- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: What happens if there are no stocks available to fill Keith Gills options?

Posted on 6/5/24 at 9:02 pm to GhostOfFreedom

Posted on 6/5/24 at 9:02 pm to GhostOfFreedom

Is it the MOASS or is it a company you want to buy and hold because it is undervalued?

You seem to like it fundamentally but your arguments usually amount to MOASS instead.

You seem to like it fundamentally but your arguments usually amount to MOASS instead.

Posted on 6/5/24 at 9:03 pm to DJ3K

quote:

maybe he is showing how he made a boat load of money for other traders to use on other stocks when the market continues on as normal and nothing changes. Use the same strategy going forward elsewhere =stock market dies

I don’t think I understand the argument.

Posted on 6/6/24 at 10:58 am to GhostOfFreedom

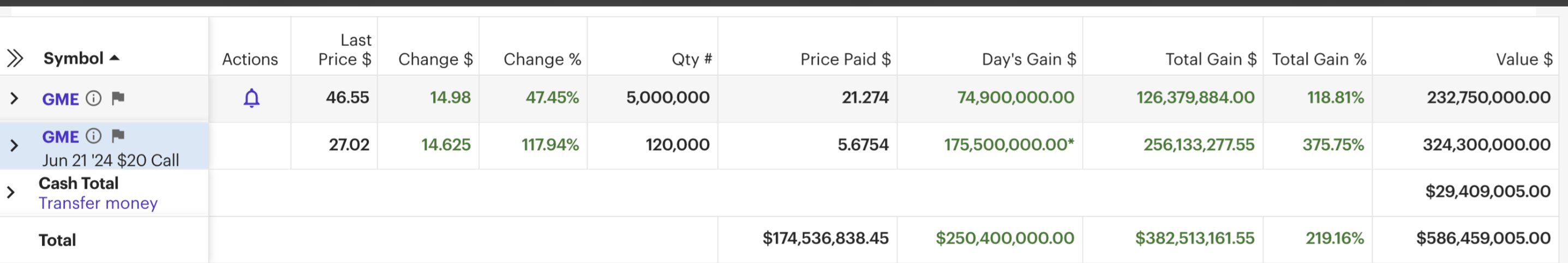

Rumor is that he is sitting on close to $100 million in cash right now.

Posted on 6/6/24 at 12:40 pm to MrLSU

Stock was just halted at $42. I'm holding until 200.

Posted on 6/6/24 at 1:14 pm to MrLSU

Anyone who thinks the market is fair and the market makers (some are also hedge funds) don't manipulate and fix the price with every freaking trick they can come up with, should compare the price movement of $GME and $AMC. AMC has done nothing to go up, but they and some other stocks often mirror GameStop because the lovely "totally not manipulating price" funds have them linked in an ETF and they short the hell out of AMC and others to take energy away from GameStop.

Will it work forever? Or, it it get stopped?

Will it work forever? Or, it it get stopped?

Posted on 6/6/24 at 5:31 pm to GhostOfFreedom

Exchange guarantees the counter party risk. I saw it mentioned on here the market makers do this. I don’t believe this is accurate. I could be wrong, and I’m willing to learn if I’m wrong.

eta. I posted exchange, it’s probably OCC.

eta. I posted exchange, it’s probably OCC.

This post was edited on 6/6/24 at 5:34 pm

Posted on 6/6/24 at 7:05 pm to GhostOfFreedom

quote:

Anyone who thinks the market is fair and the market makers (some are also hedge funds) don't manipulate and fix the price with every freaking trick they can come up with, should compare the price movement of $GME and $AMC. AMC has done nothing to go up, but they and some other stocks often mirror GameStop because the lovely "totally not manipulating price" funds have them linked in an ETF and they short the hell out of AMC and others to take energy away from GameStop. Will it work forever? Or, it it get stopped?

There isn’t a fact in this rant.

Posted on 6/6/24 at 7:27 pm to MrLSU

I am thinking about playing a put about a month out back around $30. Do y’all think this is going to drop back down like always? Or is it dumb to play with fire. Just seems a little too easy.

Posted on 6/6/24 at 7:30 pm to GhostOfFreedom

quote:

they short the hell out of AMC and others to take energy away from GameStop.

AMC gets sold into a shelf offering every time.

This post was edited on 6/6/24 at 7:48 pm

Posted on 6/6/24 at 7:42 pm to MrLSU

It's up to $61 post market.

I threw some fun money on it today to go for a ride. Let's see what happens tomorrow.

*Unlike some here, I plan to sell.

I threw some fun money on it today to go for a ride. Let's see what happens tomorrow.

*Unlike some here, I plan to sell.

Posted on 6/6/24 at 8:21 pm to kung fu kenny

quote:

Do y’all think this is going to drop back down like always?

Of course, but how high does it go in the meantime?

Posted on 6/6/24 at 8:46 pm to slackster

quote:

There isn’t a fact in this rant.

Of course there isn't.

Are you familiar with this guy's little MOASS cult? They literally believe that if they spend all of their money buying and holding GME that eventually the price will shoot to over a million a share, which is greater than the total value of the entire US stock market, and that the government will "print" the money to buy their shares from them. It's all quite crazy.

Posted on 6/7/24 at 8:37 am to kung fu kenny

quote:

Do y’all think this is going to drop back down like always? Or is it dumb to play with fire. Just seems a little too easy.

The implied volatility on GME is around 300% (crazy high). So if you’re buying a 30 strike put with a July 5 expiration, as of yesterday’s close, you’d pay about $550 for it. If the stock gets down to $24.50 by expiration, you’d break even (before fees/commissions). But if the IV keeps expanding, if the stock just trended in the direction of $30 probably a week or two before expiration, good chance you could sell that put for a profit. How much? I have absolutely NO idea. With this ticker, given its volatility, it’s almost like you’re playing an option on an option.

TL/DR: Going long any option on this ticker would be a purely speculative bet. But at least you limit your risk of loss to what you’ve paid for the option. Ya pays your money, ya takes ya chances.

Posted on 6/9/24 at 5:03 pm to Jag_Warrior

quote:

So if you’re buying a 30 strike put with a July 5 expiration, as of yesterday’s close, you’d pay about $550 for it.

As of Friday’s close, that July 5 30 strike put was trading at $967 (mid price).

Posted on 6/9/24 at 7:24 pm to Jag_Warrior

GME After hours is over $30 tonight

Popular

Back to top

1

1