- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: I have zero credit

Posted on 5/28/25 at 7:05 am to Chief One Word

Posted on 5/28/25 at 7:05 am to Chief One Word

quote:

Question what is the best way to establish credit?

I like your style and can relate.

Only way to build credit is to be irresponsible and run up a bunch of debt. It’s a game irresponsible people use to feel good about themselves even tho they’re making a ton of bad decisions.

Posted on 5/28/25 at 7:07 am to bigjoe1

quote:

I'd guess the convivence of paying day to day expenses instead of hauling cash around or writing a check

What people are saying then is the route. Opening a separate checking account off you main larger accounts and get a debit card off them. It will be a Visa or MasterCard depending on bank. The reason you get a second account is to shield your larger account from fraud. Transfer money over to the new account, few thousand at at time as you need. You basically have a CC you are paying off in real time.

Posted on 5/28/25 at 7:21 am to BabyTac

quote:

Only way to build credit is to be irresponsible and run up a bunch of debt. It’s a game irresponsible people use to feel good about themselves even tho they’re making a ton of bad decisions.

Building credit is not about being irresponsible, if you're irresponsible (miss payments, dont make full payment, use a lot of available credit) your credit score will tank.

The key to good credit score is simply interacting with the available credit in a RESPONSIBLE way. We have about $100k in available credit through our credit cards, there are basically never more than $6k or so on these card in a given month and are paid off every single month in full so we've never paid a cent in interest and our utilization is very low. We've always paid our mortgage on time, we've always paid our car payments on time and early in fact, etc etc...Both of us have credit scores around 815-820.

When you build credit responsibly it helps a number of things - getting the best rate for a mortgage, getting the best rate for a car loan (our car loans are typically 0-1.5%), always getting approved for any new credit card without question we can reap rewards on, etc...

This post was edited on 5/28/25 at 7:25 am

Posted on 5/28/25 at 7:28 am to thunderbird1100

quote:

When you build credit responsibly it helps a number of things - getting the best rate for a mortgage, getting the best rate for a car loan (our car loans are typically 0-1.5%), always getting approved for any new credit card without question we can reap rewards on, etc...

I buy stuff I can afford. Not worried about a rate or reward. Nothing is free, chief.

Posted on 5/28/25 at 8:47 am to BabyTac

quote:

I buy stuff I can afford. Not worried about a rate or reward. Nothing is free, chief.

So do we, again, we've never paid a cent of interest on any credit card. Last year we made over $2k in cash back on our credit cards. Thats with ZERO new cards (bonus offers) we've opened too, just using cards we already have. We could have paid cash for all of that, been out the exact same amount of money, and also not get over $2k back.

We bought my wife's 2022 MDX last year at 1.49%, we could have paid cash but that cash is earning 4-10%, so why would I pay for the car in cash when I make a lot more money by leaving it invested? Getting 1.49% on a used vehicle is great.

Our mortgage is at 2.375%, literally in zero hurry to pay that off.

This post was edited on 5/28/25 at 8:55 am

Posted on 5/28/25 at 9:06 am to Chief One Word

quote:did you happen to spend the last 40 years in prison or something?

Might sound.weird but Im 67.yrs old and have always paid cash for everything.

I almost find it unbelievable to not have any credit at 67. At least some

Bad credit somewhere

Posted on 5/28/25 at 9:08 am to thunderbird1100

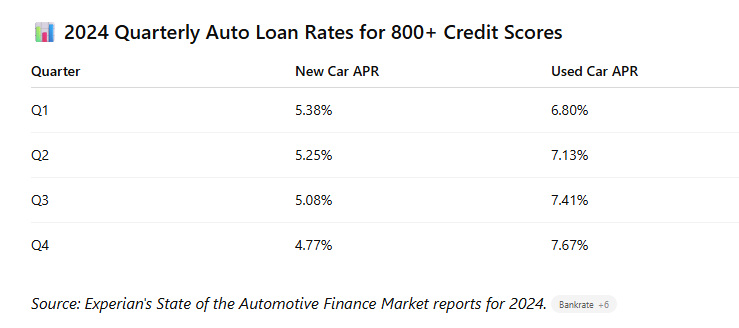

quote:getting 1.49% on a 3yo used vehicle is pretty good from my understanding. But I’ve never financed a used

We bought my wife's 2022 MDX last year at 1.49%

Posted on 5/28/25 at 9:54 am to Chief One Word

quote:

Might sound.weird but Im 67.yrs old and have always paid cash for everything. No loans all my real-estate is deals were cash. Flipped house since the mid 80s. Question what is the best way to establish credit? Thanks.

Congrats. I wouldn't change a thing.

Posted on 5/28/25 at 10:12 am to thunderbird1100

quote:

Getting 1.49% on a used vehicle is great.

The devil is in the details. Who did you finance the MDX through?

1.49% on used or new is not normal in the current car market and also not directly related to good credit, although tied too it. Your 1.49% more than likely was a promotional rate with a dealer or manufacturer trying to move metal. The dealer or manufacturer are basically paying for this rate to move cars off lots and the need for them to clear inventory will directly impact the passable credit level to get that 1.49%.

If you rolled into Porsche and decide to walk out with a new or used 911, you are not getting 1.49%.

Posted on 5/28/25 at 10:18 am to BabyTac

quote:

Only way to build credit is to be irresponsible and run up a bunch of debt. It’s a game irresponsible people use to feel good about themselves even tho they’re making a ton of bad decisions.

tell me you do not know shite about good debts and leverage or knowing how to use business credit to make money without telling me.

dumb. ignorant. laughable statements from you.

ahh i shoulda figured. another dumbass OT poster. stay on that board lil buddy as you are in the deep end of the pool here. run back to the kiddie pool.

This post was edited on 5/28/25 at 10:28 am

Posted on 5/28/25 at 10:23 am to thunderbird1100

quote:

We could have paid cash for all of that, been out the exact same amount of money, and also not get over $2k back.

yup

quote:

We bought my wife's 2022 MDX last year at 1.49%, we could have paid cash but that cash is earning 4-10%, so why would I pay for the car in cash when I make a lot more money by leaving it invested? Getting 1.49% on a used vehicle is great.

right again.

Posted on 5/28/25 at 10:26 am to DarthRebel

quote:

The devil is in the details. Who did you finance the MDX through?

Through Acura, they almost always are running subsidized rates on the CPO vehicles. Again, you only get this type of stuff though if your credit is in order. They arent giving those rates out to people with 500, 600 or even probably 700 credit scores.

I've told many on here about this, I would hesitate to buy any used vehicle right now that isnt something subsidized through the manufacturer or I would pay cash. Used vehicle market rates suck even with good credit (7-8%) as you posted, there's no way I'm spending 7-8% interest on a fastly depreciating asset. We've always financed cars at lower rates, worst was 3.74% and thats just when rates were low even for used in the market. I did my Accord at 0.9% brand new. Too often people will fixate on the exact vehicle they want and ignore any incentives or wait to get it when financing incentives do pop up...and this is how they end up with a 5-6-7% new car loan or 7-8-9% used car loan even with sparkling credit because thats just the rates right now.

2 people buying the same $40k vehicle, 1 gets a manufacturer subsidized 1.49%/3 years and the other got a market rate of 7% over 5 years no money down in either case.

In both cases that $40k vehicle will be worth say $20k in 5 years.

The first person paid $40,925.48 for that vehicle between principal and interest.

The second person paid $47,522.88 for that vehicle between principal and interest.

That is a near $7k difference and both vehicles are worth the exact same in the end at $20k after 5 years.

It cost the first person $20.9k to drive that vehicle (sans fuel/insurance/main) over 5 years, it cost the second person $27.5k to drive the same vehicle over the same 5 years...all because the second person didnt take advantage of a manufacturer incentive rate.

This post was edited on 5/28/25 at 10:34 am

Posted on 5/28/25 at 10:52 am to thunderbird1100

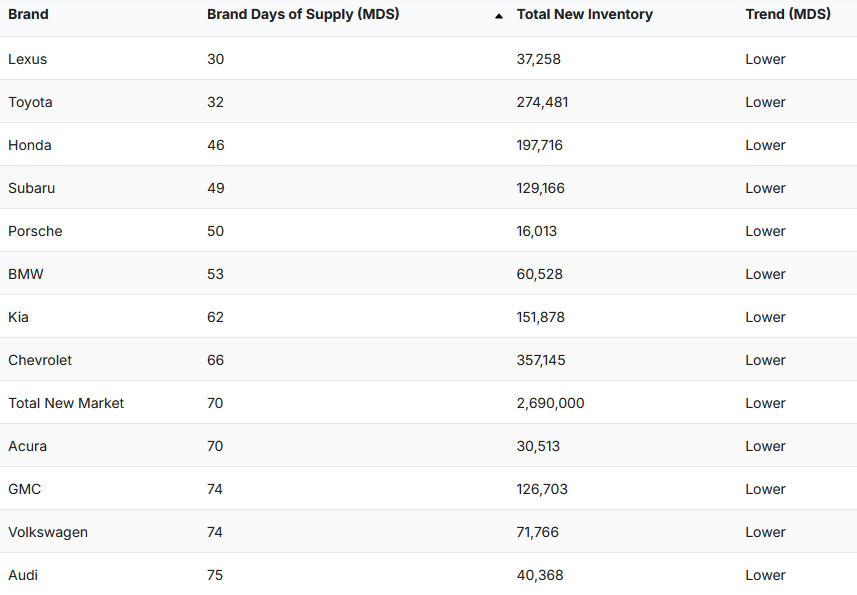

Getting a promotional rate is not a flex on how great your credit is, but related to a dealer or manufacturer not being able to move metal. Once again, a higher credit score betters your chance of qualifying, however that level of qualification is directly tied to the metal moving off the lots. If 800+ is getting it done, then nothing is changed. If inventory is piling up, that bar will drop. Acura daily supply currently (April 25) is running at industry average.

If you pulled off 1.49% on a Toyota, that would be a flex

The ability to purchase exactly what you want vs. purchasing what people do not want at a cheaper rate. That is an interesting debate on financial ability.

If you pulled off 1.49% on a Toyota, that would be a flex

quote:

Too often people will fixate on the exact vehicle they want and ignore any incentives or wait to get it when financing incentives do pop up...and this is how they end up with a 5-6-7% new car loan or 7-8-9% used car loan even with sparkling credit because thats just the rates right now.

The ability to purchase exactly what you want vs. purchasing what people do not want at a cheaper rate. That is an interesting debate on financial ability.

Posted on 5/28/25 at 11:09 am to DarthRebel

quote:

Getting a promotional rate is not a flex on how great your credit is, but related to a dealer or manufacturer not being able to move metal.

Subsidized manufacturer rates are pretty much only offered to people with very good credit, again, the theme of the thread here. Sure, you can pay $40k cash for a car, but I'd rather finance it for 1.49%/36 mo through the manufacturer if given the chance and arbitrage my available cash to make way more than that, and these things literally pop up all the time across all mainstream manufacturers (lol @ porsche example, we arent talking about 1-2%ers here), people just dont know about it.

quote:

Once again, a higher credit score betters your chance of qualifying, however that level of qualification is directly tied to the metal moving off the lots. If 800+ is getting it done, then nothing is changed. If inventory is piling up, that bar will drop. Acura daily supply currently (April 25) is running at industry average.

Pretty much anything goes on some type of manufacturer subsidized rate at some point, especially during model changeover years for new. Toyota is not immune to this. You can get new Tundras and Tacomas for 1.99% right now. They offer 3.99% on a number of other models as well (Camry, Crown, RAV4...2 of these being huge sellers for them) which is well below market rates. Again why pay market rates when inevitably in most cases a manufacturer incentive will pop up which drops the market rate significantly? It's just lighting money on fire especially in this higher than recently typical interest rate environment. Lexus is running 3.49% on a handful of models themselves. This is not even getting into Toyota/Lexus offering 0% on their electric vehicles (because if we're honest its the only way most manufacturers move their electric vehicles if someone does buy vs. lease it)

quote:

The ability to purchase exactly what you want vs. purchasing what people do not want at a cheaper rate. That is an interesting debate on financial ability.

There are literally hundreds of vehicle options out there now. If you want to light several grand on fire because you fall in love with only 1 depreciating asset by being lazy and not patient, go for it, not my money, but its still throwing money away if you buy a vehicle for market rates these days, painfully in some cases if you just wait a little bit even for a certain vehicle.

Paying high interest for a fast depreciating asset is one of the most typical (dumb) american things to do. Hey if you want ot pay 7 grand more for the exact same vehicle ultimately, go for it, I'll take 2-3 vacations on that interest you just paid the bank instead

This post was edited on 5/28/25 at 11:14 am

Posted on 5/28/25 at 12:02 pm to thunderbird1100

quote:

thunderbird1100

You are missing the point. Promotional car finance rates are impacted more by the need to move metal and not a credit score. Your great score does not get you that great rate, the dealer needing to move inventory does. Your great score was worthless in 2020 and 2021, there was no inventory. The qualifying number varies based off product to move, which is normally tied to cost of floorplan to dealer or manufacture sales incentives/goals.

Posted on 5/28/25 at 12:18 pm to DarthRebel

quote:

You are missing the point.

Not missing the point at all.

quote:

Promotional car finance rates are impacted more by the need to move metal and not a credit score.

My point was to qualify for a promotional rate you have to have a very good credit score, not sure what got lost in translation there, but you're not bringing anything new to the table or any actual insight here. I AGREE with you most promo rates are going to be on things they want to move. Of course if it's a brand new model in a new generation they wont run subsidized rates much on it immediately, but eventually most vehicles get there and some pretty quickly if overproduced some.

I gave a ton of examples on Toyota/Lexus models that are WAY under market rates and they aren't hurting for sales or have tons of extra inventory on all those. Heck the Tacoma is a brand new generation model still somewhat and 1.99% right now. What scares most people off promo rates even if they qualify for it is many times they only offer shorter terms like 36mo and people cant swallow the monthly payment, which is a bit short sided but if you feel strapped with a car on 36mo of payments I would argue you cant afford the car to begin with and buy something much cheaper.

Posted on 5/28/25 at 4:23 pm to thunderbird1100

quote:

My point was to qualify for a promotional rate you have to have a very good credit score, not sure what got lost in translation there, but you're not bringing anything new to the table or any actual insight here

This is where we are disconnecting. Promotional rates are directly tied to needing to move inventory and not credit score. The more inventory to move, the lower the bar goes for score. Your high score did not get you the 1.49%, the dealer needing to move product did. Another person with a lower score could get the same rate by putting more money down or favorable debt-to-income.

When you claim "(our car loans are typically 0-1.5%)", this is not a product of your score, but rather you specifically limiting yourself to only promotional offers where your score might qualify you for that.

I know I am being an arse, but clarity matters when someone is looking to establish credit and what their expectations should be. 800+ credit score in no way equals favorable rates, it opens up more pathways to them in specific situations though.

In the early 2000s you basically needed 700+ to get 0%, that is just a rating of Good. After the 2008 financial crisis (2010-2014), it ticked up to 720+. 700-719 could still get 0% though if income or debt-to-income were in good places. In 2020-2021 0% dropped as low as 660+ and by 2022 shot up to 720+ because of inflation and cost of subsidizing high rates with lack of inventory.

Posted on 5/28/25 at 4:35 pm to Chief One Word

67 years without credit. 68th year seeking credit. Why now?

Posted on 5/28/25 at 6:36 pm to Chief One Word

Signature loan at bank secured by CD.

Posted on 5/29/25 at 3:50 am to WM88

I have no idea how someone can go through life to 67 years old and not have a credit card. Credit cards used as designed and paid off on the due date is one of the best ways to build wealth that I can think of.

I charge everything I buy. I probably earn $24,000 a year in cash back. Not as much as my SS check but within $20K. Tax free too.

How do you stay in a hotel or fly or rent a car? Hell go to a college football or baseball game and buy a beer? They don't take cash.

I charge everything I buy. I probably earn $24,000 a year in cash back. Not as much as my SS check but within $20K. Tax free too.

How do you stay in a hotel or fly or rent a car? Hell go to a college football or baseball game and buy a beer? They don't take cash.

Popular

Back to top

2

2