- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Nebius - NBIS - AI Infrastructure Company

Posted on 10/24/25 at 11:36 am to IT_Dawg

Posted on 10/24/25 at 11:36 am to IT_Dawg

Don't know if we've discussed this but I just saw this on the Nebius reddit

quote:

1?? Inessa Wu – VP Global Revenue (ex Cloudflare, Twilio, Salesforce)

2?? Faye Farhang-Hutsell – Global VP Product Marketing (ex DigitalOcean, Oracle, Microsoft)

3?? Gary Tierney – VP Sales Europe (ex Salesforce, Google)

4?? Savita Raina – VP Marketing (ex Oracle)

5?? Aleksandr Patrushev – Head of Product (ex AWS)

6?? Joshua Liss – Global Head of Media & Entertainment (ex Google)

Loading Twitter/X Embed...

If tweet fails to load, click here.This post was edited on 10/24/25 at 11:44 am

Posted on 10/24/25 at 11:40 am to IT_Dawg

Yeah that would've been my plan if what I already had wasn't dying from the decay. I felt like the best thing I could do (which I should've done it yesterday or Wednesday for max recoupment) was roll what little value I had into something that could potentially hit it's strike before next Friday with only throwing a minimal amount more capital at it.

Posted on 10/24/25 at 11:41 am to HogPharmer

quote:

Hopefully we can finish strong and I can at least recoup a little bit of my money instead of the original call continuing to die its slow, painful death.

This is why you don't give up on a call and roll it into something else.

I think you'll make money on this call and you got a discount with the money from the roll.

Hell, there are people who believe your original $140 could still end up profitable.

I think a lot of us were thinking that the earnings report would come out this week and really provide a bump. That didn't work out.

Posted on 10/24/25 at 11:43 am to Jax-Tiger

My original call was down 95%

Probably the first one I've really lost my arse on though.

Probably the first one I've really lost my arse on though.

Posted on 10/24/25 at 11:52 am to HogPharmer

quote:

Probably the first one I've really lost my arse on though.

Nobody is perfect. The key is to learn to salvage them. When you hit a dip as low as the one we just hit, then prices are cheaper for the next spike. You should be able to get back to where you were, rather cheaply, I hope.

You don't have to win all of them. Remember, with calls, your maximum loss is set, and always assume you can lose it. However, your maximum gain is always much more than your maximum loss. Win more than you lose, and you're good...

Posted on 10/24/25 at 11:54 am to Jax-Tiger

Thanks for all the feedback!

In the past, I've allowed myself to just let them expire worthless. So I'm really learning the next steps as a novice options player here. I definitely could've bought this 120 strike at a much cheaper premium had I bought it in the last 2 days prior to this morning. But at least (so far) I've salvaged some of what was left on the old one.

In the past, I've allowed myself to just let them expire worthless. So I'm really learning the next steps as a novice options player here. I definitely could've bought this 120 strike at a much cheaper premium had I bought it in the last 2 days prior to this morning. But at least (so far) I've salvaged some of what was left on the old one.

Posted on 10/24/25 at 12:11 pm to HogPharmer

Flipped my 11/14 115s to 10/31 125s and up 30% already let’s keep going

Posted on 10/24/25 at 12:30 pm to HogPharmer

quote:

Thanks for all the feedback!

That's what's so nice about this thread. People like IT and BB88 post and provide a lot of information, but others jump in, to provide information which can help us make better decisions, and have some fun with it, too.

Posted on 10/24/25 at 12:31 pm to Jax-Tiger

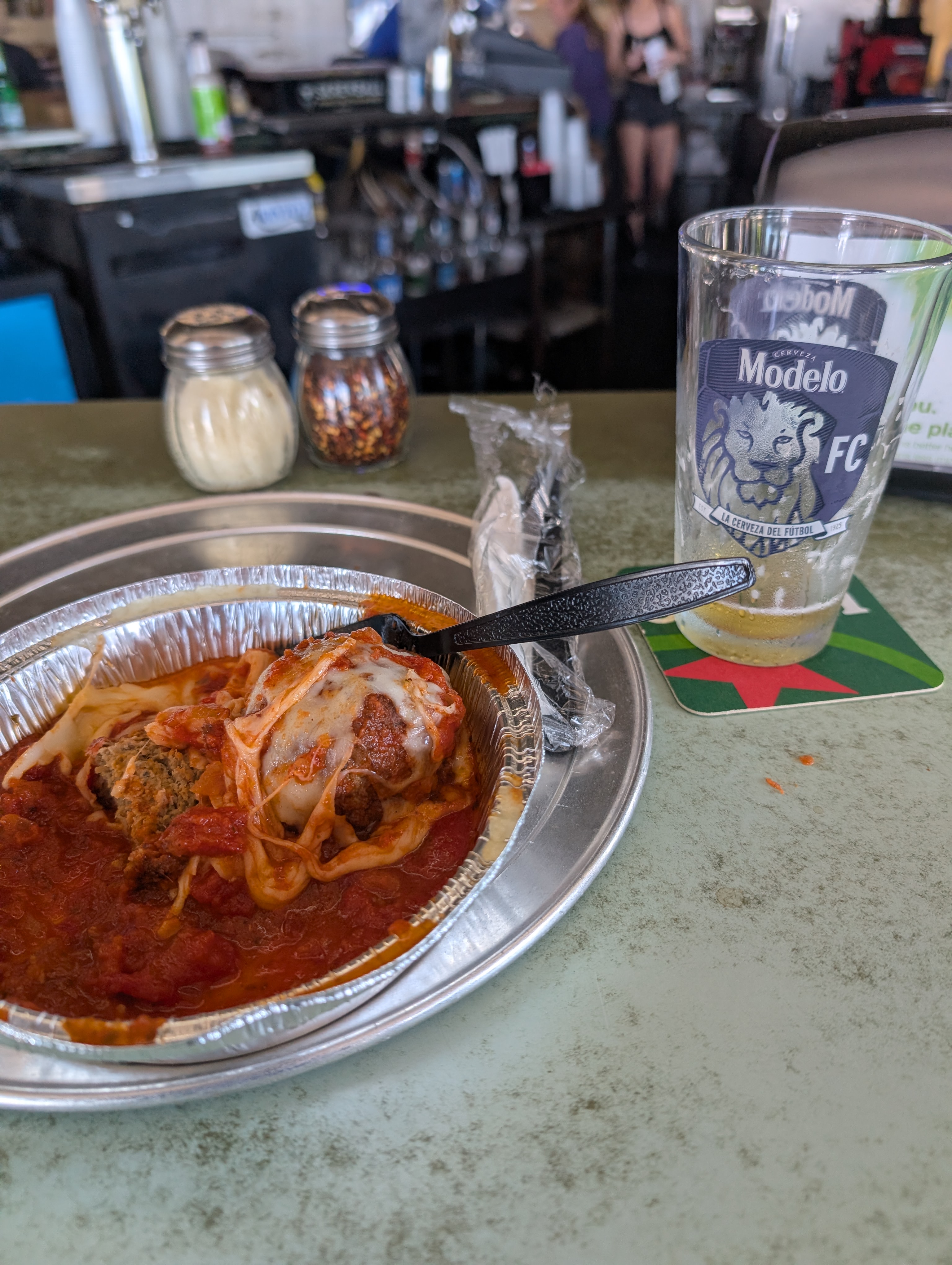

I forgot the real reason I came to post is that I'm at Earl's because this stock has been stuck in the 15's forever. Time to move it on out.

This post was edited on 10/24/25 at 12:32 pm

Posted on 10/24/25 at 12:31 pm to YungBuck

This puppy is either gonna end up right at $115 or north of $117 is my bet

Be at the bar in an hour to watch

Be at the bar in an hour to watch

Posted on 10/24/25 at 12:54 pm to IT_Dawg

Okay. We broke $116. Let's go for $117. C'mon Dawg, help me out, here

Posted on 10/24/25 at 12:55 pm to IT_Dawg

quote:Touched the 50 day and reclaimed the 9 day in 48 hours

This puppy is either gonna end up right at $115 or north of $117 is my bet

Posted on 10/24/25 at 12:55 pm to Jax-Tiger

I can’t watch because I’m the most paperhanded mofo you’ll ever meet

Posted on 10/24/25 at 12:56 pm to JetsetNuggs

quote:Smart people. They know where we're going.

1?? Inessa Wu – VP Global Revenue (ex Cloudflare, Twilio, Salesforce)

2?? Faye Farhang-Hutsell – Global VP Product Marketing (ex DigitalOcean, Oracle, Microsoft)

3?? Gary Tierney – VP Sales Europe (ex Salesforce, Google)

4?? Savita Raina – VP Marketing (ex Oracle)

5?? Aleksandr Patrushev – Head of Product (ex AWS)

6?? Joshua Liss – Global Head of Media & Entertainment (ex Google)

Posted on 10/24/25 at 1:01 pm to Jax-Tiger

quote:

C'mon Dawg, help me out, here

45 mins

Posted on 10/24/25 at 1:10 pm to IT_Dawg

I gotta leave Earls. Meeting at 2:30 EST and there's too much wind and bike noise here.

Posted on 10/24/25 at 1:23 pm to Jax-Tiger

I’m here! LFG $117!!! NBI$$$

Posted on 10/24/25 at 1:49 pm to IT_Dawg

I think you have to post a picture for a bump...

Posted on 10/24/25 at 1:52 pm to Jax-Tiger

Hold on NBIS I’m cracking a beer in 10 minutes

Popular

Back to top

1

1