- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Trump backs tax hike on rich but says GOP probably shouldn't do it

Posted on 5/11/25 at 7:17 am to TigerTalker142

Posted on 5/11/25 at 7:17 am to TigerTalker142

What if you sold a business for 100mm and already paid 30mm in taxes on the money you received from the sale. You think that 70mm you have left after paying your fair share of taxes should have a 3% asset tax on it? That doesn’t sound fair. Why are we punishing people who have been more successful than others, most likely through hard work? Shouldn’t tax rates just be the same across the board? You pay a certain percentage of your income and if we are making more money that percentage results in a higher amount of taxes paid. Why does the doctor have to give up a higher percentage of the money he made than the car salesman? If I make 100k a year, I pay 20k at a 20% rate. If I make 1mm a year, I pay 200k a year at a 20% rate. How is that unfair and “not paying fair share”? Why does the guy who worked harder, did extra schooling, put in More effort, etc have to pay a higher percentage of his income?

Posted on 5/11/25 at 9:50 am to Lsu05

quote:

You think that 70mm you have left after paying your fair share of taxes should have a 3% asset tax on it?

I think the 20 million above the 50 million dollar threshold could, and likely should be taxed, if the US government wants to find additional ways to raise meaningful revenues in a way that would have minimal impact on the demographic being taxed.

quote:

Why are we punishing people who have been more successful than others, most likely through hard work? Shouldn’t tax rates just be the same across the board?

It's not punishing. It's paying back into the system that gave them the opportunity to become so wealthy, that they, and their children, and their children's chidren would likely never need to work again a day in their life again. I mean in many cases we're literally talking about situations where it allowed the individual in questions parents or grandparents to become so wealthy that the individual with the $50m plus in wealth has never actually worked a day in their life.

Virtually anyone that gets to the level of wealth we described, did not just do so on the basis of them being a "harder worker" then everyone else that isn't as wealthy as them. They took advantage (rightly) of the system that's been set up through the work of 100's millions of others and trillions in tax revenue.

If they started their company in the US they had access to a highly educated workforce in large part funded by public dollars, as well as sources of cheaper labor that would have been in part subsidized by public dollars in the form of Medicare/Medicaid, SNAP benefits, social security, etc. They had access to sophsticated logistics pipelines who utilize public infrastructure to move goods. They had access to the best capital markets in the world to raise funding, and find partners for expansion and growth. Markets that are in large part so robust due to the federal governments willingness to use taxpayers dollars to back them in the event of emergency and to provide small business loans, grants, etc. to help subsidize industries and the growth of companies.

There's a million other cascading effects you can point to where taxpayer dollars in some way (directly or indirectly) subsidized their business or their upbringing or gave them an edge they otherwise wouldn't have had in another country.

quote:

Shouldn’t tax rates just be the same across the board? You pay a certain percentage of your income and if we are making more money that percentage results in a higher amount of taxes paid. Why does the doctor have to give up a higher percentage of the money he made than the car salesman? If I make 100k a year, I pay 20k at a 20% rate. If I make 1mm a year, I pay 200k a year at a 20% rate.

We're talking about wealth that is so beyond your numbers it's not even really comparible. Your example is essentially two W-2 employees working everyday and paying taxes on earned income that is directly correlated to the amount of hours they worked and time spent. Then implying they shouldn't be treated dramatically differently, just because the pay rate is higher for one. I can appreciate where you're coming from here, but even then I would make the argument that a progressive tax system here is still better due to diminshing marginal utility, and having access to markets that allows for excess income to compound with no extra hours or work put in. The doctor is still in a much more advantageous place with much less loss of "satisfaction" even at a higher effective tax rate.

However, the money we're talking about even considering a wealth tax on is not even remotely comparable to your examples. This is past anyone needing to work or spend time to generate this wealth. They already have it. The lowest threshold I threw out of $50 million can sit in a savings account or money market fund at today's rates and accrue ~$2 million dollars a year. So no work at all is done and it earns what your car salesman would earn in 20 years.

I think you, like many others, get stuck in a place where you don't even really appreciate how much money that level of wealth is or how it's completely decoupled from "work" or "effort". Even the high end of your example (which is a profession that has potentially the most expensive up front costs in the world, requires arguable the most schooling, is indispensible, in demand, and provides potentially the most objective sociatal benefit of any job) would make half (and most doctors make much less then $1m a year) of what the lowest threshold of wealth I put out there earns if for some reason all their wealth was just in a money market account (spoiler it would likely be earning much more). With zero effort expended on the part of the individual who is wealthy. That doesn't seem particularly "fair". I clarified this at the beginning, but again I'm also only saying tax them based on the wealth above that $50m mark.

As that other poster said, it doesn't even really mean anything at that point. It's numbers on a screen. Whether they have $50,000,000 or $1,000,000,000 they don't have to ever do anything again and they'll make more then 99% of the country every year. We're not doing these individuals some great injustice by levying a 3% tax. It's silly.

This post was edited on 5/11/25 at 4:28 pm

Posted on 5/11/25 at 12:01 pm to TigerTalker142

quote:

Exactly this. It’s obscene how much money this is. As of Q1 of 2024 1% of the country held 30% of the wealth and the bottom 50% held less then 2%….if you want to generate meaningful revenue in this country with the least impact to the individual you need to go after the ultra wealthy. And you need to base it off wealth not income.

An annual 3% tax based on the value of total assets owned over say 50 million. Would not affect the quality of life of those individuals at all, and something like real estate or equities would almost certainly appreciate greater then that 3% in a given year. Or increase long term capital gains tax for people with say 50 million in assets to be taxed at ordinary income levels or to be some much higher number the more wealth you have.

If you have over $50 million in assets and you take a loan against assets you have to recognize any gains in those assets at that point up to the amount of the loan.

Plenty of ways to collect and those folks wouldn’t have to change how they live their lives at all. Not sure why we’re hellbent on making people who already have very little give up their healthcare to make up for a deficit, rather then go after revenue from people whose lives won’t be impacted at all.

This is one of the dumbest things I’ve read on here.

Putting aside the fact that numerous nations have tried wealth taxes and they failed, your 3% wealth tax plan would be a great way to crash the stock market.

Posted on 5/11/25 at 12:06 pm to Breesus

quote:

It’s not punishment. It’s paying your fair share.

What is your fair share of what someone else has earned?

Posted on 5/11/25 at 12:07 pm to HailHailtoMichigan!

quote:

This is one of the dumbest things I’ve read on here. Putting aside the fact that numerous nations have tried wealth taxes and they failed, your 3% wealth tax plan would be a great way to crash the stock market.

Oh really? During the boom of the US economy after WWII until 1970ish, what were the top marginal rates, Mr. Dumbest?

Posted on 5/11/25 at 12:27 pm to fallguy_1978

Friendly reminder that america has the most progressive income tax system in the western world

Marx folks like mmmbeeer never mention that

Probably because their union parents never mentioned it

Marx folks like mmmbeeer never mention that

Probably because their union parents never mentioned it

Posted on 5/11/25 at 12:27 pm to mmmmmbeeer

quote:

Billionaires should be paying an ungodly tax on every dollar they make over $1B/year.

I’d be surprised if there are more than 5-10 people in this country who actually have $1B in taxable income in any given year.

Posted on 5/11/25 at 12:40 pm to HailHailtoMichigan!

Oh I agree that there would absolutely be a shock as the market digests decreased market growth expectations to account for future outflows as the only way to satisfy the tax liability for many would likely be annual divesture of assets in the market. Eventually expectations would normalize though and those tax revenues would cycle back into the economy and likely a large portion of it would find its way back into the market, just less concentrated in a handful of individuals. That being said I appreciate this would absolutely have to be done on a fairly global scale, or at least in concert with the rest of the developed world, to prevent major capital flight. So is more of a pipe dream.

That's why I threw out mutliple options in that same post to generate revenues from the ultra wealthy cohort. I'm sure there are other ideas that are floating out there from folks much smarter then me that are even more viable as well. Just practically/philsophically/etc., it feels like fiscal policy should be focusing on this cohort to reduce our deficit.

That's why I threw out mutliple options in that same post to generate revenues from the ultra wealthy cohort. I'm sure there are other ideas that are floating out there from folks much smarter then me that are even more viable as well. Just practically/philsophically/etc., it feels like fiscal policy should be focusing on this cohort to reduce our deficit.

This post was edited on 5/11/25 at 12:58 pm

Posted on 5/11/25 at 1:21 pm to HailHailtoMichigan!

quote:

Friendly reminder that america has the most progressive income tax system in the western world

Keep moving that goal post.

Posted on 5/11/25 at 1:31 pm to slackster

quote:

I’d be surprised if there are more than 5-10 people in this country who actually have $1B in taxable income in any given year.

That’s what these people just don’t understand, that European policy makers do.

There just isn’t remotely enough new revenue from “the rich” to address existing shortfalls let alone funding new goodies. Even seizing all $4.5 trillion in wealth owned by America’s billionaires—every home, car, investment, and business—could finance the federal government one time for just nine months.

It’s why Europe has the VAT

This post was edited on 5/11/25 at 1:34 pm

Posted on 5/11/25 at 1:36 pm to HailHailtoMichigan!

quote:

Friendly reminder that america has the most progressive income tax system in the western world

The rich already pay high tax rates. In some states it's over 50% when considering state and local, and making them higher won't fix any of our problems.

Capital gains is a form of double taxation already. Someone else being a billionaire isn't taking money out of your pockets

Posted on 5/11/25 at 1:42 pm to fallguy_1978

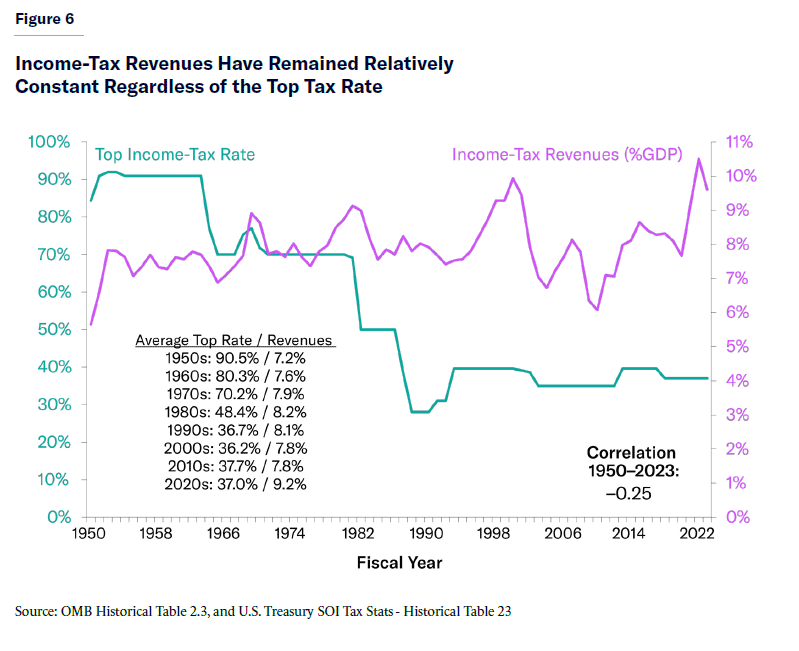

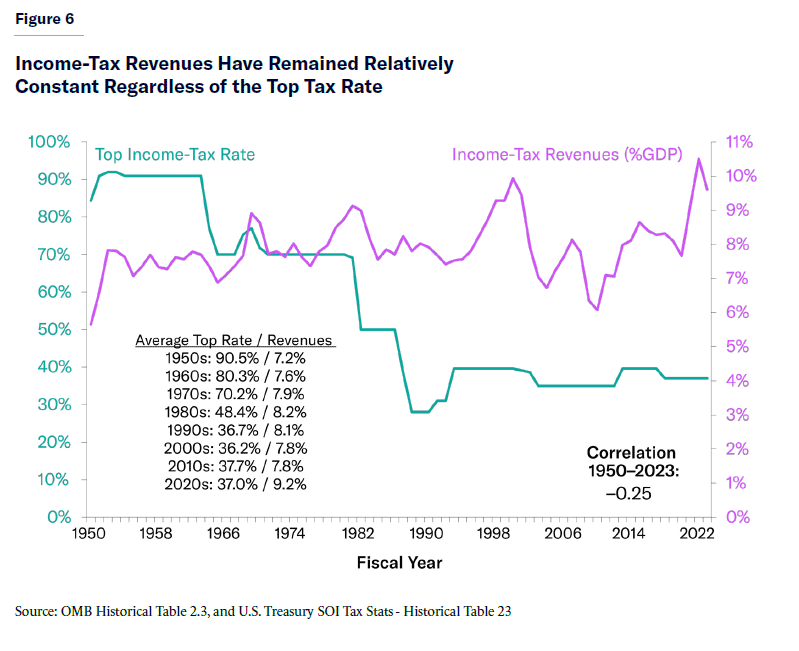

Also, another inconvenient fact that mmmmbbbeeer ignores:

Tax revenue from the rich as a % of gdp is the same as it was in the 1950s

Tax revenue from the rich as a % of gdp is the same as it was in the 1950s

Posted on 5/11/25 at 2:17 pm to HailHailtoMichigan!

quote:

Tax revenue from the rich as a % of gdp is the same as it was in the 1950s

If anything that just illustrates the point that there’s a major issue haha.

The chart seems to be saying that reducing the top marginal rate drastically has had minimal impact on the revenues generated by that group. In fact revenues seem to be growing. Even flat revenues imply they must be increasingly earning more as a share of GDP than the other cohorts to be able to make up for the shortfall that would otherwise be caused by the decrease in the top marginal rates.

This post was edited on 5/11/25 at 2:19 pm

Posted on 5/11/25 at 2:19 pm to HailHailtoMichigan!

quote:

Tax revenue from the rich as a % of gdp is the same as it was in the 1950s

I dont think that is what the chart is saying. That is income-tax revenue for all taxes, not just the top income rate.

Which if the top tax rate has been falling, shows that the richest tax payers are getting richer at a disproportionate rate compared to those below. Which is not surprising at all.

And generally will be enjoying much lower tax rates compared to previous generation.

Of course this is how this sort of thing compounds over the years

This post was edited on 5/11/25 at 2:21 pm

Posted on 5/11/25 at 2:23 pm to mmmmmbeeer

quote:Ooooh boy.

what were the top marginal rates, Mr. Dumbest?

If you were an investor, oil company owner, cattle rancher, able to depreciate major assets, bond holder, etc. top margins were often lower than they are today. You didn't know that. Now you do.

Posted on 5/11/25 at 2:33 pm to TigerTalker142

quote:

The chart seems to be saying that reducing the top marginal rate drastically has had minimal impact on the revenues generated by that group. In fact revenues seem to be growing.

Yes, it is called the laffer curve.

At sufficiently high marginal tax rates, there is such a high incentive to avoid reporting income, cut back on working/investing, etc that you end up losing revenue due to economic damage.

But back to your point about income inequality, even adjusting for increased

Inequality since the 1970s shows a clear picture of what has happened to the tax system.

quote:

For the top-earning 1%, Figure 3 shows that the progressivity ratio has increased since 1980 from 1.81 to 2.26 (meaning that its share of the federal income taxes paid has risen to 226% of its share of the income earned). The progressivity ratio of the highest-earning 20% of taxpayers has risen from 1.33 to 1.54. The ratio has fallen for every other income quintile, including the second highest income quintile (from 0.88 to 0.66), the middle (from 0.68 to 0.28), fourth (0.43 to –0.22), and bottom (0.00 to –1.45)

This post was edited on 5/11/25 at 2:35 pm

Posted on 5/11/25 at 2:38 pm to fallguy_1978

quote:

Capital gains is a form of double taxation already. Someone else being a billionaire isn't taking money out of your pockets

The current admin is pushing consumption taxes in the form of tariffs and cuts to other services typically utilized by non-billionaires to help(in part) offset the costs of continuing a tax policy that disproportionally benefits the ultra wealthy. Based on the tweet in the OP, it also seems they’ve acknowledged they don’t seem to have much of an interest of instead offseting some of these costs by either allowing the policy to sunset for higher income individuals or potentially generate revenues from those folks in other ways.

So for a lot of folks on some level it probably does appear as though money is being taken out of their pockets to pay for a billionaire.

This post was edited on 5/11/25 at 2:50 pm

Posted on 5/11/25 at 3:20 pm to TigerTalker142

The bulk of new tax cuts trump wants (no tax on tips or ss) primarily benefits the lower incomes

The rest of the tax bill is just extending current rates

Also, your claim that the TCJA disproportionally benefitted the wealthy is false. It’s a misuse of statistics. The fact is, America’s income tax system is so progressive, that you could cut taxes by 5% for the rich and 15% for the middle class and the rich would still disproportionately get a larger tax cut.

The TCJA actually made America’s income tax system *more* progressive than the previous system, when you measure the share of income tax revenue paid by higher cohorts.

The rest of the tax bill is just extending current rates

Also, your claim that the TCJA disproportionally benefitted the wealthy is false. It’s a misuse of statistics. The fact is, America’s income tax system is so progressive, that you could cut taxes by 5% for the rich and 15% for the middle class and the rich would still disproportionately get a larger tax cut.

The TCJA actually made America’s income tax system *more* progressive than the previous system, when you measure the share of income tax revenue paid by higher cohorts.

quote:

The tax cuts as a percentage of taxes paid in 2017 were largest for the lowest-income Americans and smallest for the top 1%, meaning high-income Americans now pay a larger share of income taxes than they did before the tax cuts.

This post was edited on 5/11/25 at 3:29 pm

Posted on 5/11/25 at 3:31 pm to HailHailtoMichigan!

quote:

Yes, it is called the laffer curve.

You can speculate there’s some laffer curve adjacent element at play to some extent at the absolute highest rates of the past 70 years, and there’s likely some merit to that, but generally it seems most economists are fairly critical of the laffer curve, or at the very least are incredibly skeptical that we’re on the wrong side of the curve at our current tax rates or even particularly close.

I’ve never suggested the wealthiest aren’t responsible for a large portion of tax revenues, in fact given the wealth and income disparity mathematically they have to be.

As the wage gap increases and earnings as a % of GDP increases for that cohort their progressivity ratio in the chart you posted would have to go up. The additional income they earn as the wage gap increases is more likely to be taxed at the highest marginal rate resulting in increases to this ratio.

You just keep posting charts that seem to show that income disparity is increasing.

This post was edited on 5/11/25 at 3:32 pm

Posted on 5/11/25 at 4:17 pm to HailHailtoMichigan!

quote:

The bulk of new tax cuts trump wants (no tax on tips or ss) primarily benefits the lower incomes

The rest of the tax bill is just extending current rates

Not allowing the TCJA to sunset or at least the cuts to the highest income quartiles is exactly what I'm referring to. The study done below gives you a lot of insight into the costs of extending those cuts to the budget deficit and who gets the most benefit from the cuts. It also discussses other scenaries then full extension of the cuts.

Analysis from the Department of the Treasury and who stands to benefits

Spoiler the biggest beneficiery are the highest income earners:

quote:

Scenario A: Full Extension of the TCJA

Extending the expiring individual and estate tax provisions of the TCJA would cost $4.2 trillion between 2026 and 2035 (Table 1). Evaluated as if the extension occurred in 2025, this scenario would cut taxes by an average of 2.2 percent of after-tax income for all families (Table 2).1

However, the largest tax cuts would go to the highest-income families. The tax cut as a percent of after-tax income would be smaller than the average in every decile except the highest. Families between the 95th and 99th percentiles would receive a tax cut of 3.0 percent of after-tax income,

families in the top 1 percent but not the top 0.1 percent would receive a tax cut of 3.6 percent of after-tax income, and families in the top 0.1 percent would receive a tax cut of 4.2 percent of after-tax income.

quote:

Also, your claim that the TCJA disproportionally benefitted the wealthy is false. It’s a misuse of statistics.

Take it up with the Department of the Treasury.

Back to top

1

1