- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Bloomberg: Big Oil Goes Looking for a Career Change

Posted on 9/16/20 at 8:49 pm to crazyLSUstudent

Posted on 9/16/20 at 8:49 pm to crazyLSUstudent

quote:

O&G is going to get hammered over the next 10 years as more and more electric vehicles come online

You all downvote but......

Posted on 9/16/20 at 8:51 pm to rickgrimes

Energy is everything. Don't count them out.

Posted on 9/16/20 at 8:53 pm to tigerbutt

He miiiight be right but it has little to do with EVs

Posted on 9/16/20 at 9:05 pm to Sun God

Will take a decade to move away from oil, if we ever do. Don't bet on it anytime soon.

Posted on 9/16/20 at 9:10 pm to tiger81

quote:

Will take a decade to move away from oil, if we ever do. Don't bet on it anytime soon.

It will easily take 20+ years for electric vehicles to have a 30-40% market share.

Posted on 9/16/20 at 9:27 pm to fallguy_1978

quote:

It will easily take 20+ years for electric vehicles to have a 30-40% market share.

They are not even 2% and they have already been around for a decade. The current fundamental design is not compatible with the consumer needs. People did not switch to the combustion engine because it was good for horse it was because it was more convenient, affordable, and reliable. Electric cars are smaller, more expensive, and won’t last 15-20 years on average. The common consumer is not going to be buying an electric car in the next decade until these issues are resolved.

Posted on 9/16/20 at 9:30 pm to CheEngineer

Why would anyone buy an EV right not when the vehicle du jour right now is giant pickups and SUVs

This post was edited on 9/16/20 at 9:31 pm

Posted on 9/16/20 at 9:35 pm to CheEngineer

quote:

Electric cars are smaller, more expensive, and won’t last 15-20 years on average. The common consumer is not going to be buying an electric car in the next decade until these issues are resolved.

I agree. It's still a niche market. A lot of people don't have the ability to charge at home etc and the infrastructure is still pretty poor outside of major cities.

Vehicles don't have short replacement cycles either. Most of the vehicles sold in the next 5 years will still be on the road in 15 years.

Posted on 9/16/20 at 10:13 pm to fallguy_1978

quote:

Vehicles don't have short replacement cycles either. Most of the vehicles sold in the next 5 years will still be on the road in 15 years.

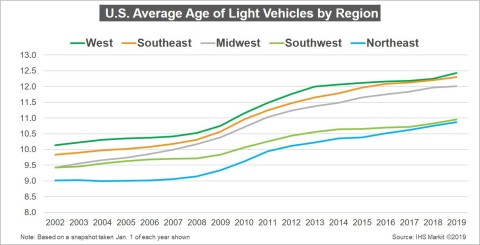

Funny you should mention this. I read earlier today that the average age of vehicles on the road in the US is at an all time high of 11.9 years. 25% of cars and light trucks on the road are >16 years old. Graph from last year’s report, but the trend is clear:

It’s kind of funny because there are a lot of people who erroneously believe vehicle quality has fallen in the last few decades. The reality is the opposite - vehicles last longer than ever now. New vehicle sales accounted for ~6% of vehicles on the road last year, and are expected to fall to 5% this year.

That means that if pure EV’s made up 100% of all new vehicle sales right now, AND they stayed on the road just as long as gasoline vehicles, it would still take 10+ years for them to make up more than 50% of cars on the road.

Posted on 9/16/20 at 10:21 pm to Cosmo

quote:

We dont just use oil for fuel.

What do you think the price of oil will be if it’s not used as a fuel?

Posted on 9/16/20 at 10:23 pm to Colonel Flagg

quote:

They are cheap because we can so easily extract it now.

It’s easy to extract if you like lighting money on fire.

Posted on 9/16/20 at 10:23 pm to GREENHEAD22

quote:

You are right in a sense but you picked the wrong example. All the McMoran big shelf wells were targeting shallow water ultra deep gas, which they found. Problem is they couldn't produce it with the technology available at the time and gas wasn't worth shite.

Whoops.

I’ll say this though - anyone who knows about Davy Jones knows exactly the type of pre-downturn thinking I’m talking about.. even if I did pick a bad example.

Posted on 9/16/20 at 10:23 pm to lostinbr

quote:

It’s kind of funny because there are a lot of people who erroneously believe vehicle quality has fallen in the last few decades. The reality is the opposite - vehicles last longer than ever now.

Finding vehicle quality rankings are starting to become increasingly worthless for this reason.

Even the worst ranked cars aren't really that bad.

This post was edited on 9/16/20 at 10:24 pm

Posted on 9/16/20 at 10:24 pm to dewster

quote:

I'll continue buying a little at a time over the next few years when I notice the price dropping below $40. And I'm prepared to hold onto it for a while.

Prep for a dividend cut while you’re at it.

Posted on 9/16/20 at 10:34 pm to AllDayEveryDay

quote:

Where ya think that battery power is coming from ya dummy?

Wind

About 25% and growing in TX.

People that doubt there’s a change coming need to drive across the SW.

I know that solar companies and speculators are buying cheap farmland along the coast.

Nearly every big energy PE firm now has an energy transition fund.

This post was edited on 9/16/20 at 11:03 pm

Posted on 9/16/20 at 10:51 pm to lsut2005

quote:

This is just BS. 15 years ago they said we’d never see below $80bbl again!!! Peak oil, etc... seriously I’ll take this with a grain of salt. Oil isn’t going anywhere and will continue to be dominant.

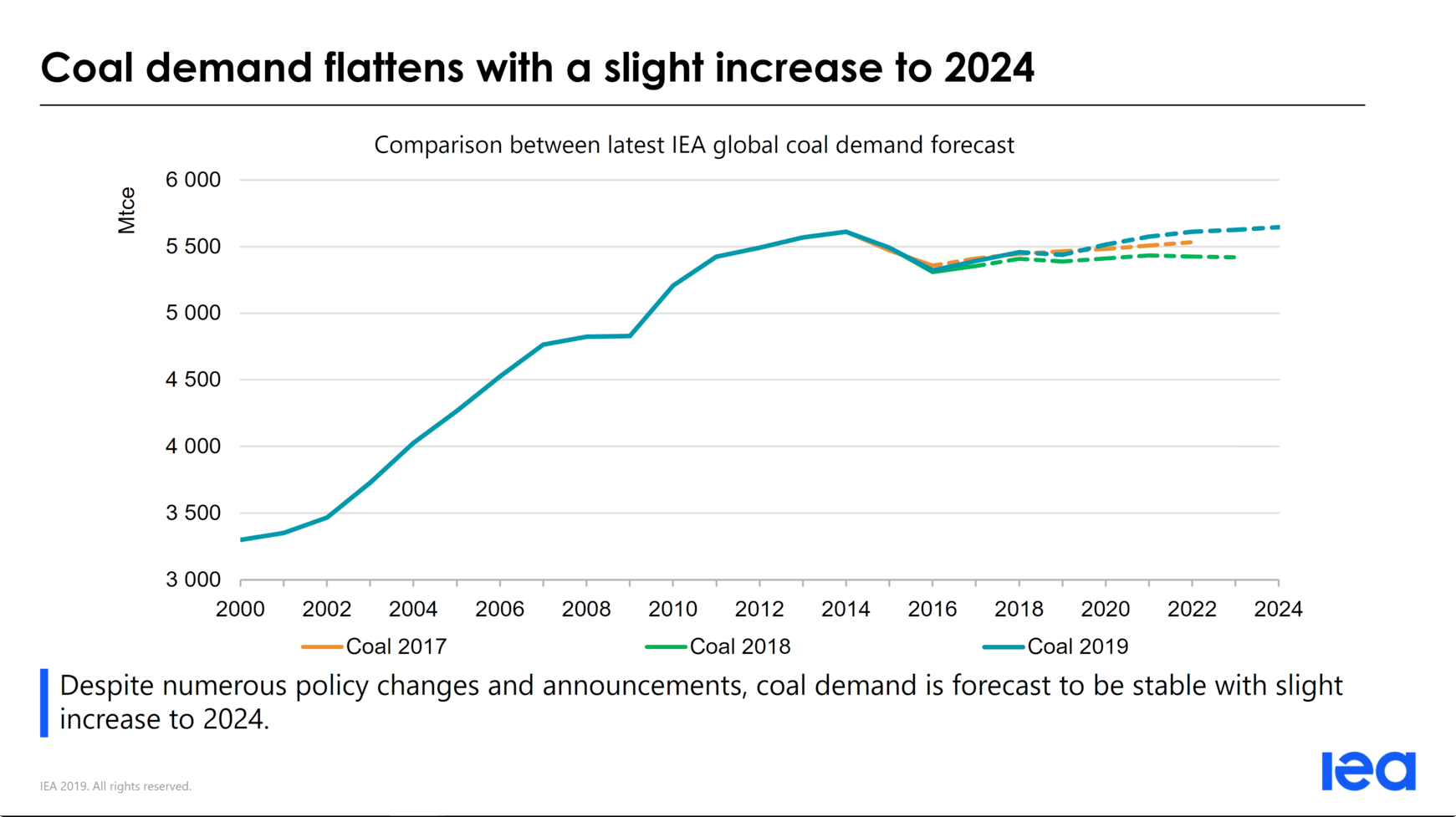

Outside of the obviously oil-specific verbiage, you can transpose a lot of that to coal from 10 or 15 years ago.

Excluding COVID’s impact on power generation this year, which this 2019 chart predates, global coal demand has basically been flat since its peak around ‘13. And yet, these companies have seen an implosion in market cap over the past decade, a wave of bankruptcies, and a massive falloff in jobs.

I’m not saying it’s a perfect analogy, but there are a lot of parallels to take into consideration. At any rate, the industry is going to need to undergo massive consolidation over the next decade.

This post was edited on 9/16/20 at 10:52 pm

Posted on 9/16/20 at 11:06 pm to lostinbr

My thoughts as well. The US energy innovation (horizontal drilling/fracking) that made shale plays economical also created the supply issues that will change the industry forever.

Popular

Back to top

1

1