- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Underperformance of international funds

Posted on 6/7/24 at 12:50 pm

Posted on 6/7/24 at 12:50 pm

The commonly given advice when I started investing was to include 20-30% international in a portfolio to be properly diversified. About 3 years ago, I finally pulled the plug on it because it was such a laggard to the US market. Looking at it now, that certainly hasn’t changed.

Anyone else given up on it?

Anyone else given up on it?

Posted on 6/7/24 at 1:19 pm to DrrTiger

20 to 30% is way too high. I’d go with 10 to 15% max. And really, you effectively have lots of international exposure just investing in the broad S&P.

Posted on 6/7/24 at 1:45 pm to DrrTiger

quote:

I started investing was to include 20-30% international in a portfolio to be properly diversified

Do you own exposure to the S&P 500?

Posted on 6/7/24 at 1:46 pm to DrrTiger

The rest of the world can’t print money like we can

Posted on 6/7/24 at 2:00 pm to SloaneRanger

quote:I would say 25-30% is the default for most future date or robo advisor driven retirement funds. I agree with you and OP that it's crazy though. How many times does the S&P have to lap the international markets before people change their baseline. Hell, I'd say the same about small caps at this point.

20 to 30% is way too high. I’d go with 10 to 15% max. And really, you effectively have lots of international exposure just investing in the broad S&P.

We're in the era of the haves and the have nots. The traditional allocation advise is outdated. If small caps, international and value got hot and outperformed mega caps for a year I would use that as an opportunity to completely reset my baseline.

This post was edited on 6/7/24 at 2:03 pm

Posted on 6/7/24 at 2:43 pm to beaverfever

The S&P 500 is an international fund

Posted on 6/7/24 at 4:02 pm to wutangfinancial

quote:That's dominated by large cap US companies.

The S&P 500 is an international fund

Posted on 6/7/24 at 4:20 pm to beaverfever

quote:

That's dominated by large cap US companies.

And 1/3 of their revenues are international

Posted on 6/7/24 at 5:44 pm to DrrTiger

I wouldn’t do more than 5% international

Posted on 6/8/24 at 12:02 am to beaverfever

quote:

I would say 25-30% is the default for most future date or robo advisor driven retirement funds.

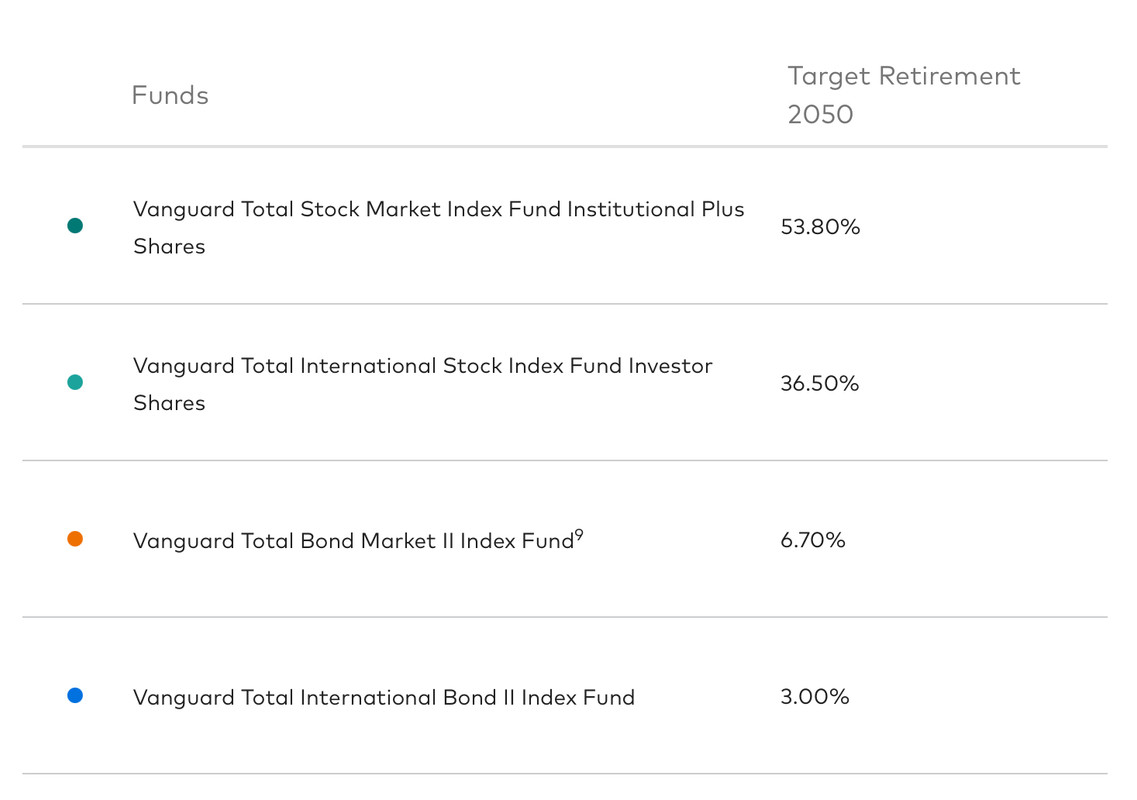

Vanguard’s 2050 target retirement is almost 37% international now. They used to advise 25% about 20 years ago.

This post was edited on 6/8/24 at 12:05 am

Posted on 6/8/24 at 5:39 am to DrrTiger

Eventually, there will be a reversion to the mean.

The point of diversification is to have various asset classes performing at different times.

It’s been a good run for US large caps.

They may run further.

Having small caps, international, real estate funds may give some diversification.

The point of diversification is to have various asset classes performing at different times.

It’s been a good run for US large caps.

They may run further.

Having small caps, international, real estate funds may give some diversification.

Popular

Back to top

5

5