- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Maybe Tesla is a car company after all

Posted on 10/18/23 at 7:08 pm

Posted on 10/18/23 at 7:08 pm

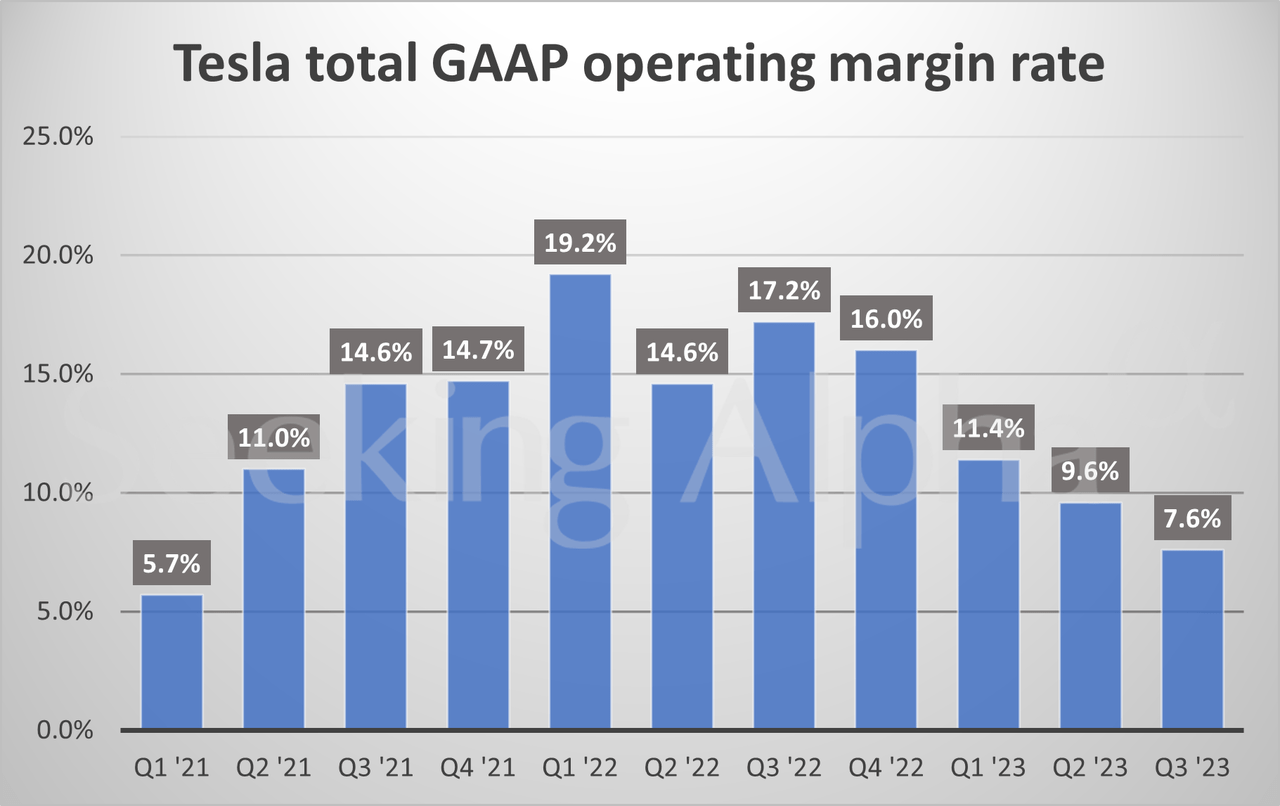

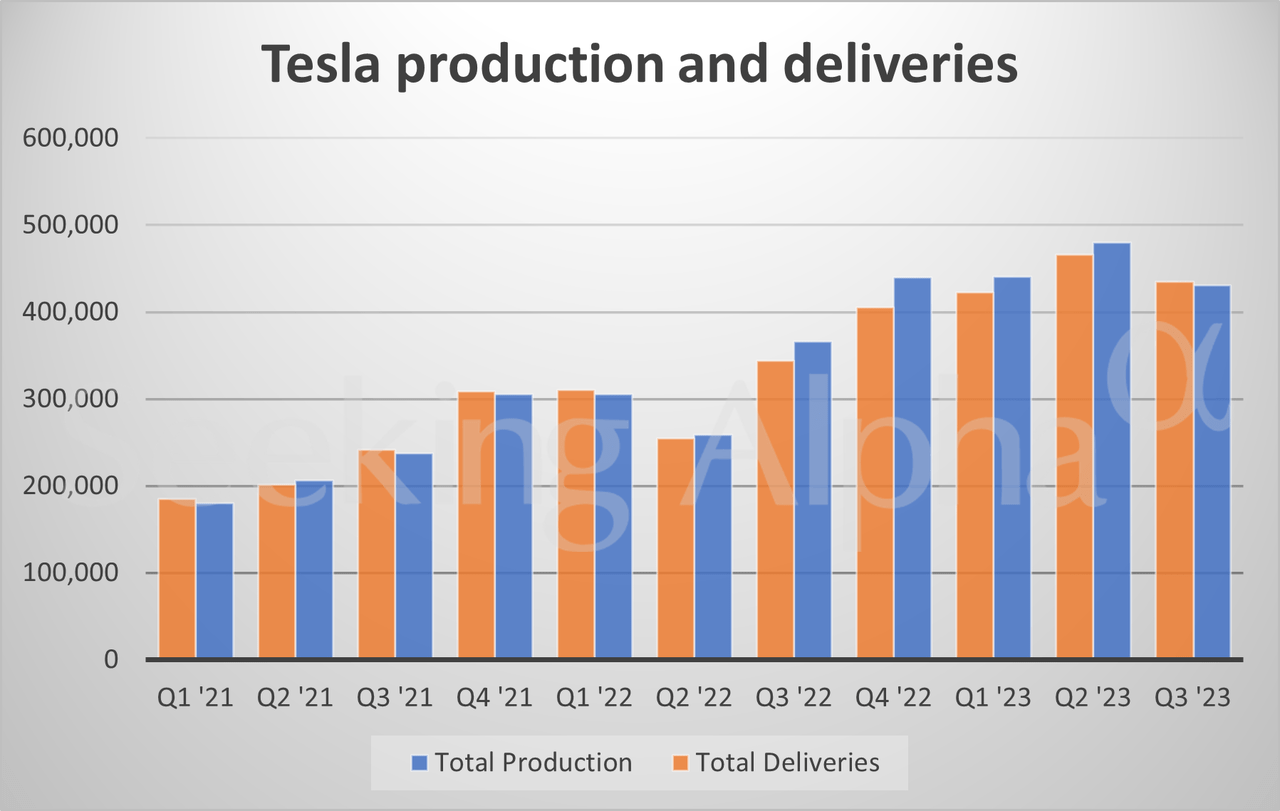

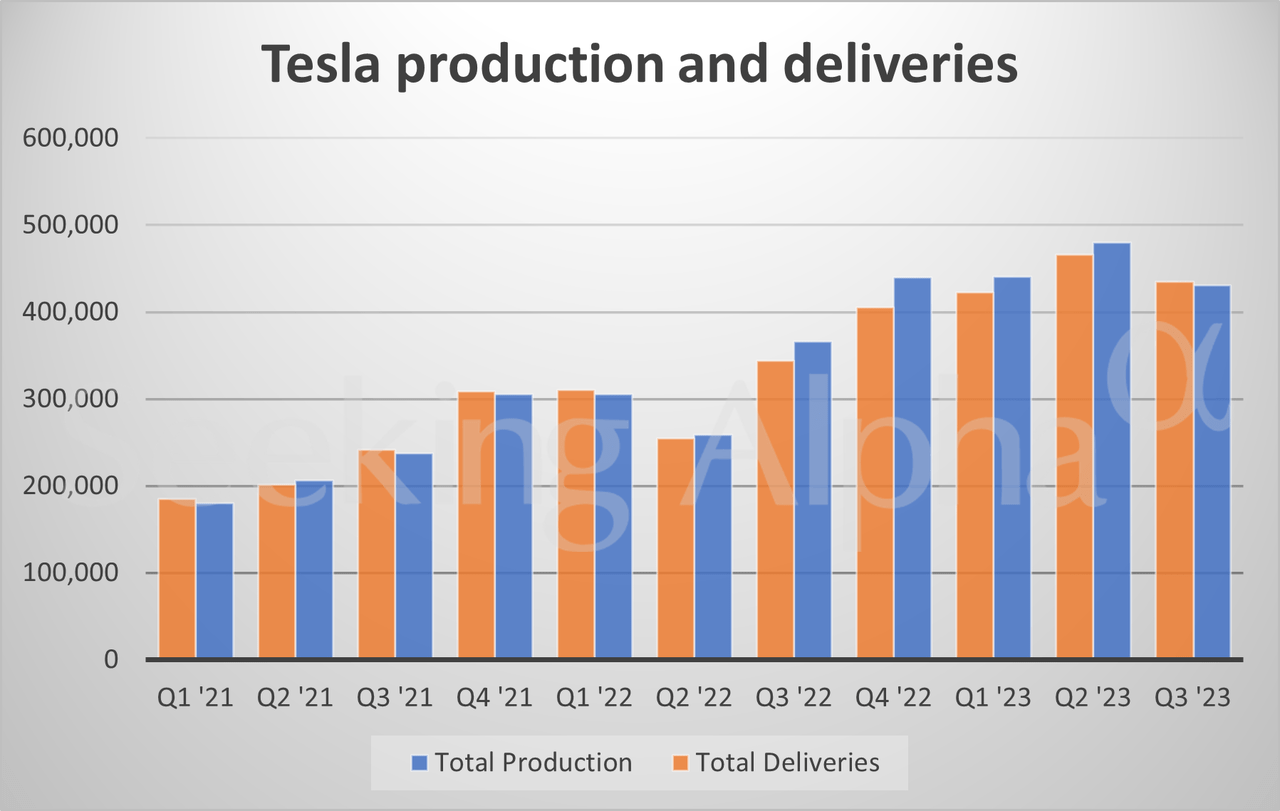

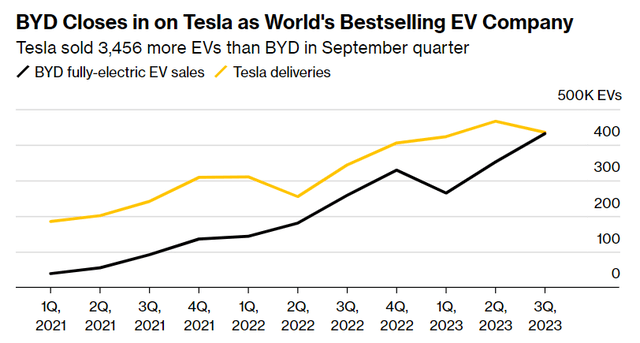

Production and deliveries dropped but not as much as operating margin and EPS is down 44% yoy. Operating margin is now inline with other car companies.

As an investment, the valuations seem way too high with a forward p/e of over 100 if EPS doesn't rebound even with the afterhours price drop and a p/s of more than 8 when industry standard is below 1.

TSLA is always going to demand some multiple premium based on its tech potential but a multiple contraction should be inevitable from here, although I'm not brave enough to buy puts on the company.

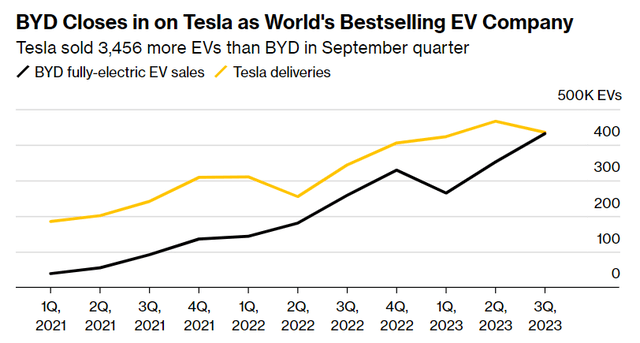

Plus BYD is coming for world domination.

As an investment, the valuations seem way too high with a forward p/e of over 100 if EPS doesn't rebound even with the afterhours price drop and a p/s of more than 8 when industry standard is below 1.

TSLA is always going to demand some multiple premium based on its tech potential but a multiple contraction should be inevitable from here, although I'm not brave enough to buy puts on the company.

Plus BYD is coming for world domination.

Posted on 10/18/23 at 7:52 pm to Diseasefreeforall

I've said all along it's just a car company. Meanwhile you have some "analysts", aka stock pimps, calling it a tech company and just a couple weeks ago pushing this Dojo computer crap. Which people took to heart and bid the price up 10%.

Laughable.

I listened to the earnings call and everything he talked about is something the rest of the auto makers have dealt with for over 100 years. Meanwhile it seems all the guys asking questions have never sat through an earnings call from a "legacy" automaker.

"We dug our own grave with Cybertruck."-Musk during call.

Mexico plant is on hold due to high interest rates and poor economic outlook. I don't recall them saying the EV market will not support another factory at this time, but that is the truth.

I bought a chunk of TSLQ today and my only regret is I didn't buy more. Also have puts but unfortunately I bought a couple months ago and they expire Friday so it will take a really big move for them to profit. (Should have sold last month)

Laughable.

I listened to the earnings call and everything he talked about is something the rest of the auto makers have dealt with for over 100 years. Meanwhile it seems all the guys asking questions have never sat through an earnings call from a "legacy" automaker.

"We dug our own grave with Cybertruck."-Musk during call.

Mexico plant is on hold due to high interest rates and poor economic outlook. I don't recall them saying the EV market will not support another factory at this time, but that is the truth.

I bought a chunk of TSLQ today and my only regret is I didn't buy more. Also have puts but unfortunately I bought a couple months ago and they expire Friday so it will take a really big move for them to profit. (Should have sold last month)

Posted on 10/18/23 at 8:27 pm to BuckyCheese

I can get behind the fact that Tesla really is a technology company while simultaneously believing that’s it’s quite overvalued.

Posted on 10/18/23 at 9:25 pm to slackster

The most obvious difference is Tesla actually has a number of factories and makes most parts in house.

Apple and Nvidia in comparison contract all manufacturing. They design things and little else.

That factory overhead is there in good times and bad and that is why Tesla has, and will have, the same challenges as any other auto manufacturer.

Apple and Nvidia in comparison contract all manufacturing. They design things and little else.

That factory overhead is there in good times and bad and that is why Tesla has, and will have, the same challenges as any other auto manufacturer.

Posted on 10/18/23 at 10:13 pm to BuckyCheese

A p/e in the mid 40's would put the price around $150 and 10 months ago the p/e got as low as 34.

Plus if margins continue at these levels a 45 p/e could eventually cut the current share price by more than half from here and I wouldn't be shocked if in the not too distant future it threatened the $101.52 week low.

I wouldn't be surprised if it didn't come close to that though because Tesla is Tesla but the fundamentals have significantly eroded.

I missed the comment about the hole the company dug itself with Cybertruck. That's an absolutely brutal statement to make on a call.

Plus if margins continue at these levels a 45 p/e could eventually cut the current share price by more than half from here and I wouldn't be shocked if in the not too distant future it threatened the $101.52 week low.

I wouldn't be surprised if it didn't come close to that though because Tesla is Tesla but the fundamentals have significantly eroded.

I missed the comment about the hole the company dug itself with Cybertruck. That's an absolutely brutal statement to make on a call.

Posted on 10/18/23 at 10:17 pm to Diseasefreeforall

At this point, the yuppies are bought in and everyone else is waiting to be offered an EV that makes their life easier or cheaper. In some ways it feels like we’re further away from widespread EV adoption than we were 5 years ago.

Posted on 10/18/23 at 10:23 pm to BuckyCheese

quote:I thought the exact same thing. I don’t want to pay a ridiculous multiple for a stock that’s ultimately beholden to a massive supply chain and ungodly investments in physical infrastructure.

I listened to the earnings call and everything he talked about is something the rest of the auto makers have dealt with for over 100 years. Meanwhile it seems all the guys asking questions have never sat through an earnings call from a "legacy" automaker.

Posted on 10/18/23 at 10:26 pm to beaverfever

quote:

At this point, the yuppies are bought in and everyone else is waiting to be offered an EV that makes their life easier or cheaper. In some ways it feels like we’re further away from widespread EV adoption than we were 5 years ago.

I never would have thought I’d own an EV but my company almost doubled my allowance so it made sense for me to get one.

Posted on 10/18/23 at 10:27 pm to Diseasefreeforall

quote:

I missed the comment about the hole the company dug itself with Cybertruck. That's an absolutely brutal statement to make on a call.

I watched the AH price immediately drop a couple bucks.

Saying that, Musk is refreshingly candid even if it isn't great for the stock price.

I don't wish him to fail, but just understand the realities of the business Tesla is in. Right now he's chasing market share which is never good for margins. However, he has factories to keep busy.

At least he doesn't have to deal with the UAW.

btw-Going from memory, but that 7.9% margin is no better than the Big 3 typically do.

This post was edited on 10/18/23 at 10:36 pm

Posted on 10/18/23 at 10:40 pm to Rize

quote:I’d love to own an EV someday. I was an early Tesla fanboy and I absolutely would have thought I’d be planning my first EV purchase by now. I’m just not going to do it until it’s a competitive alternative to my ICE. It doesn’t feel like we’ve come THAT far in the last 8 years.

I never would have thought I’d own an EV but my company almost doubled my allowance so it made sense for me to get one.

Posted on 10/18/23 at 11:45 pm to beaverfever

quote:

I’d love to own an EV someday. I was an early Tesla fanboy and I absolutely would have thought I’d be planning my first EV purchase by now. I’m just not going to do it until it’s a competitive alternative to my ICE. It doesn’t feel like we’ve come THAT far in the last 8 years.

For a commuter that you charge at home in your garage they work great. Anything outside of that is just fricking dumb. Also I have two other ICE vehicles so I would say having one Ice is a must if you plan to drive further than 200 miles in a day.

Tesla recommends charging to 80% for daily driving but they also don’t recommend going below 10%.

This post was edited on 10/18/23 at 11:49 pm

Posted on 10/18/23 at 11:57 pm to beaverfever

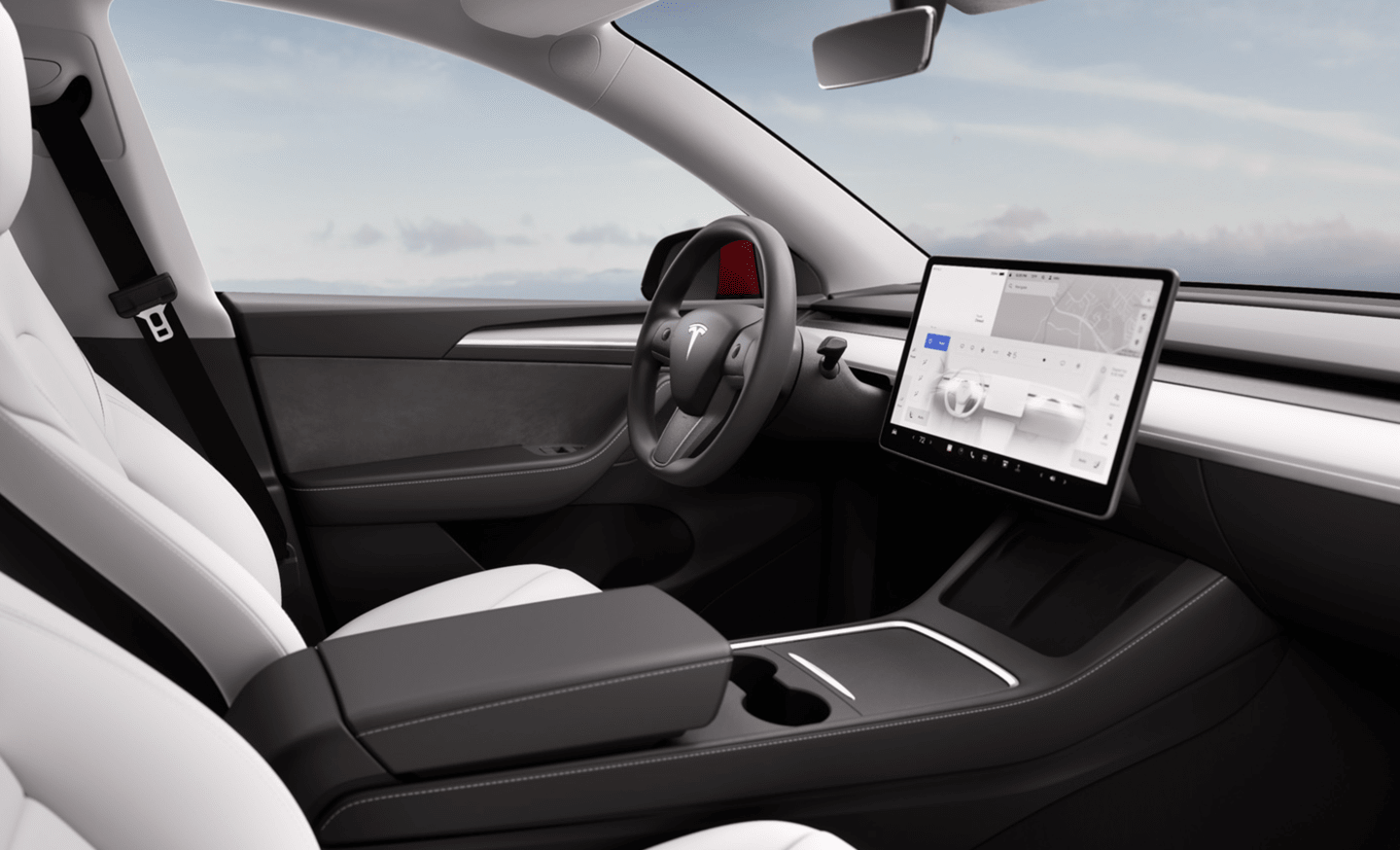

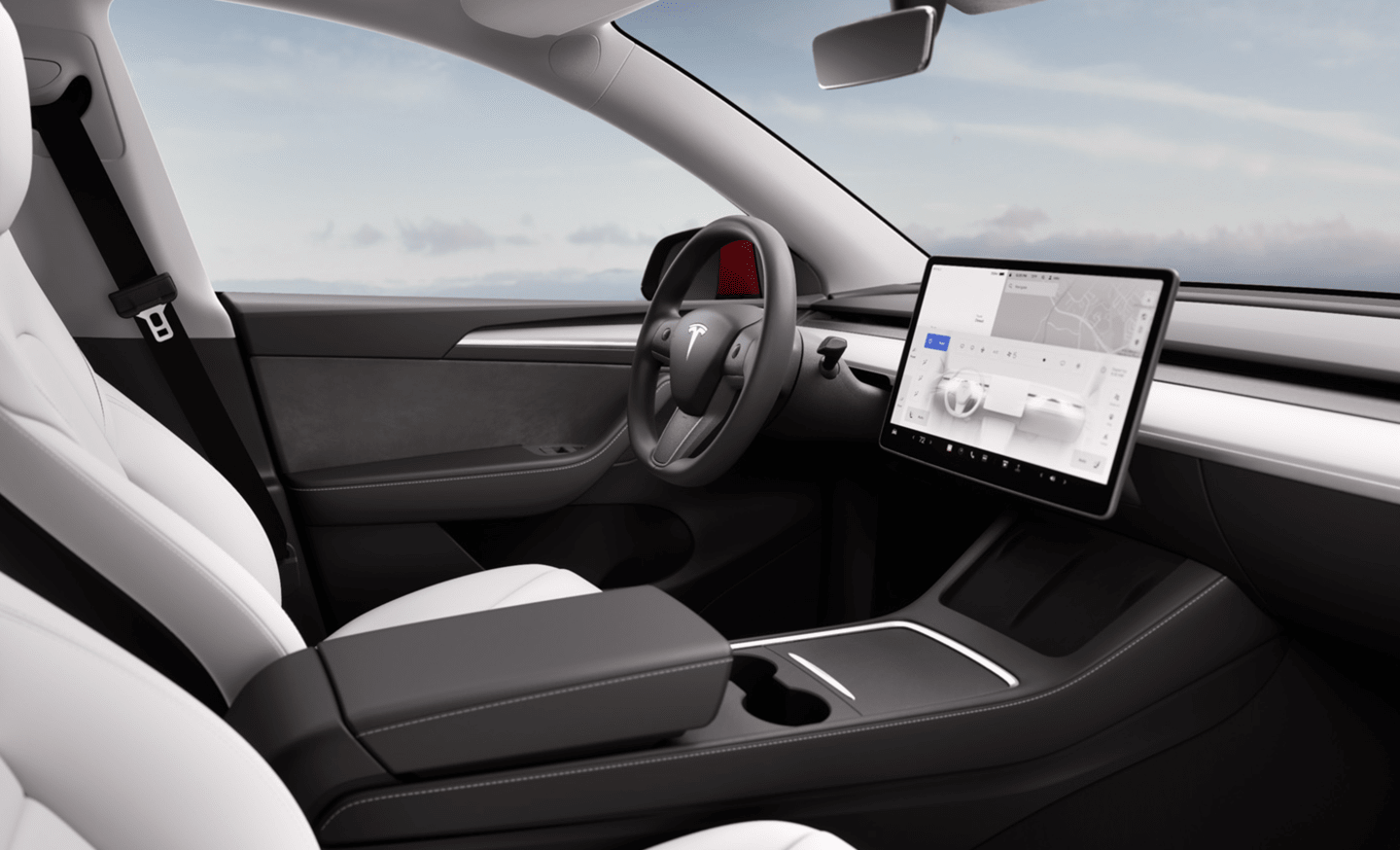

With the competition out there now I do not understand the draw Tesla has. They have very plain interiors and the materials are not top notch.

The Cadillac Lyriq is far superior to the Tesla in my opinion;

Tesla Model Y

The Cadillac Lyriq is far superior to the Tesla in my opinion;

Tesla Model Y

Posted on 10/19/23 at 12:45 am to BuckyCheese

quote:

With the competition out there now I do not understand the draw Tesla has. They have very plain interiors and the materials are not top notch. The Cadillac Lyriq is far superior to the Tesla in my opinion;

I bought mine and most of my vehicle purchases on 0-60 and 1/4 mile times the last 15 years

Posted on 10/19/23 at 7:39 am to Diseasefreeforall

quote:

Plus if margins continue at these levels a 45 p/e could eventually cut the current share price by more than half from here and I wouldn't be shocked if in the not too distant future it threatened the $101.52 week low.

I called TSLA's runup this year a dead cat bounce. I fully expect TSLA to be under $100 in 2025.

Posted on 10/19/23 at 12:17 pm to BuckyCheese

quote:

Apple and Nvidia in comparison contract all manufacturing.

I'm not invested in Nvidia but something I've been wanting to look into more.

In 2019 Nvidia bought Mellanox for their networking knowledge. The engineering for those products AFAIK remains in Israel. Manufacturing for those products in contracted out as you mention. So, long term how does the war impact Nvidia's roadmap and ability to deliver?

Posted on 10/20/23 at 10:37 pm to BuckyCheese

quote:

The Cadillac Lyriq is far superior to the Tesla in my opinion;

It’s also a little more pricey though. The Model 3 and Y were always meant to be entry level EV’s. I think the X and S need some more interior upgrades though for the price you pay.

Posted on 10/21/23 at 9:26 am to jcaz

So wasn’t the whole cybertruck proposition that it would be easier and cheaper to manufacture at large scale?

And now Musk is saying that TSLA has dug its own grave and won’t be able to produce anywhere near the scale anticipated and at a way higher cost than anticipated?

Am I off on that?

And now Musk is saying that TSLA has dug its own grave and won’t be able to produce anywhere near the scale anticipated and at a way higher cost than anticipated?

Am I off on that?

Posted on 10/21/23 at 11:34 am to JohnnyKilroy

Cybertruck, like the Lightning and GM’s new EV truck, are just a weird market.

While the EV sedan and small SUV market are doing ok, who knows how the truck and large SUV EV market will play out. Totally different consumer preference.

While the EV sedan and small SUV market are doing ok, who knows how the truck and large SUV EV market will play out. Totally different consumer preference.

Posted on 10/21/23 at 12:05 pm to BuckyCheese

quote:

With the competition out there now I do not understand the draw Tesla has. They have very plain interiors and the materials are not top notch.

It's a tech company, not a luxury car maker. They focus on the big screen, the tech they pack in it (full self driving) and the fact they are very quick vehicles in general.

That being said Tesla is releasing a new Model 3 stateside soon they already have overseas (highland model). Much improved overall on fit/finish and quality of materials.

Also they are quite a good bargain on the 3/Y especially considering they still qualify for the full tax credit. You can get into a Model 3 for $31.5k after tax credit or a Y for $37.5k, these are significantly cheaper than the competition. Heck, you can get a Model Y performance (top trim) for less than the price of the base single motor Lyriq.

Also another thing to remember is Tesla has the charger game figured out while everything else is a disaster. You will almost always get your rated speed with a Tesla at a supercharger station where anything else on other charging networks is always a huge roll of the dice, which to me only makes Teslas viable for road trips unless you are a VERY patient person and willing to fail a lot of times at charging stations before finding a decent one. This is why NACS (Tesla's charging standard) is winning out among manufacturers now. Manufacturers trusted 3rd parties to flesh out the charging network and they have failed miserably where as Tesla has that done pat.

Keep in mind this is gen1 EVs for al these manufacturers which will have their kinks to get worked out where as Tesla has been working out their kinks for over a decade now introducing improved/refreshed models over time. Almost every 1st gen EV from other manufacturers have been major headaches for people for multiple reasons.

This post was edited on 10/21/23 at 12:07 pm

Posted on 10/21/23 at 11:28 pm to thunderbird1100

quote:

It's a tech company, not a luxury car maker. They focus on the big screen, the tech they pack in it (full self driving) and the fact they are very quick vehicles in general.

That being said Tesla is releasing a new Model 3 stateside soon they already have overseas (highland model). Much improved overall on fit/finish and quality of materials.

Also they are quite a good bargain on the 3/Y especially considering they still qualify for the full tax credit. You can get into a Model 3 for $31.5k after tax credit or a Y for $37.5k, these are significantly cheaper than the competition. Heck, you can get a Model Y performance (top trim) for less than the price of the base single motor Lyriq.

Also another thing to remember is Tesla has the charger game figured out while everything else is a disaster. You will almost always get your rated speed with a Tesla at a supercharger station where anything else on other charging networks is always a huge roll of the dice, which to me only makes Teslas viable for road trips unless you are a VERY patient person and willing to fail a lot of times at charging stations before finding a decent one. This is why NACS (Tesla's charging standard) is winning out among manufacturers now. Manufacturers trusted 3rd parties to flesh out the charging network and they have failed miserably where as Tesla has that done pat.

Keep in mind this is gen1 EVs for al these manufacturers which will have their kinks to get worked out where as Tesla has been working out their kinks for over a decade now introducing improved/refreshed models over time. Almost every 1st gen EV from other manufacturers have been major headaches for people for multiple reasons.

The question is whether they can improve margins back to beyond car company levels now that there are higher rates and more competition.

If they can't increase car sales margins significantly then the current valuation will have to be justified by future licensing of FSD tech or robots or some other revenue stream that's large enough with high enough margin to offset the relatively low margin car sales.

If you think that's possible then the current valuation may be worth an investment but all of this has made Tesla a riskier and more speculative investment at the current price and means there could very well be more pain to the downside.

Back to top

2

2