- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Fed hides weekly M1 supply, says "money doesn't matter"

Posted on 7/13/22 at 3:08 pm to wutangfinancial

Posted on 7/13/22 at 3:08 pm to wutangfinancial

Tic toc

Posted on 7/13/22 at 3:09 pm to slackster

quote:

He’s not wrong. Are you suggesting he is?

You need actual velocity of money to trigger traditional inflation, and then you need that velocity to be maintained for it to be long lasting inflation.

People have been worrying about runaway inflation since 2009 and it simply hasn’t even come close to materializing in this country.

Clown

Posted on 7/13/22 at 10:30 pm to Strannix

Damn. Didnt age well.

This post was edited on 7/13/22 at 10:31 pm

Posted on 7/13/22 at 10:45 pm to USMCguy121

MB is full of sunshine pumpers with their heads I the sand, they think they can duck hard mathematical certainties

This post was edited on 7/13/22 at 10:46 pm

Posted on 7/13/22 at 11:04 pm to Strannix

quote:

Clown

It’s comical that you think my post has been proven wrong.

I’ve definitely been wrong about inflation in the short/medium term, but of all the posts you could bump to highlight it, you chose the one where I simply laid out the facts.

Posted on 7/13/22 at 11:30 pm to USMCguy121

if anything this thread shows how time is passing insanely quickly. Can’t believe my original posts were made over a year ago.

Feel like I was right on the inflationary pressures being unprecedented, but wrong in that I didn’t think the Fed had it in them to be hawkish in the face of initiating a recession. I guess I still don’t think they have it in them to maintain their hawkish posture once unemployment starts ticking up in the middle of a recession.

Feel like I was right on the inflationary pressures being unprecedented, but wrong in that I didn’t think the Fed had it in them to be hawkish in the face of initiating a recession. I guess I still don’t think they have it in them to maintain their hawkish posture once unemployment starts ticking up in the middle of a recession.

Posted on 7/13/22 at 11:41 pm to tenderfoot tigah

quote:

How do people this clueless get one of the most important jobs on the planet?

They aren’t clueless…. They know exactly what they are doing

Posted on 7/14/22 at 8:55 am to Strannix

The DXY is up 15ish% since Fedwire broke last year. Maybe your conclusion about consumer prices was right, but your conclusion on inflation is wrong. Your prediction was based on academic theory that is about 50 years outdated and without consideration for the supply variable which is the main driver for CPI increases for 1.5 years. Chill, baw. You sound like a lib flexing that a 10 year old girl got abused.

Posted on 7/14/22 at 9:25 am to Strannix

quote:

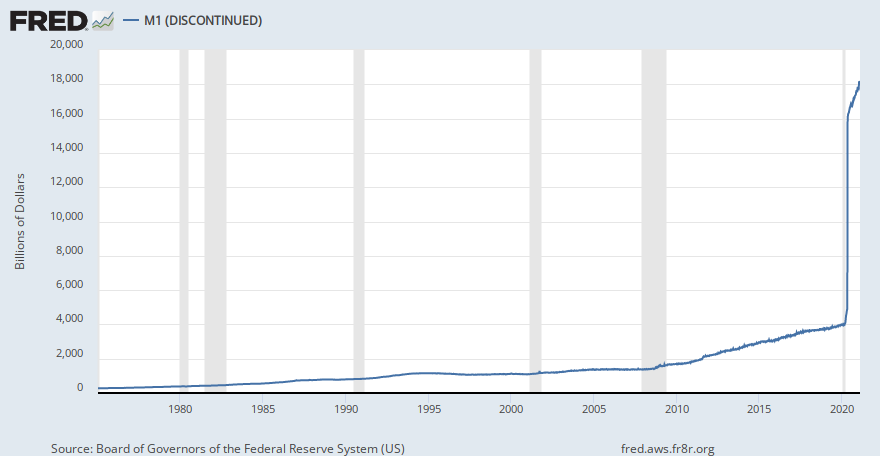

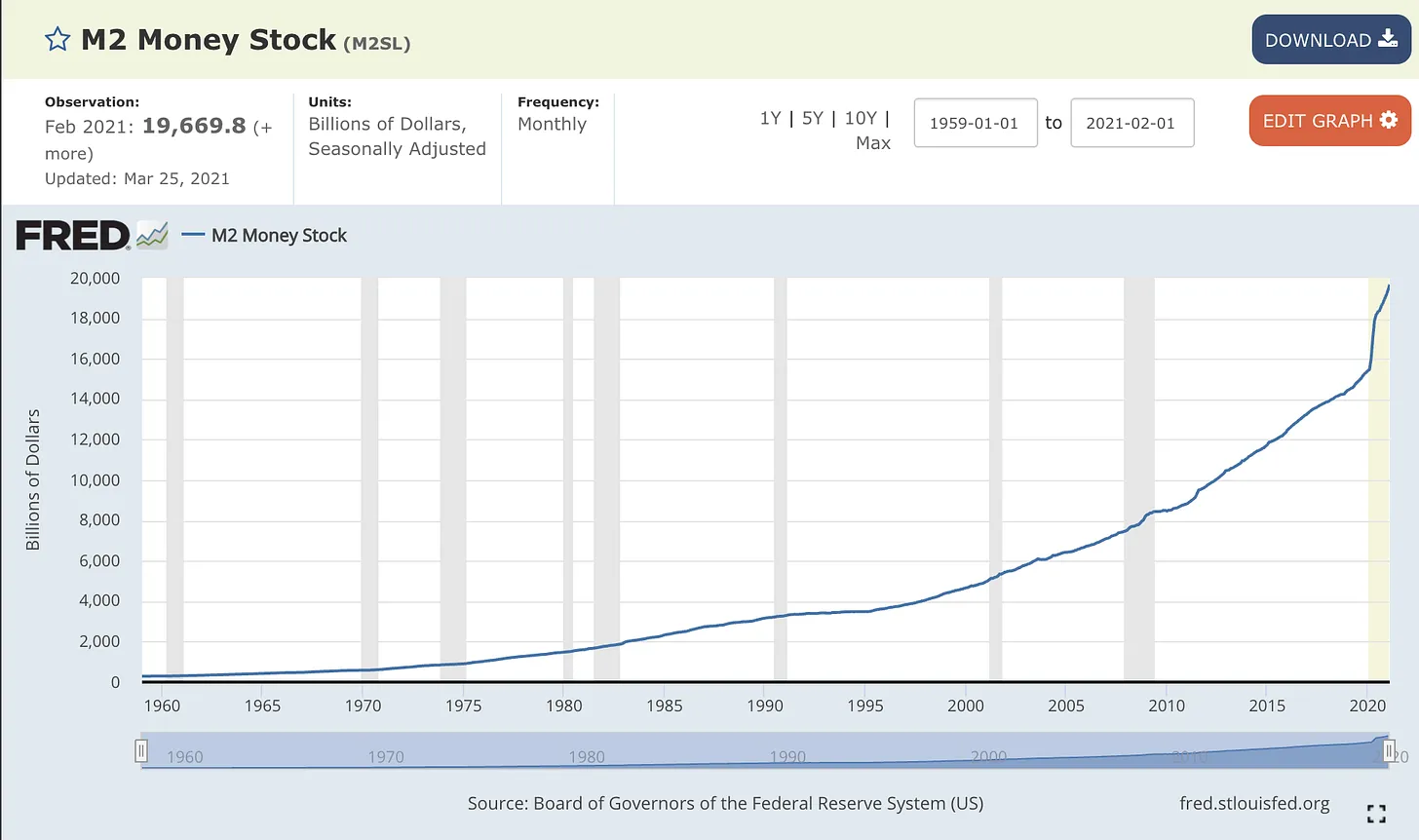

Be careful with that chart. The reason for that massive spike is due to how the Fed changed their view of the money supply. During COVID so many people began using their savings accounts as just another checking (meaning they, generally, became liquid enough to be considered as part of M1) that they added them to M1.

Don't get me wrong, there was an increase in the overall money supply, but it wasn't nearly that big a jump (see: M2)

Posted on 7/14/22 at 11:03 am to wutangfinancial

quote:

The DXY is up 15ish% since Fedwire broke last year.

Valued against what? A basket of shittier currencies?

Posted on 7/14/22 at 11:29 am to Strannix

CPI is a basket of a bunch of shitty Chinese goods. What's your point?

The dollar has not been debased to the degree that you think it has, if at all. There is no way to measure it. In fact, there are pricing signals everywhere indicating the opposite.

The dollar has not been debased to the degree that you think it has, if at all. There is no way to measure it. In fact, there are pricing signals everywhere indicating the opposite.

Posted on 7/14/22 at 11:37 am to wutangfinancial

You are so wrong I dont even know how to start to respond.

This post was edited on 7/14/22 at 11:47 am

Posted on 7/14/22 at 11:51 am to Strannix

Can’t wait until you bump this thread this winter when the dollar starts falling on a Fed pivot to confirm “it’s happening” again

Posted on 7/14/22 at 12:15 pm to wutangfinancial

I dont even care anymore

Posted on 9/14/22 at 5:52 am to Strannix

quote:

Valued against what? A basket of shittier currencies?

Pretty clear now. The USD is worth a Euro and nearing an ATH vs the Pound.

And yet we have buku inflation.

Posted on 9/14/22 at 11:13 am to TDFreak

quote:

Pretty clear now. The USD is worth a Euro and nearing an ATH vs the Pound.

And yet we have buku inflation.

Skinniest kid at fat camp.

Posted on 9/29/22 at 12:02 pm to Strannix

New white hot inflation numbers coming....

Popular

Back to top

0

0