- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Diving deeper on Standard Lithium?

Posted on 10/18/23 at 7:15 am to Ballstein32

Posted on 10/18/23 at 7:15 am to Ballstein32

quote:

might be the reason for the jump.

My own opinion, but I don't think that article has much to do with this action. There is something else driving this large surge in buys that is not out in front of us yet or we have missed it somehow. May never know.

Posted on 10/18/23 at 7:28 am to Dock Holiday

Shorts covering. 75% of my shares were returned yesterday (Fidelity).

Maybe something deeper as well.

Maybe something deeper as well.

Posted on 10/18/23 at 8:04 am to CecilShortsHisPants

Posted on 10/18/23 at 8:11 am to Dock Holiday

Shorts are gonna be hurting.

Timeline [met] not met

Timeline [met] not met

Posted on 10/18/23 at 8:45 am to SmackoverHawg

Sector getting hammered early today. Hopefully we can duck and dodge

Posted on 10/18/23 at 8:50 am to CecilShortsHisPants

Alrighty so that starts two clocks.

First, Lanxess decision. I'm going to shoot an email over to Standard to double check my timeline, I'm not as confident on this one. But I believe Lanxess now has 45 days to make a decision, so November 28th for that (ugh I hope it comes sooner).

This also starts the FID clock, officially due by Jan 19th. Recall, though, that they can request an extension on this decision so it is a soft deadline.

First, Lanxess decision. I'm going to shoot an email over to Standard to double check my timeline, I'm not as confident on this one. But I believe Lanxess now has 45 days to make a decision, so November 28th for that (ugh I hope it comes sooner).

This also starts the FID clock, officially due by Jan 19th. Recall, though, that they can request an extension on this decision so it is a soft deadline.

Posted on 10/18/23 at 9:02 am to Fe_Mike

Did someone here say that financing will be decided before the FID is announced? Asking to ask if grants are expected before FID

Posted on 10/18/23 at 9:06 am to CecilShortsHisPants

quote:

Sector getting hammered early today. Hopefully we can duck and dodge

Not worried short term. With us facing a global financial crisis, any move forward is a win in my book. Stock price doesn't really matter to me right now other than I don't want to moon before I can accumulate cash. I won't cry if it does though.

Posted on 10/18/23 at 9:07 am to ev247

quote:

Did someone here say that financing will be decided before the FID is announced? Asking to ask if grants are expected before FID

Dunno but they greatly improves their ESG score with their last few hires.

Posted on 10/18/23 at 9:23 am to Fe_Mike

quote:

This also starts the FID clock, officially due by Jan 19th. Recall, though, that they can request an extension on this decision so it is a soft deadline.

I have not been able to find a 90 day deadline for this. Not saying it doesn't exist, because SEC regs are not exactly my wheelhouse, but I'd be curious what SLI's understanding is. May want to send them the link to what you are seeing to be sure they have it in front of them... I'm reminded they are Canadian after all.... LOL

Posted on 10/18/23 at 9:27 am to ev247

quote:

Did someone here say that financing will be decided before the FID is announced?

Yes, that's typically how it works. Need Lanxess to officially decide if they are going to enter the race and to what extent, that goes into deciding how much outside capital is needed, then FID based on all of the above.

Posted on 10/18/23 at 9:35 am to ev247

quote:

Did someone here say that financing will be decided before the FID is announced? Asking to ask if grants are expected before FID

Yes, they told me that the financing would be settled prior to FID, everything would have to be in place.

That being said, I think a grant would be an exception here. I would assume that they are financing as though no grant exists, and getting one would just be lagniappe. I'm not sure how that would factor into a potential partnership or loan, if the grant came after FID. My guess is, either way, the grant will become more of an issue of accounting and will improve their cash flow at some point in the future. It will be a nice publicity boost in the near term but won't actually impact the Phase 1 economics all that much. Maybe it can help reduce equity sales/dilution if it comes early enough. (oh, eta, I don't remember if I mentioned this before but they did tell me that in the case of dilutive fundraising they are optimistic the valuation when they make an equity sale will be very different than where they currently sit....fwiw)

I don't expect grant news prior to FID, but don't have it totally off the table.

This post was edited on 10/18/23 at 9:41 am

Posted on 10/18/23 at 9:37 am to Dock Holiday

quote:

I have not been able to find a 90 day deadline for this. Not saying it doesn't exist, because SEC regs are not exactly my wheelhouse, but I'd be curious what SLI's understanding is

This is indeed Canadian regulations.

This is info that I got straight from Standard. They told me that the filing of the DFS starts a 90 day clock for them to make the FID. I do not have familiarity with the process outside of this.

Posted on 10/18/23 at 9:40 am to Fe_Mike

Breaking news and the stock drops 2.5%

Posted on 10/18/23 at 9:44 am to Drunken Crawfish

Making out gangbusters compared the rest of the sector.

REMX down 5%

Piedmont down 5%

Livent down 6%

Lithium Americas down 8%

ALB down 9% (that actually hurts, I own a lot of Albemarle haha)

(that actually hurts, I own a lot of Albemarle haha)

SLI down 1.8%? I'll take that.

Annnnnnnd we're green.

I can do this all day.

REMX down 5%

Piedmont down 5%

Livent down 6%

Lithium Americas down 8%

ALB down 9%

SLI down 1.8%? I'll take that.

Annnnnnnd we're green.

I can do this all day.

This post was edited on 10/18/23 at 10:32 am

Posted on 10/18/23 at 11:32 am to Fe_Mike

I was mainly wondering because I thought that it would take longer than 90 days (to FID) to get a grant. Based on nothing specific.

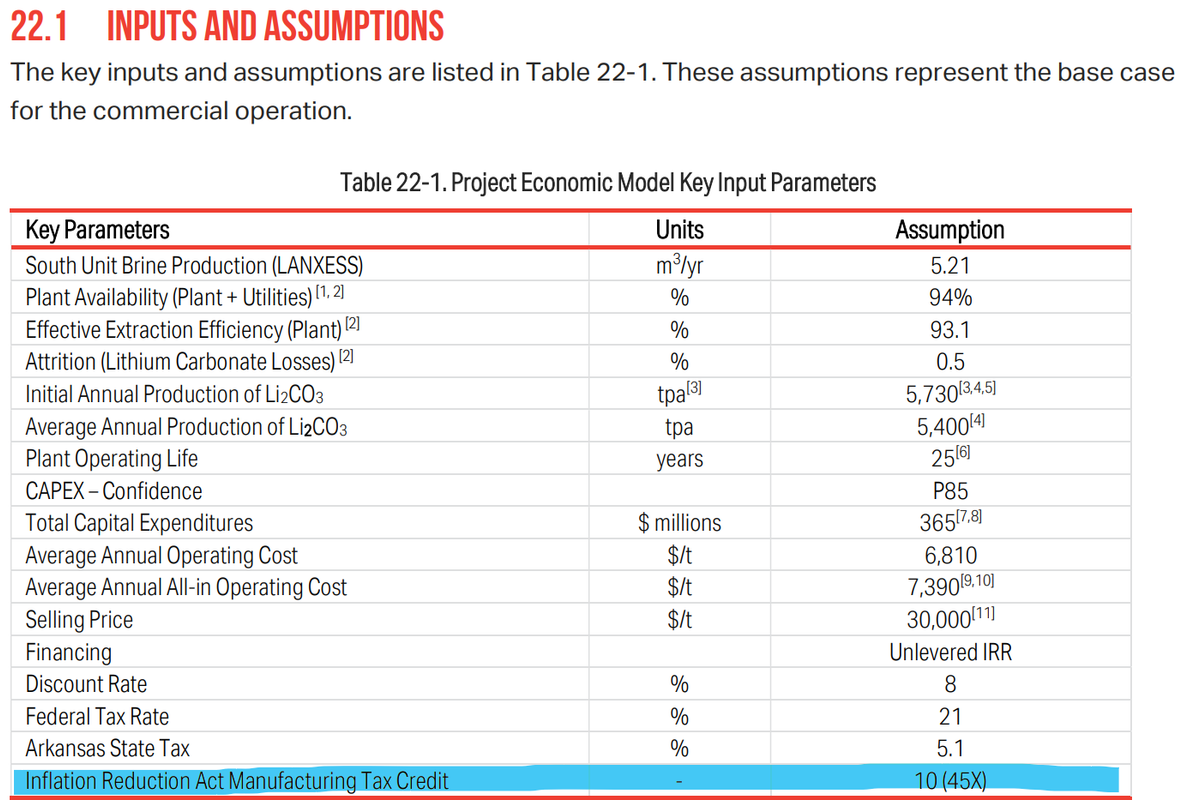

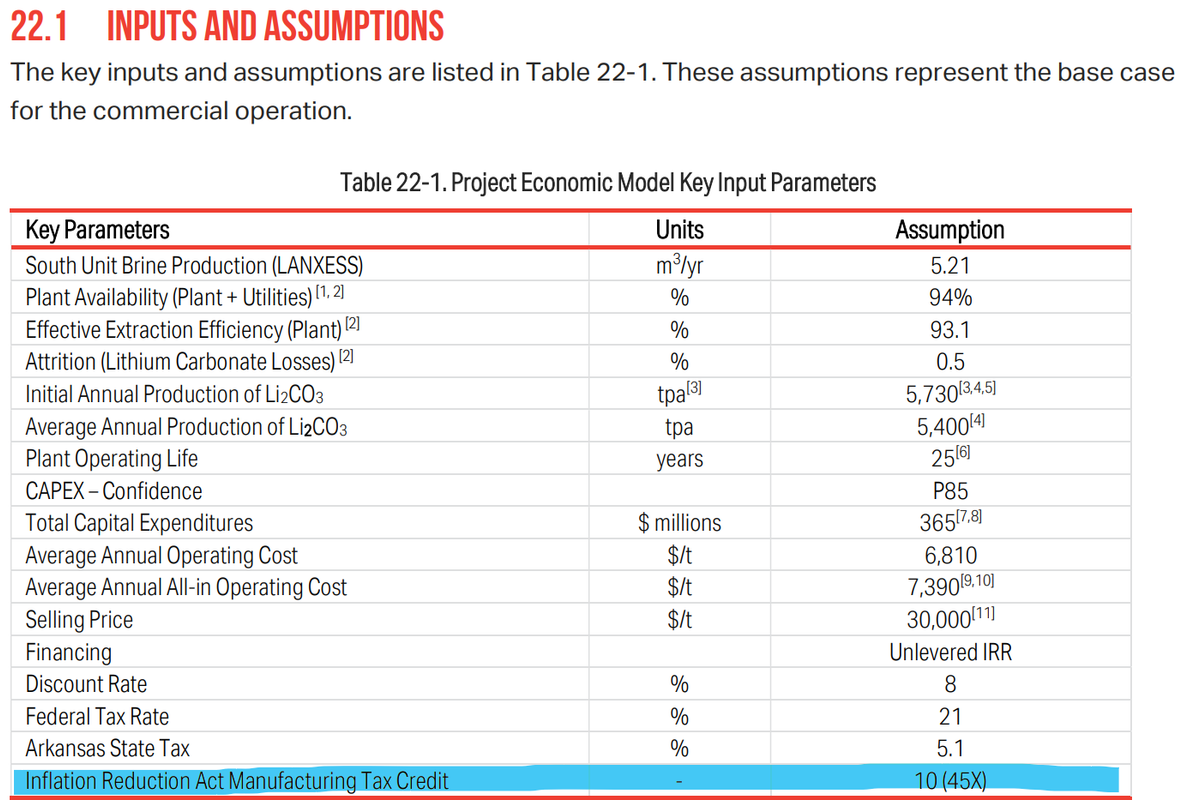

Looking through the DFS, this may be something of note. FeMike, after your last chat with the company you relayed that they were further along on the DoE grant than the IRA tax credits. On page 175 of the DFS (pic below) they assume IRA tax credits in their base case.

May be overly simplistic(?) but my logic says that 1+2=3

1. Standard IR says DoE grant is further along than IRA tax credits

2. DFS says IRA tax credits are far enough along to input them into base case

3. Therefore, the company would expect the DoE grant no less than they expect the IRA tax credits, which they built into their base economic model.

PS no clue what "10(45X)" means re IRA tax credits

Looking through the DFS, this may be something of note. FeMike, after your last chat with the company you relayed that they were further along on the DoE grant than the IRA tax credits. On page 175 of the DFS (pic below) they assume IRA tax credits in their base case.

May be overly simplistic(?) but my logic says that 1+2=3

1. Standard IR says DoE grant is further along than IRA tax credits

2. DFS says IRA tax credits are far enough along to input them into base case

3. Therefore, the company would expect the DoE grant no less than they expect the IRA tax credits, which they built into their base economic model.

PS no clue what "10(45X)" means re IRA tax credits

Posted on 10/18/23 at 11:57 am to ev247

45x is the section code for the credits.

I assume the 10 represents the credit amount which is 10% of the production costs associated to make the lithium.

I assume the 10 represents the credit amount which is 10% of the production costs associated to make the lithium.

Posted on 10/18/23 at 2:51 pm to CecilShortsHisPants

It is remarkable how they always manage to time their news/PR on days it's a bloodbath in the market

Posted on 10/18/23 at 2:51 pm to Fe_Mike

quote:

Making out gangbusters compared the rest of the sector.

Like a fart in the wind...poof!

Posted on 10/18/23 at 5:01 pm to AUHighPlainsDrifter

When they break ground in January, it'll start being real to more investors. Everything on track to start then.

Popular

Back to top

2

2