- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: AUPH - Aurinia Pharmaceuticals

Posted on 3/25/23 at 11:49 am to jerryc436

Posted on 3/25/23 at 11:49 am to jerryc436

quote:I know that the termonology is that you have the right but not the obligation to buy 100 shares at $10. I would just sell the contract before expiration to avoid any confusion.

If I buy a $10 call I believe I would be on the hook to buy costing me $1000.00 if I do not sell it before but have never done it.

Can anyone weigh in? If you're in the money after expiration Friday do you have to exercise?

I don't know why you wouldn't given you will make money as long as the stock price is above the premium paid for the contract...

This post was edited on 3/25/23 at 11:49 am

Posted on 3/25/23 at 2:32 pm to bayoubengals88

just sell before expiration so you don't have to worry about buying the contracts out to make your money

If this materializes, I will likely sell all of my contracts as soon as the premium gets close to the delta of pps vs call price.

I'm not going to get greedy over a dollar at that point

If this materializes, I will likely sell all of my contracts as soon as the premium gets close to the delta of pps vs call price.

I'm not going to get greedy over a dollar at that point

Posted on 3/26/23 at 6:33 pm to jimjackandjose

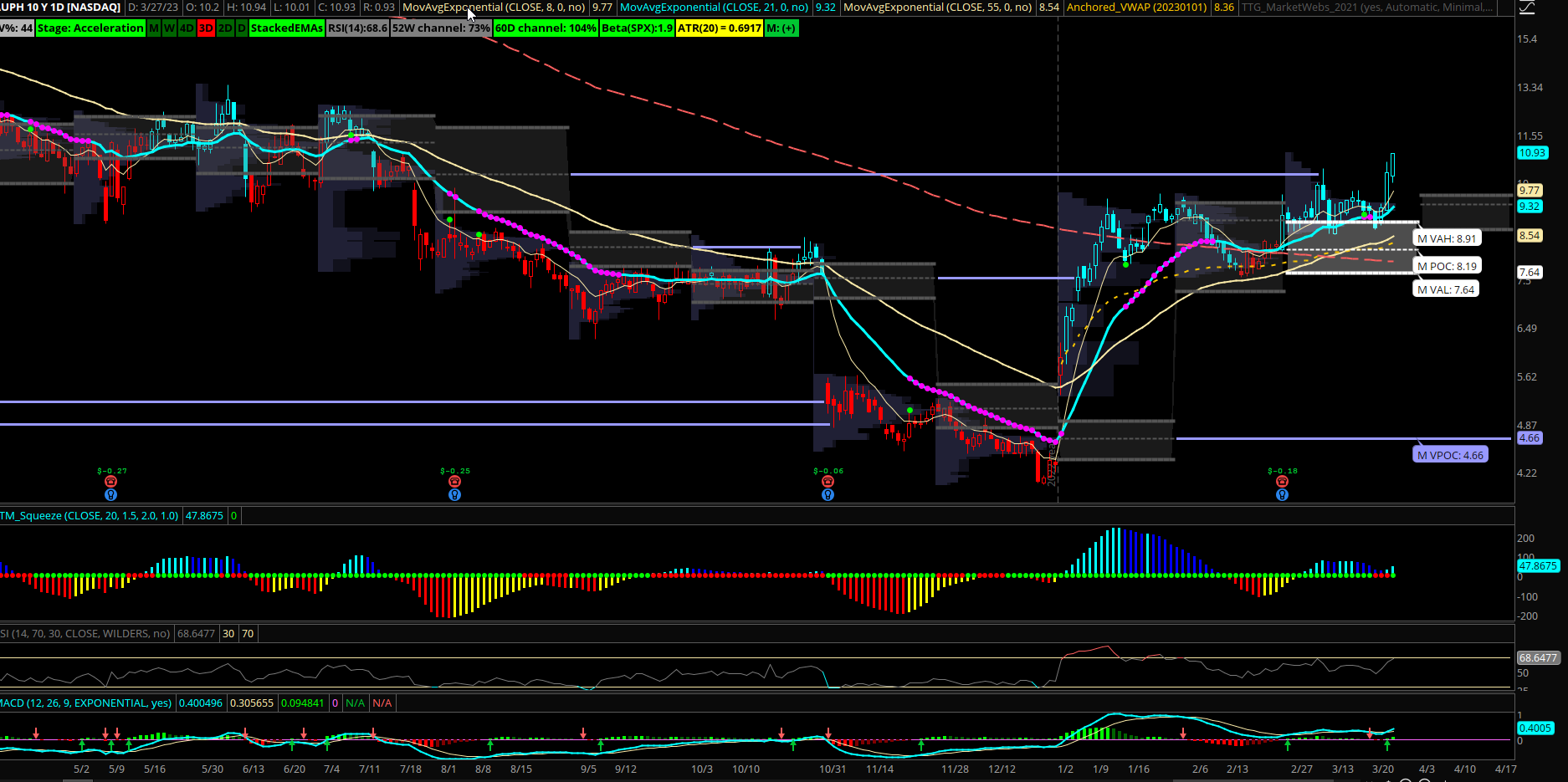

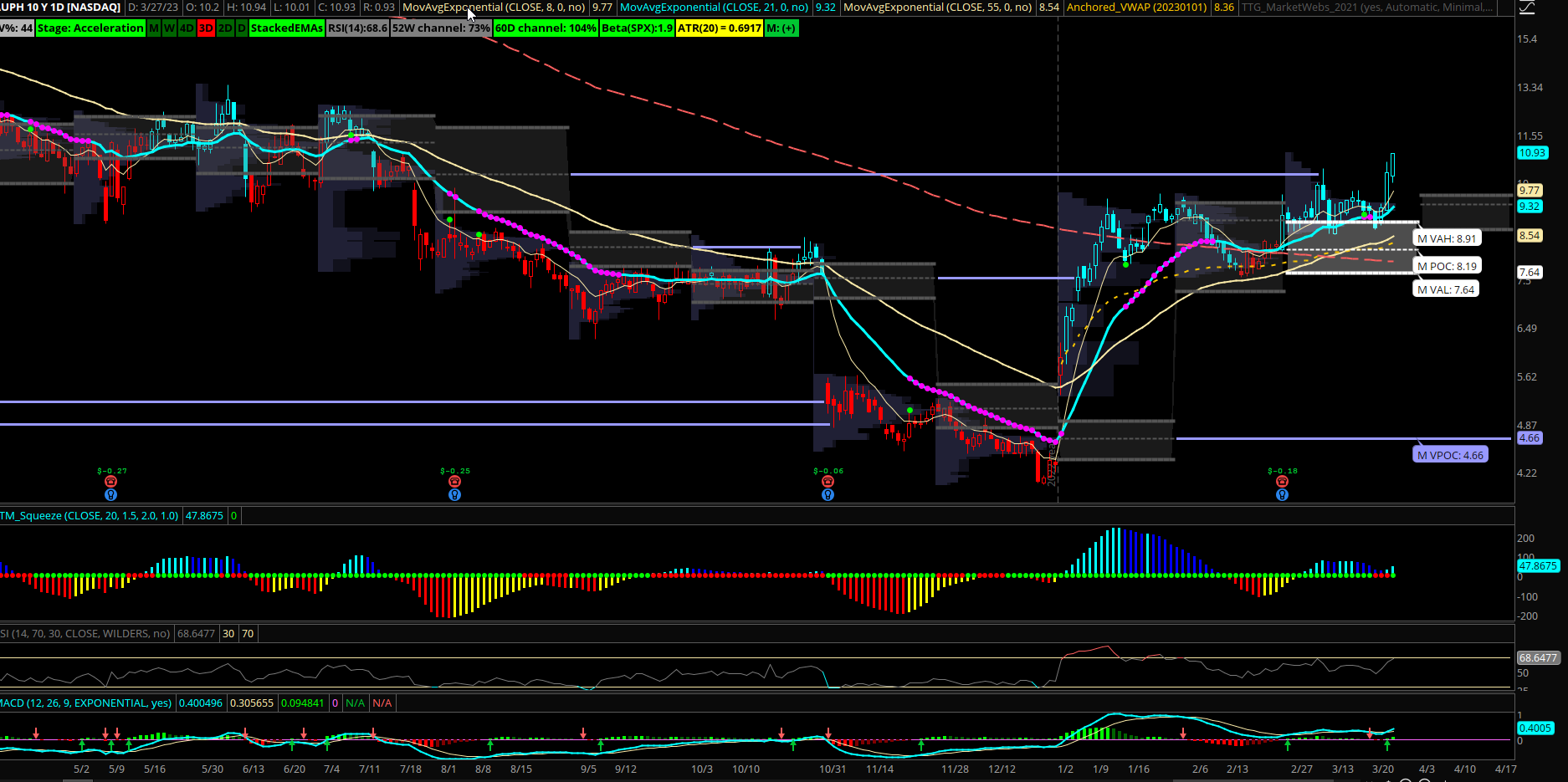

This guy on Twitter with over 200k followers featured AUPH this weekend.

He’s calling for a $12-14 gap fill.

People follow this guy and buy his recommendations.

LINK

He’s calling for a $12-14 gap fill.

People follow this guy and buy his recommendations.

LINK

Posted on 3/26/23 at 7:33 pm to bayoubengals88

He is just looking at charts. Don't think he has done the DD most have on this site.

But with 200K followers, might get a decent pump to the gap fill

But with 200K followers, might get a decent pump to the gap fill

Posted on 3/26/23 at 8:39 pm to jimjackandjose

Right, he’s all technicals, but yes, it’s all about the attention.

Could be another wild ride tomorrow.

Again, great for options premium.

Could be another wild ride tomorrow.

Again, great for options premium.

Posted on 3/27/23 at 2:34 pm to bayoubengals88

Keep the mo going

Sitting and hovering around $10.80-$10.90. Region

Keep that green line going

Sitting and hovering around $10.80-$10.90. Region

Keep that green line going

Posted on 3/27/23 at 2:42 pm to SeeeeK

Aurinia Pharma (AUPH) odd buyers of 1150 May $11 calls for $1.56 offers. Higher the past few days M&A speculation making the rounds. Breaking out to 6 month highs here +6%. AUPH is a $1.5B small cap clinical stage pharmaceutical company focused on the global nephrology market. It is currently enrolling patients in its Phase 2b clinical trial to evaluate the efficacy of its drug, voclosporin, as a treatment for LN. LN is an inflammation of the kidneys, that if inadequately treated can lead to endstage renal disease, making LN a serious and potentially life-threatening condition. High short float of 12.3%. AUPH has alot of space to run above 10 as it rallies through an old VPOC and next resistance up at 13 being the 2022 yearly value area high and the 200 week MA.

LINK

LINK

Posted on 4/10/23 at 9:12 am to BeYou

What happened? Just profit taking?

Posted on 4/10/23 at 9:23 am to GridIronTigerBaw

Announced Dylan Mulvaney, that mentally deranged trans, as their new spokesperson.

Posted on 4/11/23 at 12:54 pm to GridIronTigerBaw

quote:You were saying?

What happened? Just profit taking?

Market manipulation is only a theory, but what more evidence do you need?

This post was edited on 4/11/23 at 2:00 pm

Posted on 4/12/23 at 2:05 pm to bayoubengals88

Sold $13 calls for 4/21 for .35

Should be an easy $102

Should be an easy $102

Posted on 4/12/23 at 3:51 pm to bayoubengals88

Or you get wrecked lol

I've been considering throwing around 500 at cheap calls expiring in the monthly. Wouldn't pay .35 though. Be fine with .10. If it does sell this year, that's a cheap exposure strategy without having funds tied up in auph

I've been considering throwing around 500 at cheap calls expiring in the monthly. Wouldn't pay .35 though. Be fine with .10. If it does sell this year, that's a cheap exposure strategy without having funds tied up in auph

Posted on 4/12/23 at 3:53 pm to jimjackandjose

For example

Right now I have 100 contracts jan exp tying up 40K

I could sell those and do 1000 per month on .10 contracts with monthly expiration for 40 months while using the other funds for other investments.

Now if the company does sell, I get wrecked

Right now I have 100 contracts jan exp tying up 40K

I could sell those and do 1000 per month on .10 contracts with monthly expiration for 40 months while using the other funds for other investments.

Now if the company does sell, I get wrecked

Posted on 4/12/23 at 5:16 pm to jimjackandjose

quote:No sir.

Or you get wrecked lol

I sold the calls. Join the dark side

The only risk is that I lose my shares at $13 if the share price is above $13 by 4/21.

I’ve already collected the $105 from whoever spent .35 on the calls.

Posted on 4/12/23 at 5:27 pm to jimjackandjose

quote:Oh, I see what you’re saying.

Now if the company does sell, I get wrecked

A different version of getting wrecked haha.

Yeah, you’ll miss gains. But I’m not worried about the company getting sold before next Friday

If so, the contracts I sold represent just 10% of my position.

Sorry that I misunderstood you earlier

Posted on 4/17/23 at 8:42 pm to bayoubengals88

Options ideas going into earnings?

Considering the following:

5 long $13 May calls (will sell all before earnings). The idea is that I’ll eliminate most of the risk here. I’m ok with losing the reward. I have commons and a few leaps that will benefit from a positive earnings.

Looking for 25% gains if there’s a run up before earnings.

5 covered calls (provides some solace against if we drop 25% because Peter couldn’t even hit revenue of 32m. I’ll buy to close the calls or allow them to expire worthless.

I don’t want to go long puts. Covered calls is as bearish as I get.

What’s everyone else doing? IV is juicy.

Considering the following:

5 long $13 May calls (will sell all before earnings). The idea is that I’ll eliminate most of the risk here. I’m ok with losing the reward. I have commons and a few leaps that will benefit from a positive earnings.

Looking for 25% gains if there’s a run up before earnings.

5 covered calls (provides some solace against if we drop 25% because Peter couldn’t even hit revenue of 32m. I’ll buy to close the calls or allow them to expire worthless.

I don’t want to go long puts. Covered calls is as bearish as I get.

What’s everyone else doing? IV is juicy.

Posted on 4/17/23 at 9:00 pm to bayoubengals88

I have multiple CC's and cash covered puts expiring Friday. I have one CC at $10 that I expect to lose. Also have 2 CC at $12 that I expect to expire and 3 cc at $16 that seems safe. I have $305 in premiums on these CC's. Also have 1 put at $11 that I have $114 in premium that could go either way and 2 $5 puts, 1 $8 put, 3 $9 puts, and 1 $10 put with $159 in premiums that I expect to expire. I was willing to buy at $11 which would be $9.86 out of pocket with the premium. the others I believe will expire. I have been heavy on options puts and CC's and it has been profitable. Total of $578.00 in premiums that more than make up for the $10 CC that will return $10.34 with the premium if it stays above $10 which I expect. It has been fun.

This post was edited on 4/17/23 at 9:04 pm

Posted on 4/17/23 at 9:20 pm to jerryc436

Nice. If you get called away at $10 are you going to convert that into a $9 CSP?

Posted on 4/17/23 at 9:27 pm to bayoubengals88

They all expire Friday and I plan to replace most of them on Monday. I will probably choose CSP between $9 and $11 depending on the premium. I don't usually do CSP more than a few weeks out so I may do a couple each week to watch the share price.

Posted on 4/18/23 at 2:41 pm to jerryc436

Used the fear this morning to collect $150 from selling three $8 5/19 puts.

Popular

Back to top

1

1