- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Pulse chain

Posted on 5/18/23 at 3:59 pm to boomtown143

Posted on 5/18/23 at 3:59 pm to boomtown143

what was the pulsex buy-in price?

Posted on 5/18/23 at 4:25 pm to donRANDOMnumbers

Depending on sac bonus, $1,000 got you between 10MM-20MM coins

Posted on 5/18/23 at 4:45 pm to TigerTatorTots

quote:The chain is running awesome! PulseX is like butter.

Any of yall bridging funds yet or waiting until the kinks are worked out?

I bridged and received my funds. Already deployed.

Added a few more validators to my other ones.

Posted on 5/18/23 at 9:19 pm to FnTigers

PulseX burn

Over 18 billion PLSX burned already. Tomorrow will be one week since Pulsechain and PulseX launched.

Over 18 billion PLSX burned already. Tomorrow will be one week since Pulsechain and PulseX launched.

This post was edited on 5/18/23 at 9:21 pm

Posted on 5/19/23 at 9:15 am to FnTigers

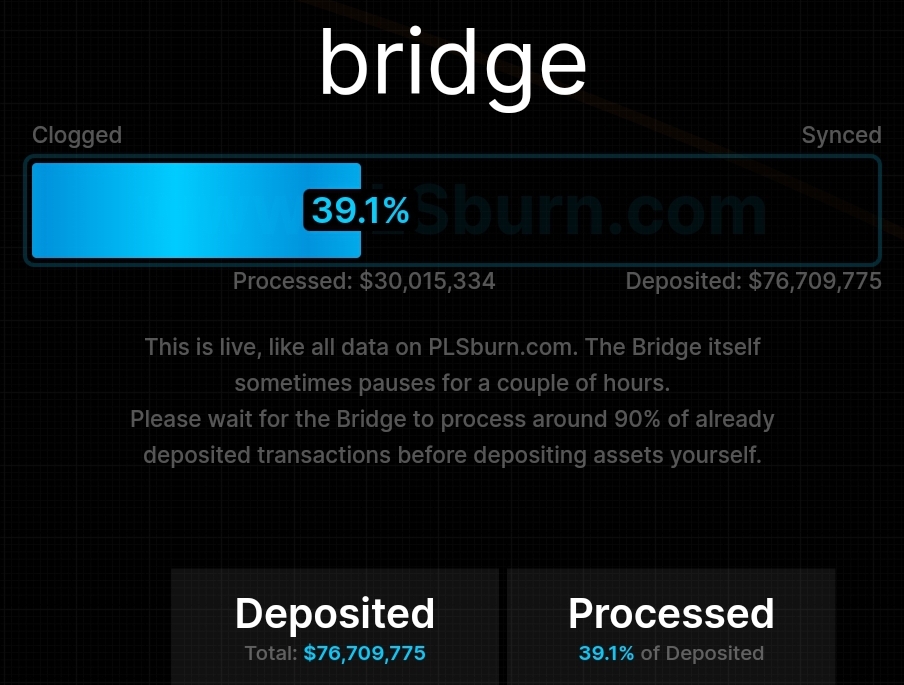

My bridge transaction is just waiting.

This post was edited on 5/19/23 at 9:16 am

Posted on 5/19/23 at 9:59 am to FnTigers

I’m trying to understand this better and read this article today. The writer isn’t as bullish on pulse chain. Can anyone give me their thoughts on this article?

Seeking Alpha article

Seeking Alpha article

Posted on 5/19/23 at 11:07 am to WDE24

I can't read the article but in less than a week:

- PulseChain is the 4th most active chain on the planet

- $1.44m USD has already bought PulseX off the open market and burned it forever. That is a built in buy and burn when using the PulseX dex.

- 200,000 Hexicans invested and locked up for 15 years have moved over to PulseChain

- The transactions are cheap as dirt

- The transactions are smoothe as butter

- And most importantly, there are no diminished returns like chains on their 3rd cycle or more.

- PulseChain is the 4th most active chain on the planet

- $1.44m USD has already bought PulseX off the open market and burned it forever. That is a built in buy and burn when using the PulseX dex.

- 200,000 Hexicans invested and locked up for 15 years have moved over to PulseChain

- The transactions are cheap as dirt

- The transactions are smoothe as butter

- And most importantly, there are no diminished returns like chains on their 3rd cycle or more.

This post was edited on 5/19/23 at 11:10 am

Posted on 5/19/23 at 11:09 am to JayDeerTay84

quote:Looking at 50 hours or so. It's processing fast, but the sheer volume coming in is insane.

My bridge transaction is just waiting

82.5 Million so far.

Posted on 5/19/23 at 11:10 am to tenderfoot tigah

I can get to it from a Google search with no sign in, but clicking the thread link requires sign in. Weird.

It is the first article from this search.

LINK

It is the first article from this search.

LINK

Posted on 5/19/23 at 2:03 pm to FnTigers

quote:

Looking at 50 hours or so. It's processing fast, but the sheer volume coming in is insane.

82.5 Million so far.

Yea I got some PLS so will be ready to go. Will start transferring over on a schedule so long as the yields stay consistent and issue free.

Posted on 5/19/23 at 2:21 pm to JayDeerTay84

quote:

Yea I got some PLS so will be ready to go. Will start transferring over on a schedule so long as the yields stay consistent and issue free.

87m now!

Posted on 5/19/23 at 5:53 pm to JayDeerTay84

quote:

My bridge transaction is just waiting.

My brother is coming up on 72 hours of being stuck in the bridge.

Posted on 5/19/23 at 7:01 pm to WDE24

Some snips from the seeking alpha link referenced above, since it's behind a paywall for some...

Probably just FUD right?

quote:

Where PulseChain seemingly stands out is that it will copy the entire state of the Ethereum network and transfer that over to its own sovereign and better-optimized blockchain. This is functionally a hard fork of Ethereum. All smart contracts, addresses, private keys to addresses, and assets linked to those addresses on Ethereum will be copied over to PulseChain with the exact same access conditions. Ethereum users who had assets prior to the initiation of PulseChain would have copied assets on PulseChain. After the full Ethereum state is copied over, PulseChain will function independently from Ethereum based on the actions of its users. PulseChain's Twitter and other marketing materials tout that this is the "largest airdrop" ever. An airdrop is a promotional event used by many crypto protocols in which tokens are given to users, or "airdropped." This creates buzz on social media and garners more interest in the project.

quote:

In reality, copying the state means very little. Value on Ethereum derives mostly from a link to something off-chain, in the form of an IOU. For example, a number of fungible (ie. ERC-20) tokens are stablecoins. The two biggest are Tether (USDT-USD) and US Dollar Coin (USDC-USD). Both are tokens which can interact with smart contracts and be sent between Ethereum addresses. Both tokens are supposed to be backed 1:1 with dollars held in a reserve. Procuring 1 USDC token to the issuer of USDC entitles one to receive $1 from the issuer. The USDC token is then removed from the supply of USDC to reflect the removal of that $1 from the reserve. Another major ERC-20 token is Wrapped Bitcoin, or wBTC. wBTC is issued by BitGo, a company which holds real BTC and ensures that wBTC can be used to claim real BTC on the Bitcoin blockchain. wBTC, like USDC and USDT, is functionally an on-chain IOU compatible for on-chain trading on Ethereum.

But it goes even deeper. Most of the utility on Ethereum is based on moving these on-chain IOUs around. For example, the largest decentralized exchange, Uniswap (UNI-USD) is a protocol for trading tokens. Some of the most liquid markets on Uniswap include wBTC, USDC, USDT. Other protocols and decentralized applications tell the same story. If any of these three issuers decided to not honor their commitments, the on-chain activity on Ethereum would most likely suffer a dramatic decrease as users stop moving around their now-worthless IOUs.

So the problem with PulseChain copying Ethereum's state is simple: copying an "I owe you" does not copy the actual thing owed. Ethereum's state has value because there are a lot of IOUs on it. In order for the PulseChain copies to have value, and for PulseChain itself to benefit from this value, the IOUs issuers must default on their commitments to Ethereum-based IOUs and honor the PulseChain copies as the "true" IOUs.

The additional value of PulseChain that comes from copying Ethereum's state scales with the probability this will happen. Personally, I think the probability is extremely close to 0. And if it doesn't happen, then PulseChain's value will rest solely on its potential as an altchain to address the scalability issue.

Why An IOU Default Probably Won't Happen

Let's go over why it is very unlikely that any of the issuers will switch over to honoring the PulseChain copies and default on their ERC-20 commitments. First, there is a large downside in the form of legal and reputational issues. Stablecoin regulations and general scrutiny are getting tougher all over the world. A decision to suddenly default on obligations will be a horrible public relations move on the part of any IOU issuer. It would attract much more negative attention and turn many stablecoin supporters and users against the issuers. Because the on-chain economies are an integral component of the business model, issuers will not risk something like this.

Second, there is very little upside. Switching over to PulseChain does not have a feasible positive impact on the bottom line of issuers. Even if all Ethereum users just picked up and switched to PulseChain, it doesn't mean more stablecoins will get issued. It is the same amount of users, using the same amount of assets. One could argue that if PulseChain was a much more efficient chain it could prompt capital inflows into the ecosystem. This might lead to more IOUs being issued. But the flip side of this is that a more efficient chain decreases the need for a higher money supply because the velocity of money can be much faster. This would decrease the amount of IOUs and hurt the bottom line of issuers.

So the benefit of switching is pretty unclear while the downsides are large. Why would the issuers switch to PulseChain?

PulseChain Doesn't Offer A Whole Lot As An Altchain Either

It is obvious that copying Ethereum's state most likely does nothing for PulseChain. But what about PulseChain's tech stack as a scalability solution? If it is much better, then perhaps that alone can be bullish for PulseChain.

Unfortunately, PulseChain doesn't have a lot to offer in this area either. A cursory glance at its website indicate that all it really offers is higher speeds, proof-of-stake (which Ethereum already is, although when PulseChain was first conceived Ethereum was proof-of-work), and lower fees. There are some mention about burning fees, which implies a deflationary token model. Burning fees or tokens is basically a share buyback. People contribute to the protocol's top line by purchasing the tokens to pay fees and this money is immediately distributed to the shareholder (in this case, tokenholder) by removing the tokens from the supply. Burning and deflation are not new in altchains. Ethereum does a similar thing too.

What is more concerning is that PulseChain does not seem to have a white or lite paper. Such documents are pretty standard in crypto. After all, Bitcoin started off with a white paper and all the major projects have something similar which outlines purpose, technology, implementation, roadmap, or mathematical concepts. PulseChain's lack of a white paper is a bit of a red flag.

PulseChain is probably meaningless in the long run. Lots of other altchains are special in their own ways, and they probably will not go anywhere either. This case study is a useful reminder for where crypto's value originates, and this is a question people have been trying to answer for a while.

No matter how special PulseChain's tech stack is (and it doesn't even seem impressive regardless), it will have to compete for the liquidity scattered across the major smart contract blockchains. At this point, the network effects of the incumbents are probably too large to overcome for a new chain, especially one without significant scalability improvements.

Probably just FUD right?

This post was edited on 5/19/23 at 7:03 pm

Posted on 5/19/23 at 8:09 pm to Grievous Angel

Who the frick wrote that? Do they even know what a bridge is?

Look, I was never a fan of RH or the sacrifice, but this is mostly bullshite and the author is focusing on the wrong things.

The bridge is where the value creation is happening "now". The sacrifice was the initial batch.

I dont know, maybe you are also unfamiliar with how bridges work in this space and what wrapped tokens are and how value moves across chains.

I am sorry you have a subscription to read that non-sense, but there is free "alpha" out there.

We could ding into all the other errors of that piece but its probably not worth the time.

Look, I was never a fan of RH or the sacrifice, but this is mostly bullshite and the author is focusing on the wrong things.

The bridge is where the value creation is happening "now". The sacrifice was the initial batch.

I dont know, maybe you are also unfamiliar with how bridges work in this space and what wrapped tokens are and how value moves across chains.

I am sorry you have a subscription to read that non-sense, but there is free "alpha" out there.

We could ding into all the other errors of that piece but its probably not worth the time.

This post was edited on 5/19/23 at 8:31 pm

Posted on 5/19/23 at 9:00 pm to Grievous Angel

quote:Fricken hilarious. Sleep on this. All those copies have liquidity.

Probably just FUD right?

The AMM fixer bot harvested the liquidity from all the dex's and put liquidity in everything copied, even the worst of the worst coins.

Hell, doge copy already did a 2500x on pulsechain.

You enjoy transacting on Ethereum? I don't

You enjoy transacting on BSC piece of trash? I don't

Pulsechain is a dream to transact on. Faster Ethereum with low fees with all the contract addresses and wallets the same. PulseX is like butter.

Maybe you should go try it out. I'll send you some pulse to transact if you'd like.

Posted on 5/20/23 at 8:30 am to FnTigers

Question - lets say I can now see my PLSx & PLS on Coinbase wallet but want to move this over to my Metamask account (should have sac'd thru there as suggested but I didn't) as it appears that is the correct wallet to transact from how would I go about doing that?

Posted on 5/20/23 at 9:03 am to LSUTIGERS74

#Pulsechain is now the 3rd most used blockchain in the world

This post was edited on 5/20/23 at 9:42 am

Posted on 5/20/23 at 3:30 pm to LSUTIGERS74

quote:Just import your seeds into Metamask wallet.

Question - lets say I can now see my PLSx & PLS on Coinbase wallet but want to move this over to my Metamask account (should have sac'd thru there as suggested but I didn't) as it appears that is the correct wallet to transact from how would I go about doing that?

Popular

Back to top

1

1