- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Experiences with 72t or Roth conversion ladders for early retirement

Posted on 3/16/19 at 1:09 am

Posted on 3/16/19 at 1:09 am

Has anyone here actually used these methods to access retirement fund before 59 1/2? If so what's your experience/advice? I'd like to start drawing on retirement savings in 3 years or so when I hit mid 40s. I've read about methods to avoid penalties but never met anyone that's actually done it.

I even asked a financial advisor and he had never heard of 72t. Friends & co-workers that are actively investing for retirement usually are unaware you can withdraw Roth contributions and aren't familiar with conversion ladder strategy.

I even asked a financial advisor and he had never heard of 72t. Friends & co-workers that are actively investing for retirement usually are unaware you can withdraw Roth contributions and aren't familiar with conversion ladder strategy.

This post was edited on 3/16/19 at 1:15 am

Posted on 3/16/19 at 8:14 am to TorchtheFlyingTiger

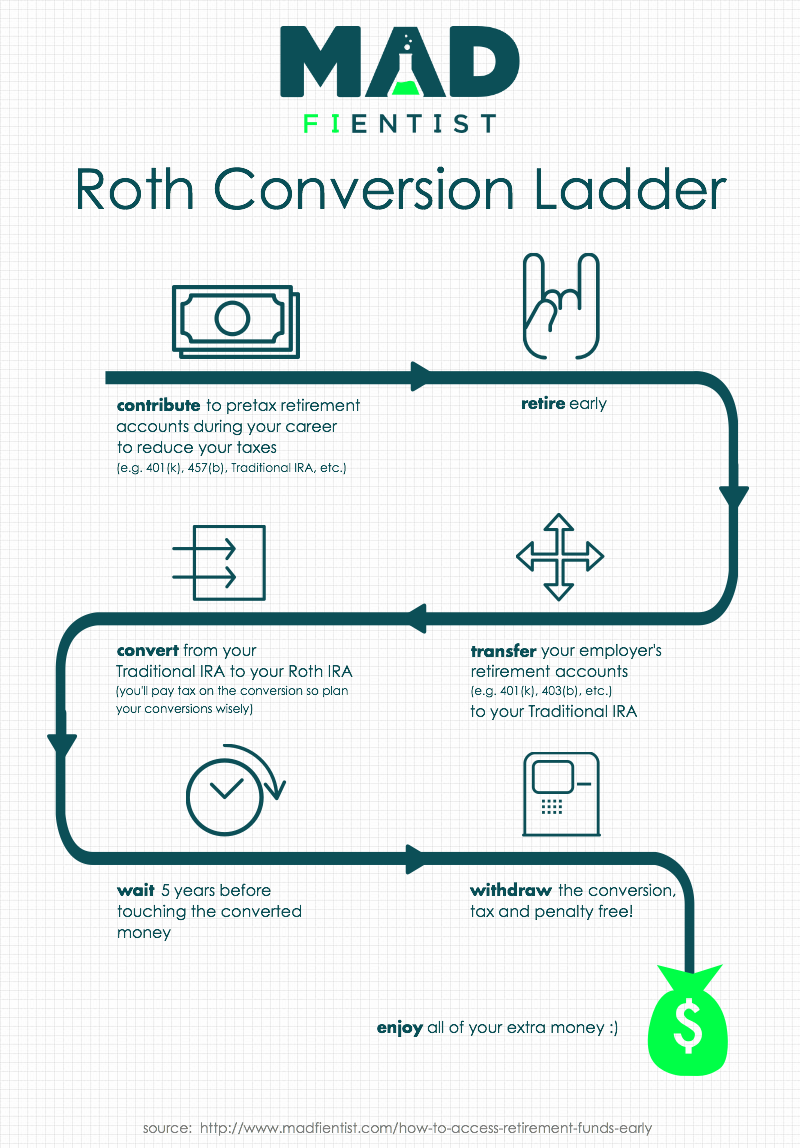

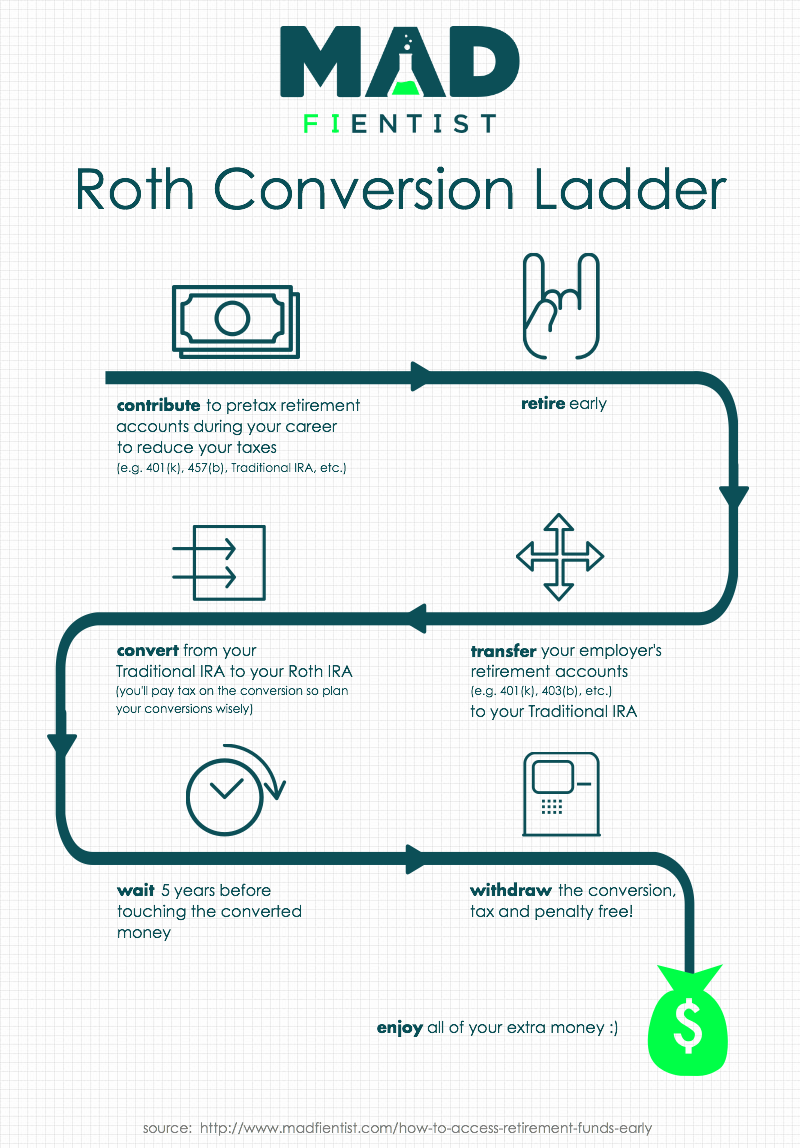

I’ll save this picture for 30 years and just assume the tax laws are the same.

Posted on 3/16/19 at 8:58 am to TorchtheFlyingTiger

So you're making your conversions while still working and most likely at peak income in your career, and essentially getting taxed at a high marginal tax rate on the conversion?

Good luck.

quote:

I'd like to start drawing on retirement savings in 3 years or so when I hit mid 40s.

Good luck.

Posted on 3/16/19 at 9:07 am to TorchtheFlyingTiger

You’ve not found anything revolutionary. You don’t hear about these strategies because it almost always makes more sense to leverage the tax advantages of the respective IRAs.

With 72t, you’re just depleting IRAs early for a minimum of 5 years straight, and you can stop once started.

Investopedia

With the Roth conversion, like previous poster mentioned, you’re going to pay tax on the entire conversion amount. Watch out for your new marginal tax rate with your new MAGI.

I’m assuming you have substantially large IRA balances, or you wouldn’t be retiring in your 40s as you are flexing. But yes, once you convert the IRA balance to a Roth IRA, the conversion amount becomes your basis and your new Roth. Basis in a Roth can be withdrawn tax free once the Roth IRA has been open and funded for five years.

With 72t, you’re just depleting IRAs early for a minimum of 5 years straight, and you can stop once started.

Investopedia

With the Roth conversion, like previous poster mentioned, you’re going to pay tax on the entire conversion amount. Watch out for your new marginal tax rate with your new MAGI.

I’m assuming you have substantially large IRA balances, or you wouldn’t be retiring in your 40s as you are flexing. But yes, once you convert the IRA balance to a Roth IRA, the conversion amount becomes your basis and your new Roth. Basis in a Roth can be withdrawn tax free once the Roth IRA has been open and funded for five years.

Posted on 3/16/19 at 9:11 am to castorinho

I'd only do this if I retire early. (Not while still working/ peak earning years) I'd live off a $70k pension augmented by draw down of Roth contributions and/or taxable investments the first 5 years while building the Roth conversion ladder.

This post was edited on 3/16/19 at 9:30 am

Posted on 3/16/19 at 9:24 am to LSUcam7

quote:

With the Roth conversion, like previous poster mentioned, you’re going to pay tax on the entire conversion amount. Watch out for your new marginal tax rate with your new MAGI.

Does the traditional to Roth conversion have to be done at all at once? If so you're right that's going to be a huge tax hit and major flaw to this strategy. I thought it could be converted in annual chunks thus the ladder. I'd prefer to avoid 72t because I'd be locked in until 59 1/2 or pay massive penalty on all previous withdrawals.

This post was edited on 3/16/19 at 9:26 am

Posted on 3/17/19 at 11:55 am to TorchtheFlyingTiger

As far as I know any Traditional IRA conversion is a tax event for all amounts in all traditional IRAs an individual owns.

So, for example, even if you're just converting your Fidelity held IRA, your Vanguard IRA will have a tax event as well.

So, for example, even if you're just converting your Fidelity held IRA, your Vanguard IRA will have a tax event as well.

This post was edited on 3/17/19 at 11:56 am

Posted on 3/17/19 at 9:25 pm to TorchtheFlyingTiger

quote:

Does the traditional to Roth conversion have to be done at all at once?

I have 2 traditional IRAs at two different firms. I have been transferring $ out of one into a Roth for the past 5 years. I just pay income tax on the $ converted. The entire amounts does not have to be converted in one year, but I’m well past 59 1/2. Not sure if that makes a difference.

Popular

Back to top

3

3