- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Posted on 2/25/16 at 12:32 pm to High C

You're free to quit your job, get on government assistance, and live the lifestyle that affords.

Posted on 2/25/16 at 12:33 pm to ForeverLSU02

quote:

pisses me off that I paid the feds $25k last year and that still wasn't enough

Why u so poor

Posted on 2/25/16 at 12:34 pm to mostbesttigerfanever

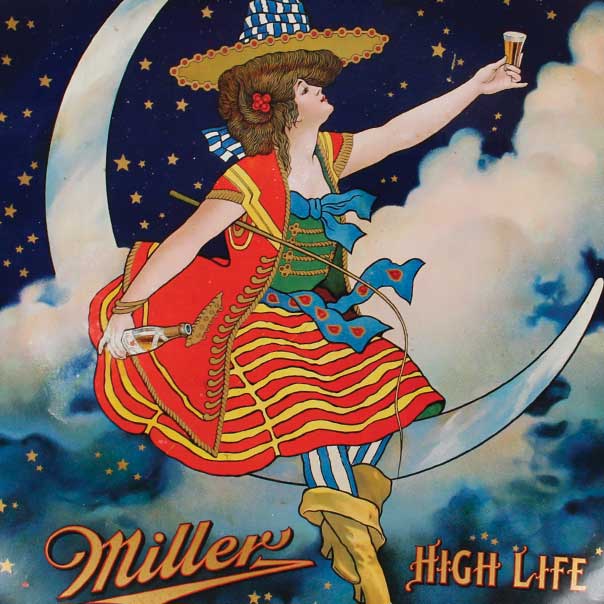

Where your money goes

Posted on 2/25/16 at 12:36 pm to High C

Anyone need any lawn are done?

I only accept cash payments

I only accept cash payments

Posted on 2/25/16 at 12:37 pm to High C

quote:

just 115,000 households, whose average income is more than $9.4 million — pay more than 20 percent of it.

Yet they own 80% of the wealth. Just to, you know, reinforce what we already know.

Also, btw bub, statistically that means there's a roughly 1:2 chance that you're in that bracket that pays nothing. Also, statistically, you've got a roughly 1:30,000,000 chance at becoming those people you're trying to protect right now.

So yeah, we can play the math game all day. You still lose, your point still sucks.

Posted on 2/25/16 at 12:39 pm to barry

Cutting SS, Military, and Medicare would do wonders. Some of the largest entitlement programs along with corporate welfare

Posted on 2/25/16 at 12:39 pm to boosiebadazz

quote:

You're free to quit your job, get on government assistance, and live the lifestyle that affords.

Gross oversimplication of what is going on and being discussed here. The way that the current tax system works there is no "need" for many to push beyond this lifestyle. Tax credits should be a way to reduce ones taxable income is a way of stimulus for those who pay.Instead tax credits reward above and beyond. True tax reform would save taxpayers money as well as implement a true "reward" for those with no drive now. Would it fix all the countries problems? No, but it would provide a better incentive and break the current lifestyle that 45% support simply because the elected realize that the more of the 45% money they give to the 40% the more votes they can get.

Posted on 2/25/16 at 12:39 pm to KG6

quote:

This statement makes it seem "less" of an issue than it is. Many in the top 1% do not make close to 2.1 million a year, yet they are helping pay that 43.6% of all taxes.

Good point. The top 1% of American household incomes is $398k or more.

Posted on 2/25/16 at 12:41 pm to High C

And the reason I have my political beliefs is that while all you said is and has been true, those people are being further villanized and asked to do more. It's why at this point, liberalism is more of a sin than the right's "lack of compassion".

This post was edited on 2/25/16 at 12:42 pm

Posted on 2/25/16 at 12:42 pm to East Coast Band

quote:

So, essentially have no incentive to move up. Just sit on your arse and get the same thing as working 40 hours a week for the whole year.

It is like being on unemployment. No use in working a few hours here or there where you can because they'll just take it from your benefits. If you can't get over the threshold, there is no point in even trying to get close.

Posted on 2/25/16 at 12:45 pm to recruitnik

quote:

Yet they own 80% of the wealth. Just to, you know, reinforce what we already know.

Also, btw bub, statistically that means there's a roughly 1:2 chance that you're in that bracket that pays nothing. Also, statistically, you've got a roughly 1:30,000,000 chance at becoming those people you're trying to protect right now.

So yeah, we can play the math game all day. You still lose, your point still sucks.

Bernie appreciates your vote, bub.

Posted on 2/25/16 at 12:45 pm to boosiebadazz

quote:

You're free to quit your job, get on government assistance, and live the lifestyle that affords.

Such a cop out.

No one is saying they have a better lifestyle than others, but there is no denying that if you can get used to that lifestyle, you're discouraged to do anything else above and beyond that. In essence, if you can't make $45K as a family of 4, you're better off staying home completely and doing nothing.

*I'm making up the $45k, but the real number isn't that far off.

Posted on 2/25/16 at 12:47 pm to TJGator1215

quote:

Some of the largest entitlement programs along with corporate welfare

I never fully got on board with the corporate welfare thing. Is that money just not passed on to the employees, shareholders, bondholders, etc. and taxed later on. Its not like it doesn't end up back in uncle sams pocket.

Posted on 2/25/16 at 12:47 pm to Swoopin

quote:

liberalism is more of a sin than the right's "lack of compassion".

Posted on 2/25/16 at 12:49 pm to slackster

quote:

No use in working a few hours here or there where you can because they'll just take it from your benefits. If you can't get over the threshold, there is no point in even trying to get close.

Exactly, there are plenty of mothers who would work, but if you have two or three young kids then you would pay more in daycare then you could make working.

Its not their fault, they are going to struggle even more just to make sure its "fair"

Posted on 2/25/16 at 12:51 pm to TJGator1215

quote:

The reality is that the income tax is one of a number of types of taxes that individuals pay, both over the course of their lifetimes and in a given year, and it makes little sense to treat it as though it were the only one that matters. Some 86 percent of working households pay more in payroll taxes than in federal income taxes. In fact, low- and moderate-income people pay a much larger share of their incomes in federal payroll taxes than high-income people do: taxpayers in the bottom 20 percent of the income scale paid an average of 8.8 percent of their incomes in payroll taxes in 2007, compared to just 1.6 percent for taxpayers in the top 1 percent of the income distribution

LINK

This post was edited on 2/25/16 at 12:54 pm

Posted on 2/25/16 at 12:51 pm to recruitnik

quote:

Yet they own 80% of the wealth. Just to, you know, reinforce what we already know.

Good thing we don't pay wealth taxes or you'd have a decent point. It is an income tax system in this country. Are you advocating that we tax them again on the money they've saved? If that money generates income, then sure, but accumulating wealth and saving it shouldn't be discouraged.

Posted on 2/25/16 at 12:52 pm to TJGator1215

quote:

One In Four American Millionaires Pay A Lower Overall Tax Rate Than That Faced By 10.4 Million Middle-Income Americans. From the Congressional Research Service: “The results of this analysis show that the current U.S. tax system violates the Buffett rule in that a large proportion of millionaires pay a smaller percentage of their income in taxes than a significant proportion of moderate-income taxpayers. Roughly a quarter of all millionaires (about 94,500 taxpayers) face a tax rate that is lower than the tax rate faced by 10.4 million moderate income taxpayers (10% of the moderate-income taxpayers). Tax reforms that are consistent with the Buffett rule would likely include raising tax rates on capital gains and dividends. For example, the President has proposed allowing the 2001 and 2003 Bush tax cuts to expire for high income taxpayers and taxing carried interests of hedge fund managers as ordinary income as tax reforms that observe the Buffett rule. Research suggests that these tax reforms are unlikely to affect many small businesses or to deter saving and investment.” [Congressional Research Service via House.gov, 10/7/11]

400 Wealthiest Americans Paid Average Income Tax Rate Of 18.11 Percent In 2008. From the Center for American Progress: “The average federal income tax rate of the richest 400 people in the country in 2008 was 18.11 percent. In 2007 it was 16.62 percent. That is only a little more than just the payroll tax on wages—normally 15.3 percent on a worker’s first $106,800 in wages, counting both the share that workers pay directly and the share their employers pay, which comes out of their wages—let alone the federal income tax on those wages. The tax rates paid by the ‘Fortunate 400’ have plummeted since the mid-1990s, when their average effective rates were about 30 percent.” [Center for American Progress, 9/20/11]In 2005, Wealthiest 1 Percent Paid Less Than 20 Percent Effective Income Tax Rate. From the Congressional Budget Office: “CBO’s previous estimates show an effective individual income tax rate of 19.4 percent in 2005 for the 1 percent of the population with the highest income. There was little variation among subgroups in the top 1 percent, except for people in the top 0.01 percent, whose effective individual income tax rate was 17.0 percent in 2005. That lower rate results from the combination of a large share of income (44 percent) from capital gains among households in that group in 2005 and a lower tax rate on capital gains than on other income.” [CBO.gov, December 2008]

LINK

Popular

Back to top

0

0