- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Compounding effects-Passing money through 401k

Posted on 8/9/24 at 11:14 pm

Posted on 8/9/24 at 11:14 pm

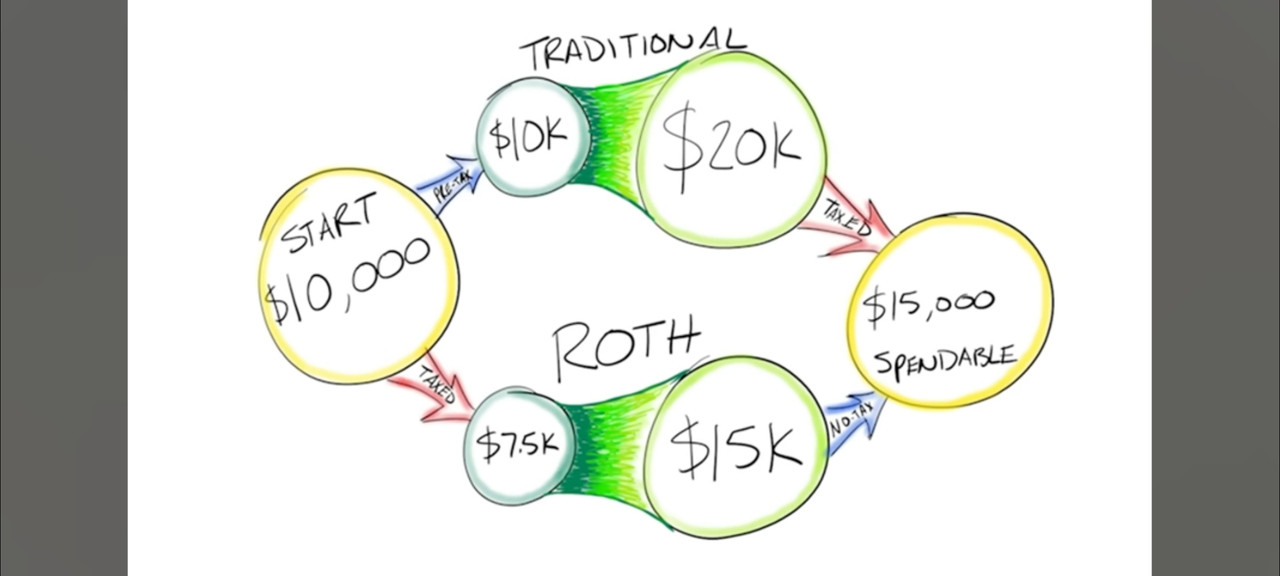

There is an axiom that it is a bad idea to maximize our 401K contributions if you think there is any chance that you will ever need to withdrawal a dollar prior to turning 59 1/2. Is there any mathematical basis for this?

If your marginal tax rate is 22% or greater would it not be better to use the 401K as a passthrough for as much pre-tax income as possible so that the money compounds without that 24% tax?

The penalty for the portion that you theoretically withdrawal prior to 59 1/2 is 10% on your annually compounded pre-tax. Like that's the worst way you could end up with a 10% tax bill?

I feel like I'm missing something.

If your marginal tax rate is 22% or greater would it not be better to use the 401K as a passthrough for as much pre-tax income as possible so that the money compounds without that 24% tax?

The penalty for the portion that you theoretically withdrawal prior to 59 1/2 is 10% on your annually compounded pre-tax. Like that's the worst way you could end up with a 10% tax bill?

I feel like I'm missing something.

Posted on 8/9/24 at 11:58 pm to beaverfever

I’m not sure I completely understand your question, but you can save in non-qualified accounts very tax efficiently too. Most of the taxable income on a non qualified equity account is going to be taxed much lower than your marginal rate too.

For example: if you put $10,000 into an investment that doesn’t pay a dividend, and the investment grows 4x in your 401k, you’ve saved $2200 in taxes on the front end but you’ll pay ordinary income taxes on $40,000 at some point in the back end. That money will always be taxable, even to your heirs.

If you instead invested that $7800 (net of the $2200 taxes) into the same investment in a non qualified account, you’d have $31,200 with unrealized gains of $23,400. Those gains could be taxed as low as 0% potentially, and are currently only taxed at 20% on the highest end. They could also be eliminated altogether with a step up in basis upon death, so your heirs wouldn’t pay any taxes on them. And obviously you can use it before 59.5 without any additional penalties.

I’m not arguing against the benefits of tax deferred growth, but I don’t recommend clients save money in their 401k or other traditional qualified accounts that they’ll need before retirement.

For example: if you put $10,000 into an investment that doesn’t pay a dividend, and the investment grows 4x in your 401k, you’ve saved $2200 in taxes on the front end but you’ll pay ordinary income taxes on $40,000 at some point in the back end. That money will always be taxable, even to your heirs.

If you instead invested that $7800 (net of the $2200 taxes) into the same investment in a non qualified account, you’d have $31,200 with unrealized gains of $23,400. Those gains could be taxed as low as 0% potentially, and are currently only taxed at 20% on the highest end. They could also be eliminated altogether with a step up in basis upon death, so your heirs wouldn’t pay any taxes on them. And obviously you can use it before 59.5 without any additional penalties.

I’m not arguing against the benefits of tax deferred growth, but I don’t recommend clients save money in their 401k or other traditional qualified accounts that they’ll need before retirement.

This post was edited on 8/10/24 at 12:08 am

Posted on 8/10/24 at 2:23 am to slackster

quote:

That money will always be taxable, even to your heirs.

A trad 401k can be rolled over to a pre-tax ira; then you can convert that (or a subset) to a roth ira at any time. You just pay income tax on that conversion amount. This could be as low as 10% income tax if you have no other income. Ideally you do these roth conversions in early retirement before taking social security, pension etc.

At that point, since it's now in a roth ira it's tax free. The roth conversion amount become eligible for penalty free withdrawals in 5 years.

Posted on 8/10/24 at 7:39 am to gpburdell

Tax man is going to get his either way. You tack the 10% penalty on top of the tax

Posted on 8/10/24 at 11:38 am to XenScott

quote:But your marginal tax rate on the withdrawals is likely lower than it would have been on the original income. After all, you’re probably withdrawing early because you need money.

Tax man is going to get his either way. You tack the 10% penalty on top of the tax

That wasn’t my main thought process but I think it even further supports the argument. My main argument was that 10% doesn’t seem sufficient to dissuade someone from choosing the pre-tax compounding option.

Posted on 8/10/24 at 11:47 am to slackster

quote:This is probably the best counter argument that could tilt the scale the other way. This is a huge opportunity that most don’t consider.

They could also be eliminated altogether with a step up in basis upon death

Posted on 8/10/24 at 11:51 am to beaverfever

It’s a 10% penalty plus your tax rate not just 10%

Posted on 8/10/24 at 11:57 am to beaverfever

Max out that pre-tax 401k. You'll have more money in the end, which does indeed have a higher tax burden. I fail to see the downside.

Posted on 8/10/24 at 12:12 pm to Asharad

Hell I could lose my job during the recession and decide to work on getting a grad degree or something in 2025 and pay jack shite in taxes on the withdrawals outside of that 10%. In that case I skipped the 22%+ on the front end and I skipped the unrealized capital gains tax obligation that grew while the funds were invested in a taxable account.

If you max out your 401k there is a clear playbook for dealing with less ideal circumstances (recession/job loss) and a playbook for dealing with a best case scenario (you never need the money before 59 1/2). It leaves you with more flexibility than if you choose to take the income and the tax hit on the front end and keep the funds in a taxable account.

If you max out your 401k there is a clear playbook for dealing with less ideal circumstances (recession/job loss) and a playbook for dealing with a best case scenario (you never need the money before 59 1/2). It leaves you with more flexibility than if you choose to take the income and the tax hit on the front end and keep the funds in a taxable account.

This post was edited on 8/10/24 at 12:21 pm

Posted on 8/10/24 at 1:24 pm to beaverfever

It’s also not super easy to get money out of a 401k if you’re still employed.

Posted on 8/10/24 at 1:46 pm to beaverfever

quote:

In what way?

The types of withdrawals you can take while employed are very limited, and some plans don’t allow hardship withdrawals, for example.

Posted on 8/10/24 at 2:24 pm to XenScott

quote:

Tax man is going to get his either way. You tack the 10% penalty on top of the tax

There is no penalty on converting from a pre tax ira to roth ira even before 59.5.

Posted on 8/10/24 at 3:26 pm to gpburdell

Yeah I’m well aware of the conversion options, but it doesn’t change the ordinary income tax treatment, which was my point.

Posted on 8/12/24 at 8:37 am to slackster

When I had three in college at the same time I borrowed from my 401. Repaid with payroll deduction,

LINK

LINK

quote:

A loan lets you borrow money from your retirement savings and pay it back to yourself over time, with interest—the loan payments and interest go back into your account

A withdrawal permanently removes money from your retirement savings for your immediate use, but you'll have to pay extra taxes and possible penalties.

.

Posted on 8/12/24 at 12:56 pm to OlGrandad

Loans are an option but not required to be offered by law. We’re discussing this broadly but obviously it depends on your 401k specific options.

Posted on 8/12/24 at 2:40 pm to beaverfever

Even w the penalty if you are in lower bracket at early withdrawal and were in a high bracket at contribution it might work out better.

There's also Rule of 55 and 72(t) SEPP for penalty free early withdrwals.

There's also Rule of 55 and 72(t) SEPP for penalty free early withdrwals.

This post was edited on 8/13/24 at 7:34 am

Popular

Back to top

5

5

[/url]

[/url]