- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Posted on 4/17/18 at 11:57 am to chRxis

quote:

chRxis

I'm well aware of what non-discretionary spending is, so no need for the cut and paste job.

I simply want the answer of whether or not it increased under Obama, and why it was left out of the argument about increased spending between Obama and Trump.

This post was edited on 4/17/18 at 11:58 am

Posted on 4/17/18 at 12:31 pm to Centinel

quote:

I've yet to use a single insult.

you're right... you didn't... but i'm not specifically speaking just about you... sorry you made that assumption....

quote:

He's yet to provide the case his argument is a factual one.

as per discretionary spending, he kind of has.... and he's already stated his position on the mandatory spending, so....

Posted on 4/17/18 at 12:32 pm to Centinel

quote:

I simply want the answer of whether or not it increased under Obama, and why it was left out of the argument about increased spending between Obama and Trump.

it's irrelevant to the point.... again, mandatory spending is NOT at the behest of the president, so regardless of who's there, its NOT their fault for the increase... Trump would be included in that, so settle down...

it's Congress.... and last time i checked, thats a majority of Republicans right now, correct?

Posted on 4/17/18 at 12:33 pm to Centinel

quote:

I'm well aware of what non-discretionary spending is,

you seem to be unaware of who actually is responsible for increases to that spending, and how it actually does increase....

Congress established mandatory programs under authorization laws. Congress legislates spending for mandatory programs outside of the annual appropriations bill process. Congress can only reduce the funding for programs by changing the authorization law itself. This requires a 60 vote majority in the Senate to pass.

This post was edited on 4/17/18 at 12:35 pm

Posted on 4/17/18 at 12:38 pm to junkfunky

quote:

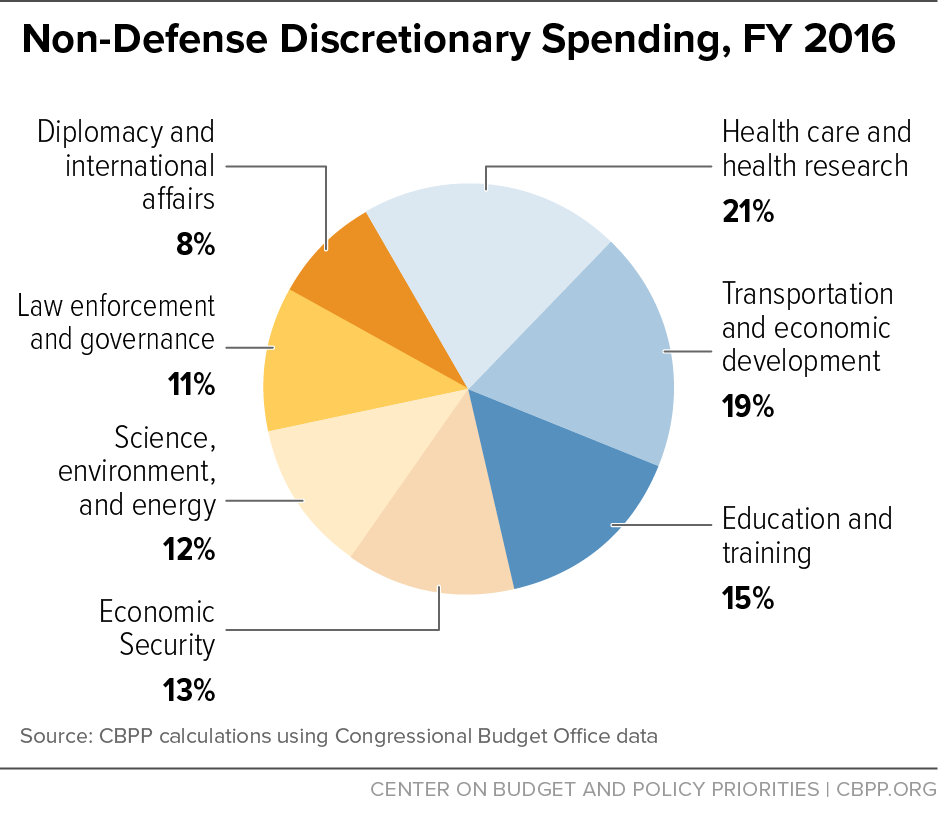

Military spending is about 1/6th our budget.

The other 5/6 is what needs to be cut.

This post was edited on 4/17/18 at 12:39 pm

Posted on 4/17/18 at 12:41 pm to CajunPhil

ok, but is this really a necessity?

wouldn't some of that money be better suited to going to our crumbling infrastructure and/or back into your pocket via less taxes being collected to fund that much military?

wouldn't some of that money be better suited to going to our crumbling infrastructure and/or back into your pocket via less taxes being collected to fund that much military?

Posted on 4/17/18 at 12:42 pm to chRxis

quote:

chRxis

Now post a graphic of Social Security/ Unemployment & Medicare and tell me where you want to make cuts.

Then we can talk.

Posted on 4/17/18 at 12:46 pm to chRxis

quote:

you seem to be unaware of who actually is responsible for increases to that spending, and how it actually does increase....

I'm well aware. However you seem to be under the impression that the president decides on discretionary, and Congress non-discretionary. Congress is over both.

ETA: Which is why even arguing "Obama spent less money than Trump!" is a stupid argument to begin with. Congress spent the money, not the President.

Now to my entire point:

Obamacare. Discretionary or non-discretionary?

This post was edited on 4/17/18 at 12:50 pm

Posted on 4/17/18 at 12:47 pm to 50_Tiger

quote:

Now post a graphic of Social Security/ Unemployment & Medicare and tell me where you want to make cuts.

hey, look, i'm not sitting here saying that the military is the ONLY place we are fricking up... there's a lot fiscally irresponsible spending across the board, chief...

but the TOPIC of the thread was military and military spending, therefore, i'm discussing that.... if you wanna make another thread to talk about those others sectors, i'll be obliged to talk about that there...

until then, i'll stay on topic....

Posted on 4/17/18 at 12:50 pm to Centinel

quote:

However you seem to be under the impression that the president decides on discretionary, and Congress non-discretionary. Congress is over both.

the president has a say in discretionary... he doesn't in mandatory... THAT'S the point...

quote:

Obamacare. Discretionary or non-discretionary?

first off, i'm not a big fan, and i've already stated i'm for single payer, but:

Why It Keeps Growing

Congress has a difficult time reducing the benefits entitled under any mandated program. Most consider it political suicide because such cuts guarantee voter opposition by the group receiving fewer benefits. That's one reason mandatory spending continues to grow.

Another reason is the aging of America. As more people require Social Security and Medicare, costs for these two programs will almost double in the next 10 years.

This contributes to higher health care spending. In addition, technological breakthroughs allow more diseases to be treated. This comes at a higher cost. This is one reason President Obama asked for health care reform.

Many people don't realize that the real benefit of the Affordable Care Act is lower costs. First, it pays for preventive care, treating Medicare and Medicaid recipients before they require expensive emergency room treatment. Second, it rewards doctors based on treatment outcomes, as opposed to paying them for each test and procedure. Third, it's helped move medical records onto an electronic database. That allows patients to take more ownership of their health care. It also gives doctors current data on the most effective treatments.

It's difficult for any elected official in Congress to vote for a reduction in these benefits. Who can vote for cutting off the income of Grandma, the blind or a veteran? In addition, many of these groups now have powerful lobbyists, like AARP, who can sway elections and funding. It's easy, and politically rewarding, to mandate new programs. It’s political suicide to eliminate them.

A good example of this is health care reform. It was passed in 2010 but at great political cost. Many of the Congressmen who voted for it lost their seat in the mid-term elections to candidates from the Tea Party. This is despite its promise to actually reduce the mandatory budget by cutting health care costs, and charging the health care industry more for Medicare and Medicaid. For more, see Health Care and the Budget.

Posted on 4/17/18 at 12:54 pm to chRxis

quote:

the president has a say in discretionary... he doesn't in mandatory... THAT'S the point...

The president most certainly has a say in non-discretionary. And Congress can ignore it just like they can with discretionary.

Again, Obamacare.

Discretionary, or non-discretionary?

This post was edited on 4/17/18 at 12:55 pm

Posted on 4/17/18 at 1:04 pm to Centinel

quote:

The president most certainly has a say in non-discretionary.

being most of the programs are indefinite, he kind of doesn't...

Congress can only reduce the funding for these programs by changing the authorization law itself. That requires a 60-vote majority in the Senate to pass. For example, Congress amended the Social Security Act to create Medicare. For this reason, mandatory programs are outside the annual budget process that governs discretionary spending. Since it is so difficult to change mandatory spending, it is not part of discretionary fiscal policy.

quote:

And Congress can ignore it just like they can with discretionary.

true, and i've already posted something explaining why they normally don't...

quote:

Again, Obamacare.

Discretionary, or non-discretionary?

i would think it would be considered non-defense discretionary....

Posted on 4/17/18 at 1:07 pm to chRxis

but then again:

Other Mandatory Programs

All other mandatory programs will cost $656 billion. Most of these are income support programs provide federal assistance for those who can't provide for themselves. One group helps keep low-income families from starving. These include Food Stamps, Child Tax Credits, and Child Nutrition programs. These are just three of the welfare programs which also include TANF, EITC, and Housing Assistance. Almost all of them are permanent, but there are exceptions. For example, the Food Stamp program requires periodic renewal.

There's also unemployment benefits for those who were laid off. Student Loans help create a more highly skilled work force. Other retirement and disability programs are for those who were former federal employees. These include civil servants, the Coast Guard, and the military.

In FY 2009, Congress passed the Economic Stimulus Act. This was added to the mandatory budget in FY 2010 as the TARP program, and as homeowner assistance in FY 2011.

In FY 2010, the Patient Protection and Affordable Care Act became law. It phased in new health care benefits and costs that year. It extended coverage to those with pre-existing conditions, children, and those who were laid off. It gave subsidies to small businesses and seniors with high prescription drug costs. It also provided funding to ease the shortage of doctors and nurses. The ACA’s mandatory costs that are offset by higher payroll taxes, fees to prescription drug companies and lower payments to hospitals.

Other Mandatory Programs

All other mandatory programs will cost $656 billion. Most of these are income support programs provide federal assistance for those who can't provide for themselves. One group helps keep low-income families from starving. These include Food Stamps, Child Tax Credits, and Child Nutrition programs. These are just three of the welfare programs which also include TANF, EITC, and Housing Assistance. Almost all of them are permanent, but there are exceptions. For example, the Food Stamp program requires periodic renewal.

There's also unemployment benefits for those who were laid off. Student Loans help create a more highly skilled work force. Other retirement and disability programs are for those who were former federal employees. These include civil servants, the Coast Guard, and the military.

In FY 2009, Congress passed the Economic Stimulus Act. This was added to the mandatory budget in FY 2010 as the TARP program, and as homeowner assistance in FY 2011.

In FY 2010, the Patient Protection and Affordable Care Act became law. It phased in new health care benefits and costs that year. It extended coverage to those with pre-existing conditions, children, and those who were laid off. It gave subsidies to small businesses and seniors with high prescription drug costs. It also provided funding to ease the shortage of doctors and nurses. The ACA’s mandatory costs that are offset by higher payroll taxes, fees to prescription drug companies and lower payments to hospitals.

This post was edited on 4/17/18 at 1:08 pm

Posted on 4/17/18 at 1:09 pm to chRxis

quote:

would think it would be considered non-defense discretionary....

And the part of Obamacare that expanded Medicaid?

ETA: Do you see where I'm going with this? To make the argument that Obama spent far less money than Trump, but then only count discretionary spending and completely ignore the massive expansion of Medicaid under the ACA is disingenuous to the extreme.

Which is the entire reason I called out that auburn dude on his hyperventilating hyperbole.

This post was edited on 4/17/18 at 1:11 pm

Posted on 4/17/18 at 1:41 pm to Centinel

quote:

the part of Obamacare that expanded Medicaid?

the part that individual STATES institute? that's not a federal mandate...

and the expansion is actually a GOOD thing, that will eventually lead to decreased health care cost overall...

This post was edited on 4/17/18 at 1:45 pm

Posted on 4/17/18 at 1:57 pm to chRxis

quote:

the part that individual STATES institute? that's not a federal mandate...

But it was 100% federally funded during Obama's term. It didn't start decreasing until last year where it moved to 95% federal funding. Which is still an absolutely absurd amount of money, and again is completely disingenuous to leave out when discussing spending levels between Obama and Trump.

And your second point is irrelevant to the topic at hand.

This post was edited on 4/17/18 at 2:00 pm

Posted on 4/17/18 at 2:24 pm to Centinel

quote:

You didn't answer the question of whether mandatory spending increased under Obama.

Of course it did dumbass. Ever hear of something called demographics? Baby boomers?

Just how stupid a baw are you? So I know how much to dumb things down..

Posted on 4/17/18 at 2:42 pm to Centinel

quote:

ETA: Which is why even arguing "Obama spent less money than Trump!" is a stupid argument to begin with. Congress spent the money, not the President.

Well, we have a Republican president and Congress now and they have put the debt and deficit on the worst trajectory in decades, possibly since WWII.

My real argument here is simple and it isn't really even debatable if you are using facts and not misleading talking points.

Democrats are more fiscally responsible than Republicans by a wide margin. The GOP took full control when the country elected that moron and the trajectory of the debt and deficit have skyrocketed due to the massive spending increases and tax cuts put forth by Congress signed by the chief moron.

Posted on 4/17/18 at 2:56 pm to Tiger n Miami AU83

quote:

Democrats are more fiscally responsible than Republicans by a wide margin.

Popular

Back to top

0

0