- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

401K v. Real Estate

Posted on 1/27/17 at 3:39 pm

Posted on 1/27/17 at 3:39 pm

I got in a discussion with a friend of mine about whether it is smarter to invest in real estate v. investing in your 401k. So I created a spreadsheet to think through the problem. Caveat: This is extremely rudimentary, but I figured that if I posted it here I could get some more ideas on how to add to the spreadsheet.

I'm certain I'm failing to factor certain things into the equations, so please let me know what I'm missing and how I should calculate it.

Things that aren't factored into the spreadsheets:

Risk of real estate v. risk in market

Employer contributions to 401k.

Taxes!

If I was to take $20,000.00 and put it in a 401k or mutual fund or the like, and it grew steadily at 6% interest. This is what I figure it would be worth in about 60 years:

0- $20,000.00

1- $21,200.00

2- $22,472.00

3- $23,820.32

4- $25,249.54

5- $26,764.51

6- $28,370.38

7- $30,072.61

8- $31,876.96

9- $33,789.58

10- $35,816.95

11- $37,965.97

12- $40,243.93

13- $42,658.57

14- $45,218.08

15- $47,931.16

16- $50,807.03

17- $53,855.46

18- $57,086.78

19- $60,511.99

20- $64,142.71

21- $67,991.27

22- $72,070.75

23- $76,394.99

24- $80,978.69

25- $85,837.41

26- $90,987.66

27- $96,446.92

28- $102,233.73

29- $108,367.76

30- $114,869.82

31- $121,762.01

32- $129,067.73

33- $136,811.80

34- $145,020.51

35- $153,721.74

36- $162,945.04

37- $172,721.74

38- $183,085.05

39- $194,070.15

40- $205,714.36

41- $218,057.22

42- $231,140.65

43- $245,009.09

44- $259,709.64

45- $275,292.22

46- $291,809.75

47- $309,318.33

48- $327,877.43

49- $347,550.08

50- $368,403.09

51- $390,507.27

52- $413,937.71

53- $438,773.97

54- $465,100.41

55- $493,006.43

56- $522,586.82

57- $553,942.03

58- $587,178.55

59- $622,409.26

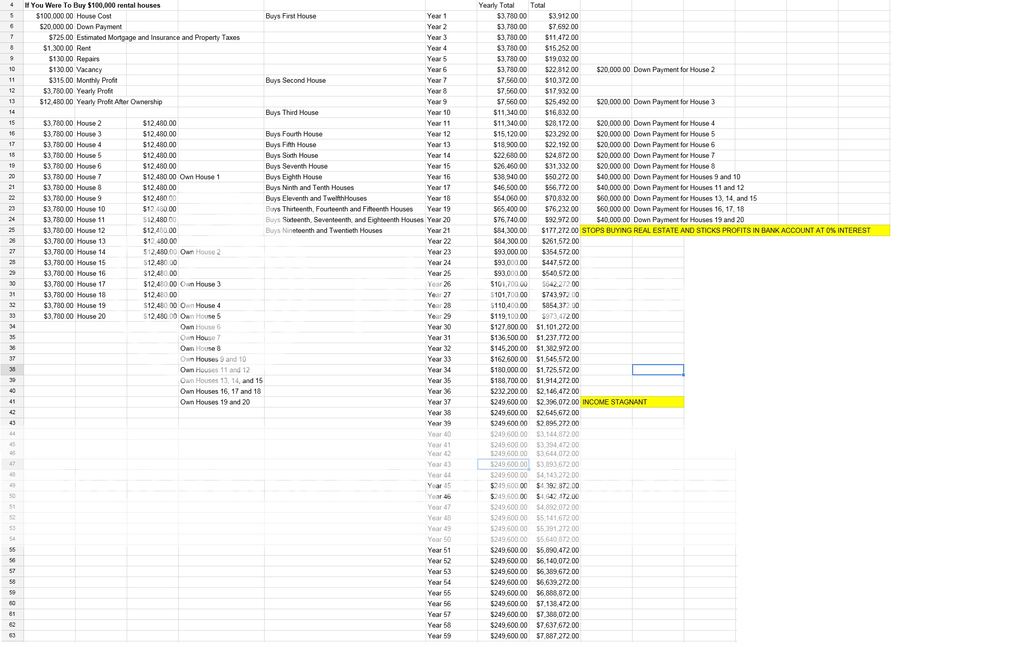

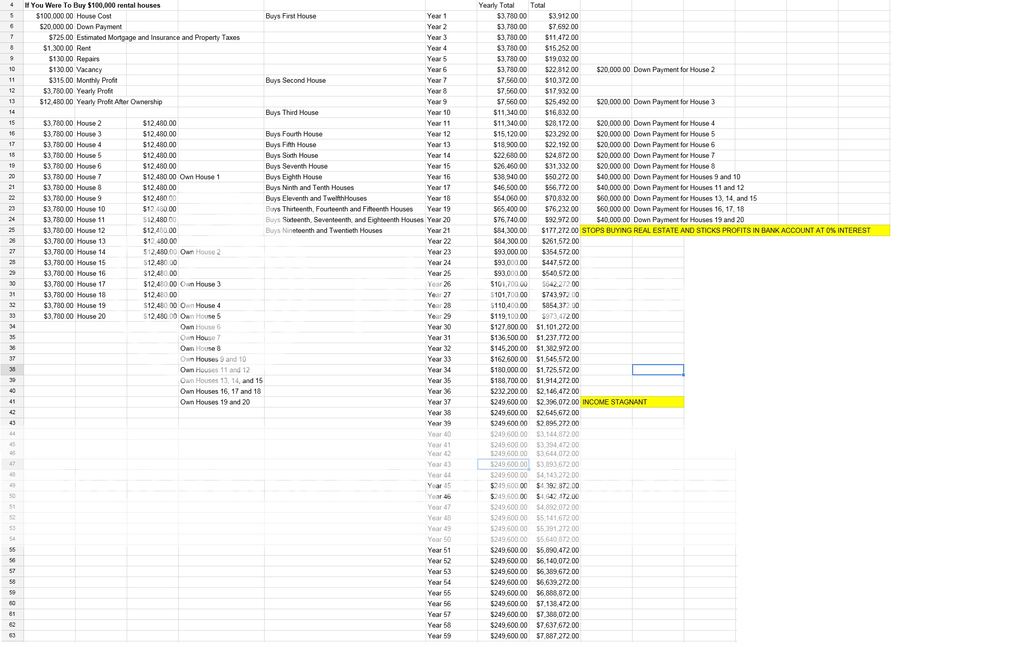

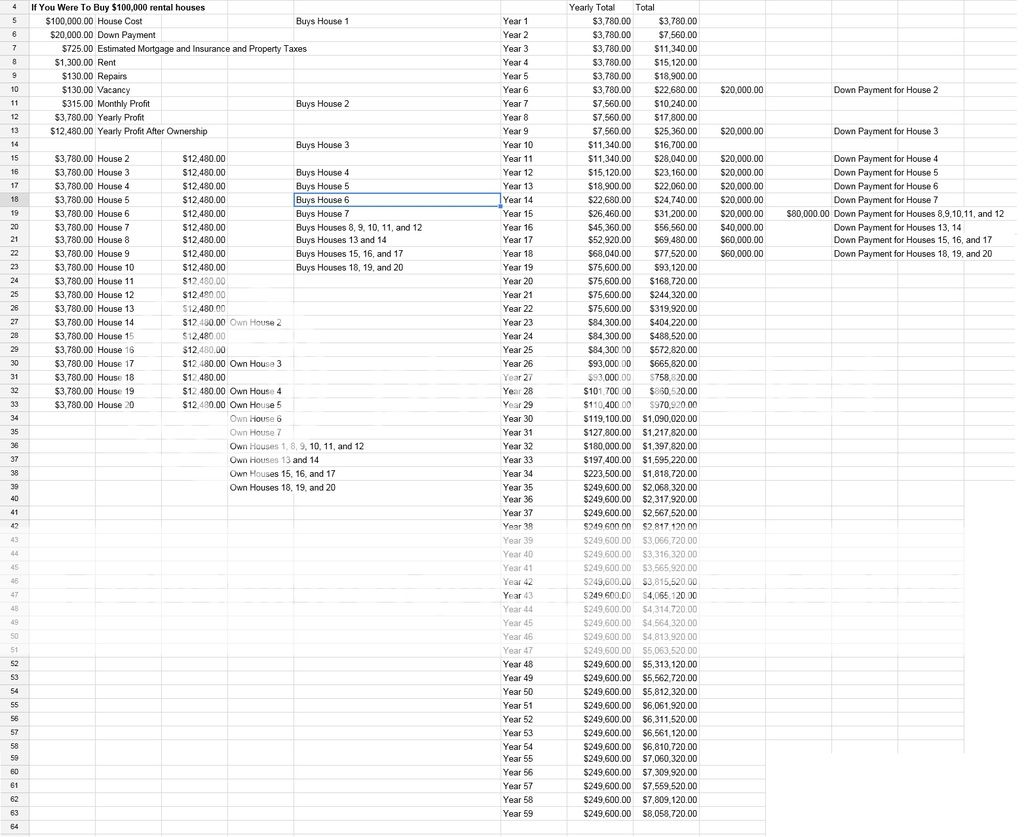

This is my spreadsheet for the real estate. Sorry it's small and blurry. I couldn't figure out another way to post it. In short, it assumes you buy a $100,000 duplex that rents for $1,300 a month. You take out 10% for vacancies, 10% for repairs. You don't take anything out of the business and every time you get $20k in the bank, you buy another house.

Any ideas or insights will be helpful. TIA

I'm certain I'm failing to factor certain things into the equations, so please let me know what I'm missing and how I should calculate it.

Things that aren't factored into the spreadsheets:

Risk of real estate v. risk in market

Employer contributions to 401k.

Taxes!

If I was to take $20,000.00 and put it in a 401k or mutual fund or the like, and it grew steadily at 6% interest. This is what I figure it would be worth in about 60 years:

0- $20,000.00

1- $21,200.00

2- $22,472.00

3- $23,820.32

4- $25,249.54

5- $26,764.51

6- $28,370.38

7- $30,072.61

8- $31,876.96

9- $33,789.58

10- $35,816.95

11- $37,965.97

12- $40,243.93

13- $42,658.57

14- $45,218.08

15- $47,931.16

16- $50,807.03

17- $53,855.46

18- $57,086.78

19- $60,511.99

20- $64,142.71

21- $67,991.27

22- $72,070.75

23- $76,394.99

24- $80,978.69

25- $85,837.41

26- $90,987.66

27- $96,446.92

28- $102,233.73

29- $108,367.76

30- $114,869.82

31- $121,762.01

32- $129,067.73

33- $136,811.80

34- $145,020.51

35- $153,721.74

36- $162,945.04

37- $172,721.74

38- $183,085.05

39- $194,070.15

40- $205,714.36

41- $218,057.22

42- $231,140.65

43- $245,009.09

44- $259,709.64

45- $275,292.22

46- $291,809.75

47- $309,318.33

48- $327,877.43

49- $347,550.08

50- $368,403.09

51- $390,507.27

52- $413,937.71

53- $438,773.97

54- $465,100.41

55- $493,006.43

56- $522,586.82

57- $553,942.03

58- $587,178.55

59- $622,409.26

This is my spreadsheet for the real estate. Sorry it's small and blurry. I couldn't figure out another way to post it. In short, it assumes you buy a $100,000 duplex that rents for $1,300 a month. You take out 10% for vacancies, 10% for repairs. You don't take anything out of the business and every time you get $20k in the bank, you buy another house.

Any ideas or insights will be helpful. TIA

Posted on 1/27/17 at 3:42 pm to The Johnny Lawrence

Does that include the cost of your time as a landlord?

Posted on 1/27/17 at 4:01 pm to The Johnny Lawrence

Property taxes?????

Posted on 1/27/17 at 4:16 pm to The Johnny Lawrence

Laughable. Even with PITI AND vacancies and maintenance and property management my returns are much better than a 401k. I don't have many vacancies and my property management is 8%. Way more control in RE VERSUS a 401k. I'll post an article tomorrow when I'm back at work.

Posted on 1/27/17 at 4:42 pm to The Johnny Lawrence

Did you calculate that $20,000 in a 401k is not the same as $20,000 after taxes in real estate? Or does that fall under the "taxes" caveat? You could of course correct it by subtracting some arbitrary amount from the real estate starting funds

This post was edited on 1/27/17 at 4:45 pm

Posted on 1/27/17 at 4:59 pm to The Johnny Lawrence

This doesn't really answer your question, but my input would be an either/or on 401K -v- Real Estate misses what I consider to be a vital part of anyone's portfolio. That is to say, why not have some real estate in addition to securities in a 401K. I own both. I think have have about every assets class represented. I've read everything on why a heavier weighted real estate portfolio outperforms a 401K. I'm personally still more weighted in securities than I am in real estate. There are some pitfalls to real estate tat aren't necessarily inherent to owning a mutual fund. It's difficult to balance a real estate portfolio geographically. It's difficult to balance commercial, residential, office space, warehouse space, multi family, single family. Essentially it does pay a dividend. Essentially there are certainly tax advantages in real estate. But essentially there is also the dilemma of what it is worth when you really need to sell it. Which is the same as a security. But harder to mange due to liquidity.

So I guess my answer is I don't personally care what wins the cage fight between real estate and a 401K, I think everyone should probably own some of each. Securities are easier. Notwithstanding the many on here and elsewhere they say it is not. Securities are more liquid. Moral and morale hazards exist in both. Fannie is getting into buying paper of single family dwellings held as rentals. That probably will be high geographic in impact, but it will have an impact.

Anyway, another novel by myself. Just some thoughts I have based on my experience with both.

So I guess my answer is I don't personally care what wins the cage fight between real estate and a 401K, I think everyone should probably own some of each. Securities are easier. Notwithstanding the many on here and elsewhere they say it is not. Securities are more liquid. Moral and morale hazards exist in both. Fannie is getting into buying paper of single family dwellings held as rentals. That probably will be high geographic in impact, but it will have an impact.

Anyway, another novel by myself. Just some thoughts I have based on my experience with both.

Posted on 1/27/17 at 5:12 pm to The Johnny Lawrence

I'm probably missing something here on your chart, but how do you go from year 1 earnings of $3780, to total earnings after year 1 @ $3,912.

It makes me really not trust your excel spreadsheet formulas.

It makes me really not trust your excel spreadsheet formulas.

Posted on 1/28/17 at 8:39 am to The Johnny Lawrence

Why did you use 59 years? No one person will invest for that long of a period.

Considering that the average person starts working in their 20s and retires in their 60s ,I would only use a 40 year time frame.

.

Secondly, when you "invest" in your 401k, typically companies match you at a certain %.

For example, for my 6%, my company adds an additional 4.5%. That's a huge ROI immediately.

Considering that the average person starts working in their 20s and retires in their 60s ,I would only use a 40 year time frame.

.

Secondly, when you "invest" in your 401k, typically companies match you at a certain %.

For example, for my 6%, my company adds an additional 4.5%. That's a huge ROI immediately.

Posted on 1/28/17 at 8:50 am to The Johnny Lawrence

The correct answer is to have both.

What if you are getting rent and property value increases at 3% a year as well? What if the market tanks and your property is worth 50%?

There is no right answer. You should strive for diversified investments and multiple income streams.

What if you are getting rent and property value increases at 3% a year as well? What if the market tanks and your property is worth 50%?

There is no right answer. You should strive for diversified investments and multiple income streams.

Posted on 1/28/17 at 9:52 am to The Johnny Lawrence

There's so much you're leaving out including refinancing house one when paid off and turning that one into 5 additional $20k down payments, rinse, and repeat....

This post was edited on 1/28/17 at 10:08 am

Posted on 1/28/17 at 12:59 pm to The Johnny Lawrence

I didn't read all of that but I can tell you this.. I have a friend with a pretty good amount of money osnhis 401k and in the past 5 or so years he's gotten into rental properties and flipping houses.. he's kicking himself for having that money in his 401k and not in real estate

Posted on 1/28/17 at 6:59 pm to The Johnny Lawrence

You are overstating the reliability of tenets over that long of a time frame, down playing the cost of repairs over that long of a time frame when you factor in renovation overhauls to keep up demand, and assuming the reliability of purchases both in term of availability at price point, and in output.

On paper, it looks nice. But in practice, it is probably best to wave off after a handful of houses. Your risk exposure far exceeds the returns at the higher values.

On paper, it looks nice. But in practice, it is probably best to wave off after a handful of houses. Your risk exposure far exceeds the returns at the higher values.

Posted on 1/28/17 at 7:21 pm to The Johnny Lawrence

The biggest hurdle is the upfront costs associated with real estate. With a 401k/IRA, it's generally a small % of your check taken out before you even see it.

As far as returns, and yes i'm an agent, there is no way a retirement account can touch real estate. This year alone i've got one project i'm anticipating a 150k return on. But the CTB when complete will come in around 700k.

As far as returns, and yes i'm an agent, there is no way a retirement account can touch real estate. This year alone i've got one project i'm anticipating a 150k return on. But the CTB when complete will come in around 700k.

Posted on 1/30/17 at 8:48 am to The Johnny Lawrence

quote:

Why did you use 59 years? No one person will invest for that long of a period.

If you want to stop after 40 years, you can just compare the charts at the 40 year mark. It doesn't take any time to drag the spreadsheet out to any number of years, so I just ran it to 59 for no good reason. I'm also 28, so I figured I probably won't live past 90 or so.

quote:

Secondly, when you "invest" in your 401k, typically companies match you at a certain %.

I agree. I always take advantage of the free money my employer gives me. But this scenario is just a comparison of finding $20k on the street. Basically, you inherit $20k or you win a lawsuit. I just wanted to see if a mutual fund or market could beat real estate.

quote:

There's so much you're leaving out including refinancing house one when paid off and turning that one into 5 additional $20k down payments, rinse, and repeat....

I hadn't even thought of that for the spreadsheet. I had considered it for buying a distressed property and refinancing after a couple of years, but hadn't thought about doing it after you own the property. I ran the numbers and the spreadsheet is below. I don't think it gains you that much, because I just refinanced my first house on the spreadsheet. After I own the second one, I already owned 20 houses and didn't want to compare spreadsheets with a different amount of house ownership.

quote:

remember we are not talking about ANY appreciation whatsoever in RE. I am only using MY positive cash flow returns as evidence. It beats the market even if you let the market compound capital gains plus dividends. Look at the history. Now if you only use RE appreciation (not cash flow) long term versus the stock market the stock market probably wins barely due to housing crashes, etc. But we are not using that. I do not buy properties for appreciation. I buy for cash flow. You need cash flow to retire. A housing crash doesn't stop my properties from getting positive cash flow. Do you want to draw down a TIRA or RIRA or 401k? I do not. To me it defeats the purpose of busting your arse for decades to put that money away to work for you. Sure, drawing down is better than having nothing but that is not how i operate.

Absolutely. I didn't factor in appreciation at all. Typically, houses always go up in value, but it is extremely hard to factor into a spreadsheet. I just wanted to keep it simple.

quote:

You are overstating the reliability of tenets over that long of a time frame, down playing the cost of repairs over that long of a time frame when you factor in renovation overhauls to keep up demand, and assuming the reliability of purchases both in term of availability at price point, and in output.

I've factored in 10% for vacancies and 10% for repairs. From everything I've read, this is the proper amount to hold back. That should cover the down months and cover the repairs as needed. A lot of people run their properties with less set backs for repairs and vacancies. All depends on the property, I guess.

quote:

True. But the 6 percent is also a very conservative average as it is.

I ran your numbers at 11% compound interest. Real estate still does better until you get to the 50ish year mark of 11% compounded annually.

Year 401K

0 $20,000.00

1 $22,200.00

2 $24,642.00

3 $27,352.62

4 $30,361.41

5 $33,701.16

6 $37,408.29

7 $41,523.20

8 $46,090.76

9 $51,160.74

10 $56,788.42

11 $63,035.15

12 $69,969.01

13 $77,665.60

14 $86,208.82

15 $95,691.79

16 $106,217.89

17 $117,901.85

18 $130,871.06

19 $145,266.87

20 $161,246.23

21 $178,983.32

22 $198,671.48

23 $220,525.34

24 $244,783.13

25 $271,709.28

26 $301,597.30

27 $334,773.00

28 $371,598.03

29 $412,473.81

30 $457,845.93

31 $508,208.98

32 $564,111.97

33 $626,164.29

34 $695,042.36

35 $771,497.02

36 $856,361.69

37 $950,561.48

38 $1,055,123.24

39 $1,171,186.80

40 $1,300,017.35

41 $1,443,019.25

42 $1,601,751.37

43 $1,777,944.02

44 $1,973,517.87

45 $2,190,604.83

46 $2,431,571.36

47 $2,699,044.21

48 $2,995,939.08

49 $3,325,492.37

50 $3,691,296.53

51 $4,097,339.15

52 $4,548,046.46

53 $5,048,331.57

54 $5,603,648.04

55 $6,220,049.33

56 $6,904,254.76

57 $7,663,722.78

58 $8,506,732.28

59 $9,442,472.83

I really do appreciate all of the insight. There are a couple of things I'm still trying to figure out how to put into the spreadsheet- Taxes, etc. Once I figure out a fair way to calculate those, I'll make another spreadsheet and post it.

Popular

Back to top

13

13