- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

I posted on PoliBoard, but you OT ballers will like it, too

Posted on 12/14/15 at 10:59 am

Posted on 12/14/15 at 10:59 am

Coming to YOUR neighborhood ...

LINK

HomeReady™ is a mortgage program created in December 2015. It's backed by the U.S. government via Fannie Mae and available via most U.S. lenders.

HomeReady™ allows a downpayment of just 3% on a home and permits the "income pooling" for all of the members of a household. This means that income from grandparents, parents, relatives, and working children can all be used to help qualify for a home loan.

From the Q and A

For the HomeReady™ mortgage program, do my co-habitants have to be legal residents of the United States?

No, via the HomeReady™ home loan program, non-borrowing relatives do not need to be legal residents of the United States of America.

If I use the income of somebody living in my house to help qualify for the HomeReady™ loan, does that person need to be on the mortgage application?

No, you do not need to include other people on your HomeReady™ mortgage application -- even if their income is used to help you qualify.

In order to use another person's income on your application, you will only need to show that person's proof of income and a signed statement indicating their intent to live with you for a period of at least 12 months.

More goodies at the link.

LINK

HomeReady™ is a mortgage program created in December 2015. It's backed by the U.S. government via Fannie Mae and available via most U.S. lenders.

HomeReady™ allows a downpayment of just 3% on a home and permits the "income pooling" for all of the members of a household. This means that income from grandparents, parents, relatives, and working children can all be used to help qualify for a home loan.

From the Q and A

For the HomeReady™ mortgage program, do my co-habitants have to be legal residents of the United States?

No, via the HomeReady™ home loan program, non-borrowing relatives do not need to be legal residents of the United States of America.

If I use the income of somebody living in my house to help qualify for the HomeReady™ loan, does that person need to be on the mortgage application?

No, you do not need to include other people on your HomeReady™ mortgage application -- even if their income is used to help you qualify.

In order to use another person's income on your application, you will only need to show that person's proof of income and a signed statement indicating their intent to live with you for a period of at least 12 months.

More goodies at the link.

Posted on 12/14/15 at 11:01 am to CAD703X

quote:

it takes a village

To get a home loan. Literally.

Posted on 12/14/15 at 11:01 am to anc

It's about time we make it easier to buy a house.

Posted on 12/14/15 at 11:01 am to anc

So the income that is being used to justify the mortgage payment will NOT be available to pursue upon inevitable default?

Sounds profitable - for someone.

Sounds profitable - for someone.

Posted on 12/14/15 at 11:02 am to CAD703X

quote:

it takes a village

To elect an idiot for Prez

Posted on 12/14/15 at 11:05 am to anc

quote:

I don't have a credit score. Can I still use the HomeReady™ program?

Yes, you can still use the HomeReady™ if your credit score is non-existent. The program allows the use of non-traditional tradelines to establish credit history, including utility bills, gym membership, and most other accounts which require monthly payment.

GYM MEMBERSHIP!

This is the moment. America has truly jumped the shark.

Posted on 12/14/15 at 11:06 am to anc

what could possibly go wrong.

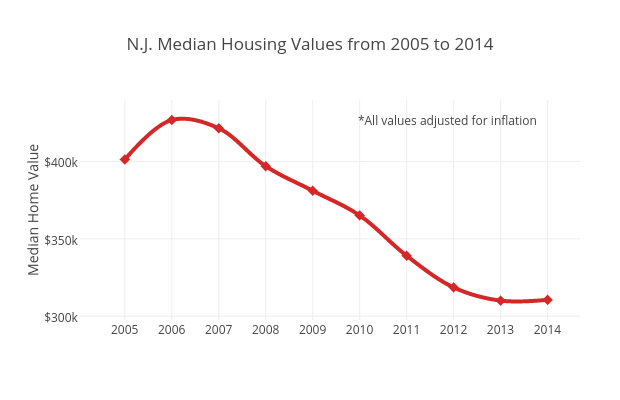

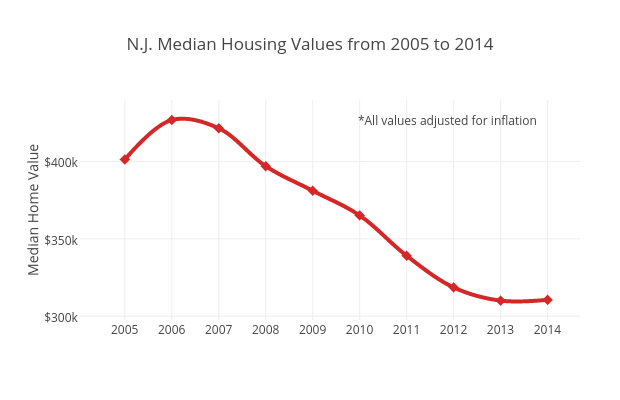

(I just picked a NJ chart because it came up first)

(I just picked a NJ chart because it came up first)

This post was edited on 12/14/15 at 11:07 am

Posted on 12/14/15 at 11:07 am to anc

quote:

No, via the HomeReady™ home loan program, non-borrowing relatives do not need to be legal residents of the United States of America.

It is very easy to see where this is going. If the buyers are illegal aliens and get sent back, we the taxpayers pickup the bill.

Posted on 12/14/15 at 11:07 am to anc

There goes the neighborhood.

All of them.

All of them.

Posted on 12/14/15 at 11:08 am to anc

Does the allowance my kids earn qualify?

ETA: My kids are about to be making $80k a year in allowance on paper.

ETA: My kids are about to be making $80k a year in allowance on paper.

This post was edited on 12/14/15 at 11:10 am

Posted on 12/14/15 at 11:09 am to anc

And that's why HOAs are important

Posted on 12/14/15 at 11:09 am to anc

Next thing you know we'll be seeing 60yr loans

Posted on 12/14/15 at 11:10 am to 13SaintTiger

quote:

Next thing you know we'll be seeing 60yr loans

40s are out there. They aren't widespread yet though.

Posted on 12/14/15 at 11:11 am to OysterPoBoy

quote:

It's about time we make it easier to buy a house.

Serious, Clark?

Posted on 12/14/15 at 11:13 am to mizzoukills

What's an HOA got to do with any of this?

Posted on 12/14/15 at 11:13 am to ShreveportHog94

quote:

Serious, Clark?

Why wouldn't he be serious? Expensive houses is what caused the crash in 2008

Posted on 12/14/15 at 11:14 am to anc

3% of $250K is $7500 dollars.

You're going to have people putting down $7500 on a $250,000 house.

These people are ALL going to default! I mean is that part of the plan?

You're going to have people putting down $7500 on a $250,000 house.

These people are ALL going to default! I mean is that part of the plan?

Popular

Back to top

21

21