- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

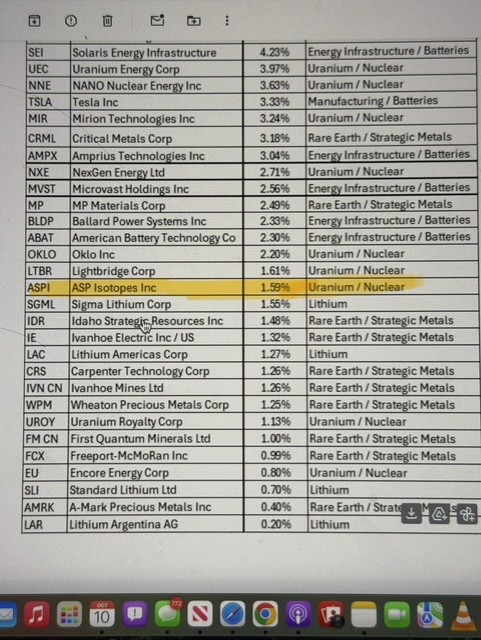

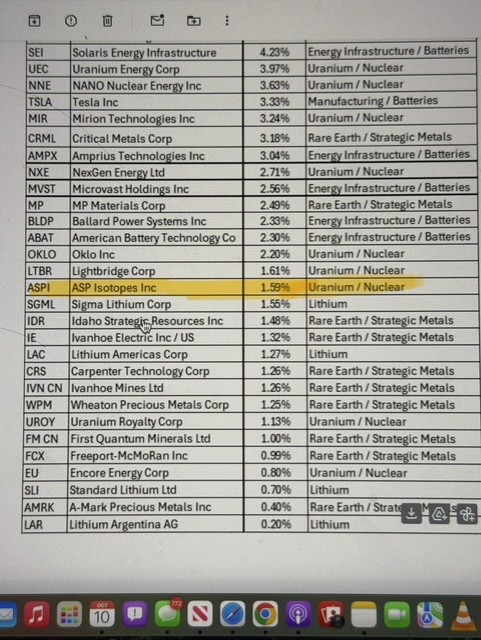

ASP Isotopes (ASPI)

Posted on 10/14/25 at 4:39 pm

Posted on 10/14/25 at 4:39 pm

Just wondering if anyone has ever heard of this company or is invested in them.

I'd seen the name and have jumped in over the last couple of days.

Sold covered calls too so I was actually glad to see the ATM offering after two monster days of gains.

Apparently the Silicon-28 news was really big for them.

They have proprietary technology in key industries (nuclear medical, Quantum, Semiconductors) and have recently been added to the Morgan Stanley National Security Basket.

Proprietary Technologies: ASP uses two main platforms:Aerodynamic Separation Process (ASP): A gas-based method for separating isotopes in a volatile state, initially focused on medical isotopes like Carbon-14 (used in pharmaceuticals and research).

Quantum Enrichment (QE): A laser-based process for precise enrichment, enabling production of isotopes like Ytterbium-176 (for cancer therapies such as Lutetium-177-based treatments).

Production and Facilities: As of 2025, ASP has transitioned to full commercialization, with operational facilities in Pretoria, South Africa. They commenced commercial production of Carbon-14 in February 2025 using ASP technology and Ytterbium-176 via QE. Expansions include three enrichment facilities targeting isotopes like Silicon-28 (for quantum computing and semiconductors) and Nickel-64 (for medical imaging). Deliveries under contracts, such as a major Silicon-28 agreement, are slated for Q1 2026.

WEBSITE

FINVIZ

FINTEL

>

>

I'd seen the name and have jumped in over the last couple of days.

Sold covered calls too so I was actually glad to see the ATM offering after two monster days of gains.

Apparently the Silicon-28 news was really big for them.

They have proprietary technology in key industries (nuclear medical, Quantum, Semiconductors) and have recently been added to the Morgan Stanley National Security Basket.

Proprietary Technologies: ASP uses two main platforms:Aerodynamic Separation Process (ASP): A gas-based method for separating isotopes in a volatile state, initially focused on medical isotopes like Carbon-14 (used in pharmaceuticals and research).

Quantum Enrichment (QE): A laser-based process for precise enrichment, enabling production of isotopes like Ytterbium-176 (for cancer therapies such as Lutetium-177-based treatments).

Production and Facilities: As of 2025, ASP has transitioned to full commercialization, with operational facilities in Pretoria, South Africa. They commenced commercial production of Carbon-14 in February 2025 using ASP technology and Ytterbium-176 via QE. Expansions include three enrichment facilities targeting isotopes like Silicon-28 (for quantum computing and semiconductors) and Nickel-64 (for medical imaging). Deliveries under contracts, such as a major Silicon-28 agreement, are slated for Q1 2026.

WEBSITE

FINVIZ

FINTEL

This post was edited on 10/14/25 at 4:40 pm

Posted on 10/14/25 at 4:41 pm to bayoubengals88

Looks like we would be buying at the top

Yikes public offering AH. Now might be the time to get in.

Yikes public offering AH. Now might be the time to get in.

This post was edited on 10/14/25 at 4:46 pm

Posted on 10/14/25 at 4:46 pm to Craft

The offering news is a buying opportunity after reaching 14.49 today.

You pay more now because it is substantially derisked after the big news yesterday morning.

I could be way off here.

You pay more now because it is substantially derisked after the big news yesterday morning.

I could be way off here.

Posted on 10/14/25 at 4:53 pm to bayoubengals88

It’s dilution from my understanding. Would need to hear from someone with more experience on how to handle these and when to buy.

This post was edited on 10/14/25 at 4:54 pm

Posted on 10/15/25 at 6:49 am to Craft

Yes, it’s certainly dilution.

Particularly in the form of an ATM mixed shelf offering. They can tap the markets for up to 210 million through this deal.

The number of shares outstanding was previously fairly low (sub 100m) so I’m not too concerned.

In my view, they’ve earned the right to raise more cash with the Silicon-28 contract. More on that:

-Grok

Particularly in the form of an ATM mixed shelf offering. They can tap the markets for up to 210 million through this deal.

The number of shares outstanding was previously fairly low (sub 100m) so I’m not too concerned.

In my view, they’ve earned the right to raise more cash with the Silicon-28 contract. More on that:

quote:

Why is Silicon-28 Important to ASPI?

Silicon-28 (Si-28) is a cornerstone of ASPI's business, representing its entry into the high-growth electronic gases and quantum computing markets. ASPI is the world's only commercial provider of highly enriched Si-28 derived directly from natural silane (SiH4), giving it a competitive edge in purity and scalability. Natural silicon consists of ~92% Si-28, ~5% Si-29, and ~3% Si-30, but the presence of Si-29 (which has nuclear spin) causes decoherence in quantum systems and reduces thermal efficiency. ASPI's enrichment process removes these impurities, producing Si-28 at >99.995% purity.

Key reasons for its importance:

- Quantum Computing Enablement: Si-28 is "spin-free," shielding qubits from decoherence (loss of quantum information). This makes it essential for silicon-based quantum processors, where even trace impurities disrupt performance.

- Semiconductor Advancements: Enriched Si-28 boosts thermal conductivity by ~150% compared to natural silicon, enabling smaller, faster, cooler chips for AI, high-performance computing, and next-gen electronics. This addresses thermal bottlenecks in dense chip designs.

- Market Positioning: ASPI targets a nascent but explosive market. Global quantum computing investments are accelerating (e.g., via U.S. CHIPS Act), and Si-28 demand is projected to grow rapidly as fabs adopt it for nanowires and advanced nodes.

ASPI's Si-28 operations are not just a product line—they're a strategic pillar for diversifying beyond nuclear isotopes into electronics, potentially generating high-margin, recurring revenue.

-Grok

This post was edited on 10/15/25 at 6:50 am

Posted on 10/15/25 at 6:52 am to bayoubengals88

The details just came out.

Pretty good deal here.

This seems to be in addition to the mixed shelf.

Pretty good deal here.

This seems to be in addition to the mixed shelf.

Loading Twitter/X Embed...

If tweet fails to load, click here.This post was edited on 10/15/25 at 6:54 am

Posted on 10/15/25 at 7:21 am to bayoubengals88

Offering driving share prices down initially to $12.75 or so and option remains for UW to grab another $30M within 30 days.

Posted on 10/15/25 at 8:07 am to bayoubengals88

I had a tiny position for awhile on a recommendatin and managed to sell just before the Silicon-28 deal lol

Honestly never took the time to understand the economics of the company - but it was definitely mini meme-ish early in term of popularity.

I did not put enough time into it but I could never see how the revenue would get to where needed to support market cap - but again did notgive it enough review to be firm on that

Honestly never took the time to understand the economics of the company - but it was definitely mini meme-ish early in term of popularity.

I did not put enough time into it but I could never see how the revenue would get to where needed to support market cap - but again did notgive it enough review to be firm on that

Posted on 10/15/25 at 9:08 am to igoringa

I appreciate the insight!

Up 10% from my AH buys yesterday.

Yes, it was a buying opportunity.

Up 10% from my AH buys yesterday.

Yes, it was a buying opportunity.

Posted on 10/15/25 at 1:23 pm to bayoubengals88

I’m taking a flyer on it especially if bb88 is. It sounds like it might have actual utility in the quantum sphere.

Posted on 10/15/25 at 1:27 pm to REG861

quote:I sold at 13+ because I had to take advantage of the NBIS dip.

I’m taking a flyer on it especially if bb88 is.

I DO plan to be back in after NBIS recovers. Hopefully not too late!

Posted on 10/15/25 at 2:11 pm to bayoubengals88

quote:

Up 10% from my AH buys yesterday.

Yes, it was a buying opportunity.

Great job!

Posted on 10/15/25 at 7:58 pm to igoringa

I got back in AH.

I think the company is just too strategically valuable right now.

I think the company is just too strategically valuable right now.

Posted on 10/15/25 at 9:57 pm to bayoubengals88

Yeah I only got $1000 in at 12.35 I’m thinking I want a lot more

Posted on 10/17/25 at 11:54 am to Craft

I wish I didn’t want a lot more lol I’m gonna need this one to come back at some point

Posted on 10/17/25 at 11:55 am to Craft

I got out again with a small gain, but sunk it into NBIS.

I have my eye on it for sure.

I have my eye on it for sure.

Posted on 10/17/25 at 12:06 pm to bayoubengals88

Yeah I think NBIS is going to be one of those stocks we all look back on in 10 years and say we should have slammed these prices.

Posted on 10/17/25 at 12:12 pm to bayoubengals88

Absolutely nasty weekly bar on it. Give it a few weeks to churn sideways first imo.

Posted on 10/17/25 at 12:47 pm to Craft

We were slamming it….this week it slammed back though.

Posted on 10/17/25 at 1:27 pm to SquatchDawg

I am going long on it. 2027 calls.

Popular

Back to top

3

3