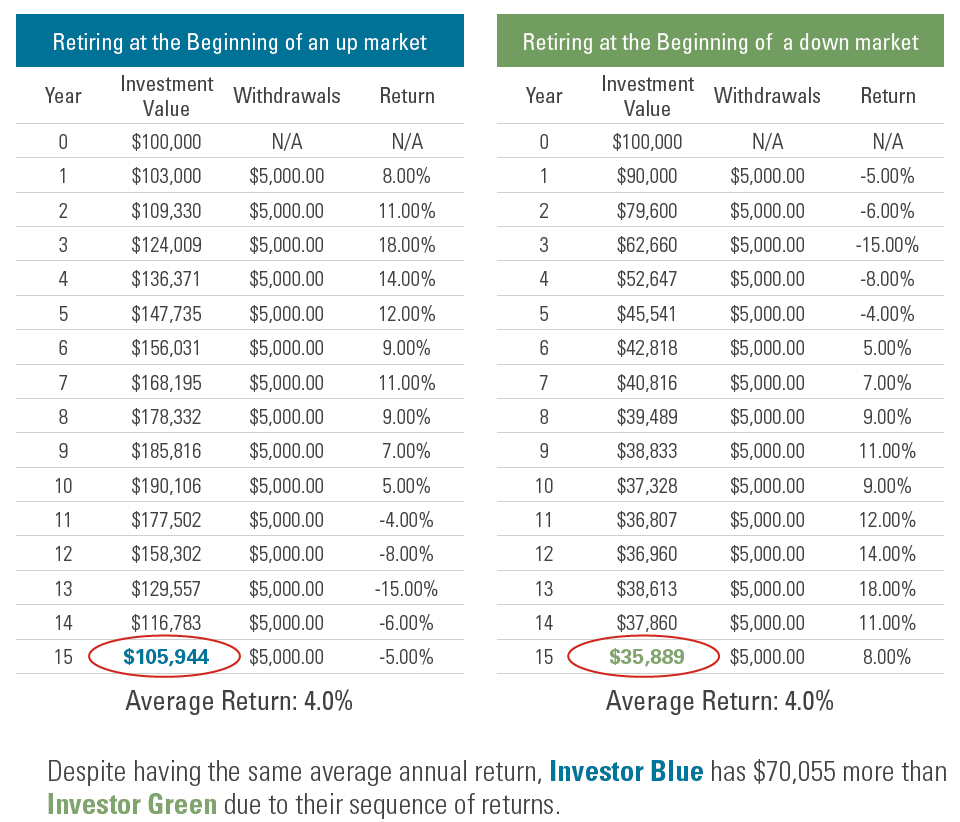

I've had other financial advisors point out that the first few years after retirement dictates the success or failure of a retirement plan

You should look into sequence of returns risk. In general the last 5 years before retirement and the first 5 years after retiring is the most important time period dictating success. This should not be surprising because this is when your portfolio is the biggest and before the drawdowns have eaten away at it.

It is also important to note that most retirement plans are based on worst case scenario and include many contingency plans/back stops. The key retirement studies found that you typically will die with a larger net worth than when you retire (assuming you had an actual plan that included the appropriate risks).

Posted on 5/19/22 at 9:30 am to Enadious

Lump sum down but market down more.. so if wanted to take the money and put in beaten down index funds…

Imo more important is bonds are better than they have been and in retirement you want the money to kick out an income stream… so bond yields are a lot better than a few years ago…

Retire when the time is right … a 100k on a million dollar payout should not be the deciding factor.. diversifying the lump sum in beaten down index funds and building an initial 3-5 year bond ladder and keep cash to continue dca in both for the next year.

Imo more important is bonds are better than they have been and in retirement you want the money to kick out an income stream… so bond yields are a lot better than a few years ago…

Retire when the time is right … a 100k on a million dollar payout should not be the deciding factor.. diversifying the lump sum in beaten down index funds and building an initial 3-5 year bond ladder and keep cash to continue dca in both for the next year.

Posted on 5/19/22 at 9:56 am to slackster

quote:

So they’ve got $6k/mth in income? That $45k 401k is peanuts compared to their income.

Yep. Social security and my mother’s pension.

It’s not bad, but they’re 63. Assuming they live 20 years, with inflation and inevitable healthcare/assistance costs, they don’t have a whole lot.

This post was edited on 5/19/22 at 9:57 am

Posted on 5/19/22 at 10:05 am to bod312

quote:

Actually the historical data says 1966 was the worst year to retire for a diversified (60/40) portfolio.

I can buy this - that 1966 to 1981 range on the S&P was rough. (Thanks Reagan.)

Posted on 5/19/22 at 10:11 am to Enadious

I was wanting to retire in 2 years. Not so sure now. I guess we will see what happens. This is going to be way worse than covid.

I could see this recession lasting till the 2024 elections, especially if the republicans don't take at least one branch in November.

I could see this recession lasting till the 2024 elections, especially if the republicans don't take at least one branch in November.

Posted on 5/19/22 at 10:34 am to Enadious

quote:

I've had other financial advisors point out that the first few years after retirement dictates the success or failure of a retirement plan. It would seem the best move is to keep working until we at least find something of a bottom.

It's called sequence of returns risk. This graphics shows you why it's important. Also I'd say it's the few years before and after retirement where this applies. If it happens right before retirement; can cause you to delay retiring which is what happened to many in 2007.

I'm not sure what the best way to mitigate the risk is. I've read of several strategies from holding several years worth of expenses in cash/bonds, a bond tent to adjusting your withdrawal rate based on market performance etc.

Popular

Back to top

12

12