- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Update: DJIA craters by 1200+ points today following worse than expected inflation report

Posted on 9/13/22 at 8:01 am

Posted on 9/13/22 at 8:01 am

May be the worst day for 2022 - which itself has been a terrible year.

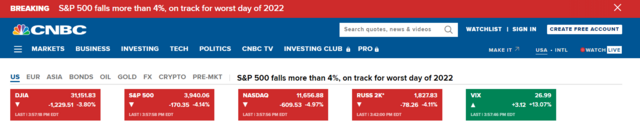

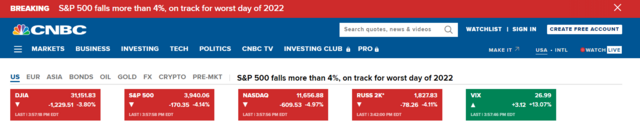

Update 3PM Central: S&P 500 falls more than 4%, on track for worst day of 2022

Update 11AM Central Stock sell-off deepens, Dow drops 900 points after hot inflation report

Update 10AM Central: Stock sell-off deepens, Dow drops 800 points following hot inflation report

Update 3PM Central: S&P 500 falls more than 4%, on track for worst day of 2022

quote:

Stocks fell sharply on Tuesday after a key August inflation report came in hotter than expected, hurting investor optimism for cooling prices and a less aggressive Federal Reserve.

The Dow Jones Industrial Average slid 1,244 points, or 3.8%. The S&P 500 dropped about 4.2%, and the Nasdaq Composite sank 5%. It was the worst day of the year for all three averages. More than 490 stocks in the S&P 500 fell, with Facebook-parent Meta dropping 8% and Caesars Entertainment losing 7.3%.

The drop erased nearly all of the recent rally for stocks, pulling the S&P 500 back toward its Sept. 6 close of 3,908 and causing some traders to glance back at mid-June, when the index fell below 3,700.

Update 11AM Central Stock sell-off deepens, Dow drops 900 points after hot inflation report

quote:

The Dow Jones Industrial Average slid 900 points, or 2.8%. The S&P 500 dropped 3.2%, and the Nasdaq Composite sank 4.1%. More than 490 stocks in the S&P 500 fell, with Facebook-parent Meta dropping 7.9% and Caesars Entertainment losing 7.3%.

Update 10AM Central: Stock sell-off deepens, Dow drops 800 points following hot inflation report

quote:

Stocks fell sharply on Tuesday after a key August inflation report came in hotter than expected, hurting investor optimism for cooling prices and a less aggressive Federal Reserve.

The Dow Jones Industrial Average slid 830 points, or 2.6%. The S&P 500 dropped 3%, and the Nasdaq Composite sank 3.8%. More than 490 stocks in the S&P 500 fell, with Facebook-parent Meta dropping 7.6% and Caesars Entertainment losing 6.7%.

quote:

Dow futures drop 400 points after hot inflation report

LINK

Stock futures dropped on Tuesday morning after an August inflation report came in hotter than expected.

Dow Jones Industrial Average futures sank 406 points, or about 1.3%. S&P 500 futures fell 1.7% and Nasdaq 100 futures slid 2.3%.

The August consumer price index report showed a higher-than-expected reading for inflation. Headline inflation rose 0.1% month over month, even with falling gas prices. Core inflation rose 0.6% month over month.

Economists surveyed by Dow Jones had been expecting a decline of 0.1% for overall inflation, with a rise of 0.3% for core inflation.

The report is one of the last the Fed will see ahead of their Sept. 20-21 meeting, where they’re expected to deliver their third consecutive 0.75 percentage point interest rate hike to tamp down inflation. The unexpectedly high August report could lead the Fed to continue its aggressive hikes longer than some investors anticipated.

This post was edited on 9/13/22 at 2:59 pm

Posted on 9/13/22 at 8:06 am to goofball

Great news!

My Fidelity account will be down even more.

My Fidelity account will be down even more.

Posted on 9/13/22 at 8:07 am to goofball

quote:

Economists surveyed by Dow Jones had been expecting a decline of 0.1% for overall inflation, with a rise of 0.3% for core inflation.

No one with any connection at all to mainstream, local Americans expected a decline in overall inflation and only very minor increase on core.

These people live in insulated bubbles.

Posted on 9/13/22 at 8:08 am to stout

Actually my ammo has gone up in value more than my retirement savings.

Posted on 9/13/22 at 8:09 am to member12

quote:

Actually my ammo has gone up in value more than my retirement savings.

If I hadn't lost all of mine in a tragic accident then I would say the 1500 rounds of.223 I bought right before Covid was a great investment.

Posted on 9/13/22 at 8:09 am to goofball

I'm thinking about buying a horse drawn carriage and be an early adopter. We seem to be going backwards.

Posted on 9/13/22 at 8:11 am to Cosmo

I have/had more. I bought that right before CV. Not because of CV but I found a good deal at the time and that's all they had left. It was a great deal compared to now. IIRC that same ammo is around $650 now for a case of 1000

This post was edited on 9/13/22 at 8:13 am

Posted on 9/13/22 at 8:15 am to stout

quote:

Buy ammo

Not with your credit card though lol

Posted on 9/13/22 at 8:17 am to TDsngumbo

When shite hits the fan credit card debt won't matter tho.

Posted on 9/13/22 at 8:18 am to Abstract Queso Dip

quote:

When shite hits the fan credit card debt won't matter tho.

Its not debt that hes speaking about

Posted on 9/13/22 at 8:23 am to SDVTiger

Sounds like I need a shovel and a burner phone. Time to hide some assets and hide from the federalies

Posted on 9/13/22 at 8:56 am to member12

I’m excited for another negative growth quarter that is classified as not a recession

Posted on 9/13/22 at 9:03 am to goofball

quote:

Headline inflation rose 0.1% month over month, even with falling gas prices.

Lol at them hoping gas prices were going to stop everything

Posted on 9/13/22 at 10:06 am to Areddishfish

Down 800 points now. Collapsing.

Posted on 9/13/22 at 10:10 am to Fat and Happy

quote:

I’m excited for another negative growth quarter that is classified as not a recession

We are already fitting a textbook definition of a recession.

Posted on 9/13/22 at 10:14 am to stout

quote:

Buy ammo and seeds

This is great advice. I've been putting half my paycheck towards ammo and seeds for the last year and it's probably the best decision I could have made. A bit of advice though is to get a variety in your seeds as you never know what situation you'll be in in the future. I originally started with plain seeds but lately have been buying more bbq and even ranch or pickle.

Popular

Back to top

21

21