- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: New York, New Jersey, Illinois, Connecticut and California will be demanding a bailout.

Posted on 4/26/20 at 4:25 pm to GumboPot

Posted on 4/26/20 at 4:25 pm to GumboPot

Are you really saying Louisiana is better off than California? Keep in mind California would be a top ten richest country in the world if they were independent.

Posted on 4/26/20 at 4:27 pm to Brosef Stalin

quote:

Keep in mind California would be a top ten richest country in the world if they were independent.

Then why do they need a bailout?

Posted on 4/26/20 at 4:28 pm to Brosef Stalin

Quality of life? Yes.

I think Louisiana is a better place to live.

I think Louisiana is a better place to live.

Posted on 4/26/20 at 4:28 pm to Brosef Stalin

Richest? How do you define that? Because I'm pretty sure California's balance sheet is a shitshow.

Posted on 4/26/20 at 4:29 pm to Brosef Stalin

And they would have a great big dent anvil around their neck while they are at it

Like you said they are superior to us in every way so they can figure it out themselves

Net migration numbers, all else is bullshite

Dirt poor Mexicans flock there, everybody else is a net outbound

Like you said they are superior to us in every way so they can figure it out themselves

Net migration numbers, all else is bullshite

Dirt poor Mexicans flock there, everybody else is a net outbound

Posted on 4/26/20 at 4:32 pm to Brosef Stalin

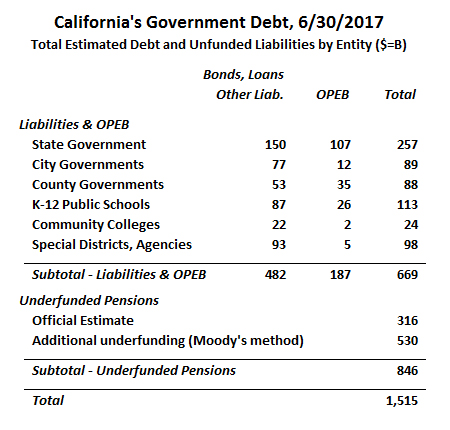

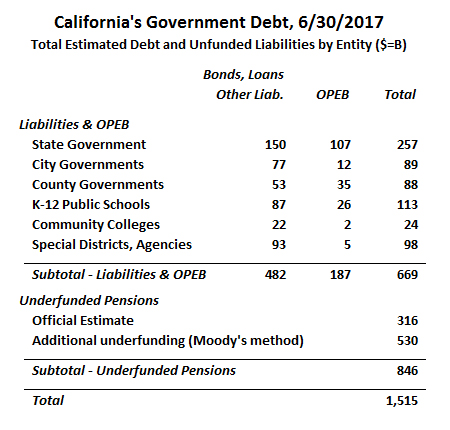

CA is 1.5 trillion in debt.

LINK

California’s total state and local government debt as of June 30, 2017 totaled just over $1.5 trillion. That total includes all outstanding bonds, loans, and other long-term liabilities, along with the officially reported unfunded liability for other post-employment benefits (primarily retiree healthcare), as well as unfunded pension liabilities.

This represents a rise of about $200 billion – or 15% – over our last debt analysis, in January 2017.

Our findings may appear to contradict reports that suggest a state budget surplus of about $9 billion. But the state’s spare cash and rainy day funds pale before the mountain of long-term liabilities that California governments at all levels have accumulated. Moreover, if the stock market drops, personal income tax and capital gains tax revenue will decline precipitously, wiping out these surpluses.

We calculate the total of unfunded pensions in California at $846 billion – $530 billion more than the official estimate of $316 billion. But even using only the officially reported estimates, California’s state and local governments are about $1.0 trillion in debt.

LINK

California’s total state and local government debt as of June 30, 2017 totaled just over $1.5 trillion. That total includes all outstanding bonds, loans, and other long-term liabilities, along with the officially reported unfunded liability for other post-employment benefits (primarily retiree healthcare), as well as unfunded pension liabilities.

This represents a rise of about $200 billion – or 15% – over our last debt analysis, in January 2017.

Our findings may appear to contradict reports that suggest a state budget surplus of about $9 billion. But the state’s spare cash and rainy day funds pale before the mountain of long-term liabilities that California governments at all levels have accumulated. Moreover, if the stock market drops, personal income tax and capital gains tax revenue will decline precipitously, wiping out these surpluses.

We calculate the total of unfunded pensions in California at $846 billion – $530 billion more than the official estimate of $316 billion. But even using only the officially reported estimates, California’s state and local governments are about $1.0 trillion in debt.

Posted on 4/26/20 at 4:39 pm to Brosef Stalin

California has a debt ratio of over 107%. New Jersey is at 280%

Posted on 4/26/20 at 7:51 pm to Brosef Stalin

Then they certainly shouldn’t need a bail out from the poor tax payers if Louisiana, Mississippi, or Arkansas problem solved comrade.

Popular

Back to top

7

7