- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Second Worst S&P drop day in 10 years

Posted on 4/5/25 at 11:20 am to JohnnyKilroy

Posted on 4/5/25 at 11:20 am to JohnnyKilroy

I’ve just heard people say it. Not money smart, I assume. Someone here told me to let it ride so I will.

Posted on 4/5/25 at 11:28 am to Dixie2023

quote:

Dixie2023

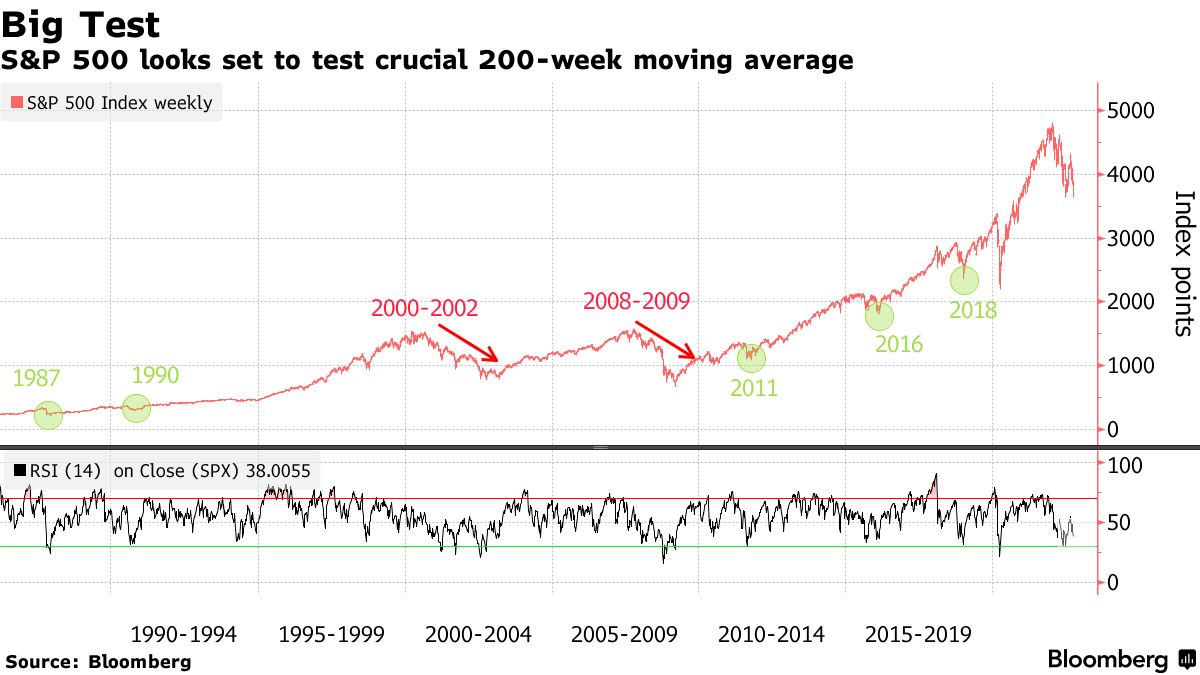

If it helps make you feel better, you can see how well the s&p has recovered since 2008

The only way you don’t recover, is getting out when things dip and trying to get back in again when they are high. Buy low, sell high. Assuming your target date fund is the right date for when you plan to retire (4 years I think you said), your investment risks should be quite conservative and all this is white noise for you.

This post was edited on 4/5/25 at 11:29 am

Posted on 4/5/25 at 11:37 am to GoCrazyAuburn

I was more stock heavy than bond. I checked recently and seem to be in 1/2 bonds now and large cap funds vs a lot of small cap. I was willing to take the risk to grow. I don’t have to retire early, but want to, working part time if necessary. Thank you.

Posted on 4/5/25 at 11:40 am to Dixie2023

50% bond is very conservative.

Also, I didn’t mean to make it seem like you shouldn’t call your broker, that was more of a joke around the knee jerk reaction. If it will make you comfortable, please call him. He will most likely tell you the same thing.

My aim was more to just get you off the ledge. The number of shares you own has not changed and your cost basis has not changed. It’s not fun looking at paper valuations when they go down, but ultimately you’re fine.

Also, I didn’t mean to make it seem like you shouldn’t call your broker, that was more of a joke around the knee jerk reaction. If it will make you comfortable, please call him. He will most likely tell you the same thing.

My aim was more to just get you off the ledge. The number of shares you own has not changed and your cost basis has not changed. It’s not fun looking at paper valuations when they go down, but ultimately you’re fine.

This post was edited on 4/5/25 at 11:44 am

Posted on 4/9/25 at 2:22 pm to fareplay

weird have you haven't started a thread about this historic 1 day rise

makes you wonder....

makes you wonder....

Posted on 4/9/25 at 2:24 pm to DawgCountry

I was burned yday on a -6% swing. Going from -6% to +8% in 2 days doesn’t really do it for me

Posted on 4/9/25 at 4:42 pm to fareplay

Or you are a bitch and the market was always going to go up.

It was 19 at the end of 2016, it's at 40 right now.

It was 19 at the end of 2016, it's at 40 right now.

Posted on 4/10/25 at 11:11 am to GoCrazyAuburn

quote:

It’s not fun looking at paper valuations when they go down, but ultimately you’re fine.

Yeah it's not fun looking at paper valuations when the "portfolio value" goes down.

Thank you for the " keep my chin up" outlook.

Popular

Back to top

1

1