- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Discussion of Fed Liquidity’s Impact on Equity Markets

Posted on 11/2/20 at 10:31 am to RedStickBR

Posted on 11/2/20 at 10:31 am to RedStickBR

That guy breaks it down very simply. What is shocking is this to me:

It blows my mind people don't understand that debt cannot help you escape debt. That number will be closer to $10 debt/$1 GDP by 2021. It it really that hard to convince a population that austerity is a better idea when your population isn't growing than more leverage that inevitably leads to a disaster?

It blows my mind people don't understand that debt cannot help you escape debt. That number will be closer to $10 debt/$1 GDP by 2021. It it really that hard to convince a population that austerity is a better idea when your population isn't growing than more leverage that inevitably leads to a disaster?

Posted on 11/2/20 at 1:36 pm to wutangfinancial

That McKinsey study is really good and discusses this topic. Here’s a relevant bit:

Recall the study was from 2010 and that, instead of deleveraging like the authors concluded would ultimately be required, we doubled down with even more debt. We are paying the price for that now with well below trend Real GDP Growth expectations, a large output gap and monetary policy that is no longer effective.

Absent an unprecedented level of government intervention, I think market forces alone will force us into belt-tightening mode and that this will occur despite continued efforts by fiscal and monetary authorities to find more room in the belt.

quote:

While we cannot say for certain that deleveraging will occur today, we do know empirically that deleveraging has followed nearly every major financial crisis in the past half-century. We find 45 episodes of deleveraging since the Great Depression in which the ratio of total debt relative to GDP declined, and 32 of them followed a financial crisis. These include some instances in which deleveraging occurred only in the public sector; others in which the private sector deleveraged; and some in which both the public and private sectors deleveraged simultaneously.

The historic episodes of deleveraging fit into one of four archetypes: 1) austerity (or “belt-tightening”), in which credit growth lags behind GDP growth for many years; 2) massive defaults; 3) high inflation; or 4) growing out of debt through very rapid real GDP growth caused by a war effort, a “peace dividend” following war, or an oil boom.

The “belt-tightening” archetype was by far the most common of the four, accounting for roughly half of the deleveraging episodes. If today’s economies were to follow this path, they would experience six to seven years of deleveraging, in which the debt-to-GDP ratio declines by around 25 percent. Deleveraging would begin two years after the start of the crisis, and GDP would contract for the first two to three years of deleveraging, and then start growing again.

Recall the study was from 2010 and that, instead of deleveraging like the authors concluded would ultimately be required, we doubled down with even more debt. We are paying the price for that now with well below trend Real GDP Growth expectations, a large output gap and monetary policy that is no longer effective.

Absent an unprecedented level of government intervention, I think market forces alone will force us into belt-tightening mode and that this will occur despite continued efforts by fiscal and monetary authorities to find more room in the belt.

Posted on 11/3/20 at 10:03 am to Mr Perfect

Started your book rec this week. It is interesting so far.

The Price of Tomorrow: Why Deflation is the Key to an Abundant Future

The Price of Tomorrow: Why Deflation is the Key to an Abundant Future

Posted on 11/12/20 at 9:01 am to wutangfinancial

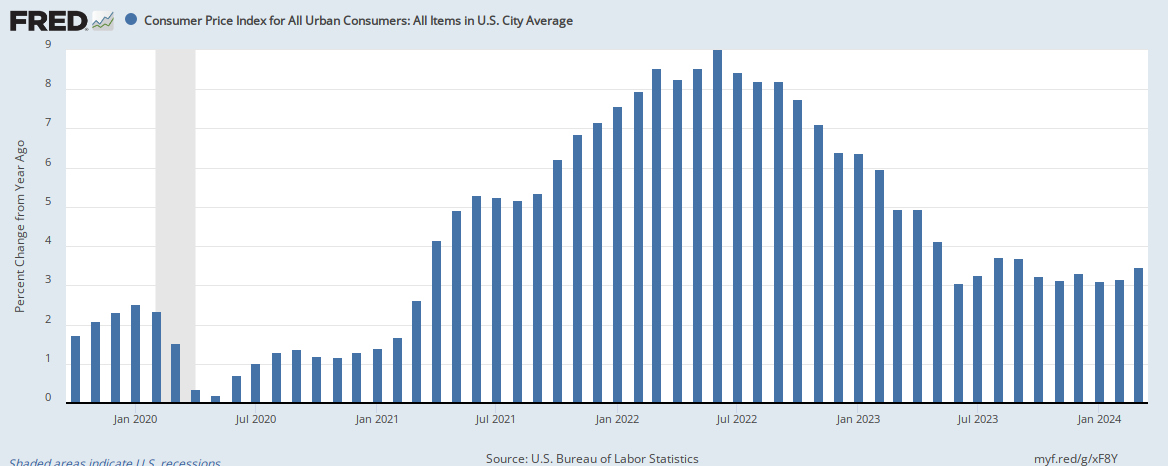

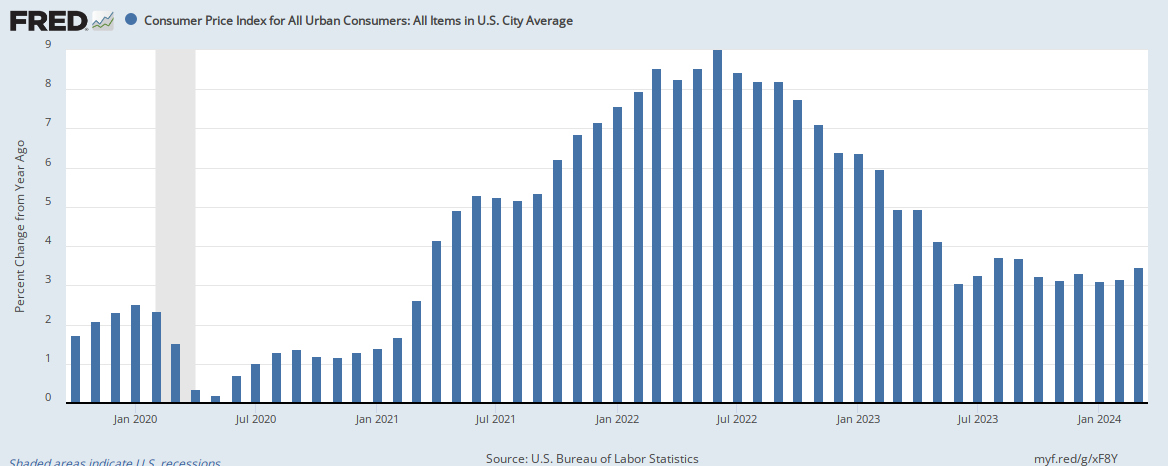

I'm sure you saw that CPI-U missed this morning. Lowest rate since July. Here's the y/y:

And here's the m/m:

And here's core (less food and energy) y/y:

And core m/m:

And here's the m/m:

And here's core (less food and energy) y/y:

And core m/m:

Posted on 11/16/20 at 8:18 am to wutangfinancial

quote:

Chris Cole Endgame

Reading this in advance of listening:

The Allegory of the Hawk and Serpent: How to Grow and Protect Wealth for 100 Years

As well as this companion piece:

The Dragon Portfolio: How to Preserve and Grow Your Wealth for the Next Century

Posted on 11/17/20 at 3:27 pm to wutangfinancial

I haven't listened to SVM lately, but I wonder if he's claiming thesis confirmation yet given the recovery and inflation are each slowing down. It's obviously still very early since the first round of fiscal stimulus began wearing off, but it does feel like things are grinding to a halt:

LINK

LINK

Posted on 11/17/20 at 3:44 pm to RedStickBR

We're going into a phase of lockdowns

That'll do wonders for their inflation targetting. I would imagine that consumption in general for the holidays goes way down. Less travel, dining out and gift shopping. 2021 is going to be shaky for the labor market.

That'll do wonders for their inflation targetting. I would imagine that consumption in general for the holidays goes way down. Less travel, dining out and gift shopping. 2021 is going to be shaky for the labor market.

Posted on 11/20/20 at 7:39 am to wutangfinancial

LINK

quote:

U.S. Treasury Secretary Steven Mnuchin decided to allow key pandemic relief programs to expire on Dec. 31.

The move is expected to drastically reduce the central bank's ability to shore up the financial system.

Posted on 11/20/20 at 10:41 am to RedStickBR

What's funny is that you know those programs wouldn't expire if Trump was re-elected.

What's not funny is that you now have the blueprint to federally backed loans from the Treasury issued through the banking system. Just like I've been saying - the banks are now government utilities. Next up are the financial institions that will be mandated to purchase Treasuries when yields can no longer be controlled by a narrative and QE.

What's not funny is that you now have the blueprint to federally backed loans from the Treasury issued through the banking system. Just like I've been saying - the banks are now government utilities. Next up are the financial institions that will be mandated to purchase Treasuries when yields can no longer be controlled by a narrative and QE.

Posted on 11/20/20 at 11:56 am to wutangfinancial

quote:

What's funny is that you know those programs wouldn't expire if Trump was re-elected.

Haha, no shite. Biden is going to be left holding the bag.

quote:

Next up are the financial institions that will be mandated to purchase Treasuries when yields can no longer be controlled by a narrative and QE.

You can almost smell the desperation at this point. I wish the bond market would say to hell with it and jack rates up.

Posted on 11/20/20 at 12:08 pm to wutangfinancial

quote:

It it really that hard to convince a population that austerity is a better idea when your population isn't growing than more leverage that inevitably leads to a disaster?

It is as long as someone across the aisle is willing to promise the moon and a fix to all your problems if you would just vote them in instead.

They’ll treat the coming crisis like a hot potato handgrenade and just pray it doesn’t explode in their face when it’s their turn to be in power. All the while they’ll leverage their position of power to make as much money as possible and plan to ride off into the sunset to safety if/when the crisis comes home to roost.

This post was edited on 11/20/20 at 1:23 pm

Posted on 11/24/20 at 4:00 pm to RedStickBR

Check these graphs out. Stock buyback charts: Yardeni Research

I'm trying to find research on debt financed stock buybacks by S&P sector.

Oh and we should welcome back Janet Yellen to the team

I'm trying to find research on debt financed stock buybacks by S&P sector.

Oh and we should welcome back Janet Yellen to the team

Posted on 11/26/20 at 9:53 am to wutangfinancial

Good stuff, thanks for sharing.

PCE inflation numbers released yesterday continue to slow. Just about in a deflationary environment on the m/m numbers, while y/y are obviously still positive, but slowing. Household income dropped 0.7% m/m as well.

LINK

PCE inflation numbers released yesterday continue to slow. Just about in a deflationary environment on the m/m numbers, while y/y are obviously still positive, but slowing. Household income dropped 0.7% m/m as well.

LINK

Posted on 11/26/20 at 11:48 am to RedStickBR

I forgot to tell you. I heard a really good point about the "sideline cash" we pointed out in Q2 with the money market inflows. Don't be tricked by it. When corporations drew their revolvers that cash goes into money market mutual funds.

The inflation rates by month compared to prior year are pretty eye opening. Not sure if that's the norm. 2021 is going to be a ride. Stimulus will help fill gaps but there has to be major white collar layoffs and unless there's some extended moratorium on rent/mortgage payments the consumption rates will drop dramatically.

The inflation rates by month compared to prior year are pretty eye opening. Not sure if that's the norm. 2021 is going to be a ride. Stimulus will help fill gaps but there has to be major white collar layoffs and unless there's some extended moratorium on rent/mortgage payments the consumption rates will drop dramatically.

This post was edited on 11/26/20 at 11:49 am

Posted on 11/26/20 at 12:00 pm to wutangfinancial

quote:

I forgot to tell you. I heard a really good point about the "sideline cash" we pointed out in Q2 with the money market inflows. Don't be tricked by it. When corporations drew their revolvers that cash goes into money market mutual funds.

That’s a really good point.

quote:

The inflation rates by month compared to prior year are pretty eye opening

The m/m are obviously going to be lower than the y/y, but still a good leading indicator for the y/y. I regularly monitor both. With the weakness in consumer spending and personal income recently, you’d think it continues to worsen absent more stimulus.

Also, you gotta read this. Note the date. Then note what happened immediately thereafter. And the parallels to today are eery. Definitely one of those papers you’ll want to highlight the hell out of and keep on your bookshelf within arm’s reach.

LINK

This post was edited on 11/26/20 at 12:02 pm

Posted on 11/30/20 at 12:05 pm to RedStickBR

Posted on 11/30/20 at 3:19 pm to RedStickBR

Posted on 11/30/20 at 3:21 pm to RedStickBR

What are y’all’s investment positions going to be when the fruits of deflation bear out over 2021.

Posted on 11/30/20 at 4:00 pm to CorkRockingham

Keeping a good chunk of cash, long the dollar vs a basket, infrastructure stocks, a small value exposure, and some funky stuff that shouldn’t correlate vs the market.

Back to top

2

2