- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

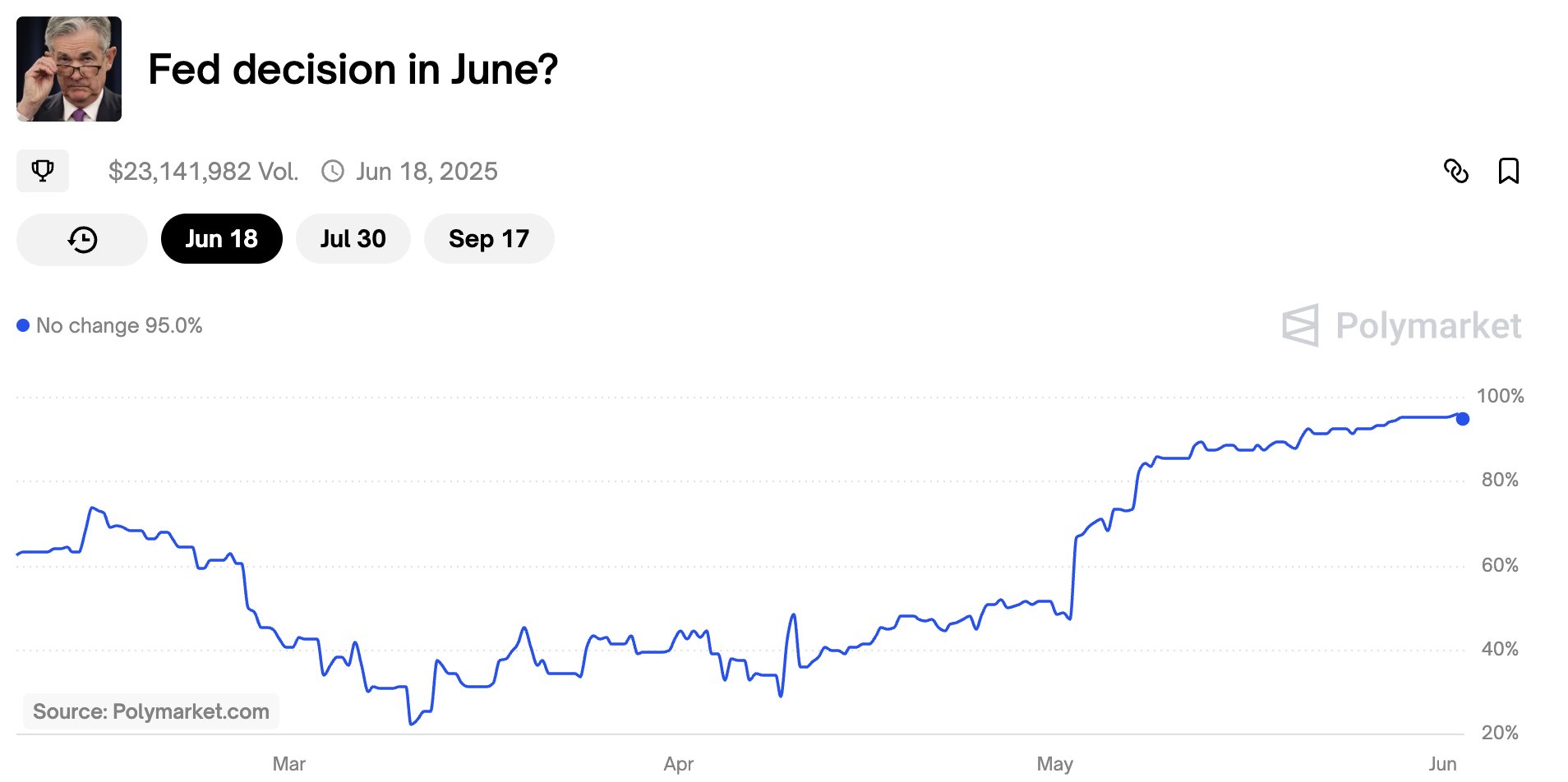

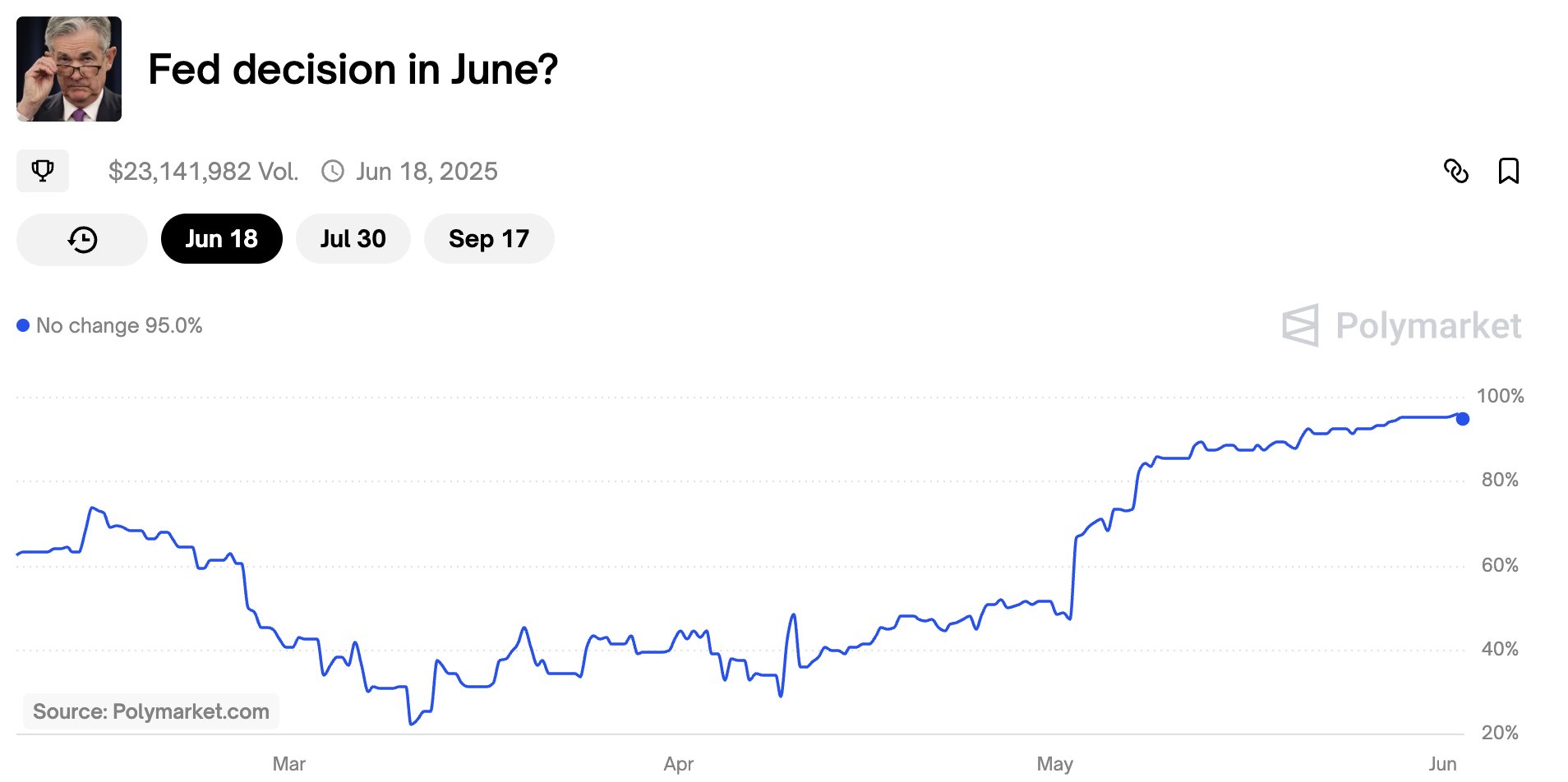

Betting markets are currently pricing in a 95% chance of no change in interest rates

Posted on 6/4/25 at 7:48 am

Posted on 6/4/25 at 7:48 am

At the next Fed meeting in 2 weeks

However, if you want lower mortgage rates, then you should be crying about the money printing the Big Beautiful Bill will cause, which will affect the 10YY more than whatever the Fed does

However, if you want lower mortgage rates, then you should be crying about the money printing the Big Beautiful Bill will cause, which will affect the 10YY more than whatever the Fed does

Posted on 6/4/25 at 7:50 am to stout

quote:

However, if you want lower mortgage rates, then you should be crying about the money printing the Big Beautiful Bill will cause

Well I'm definitely on the side of "stop spending money we don't have on stupid shite that doesn't positively impact the taxpayers". We suck at this. And I want to primary every republican that pushed that disaster right now. frick them.

And I'm either getting older or I'm just kind of an a-hole - but I honestly think mortgage rates are at a healthy spot. We saw record low rates for a while - those days are not coming back. We don't have a buyer frenzy in my area, but housing that's under $300K seems to move reasonably quickly. The $300k-$600k range tends to sit for a while which should be expected - the market for them is smaller and have more unique requirements/demands on location, style, size, and amenities.

I think housing prices need more downward pressure in the future by increasing housing supply on the affordable end. The best way to do that is to do something about crime in this country and revamp the smaller, affordable post-war housing in America's cities. We already have that housing stock but it's often either in super expensive or super ghetto areas. Address the crime issues and we could see younger people investing in homes in the city instead of renting or moving directly to the suburbs.

I don't know how we can do something about crime. It has to be a permanent solution in how judges or DA's get into office in some of these cities or we will end up seeing people invest in a sinking ship. Right now suburbs are safer bets in many places despite their lack of infrastructure, traffic issues, and affordability problems. It's a shame because America build so many homes between 1940 and 1970 that are the right size for smaller families and could be easily updated very quickly. But they are mostly either very expensive, established areas or in very risky, high crime areas. Younger buyers aren't going for either of those.

This post was edited on 6/4/25 at 8:02 am

Posted on 6/4/25 at 7:57 am to stout

You lower rates when the economy starts getting bad. You raise rates or hold them steady when the economy is good.

So the question people should be asking themselves is whether or not they think the economy is starting to get bad.

So the question people should be asking themselves is whether or not they think the economy is starting to get bad.

Posted on 6/4/25 at 7:57 am to stout

CME has it at 99% no cut

Everyone knows too late is playing politics

Everyone knows too late is playing politics

Posted on 6/4/25 at 7:57 am to member12

I agree with you, especially if we could stay in a healthy 6% range. That is not so high that it kills the economy but high enough to demand somewhat of a correction back to affordability in the RE market.

Posted on 6/4/25 at 7:58 am to member12

quote:

. The best way to do that is to do something about crime in this country

Dude crime is plummeting after the post Covid spike

Has been since 2023

Posted on 6/4/25 at 7:59 am to stout

quote:Correct.

if you want lower mortgage rates, then you should be crying about the money printing the Big Beautiful Bill will cause, which will affect the 10YY more than whatever the Fed does

Posted on 6/4/25 at 7:59 am to Bard

quote:

So the question people should be asking themselves is whether or not they think the economy is starting to get bad.

ADP numbers out this morning show an economic cool down

Loading Twitter/X Embed...

If tweet fails to load, click here. Posted on 6/4/25 at 8:02 am to SDVTiger

quote:Just because you don't like the recent Fed's interest rate decisions does not mean "everyone" does. You don't know what "everyone" thinks.

Everyone knows too late is playing politics

Posted on 6/4/25 at 8:03 am to stout

quote:

ADP numbers out this morning show an economic cool down

Atlanta fed in t'mud

Posted on 6/4/25 at 8:05 am to LSURussian

quote:

You don't know what "everyone" thinks.

Probably should have said everyone with a brain knows it

Posted on 6/4/25 at 8:05 am to stout

Were you on here bitching about the Green Deal, that led to near double digit inflation? No? I didn't think so. But carry on with your fear mongering.

Posted on 6/4/25 at 8:05 am to SDVTiger

quote:

Everyone knows too late is playing politics

What will your reaction be if they cut rates, but the 10YY rises because a cut makes investors anticipate economic stimulation and potential future inflation?

Right now, a slowing economy is more likely to bring down the 10-year yield, so I don’t understand why you, someone who wants lower mortgage rates, are cheering for the opposite.

Posted on 6/4/25 at 8:06 am to member12

quote:

but I honestly think mortgage rates are at a healthy spot.

let me guess, yours is locked in Low or you paid your mortgage off. I love these kind of posts. The "hey it doesn't impact me, so f it".

Posted on 6/4/25 at 8:07 am to Mandtgr47

quote:

Were you on here bitching about the Green Deal, that led to near double digit inflation? No? I didn't think so.

Yes, I bitched about it a lot.

I bitch anytime we are printing Trillions. Trump being behind it doesn't change my mind, despite my support for him over the past 10 years.

Posted on 6/4/25 at 8:09 am to SDVTiger

quote:Why leave yourself out...

Probably should have said everyone with a brain knows it

Posted on 6/4/25 at 8:09 am to Mandtgr47

quote:

Were you on here bitching about the Green Deal, that led to near double digit inflation?

When did the Green New Deal pass?

Posted on 6/4/25 at 8:10 am to stout

quote:

What will your reaction be if they cut rates, but the 10YY rises because a cut makes investors anticipate economic stimulation and potential future inflation?

What if that doesnt happen. You act like im wanting zero rates

They are too restrictive and it needs another 1% cut however you break it down by the end of the year. And they will be cutting

I dont give a shite if mortgage rates lower I have told you this. They can go to 20% and I will be ecstatic.

Posted on 6/4/25 at 8:10 am to Mandtgr47

quote:

The "hey it doesn't impact me, so f it".

Lower rates would affect him as it would probably make his home's value rise more and at a faster pace.

It will also affect him for any other financing decisions.

The Feds impact on mortgage rates is greatly overestimated by many. I am guessing you are one of those.

Posted on 6/4/25 at 8:12 am to SlowFlowPro

Not sure. What was Congress like then?

Popular

Back to top

8

8