- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Bitcoin...LOL

Posted on 1/21/22 at 10:09 am to Bigdavewave

Posted on 1/21/22 at 10:09 am to Bigdavewave

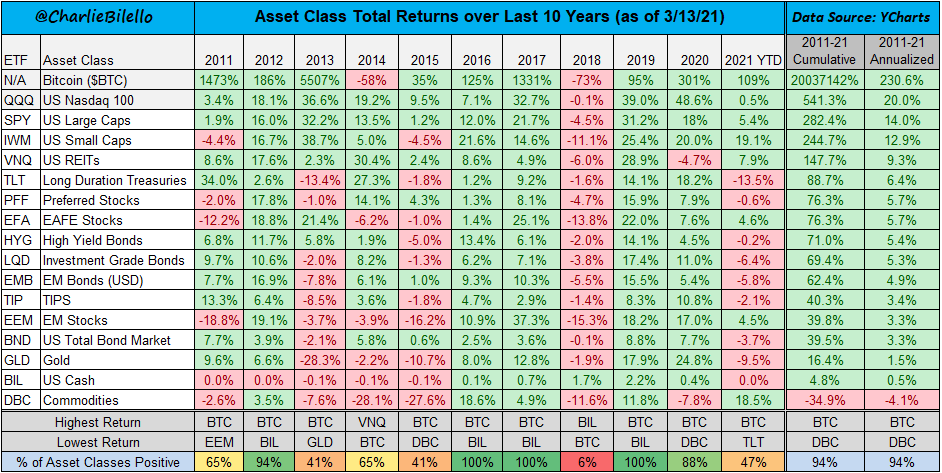

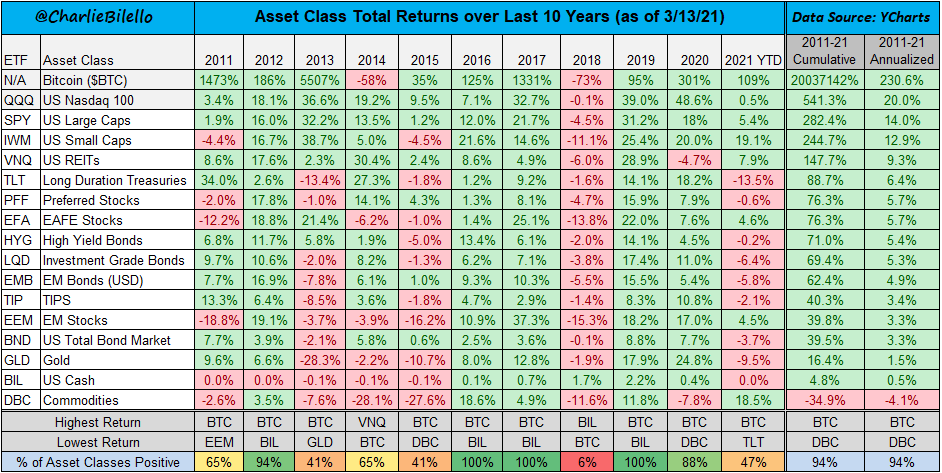

I am by no means a crypto advocate, but looking at the past data is intriguing. I guess I should add “past performance is no future blah blah blah”

Posted on 1/21/22 at 10:35 am to JayDeerTay84

quote:

Bro, BTC has been around for 13 years and made it all this way with no FED or outside monetary policy.

So, it went public when the 2009 bull market run started? And the fact that there hasn't been any regulation YET is not the selling point you think it is.

Posted on 1/21/22 at 11:07 am to Bigdavewave

It’s hard to believe these threads are still happening with the same not so hot takes…okay well not that hard to believe.

I’m sure y’all are right this time and Bitcoin will go to $0

I’m sure y’all are right this time and Bitcoin will go to $0

Posted on 1/21/22 at 11:23 am to TrussvilleTide

quote:

Remember when it was a hedge against inflation

did it outperform inflation?

if so then it's an inflation hedge

this is like preschool math

Posted on 1/21/22 at 11:34 am to GhostofJackson

quote:

So, it went public when the 2009 bull market run started? And the fact that there hasn't been any regulation YET is not the selling point you think it is.

So what exactly are they going to regulate with BTC? They already said its not a security.... They classify it as property.

What do you know that we dont?

Posted on 1/21/22 at 11:38 am to Bigdavewave

Check back in in a few months

Posted on 1/21/22 at 11:44 am to rocket31

this thread will not age well

Posted on 1/21/22 at 11:47 am to rocket31

Good point. Most buyers were smart like you and got in when it was less than a few hundred dollars per coin.

Posted on 1/21/22 at 11:53 am to rocket31

quote:

did it outperform inflation? if so then it's an inflation hedge this is like preschool math

Eh, depends how it’s marketed, so to speak. Most people think of a hedge as something that provides negative correlation to whatever alternative you’re using. In other words, if dollars go down over this time frame, then bitcoin will offset that loss by going up some amount.

If you’re sitting in February of 2021 and you believe inflation is about to be much more persistent and sticky than the forecasts, buying Bitcoin hasn’t worked as an inflation hedge. However, stocks have.

If you’re saying Bitcoin growth will outpace inflation over a long time frame, that a different story altogether.

Posted on 1/21/22 at 11:56 am to wutangfinancial

sure but you could buy today at $38.5k and as long as it outperforms inflation for the year, its still a better hold then cash.

Posted on 1/21/22 at 12:01 pm to slackster

quote:

If you’re sitting in February of 2021 and you believe inflation is about to be much more persistent and sticky than the forecasts, buying Bitcoin hasn’t worked as an inflation hedge. However, stocks have.

it doesn't even need to necessarily be a cpi inflation hedge

bitcoin is an alternative monetary system that offers an escape from the perpetual credit expansions and credit contractions

in other words it can be a hedge on the current system collapsing

This post was edited on 1/21/22 at 12:03 pm

Posted on 1/21/22 at 12:06 pm to Big_Sur

That chart doesn't mean shite without context. You have to show how it compares to other assets distributions.

Posted on 1/21/22 at 12:09 pm to rocket31

Your understanding of inflation is incorrect and holding cash outperforms falling asset prices. Outperforming CPI prints means nothing if you are a saver.

When will you stop your love affair? Bitcoin is just another asset class that goes up and down. It’s not an uncorrelated asset, it doesn’t store value, it’s not an inflation hedge, it is as much of a currency as the onshore Yuan. When the crowd gets saved by Ceasar it will continue to go up like everything else but why do you cling to the narrative?

When will you stop your love affair? Bitcoin is just another asset class that goes up and down. It’s not an uncorrelated asset, it doesn’t store value, it’s not an inflation hedge, it is as much of a currency as the onshore Yuan. When the crowd gets saved by Ceasar it will continue to go up like everything else but why do you cling to the narrative?

Posted on 1/21/22 at 12:22 pm to TurtleSS208

looks to me like commodities, precious metals, long bonds, tips and international/EM going to be good the next decade

and

BTC

EDIT: That really was an incredible run in the Nasdaq - wow

and

BTC

EDIT: That really was an incredible run in the Nasdaq - wow

This post was edited on 1/21/22 at 12:23 pm

Posted on 1/21/22 at 12:31 pm to wutangfinancial

BTC is only 13 years old so the volatility is not going away anytime soon. I'm not one to cling to a narrative and if it fails or something better comes along then I'll change perspective

I no longer anticipate 100% gains every year and I was wrong to expect that but I still would rather hold it than holding cash. math supports this idea so far.

but with that said. i don't like that it's shown correlation to tradfi. that has been disappointing to observe

I no longer anticipate 100% gains every year and I was wrong to expect that but I still would rather hold it than holding cash. math supports this idea so far.

but with that said. i don't like that it's shown correlation to tradfi. that has been disappointing to observe

Posted on 1/21/22 at 12:37 pm to wutangfinancial

quote:

holding cash outperforms falling asset prices

Isn't this 100% determined on "timing" the fall?

Posted on 1/21/22 at 12:43 pm to rocket31

quote:

i don't like that it's shown correlation to tradfi. that has been disappointing to observe

you get what you ask for ... bitcoiners wanted institutional adoption well we got that. ETFs and Futures ETFS? got that too. leverage. BIG TIME. Derivatives? YUP

so

you get institutional/deleverage/rotational action in markets too.

remember - traditionally gold sells off initially with a stock/bond market sell off because traders need cash -- then there is a rush into Gold for safety

Leeeeet's see how it shakes out this time around with BTC in the mix

Posted on 1/21/22 at 12:44 pm to JayDeerTay84

Much like selling your retirement units for cash when you’re not working and generating an income is. Yes.

Posted on 1/21/22 at 1:38 pm to rocket31

I should restate what I said earlier. I think BTC is a good option if you aren't super rich to store wealth similar to how wealthy people do in offshore accounts. To add on to that in a currency crisis I think it would be a good asset to be holding. But not units of a trust or ETN/ETP, but a private wallet of actual BTC not tied to an exchange. Similar to gold in that regard.

I haven't looked at the analytics lately but the flows will be back, Wall Street and VC has too much skin in the game for it to go away, and it looks like the shiny new hook for retirement assets now that most of the fees have been deflated away by competition in passive products.

So to re-direct the conversation back to the OP. This will not age well along with crisis of faith in big tech.

I haven't looked at the analytics lately but the flows will be back, Wall Street and VC has too much skin in the game for it to go away, and it looks like the shiny new hook for retirement assets now that most of the fees have been deflated away by competition in passive products.

So to re-direct the conversation back to the OP. This will not age well along with crisis of faith in big tech.

Posted on 1/21/22 at 1:59 pm to wutangfinancial

quote:

So to re-direct the conversation back to the OP. This will not age well along with crisis of faith in big tech.

Agree. The NASDAQ will surpass the DOW at some point in time.

Just wait till the 401Ks start offering positions in Crypto.

Popular

Back to top

1

1