- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Juy FOMC to inform market Sept rate cut?

Posted on 7/7/24 at 4:20 pm

Posted on 7/7/24 at 4:20 pm

Posted on 7/7/24 at 5:09 pm to boomtown143

Yup just in time. Magically the BLS headlines shows increases but unemployment is rising and the fed says this is what will cause a cut

4.2 was the number and we are at 4.1

4.2 was the number and we are at 4.1

Posted on 7/7/24 at 9:25 pm to boomtown143

I'll believe it when I see it. That would be such a major change in tune

Posted on 7/7/24 at 9:39 pm to TigerTatorTots

Posted on 7/8/24 at 12:16 pm to boomtown143

Yield curve is still inverted (we're currently in the longest recorded inversion), it's reversion to normal behavior is also an early predictor of a likely recession within the next year or two.

If those two indicators hold true, it could mean not just a recession, but a multi-year recession (possibly longer than the 2009 recession, but it's still way too early to tell that).

If those two indicators hold true, it could mean not just a recession, but a multi-year recession (possibly longer than the 2009 recession, but it's still way too early to tell that).

Posted on 7/8/24 at 1:40 pm to Bard

History shows that when the Fed PIVOTS (not stops raising or simply sits static, but actually lowers rates), the economy collapses about 12-18 months later.

Posted on 7/9/24 at 9:14 am to boomtown143

The cpi and ppi data will support a rate cut

At least that’s my expectation

Inflation is certainly taming

At least that’s my expectation

Inflation is certainly taming

Posted on 7/9/24 at 9:42 am to Bard

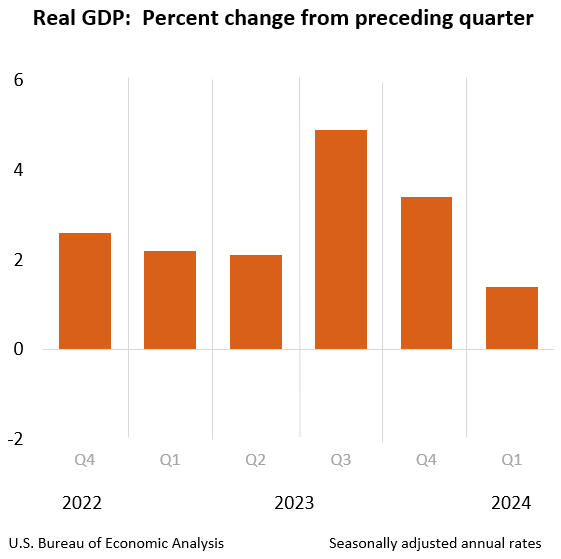

Are we not currently in a recession? A common rule of thumb is that two consecutive quarters of negative gross domestic product (GDP) growth indicate a recession.

Posted on 7/9/24 at 10:35 am to SlidellCajun

quote:

The cpi and ppi data will support a rate cut

At least that’s my expectation

Inflation is certainly taming

I continue to agree that cuts are very likely on the plate for September, but it's smoke and mirrors which obfuscates what else is going on.

We're still well above the money supply level of May 2020, much less January 2020, with both M1 & M2 seeming to have levelled off (for those new to the forum/discussion, the short-hand definition for inflation is that it's too much money chasing too few goods and services). For inflation to truly be tamed, prices have to have risen to the level where the devaluing of the currency now balances out. Considering the obscene amount of money crammed into the economy during COVID and how much has been created through increasing debt (with high interest rates), I don't think we're there yet.

Housing demand hasn't declined, it's merely sitting on the sidelines waiting for rate cuts before it drives home prices higher again. This will be the big resistance to inflation for any cuts as I think any rate cuts will create a disproportionate increase in home prices as more buyers jump back into the market.

Green policies continue to push up energy costs and pretty much everything takes energy to be made.

The pace of consumer debt creation has slowed, but still continues to climb while interest rates remain at levels ranging from "generationally high" to "historically high". Along with that, the federal government is still spending ridiculous amounts of deficit dollars while debt servicing is quickly moving towards being the single largest expense item of the federal government. To me, both are problems but the former is where the most immediate issue lies.

Continued claims have been rising (slowly but steadily) while Initial claims have also started to slowly rise (after both have remained relatively flat for the last couple of years). As such, Unemployment (if we can believe those and the jobs numbers... lulz) has finally made it over the 4% mark. What this seems to say is that more people are staying unemployed for longer (regardless of job numbers) while also that more people are becoming unemployed. This is where the problem with consumer debt comes in. If the increase in unemployment persists (and slowing GDP numbers would indicate it will), then that record high level of consumer debt at high and record-high servicing rates becomes more and more problematic.

In the past I've posted about rising consumer delinquencies and subsequent bankruptcy filings and my concern that if those rise too much in a short period, we could get into a recessionary scenario that could have a snowballing effect as so much of our GDP growth has been solely on the back of consumer debt creation. In other words, if consumers aren't able to keep creating enough debt to keep economic activity going, we pop the consumer debt bubble and get a monster recession strong enough to create deflation.

Avoiding this scenario is the needle I don't think JPow can thread.

This post was edited on 7/9/24 at 10:44 am

Posted on 7/9/24 at 10:42 am to cmac5125

quote:

Are we not currently in a recession?

No.

quote:

A common rule of thumb is that two consecutive quarters of negative gross domestic product (GDP) growth indicate a recession.

Growth has slowed dramatically, but we aren't into negative numbers yet. Slowing growth is still positive growth.

Posted on 7/9/24 at 3:54 pm to boomtown143

Just as higher rates are hitting the corporate world

These guys are clowns

These guys are clowns

Posted on 7/14/24 at 12:42 pm to oneg8rh8r

How do you downvote history and stats? lol, you truly are special.

Posted on 7/15/24 at 12:24 pm to Bard

Powel has stated that if they wait too late to lower rates, it could damage growth.

He’s clearly got a cut in mind for September

The markets have that baked in

He’s clearly got a cut in mind for September

The markets have that baked in

Posted on 7/15/24 at 1:03 pm to SlidellCajun

If PPI ends up telegraphing an inflation increase for July and/or August, it's going to be hard for him to paint a rate cut as anything except political partisanship.

If inflation even remains flat from now through then, that's still going to be a tough sell. Inflation is going to need to come in at 2.8% or lower for August to be able to claim, with a straight face, that data is driving the cut.

If inflation even remains flat from now through then, that's still going to be a tough sell. Inflation is going to need to come in at 2.8% or lower for August to be able to claim, with a straight face, that data is driving the cut.

Popular

Back to top

4

4