- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Beginner investors. My 2 teen kids.

Posted on 4/5/23 at 5:16 am to lsugorilla

Posted on 4/5/23 at 5:16 am to lsugorilla

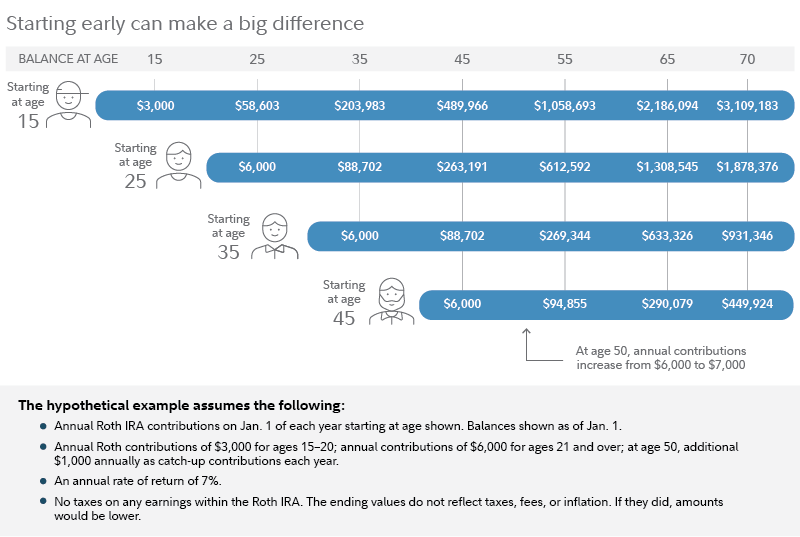

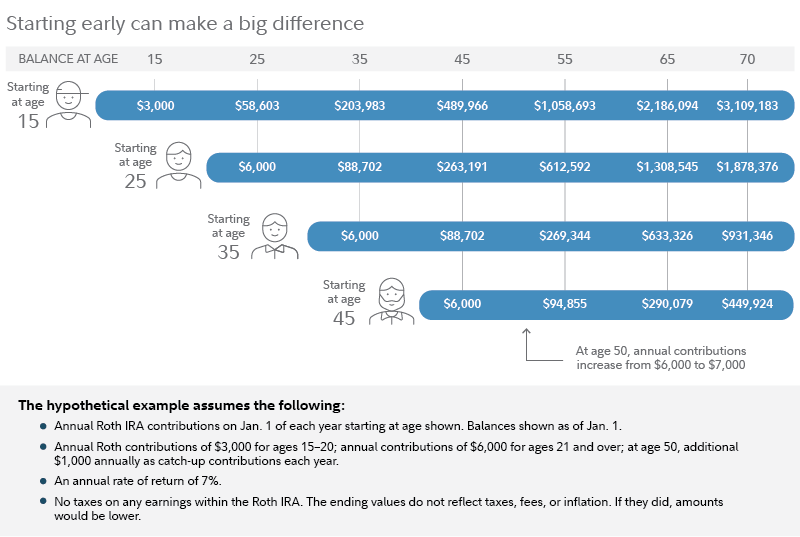

Fidelity: Turbocharge your child's retirement with a Roth IRA for Kids

The kid can only contribute up to the amount of their earned income (up to $6,000). You can wait until they get their W-2s and 1099s to establish that amount for a year, then make and designate the contribution for that prior year (until April 15).

If I had a kid or youth I cared about, I would open a Roth IRA for them and make the contribution up to their max allowable each year. Put it in mainly an S&P 500 index fund, but let them pick a few individual stocks to make it interesting.

The real-life example I give is $5,000 I put in Fidelity Blue Chip Growth fund in the mid-90s. Let it ride, with dividends reinvested, ever since. Otherwise never added or withdrew a penny. It's been interesting to watch it go up and down, sometimes crashing and then clawing back, and for a while up to as much as over $80K; it's around $63K now.

Imagine the stash a kid might have at retirement if you funded a Roth for a few years in their early years, and they let it ride for 40 years or so. Watching it grow may also motivate them to hit it harder on their own 401k and other retirement plans.

The kid can only contribute up to the amount of their earned income (up to $6,000). You can wait until they get their W-2s and 1099s to establish that amount for a year, then make and designate the contribution for that prior year (until April 15).

If I had a kid or youth I cared about, I would open a Roth IRA for them and make the contribution up to their max allowable each year. Put it in mainly an S&P 500 index fund, but let them pick a few individual stocks to make it interesting.

The real-life example I give is $5,000 I put in Fidelity Blue Chip Growth fund in the mid-90s. Let it ride, with dividends reinvested, ever since. Otherwise never added or withdrew a penny. It's been interesting to watch it go up and down, sometimes crashing and then clawing back, and for a while up to as much as over $80K; it's around $63K now.

Imagine the stash a kid might have at retirement if you funded a Roth for a few years in their early years, and they let it ride for 40 years or so. Watching it grow may also motivate them to hit it harder on their own 401k and other retirement plans.

Posted on 4/5/23 at 8:32 am to Twenty 49

Show them this.

And ignore the advice to stock pick. Teach them to invest in the market with index funds and not try to beat the pros. A small percent in individual stocks for sport may be ok. But runs the risk of giving false sense they have some special ability to beat the market when in long term they almost certainly wont. Small wins now could lead to excess risk and big loses later when substantial assets are at play.

And ignore the advice to stock pick. Teach them to invest in the market with index funds and not try to beat the pros. A small percent in individual stocks for sport may be ok. But runs the risk of giving false sense they have some special ability to beat the market when in long term they almost certainly wont. Small wins now could lead to excess risk and big loses later when substantial assets are at play.

Posted on 4/5/23 at 4:07 pm to Twenty 49

quote:

If I had a kid or youth I cared about, I would open a Roth IRA for them and make the contribution up to their max allowable each year. Put it in mainly an S&P 500 index fund, but let them pick a few individual stocks to make it interesting.

this is what i do along with my company 401k.

Popular

Back to top

2

2