- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

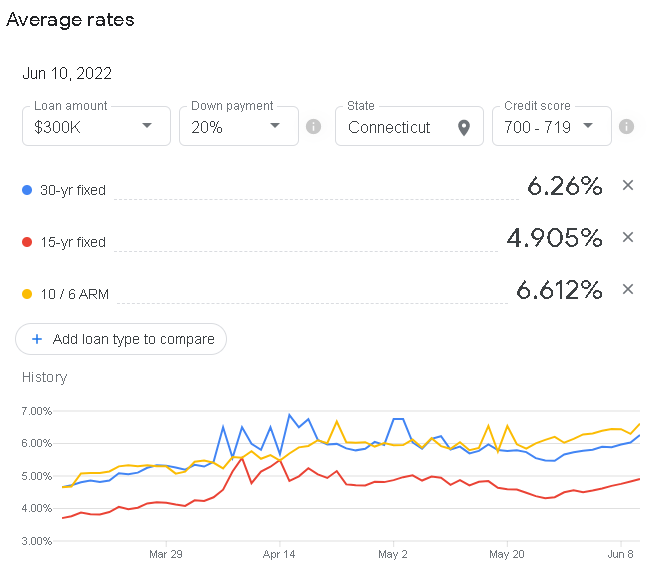

30 year fixed interest rate avg rising fast

Posted on 6/13/22 at 10:57 am

Posted on 6/13/22 at 10:57 am

Posted on 6/13/22 at 10:59 am to MrLSU

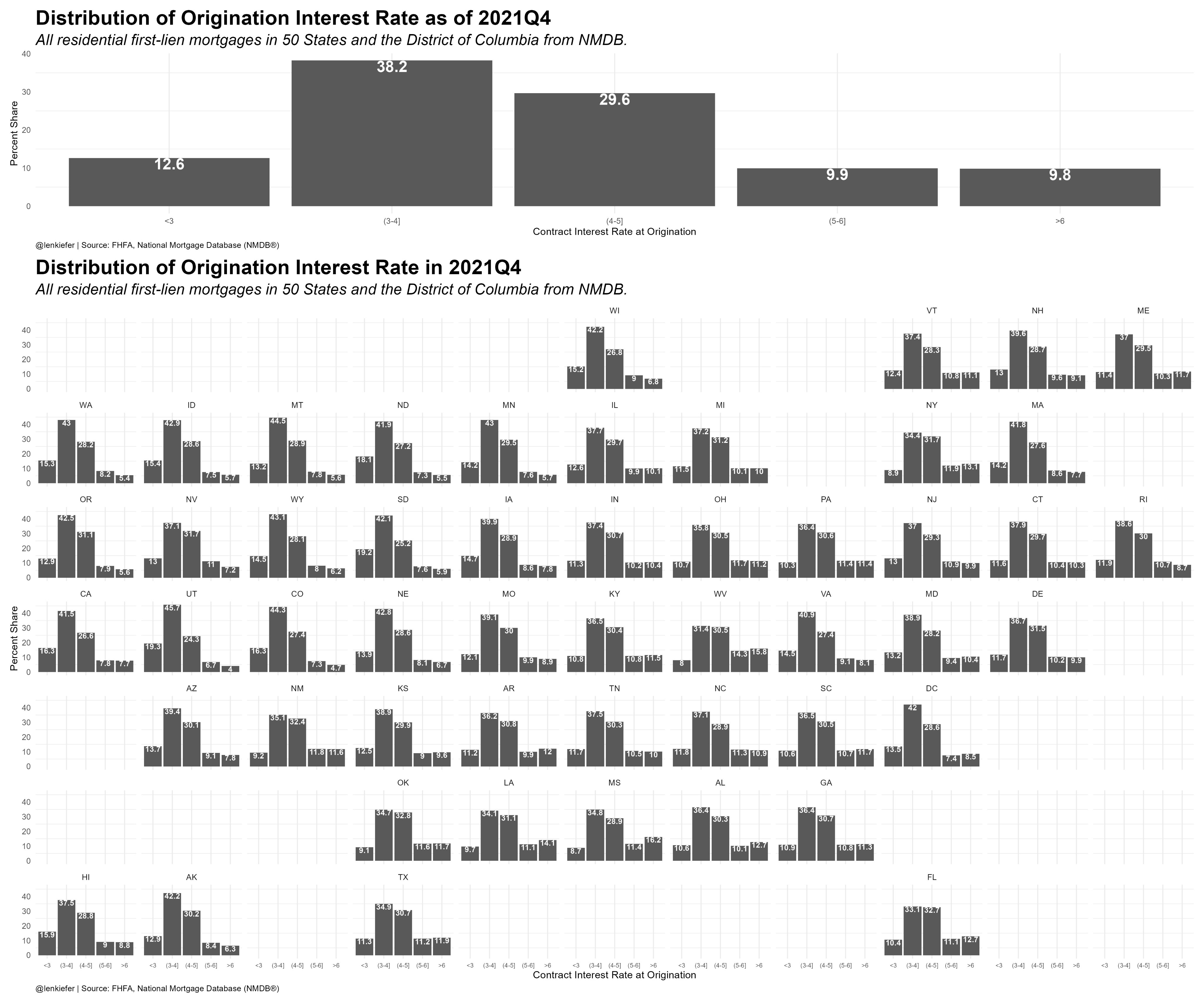

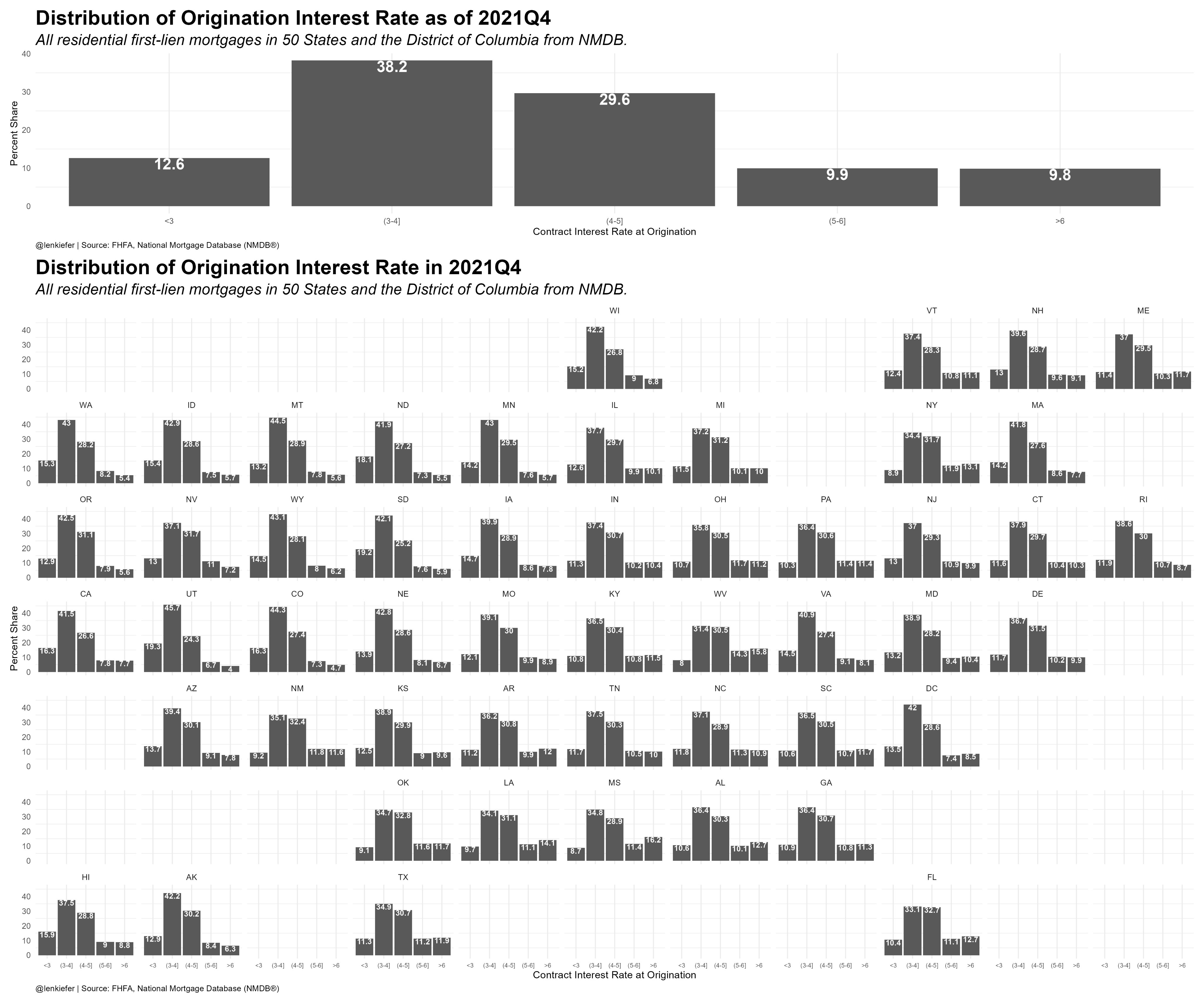

I read somewhere that something like 70%+ mortgages in the US are under 4.5% or something along those lines. Should help insulate us from RE melting down the rest of the financial world a la 2008/9.

Posted on 6/13/22 at 11:10 am to slackster

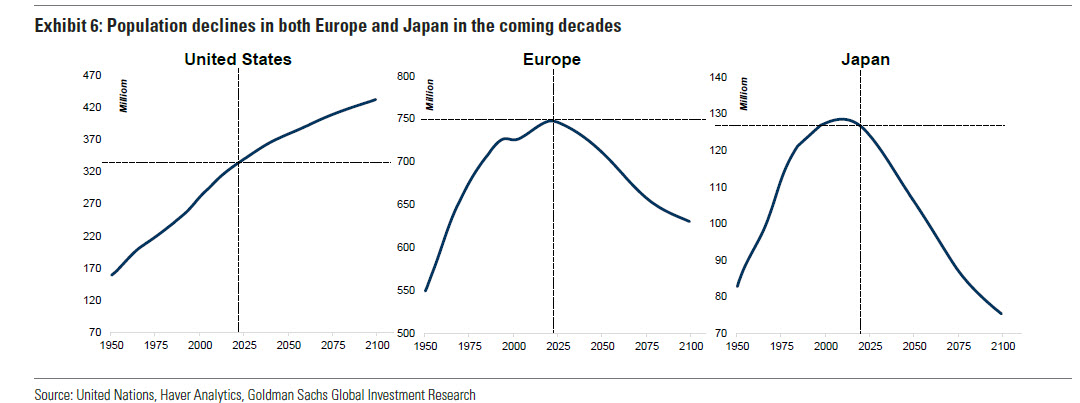

Yea it seems like the inventory issues will persist/maybe even get worse when most existing homeowners have rates much lower than current rates.

We just moved due to job relocation and it sucks going from 3.0 to 4.875.

We just moved due to job relocation and it sucks going from 3.0 to 4.875.

Posted on 6/13/22 at 11:13 am to slackster

quote:

I read somewhere that something like 70%+ mortgages in the US are under 4.5% or something along those lines. Should help insulate us from RE melting down the rest of the financial world a la 2008/9.

And lot's of cash buys.

I see a problem with all these non critical corporate project manager roles that were created over the last 5 years and those folks living in 500-1M homes.

If those cuts start happening at any extensive level and people have to sell homes, things might get interesting.

But def. won't be 08/09, no chance.

Posted on 6/13/22 at 11:34 am to STLhog

quote:

I see a problem with all these non critical corporate project manager roles that were created over the last 5 years and those folks living in 500-1M homes.

There will be problems with most if not all buyers that need leverage. Imagine trying to buy a decent home in a top 20 market in your 20’s or 30’s with today’s wages, interest rates and home prices.

Posted on 6/13/22 at 11:46 am to STLhog

quote:

And lot's of cash buys.

I see a problem with all these non critical corporate project manager roles that were created over the last 5 years and those folks living in 500-1M homes.

If those cuts start happening at any extensive level and people have to sell homes, things might get interesting.

Florida in 2010. Found a beautiful house that was foreclosed for sale for $100,000. I had cost $450k to build just a couple of years before. Should have put it on a credit card.

Posted on 6/13/22 at 11:59 am to MrLSU

Actually over the last month it's been pretty flat.

Freddie mac average rates

For 30 yr:

5/5 - 5.27%

5/12 - 5.30%

5/19 - 5.25%

5/26 - 5.10%

6/2 - 5.09%

6'9 - 5.23%

mortgage market kind of got ahead of the rate hikes and now it's been about the same for the last 6 weeks. Granted with more hikes to come it will go up again.

Freddie mac average rates

For 30 yr:

5/5 - 5.27%

5/12 - 5.30%

5/19 - 5.25%

5/26 - 5.10%

6/2 - 5.09%

6'9 - 5.23%

mortgage market kind of got ahead of the rate hikes and now it's been about the same for the last 6 weeks. Granted with more hikes to come it will go up again.

This post was edited on 6/13/22 at 12:00 pm

Posted on 6/13/22 at 12:15 pm to MrLSU

I'm in the market for a house in DFW and NW Arkansas. I'm really tempted to go with an ARM.

Posted on 6/13/22 at 12:28 pm to wutangfinancial

quote:

I'm in the market for a house in DFW and NW Arkansas. I'm really tempted to go with an ARM.

I’m not a financial advisor but it seems like the rates will keep going up, and if they go down you can usually refinance. I think you’d be better served to lock in today’s rate.

Posted on 6/13/22 at 12:39 pm to Jon Ham

quote:

I’m not a financial advisor but it seems like the rates will keep going up, and if they go down you can usually refinance. I think you’d be better served to lock in today’s rate.

Just dont like the rolling the dice with ARMs myself. Could put yourself in a pretty bad spot once the variable comes into play if rates never drop.

Much rather go the conventional lock in and refi later if rates eventually drop. It could be just a few years, it could be 10 years, just never know. We have lived in such a low interest rate environment for so long it's hard seeing those rates again very soon.

I think it makes sense if you know you will be somewhere only 5 years or less.

This post was edited on 6/13/22 at 12:43 pm

Posted on 6/13/22 at 12:42 pm to wutangfinancial

quote:

I'm really tempted to go with an ARM.

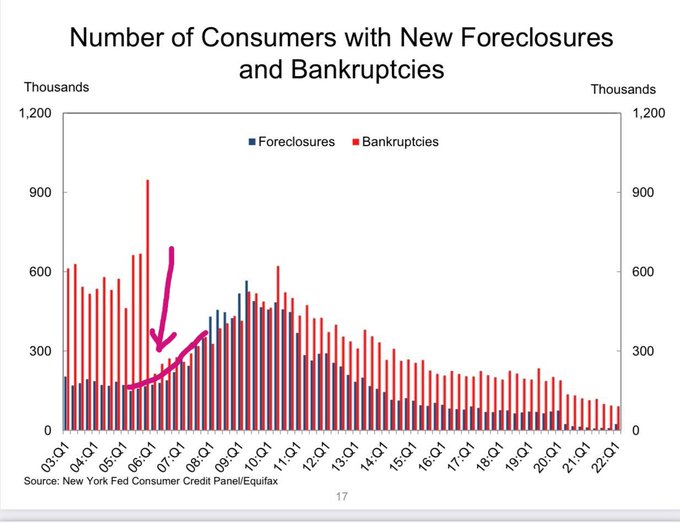

Oh good. It’s 2008 again. Hopefully the government doesn’t come back with its “too big to fail” crap.

This post was edited on 6/13/22 at 12:45 pm

Posted on 6/13/22 at 12:50 pm to sawtooth

quote:

Oh good. It’s 2008 again. Hopefully the government doesn’t come back with its “too big to fail” crap.

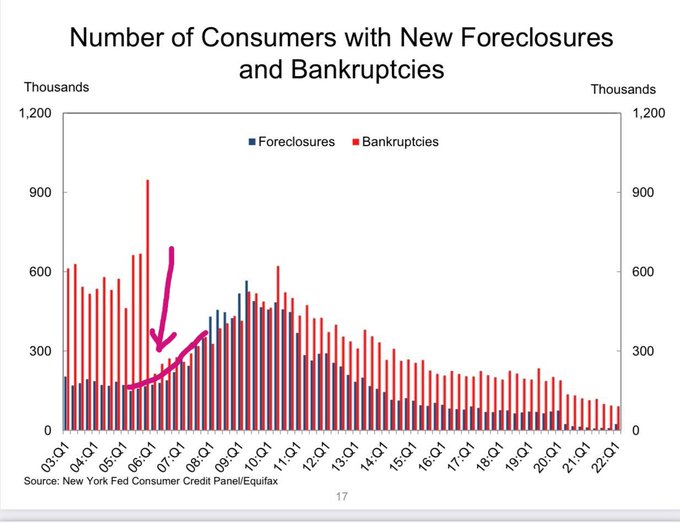

I don’t think you have any idea how much things changed after 2008 and how unlikely 2008 meltdown is in the current environment. People actually have to prove they can afford the homes now and banks actually have to confirm homes are worth what they are lining out. This is nothing like 2008.

Posted on 6/13/22 at 12:56 pm to go ta hell ole miss

quote:

This is nothing like 2008

So why are people getting ARM loans? Because they can’t afford the conventional rate so they use that option.

It’s just like 2008 and honestly I don’t care what an individual does. I do mind when the government bails out the banks who never should have loaned out the money to begin with.

Posted on 6/13/22 at 1:15 pm to slackster

12.6% of the US has an interest rate of 3% or below.

38.2% of the US has an interest rate between 3%-4%.

29.6% of the US has an interest rate between 4%-5%.

38.2% of the US has an interest rate between 3%-4%.

29.6% of the US has an interest rate between 4%-5%.

Posted on 6/13/22 at 2:05 pm to sawtooth

quote:

Oh good. It’s 2008 again. Hopefully the government doesn’t come back with its “too big to fail” crap.

What a low IQ comment. Were you in a coma in 2018, 2019 and 2020?

Posted on 6/13/22 at 2:42 pm to thunderbird1100

quote:

mortgage market kind of got ahead of the rate hikes and now it's been about the same for the last 6 weeks. Granted with more hikes to come it will go up again.

Because mortgage rates are tied to the 10 yr treasury rates not fed fund rates

Posted on 6/13/22 at 3:04 pm to dsides

quote:

Because mortgage rates are tied to the 10 yr treasury rates not fed fund rates

They are not tied to 10 year treasury rates actually, but that is commonly believed

LINK

They tend to follow one another but arent tied to each other.

This post was edited on 6/13/22 at 3:05 pm

Posted on 6/13/22 at 3:23 pm to thunderbird1100

quote:

They are not tied to 10 year treasury rates actually, but that is commonly believed

Rates, at least on commercial real estate, are typically quoted as a spread over the treasury rates so yes they are tied together. Now the spread can widen or tighten based on certain factors such as corp bond yields, etc

Posted on 6/13/22 at 4:23 pm to thunderbird1100

For all we know some derivative hedging or some dealer frickery is going on that affects the underlying security pricing. Maybe nobody wants the MBS collateral when they can take on less risk with treasuries. Who freaking knows. It's all just narrative. It's correlated with the 10 year but that doesn't really mean much in reality.

Posted on 6/13/22 at 5:24 pm to MrLSU

where should i buy my vacation home after this market goes to shite?

Popular

Back to top

5

5