- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

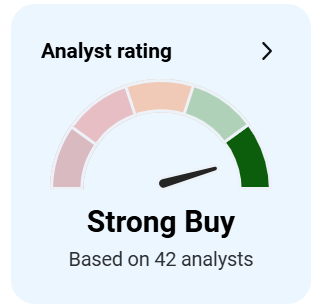

Is Broadcom AVGO a buy at this price?

Posted on 6/4/25 at 8:35 am

Posted on 6/4/25 at 8:35 am

?

Posted on 6/4/25 at 8:48 am to PSS101

They report earnings tomorrow, and the gigantic 15 minute candle that is forming at the moment certainly suggests it a lot of people thought it was a buy under $260 today

its run from under $150 on liberation day to a current trading price of $264.

all rational thought would suggest waiting for a pullback as its surely overbought and riding hype, but none of this is rational anyways.

catching a lot of upgrades from analysts and their new tomahawk 6 AI Networking chip is certainly garnering a lot of attention.

its run from under $150 on liberation day to a current trading price of $264.

all rational thought would suggest waiting for a pullback as its surely overbought and riding hype, but none of this is rational anyways.

catching a lot of upgrades from analysts and their new tomahawk 6 AI Networking chip is certainly garnering a lot of attention.

Posted on 6/4/25 at 9:38 am to PSS101

I bought today. Earnings tomorrow

Posted on 6/4/25 at 10:13 am to PSS101

I hate trying to pick the right semi stock so i own NVDA and the ETF SOXX. AVGO is SOXX top holding. If it goes up big on earnings up 5 bucks and it drops big only down 5 bucks. This strategy has worked out well for me in this sector.

This post was edited on 6/4/25 at 10:15 am

Posted on 6/4/25 at 10:22 am to PSS101

Follow a guy (JC Parets from Allstar Charts) who said they are about to gap and go on Friday morning after the ER.

Do with that what you will.

Do with that what you will.

Posted on 6/4/25 at 1:26 pm to Triple Bogey

quote:

Follow a guy (JC Parets from Allstar Charts) who said they are about to gap and go on Friday morning after the ER.

Do with that what you will.

Posted on 6/4/25 at 2:44 pm to AuburnTigers

In for 5. Sorry guys, tomorrow is guaranteed to suck now

Posted on 6/5/25 at 10:40 am to meeple

AVGO starting to pick up steam. earnings report after hours

Posted on 6/5/25 at 3:27 pm to PSS101

quote:

Broadcom posted strong Q2 results, with revenue climbing 20% year-over-year to a record $15 billion, fueled by rapid growth in AI semiconductor demand and contributions from VMware.

The company reported GAAP net income of $5 billion and non-GAAP net income of $7.8 billion. Adjusted EBITDA rose 35% to $10.0 billion, representing 67% of revenue. AI revenue reached $4.4 billion in Q2, up 46% from the previous year, and is projected to grow further to $5.1 billion in Q3.

CEO Hock Tan noted continued investment from hyperscale partners and 10 straight quarters of AI revenue growth. Broadcom also generated $6.4 billion in free cash flow, returning $7 billion to shareholders via dividends and share buybacks.

The company expects Q3 revenue of approximately $15.8 billion, up 21% year-over-year, and maintains strong profitability guidance. Despite this, shares slipped in after-hour trading 28.6% from the close.

Posted on 6/5/25 at 3:37 pm to jefforize

Excellent report. Kudos to the team.

I’ll be buying more if the dip nears 10%

I’ll be buying more if the dip nears 10%

Posted on 6/5/25 at 4:01 pm to Boomer Rick

quote:its headed that direction. Crazy they beat earnings and are gapping down. Sigh

Excellent report. Kudos to the team.

I’ll be buying more if the dip nears 10%

Posted on 6/5/25 at 4:12 pm to AuburnTigers

holy volatility batman.

Posted on 6/6/25 at 7:51 am to AuburnTigers

quote:

its headed that direction. Crazy they beat earnings and are gapping down. Sigh

I’ve held AAPL for close to 15 years so I’m accustomed to this

Posted on 6/6/25 at 8:54 am to 632627

quote:Was disappointed for 5 mins, sold out and rolled it into Coreweave.

I’ve held AAPL for close to 15 years so I’m accustomed to this

Made all my losses back and then some this morning

Posted on 6/6/25 at 9:34 am to AuburnTigers

Maybe AVGO should report some bad news to make the price go back up

Posted on 6/6/25 at 7:19 pm to DarthRebel

I worry about a lot of so called investors. You picked your stocks for a reason why sell especially when the company is doing even better quarter after quarter. I only get out of a company when I stop believing in them. I do need to get over refusing to buy more when I’m up over 100%. Just because I gained over 100% doesn’t mean it’s not a good buy

Popular

Back to top

7

7