- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

| Favorite team: | LSU |

| Location: | Baton Rouge |

| Biography: | |

| Interests: | |

| Occupation: | work hard for the money |

| Number of Posts: | 136 |

| Registered on: | 4/1/2006 |

| Online Status: | Not Online |

Recent Posts

Message

I had a pretty gnarly bad burn in early 2020 during the initial COVID era.

Miller Lite and a pain med usually got me up for it. Doctors and burn units were treating via telehealth, so we were kinda on our own

Miller Lite and a pain med usually got me up for it. Doctors and burn units were treating via telehealth, so we were kinda on our own

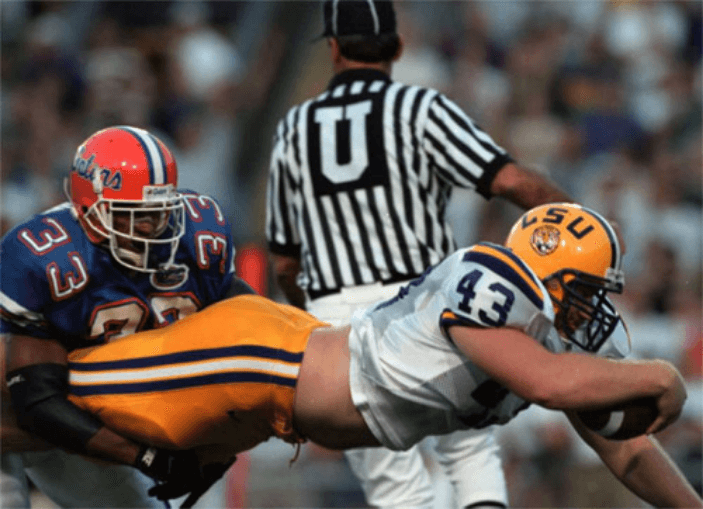

re: Post a picture of your favorite random LSU player.

Posted by Slima on 10/29/23 at 7:05 pm to whitetiger1234

Come on, baws.

No tommy banks?

No tommy banks?

I use the youtrade portion of the chase app. Regular brokerage, non-IRA. My trades get executed in like ~5sec

re: Allright Guys Post your updated Stinker that is Killing Your portfolio

Posted by Slima on 7/9/20 at 10:05 am to FLObserver

MO

TAP

Tobacco & Beer. Getting crushed.

TAP

Tobacco & Beer. Getting crushed.

re: Should I sell my 301 share of Exxon?

Posted by Slima on 7/8/20 at 7:16 pm to Lee Chatelain

301 XOM brings $262 in dividends quarterly.

Re-invest them & keep it for a long Hold. That’s better than any interest rate you’ll find as long as they keep paying the dividend

I don’t see any way that this can’t be a win.

Low risk, safe returns, now explosive growth but keep it slow & steady.

Re-invest them & keep it for a long Hold. That’s better than any interest rate you’ll find as long as they keep paying the dividend

I don’t see any way that this can’t be a win.

Low risk, safe returns, now explosive growth but keep it slow & steady.

Thoughts on ABBV???

Posted by Slima on 7/3/20 at 7:23 pm

Dividend aristocrat but with some patents expiring. Anyone like this one at its 1yr high??

T or VZ this month?

Posted by Slima on 6/28/20 at 6:31 pm

Both going ex-div on 7/9/20

T $29 at 7%

VZ $53 at 4.5%

Which telecom do you prefer?

T $29 at 7%

VZ $53 at 4.5%

Which telecom do you prefer?

PFE. What’s the deal?

Posted by Slima on 6/25/20 at 7:53 pm

Why has Pfizer been so stagnant?

They have great drugs for everyday use but the stock has been so sluggish for the last year.

Anyone owning this one besides me?

They have great drugs for everyday use but the stock has been so sluggish for the last year.

Anyone owning this one besides me?

re: Two ex-div stocks today That I like. KO MO

Posted by Slima on 6/10/20 at 9:18 pm to TigerDeBaiter

Yes. Just to give the late-arrivers a chance at the party

Two ex-div stocks today That I like. KO MO

Posted by Slima on 6/10/20 at 9:10 pm

KO - 3.35%

MO - 7.85%

Two huge companies that are always good payers. Sometimes your gut says to go with the consumer goods. Coke zeros & marlboros.

Opinions???

MO - 7.85%

Two huge companies that are always good payers. Sometimes your gut says to go with the consumer goods. Coke zeros & marlboros.

Opinions???

Current Money Market Interest Rates

Posted by Slima on 5/24/20 at 7:29 pm

Cap1 just dropped to 1.1% for balances at $10,000+

Anyone finding anything better for a savings acct?

Anyone finding anything better for a savings acct?

re: Thoughts on These 10 Dividend Stocks?

Posted by Slima on 12/22/19 at 1:25 pm to Chef Free Gold Bloom

quote:

I went with ETFs for my intro to investing the last two years. I’m happy with where I’m at, but ready to explore more options.

I have no problem with individual companies, it’s just not where I started.

Gotcha.

Well, it's fun. I start reading into too much now on the solo companies

re: Thoughts on These 10 Dividend Stocks?

Posted by Slima on 12/22/19 at 12:53 pm to Chef Free Gold Bloom

quote:

Right now I have shares of:

SCHK

VTI

VXUS

BND

BNDX

VOO

QQQ

No interest in individual companies? Do you prefer ETFs?

quote:

Following this, I'd like to get into dividend stocks, but I am pretty illiterate when it comes to the stock market. Any good guides for getting someone into it?

I've got about $1000/month to invest. What can I realistically expect to receive in income?

Pick a stock that pays a comfortable yield but isn't over-reaching with it's ability to continuously pay that dividend.

Let's compare two:

Coca-Cola (KO) $55.00

Dividend yield is 2.97% or $1.60/share annually.

Payout ratio is 75.99% - kinda high but it has steadily increased its dividend for 56 years!

Occidental Petroleum (OXY) $39.01

Dividend yield is 8.25% or $3.16/share annually

payout ratio is 165%!!! - that means that 165% of the profits are currently being used to fund the dividend payments. OXY is using debt currently to pay dividends but has been increasing dividends for 16 years.

Does that mean that OXY is a bad buy b/c the dividend might get cut? Not necessarily. Keep tabs on the riskier yields and look at their financials

Just commit to a long term investment with them. $1,000/Month could yield you a cool $500+ in dividends at the end of 1 year. Re-invest them all to gain more shares and compound it.

Look into the S&P Dividend Aristocrats for some safer plays

Thoughts on These 10 Dividend Stocks?

Posted by Slima on 12/20/19 at 8:10 pm

Anyone owning these?

Wondering if i'm missing any red flags aside from Oxy's debt situation.

Holding these offer dividend payouts spread over every month of the year. Thoughts???

F - 6.3%

OXY - 8.1%

CNP - 4.3%

TAP - 4.2%

MO - 6.6%

KO - 2.9%

XOM - 5.0%

T - 5.3%

PFE - 3.9%

ABBV - 5.3%

Wondering if i'm missing any red flags aside from Oxy's debt situation.

Holding these offer dividend payouts spread over every month of the year. Thoughts???

F - 6.3%

OXY - 8.1%

CNP - 4.3%

TAP - 4.2%

MO - 6.6%

KO - 2.9%

XOM - 5.0%

T - 5.3%

PFE - 3.9%

ABBV - 5.3%

I bought a kobalt 80v from Lowe’s in 2016. Been using it ever since for my lot in a cul de sac. Doesn’t bog down and kill like a gas mower but thick/wet grass drains the battery much faster.

After thousands of times pulling cords on mowers and weed eaters and getting pissed off, ready to throw the damn things when they won’t start - I went electric. Love it.

After thousands of times pulling cords on mowers and weed eaters and getting pissed off, ready to throw the damn things when they won’t start - I went electric. Love it.

re: Anybody consistently work 90+ hours a week??

Posted by Slima on 4/15/19 at 11:59 pm to TheMailman

I’ve been doing this consistently since

2012-ish. Running a small business and aiming to retire early. Single and no kids at 34 makes it feasible.

Keep a $100 Benjamin taped across your headboard as a symbol for motivation; while keeping the mindset that at age 45, you’re done and retiring early and living the life you postponed.

2012-ish. Running a small business and aiming to retire early. Single and no kids at 34 makes it feasible.

Keep a $100 Benjamin taped across your headboard as a symbol for motivation; while keeping the mindset that at age 45, you’re done and retiring early and living the life you postponed.

re: A 1000 bucks

Posted by Slima on 4/5/19 at 10:39 pm to La Place Mike

But an ounce of physical Platinum bullion.

It’s shiny. It’s an industrial metal in demand. It’s an investment precious metal in a good position.

Nearly effortless to sell at any local coin shop. Worst case scenario - hand it to a jeweler to make you a ring.

LINK

It’s shiny. It’s an industrial metal in demand. It’s an investment precious metal in a good position.

Nearly effortless to sell at any local coin shop. Worst case scenario - hand it to a jeweler to make you a ring.

LINK

quote:

How much was CJs?

We’re building a base in a brand new store in a prime location while still in its infancy...

....so my price was $0.00

I’m unsure of why the question of me was being brought up????!!!

After an amazing inaugural fall football season, we’re building something great - let’s see what the future holds.

-CJ.

Physical Platinum Bullion

Posted by Slima on 1/15/18 at 1:20 am

Bought in on some at ridiculous lows in late ‘15 and a few months ago at ~$860ish spot with low premiums.

Anyone else waiting for the rocket to blast off???

Anyone else waiting for the rocket to blast off???

Go ahead, Jacob!

Popular

1

1