- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

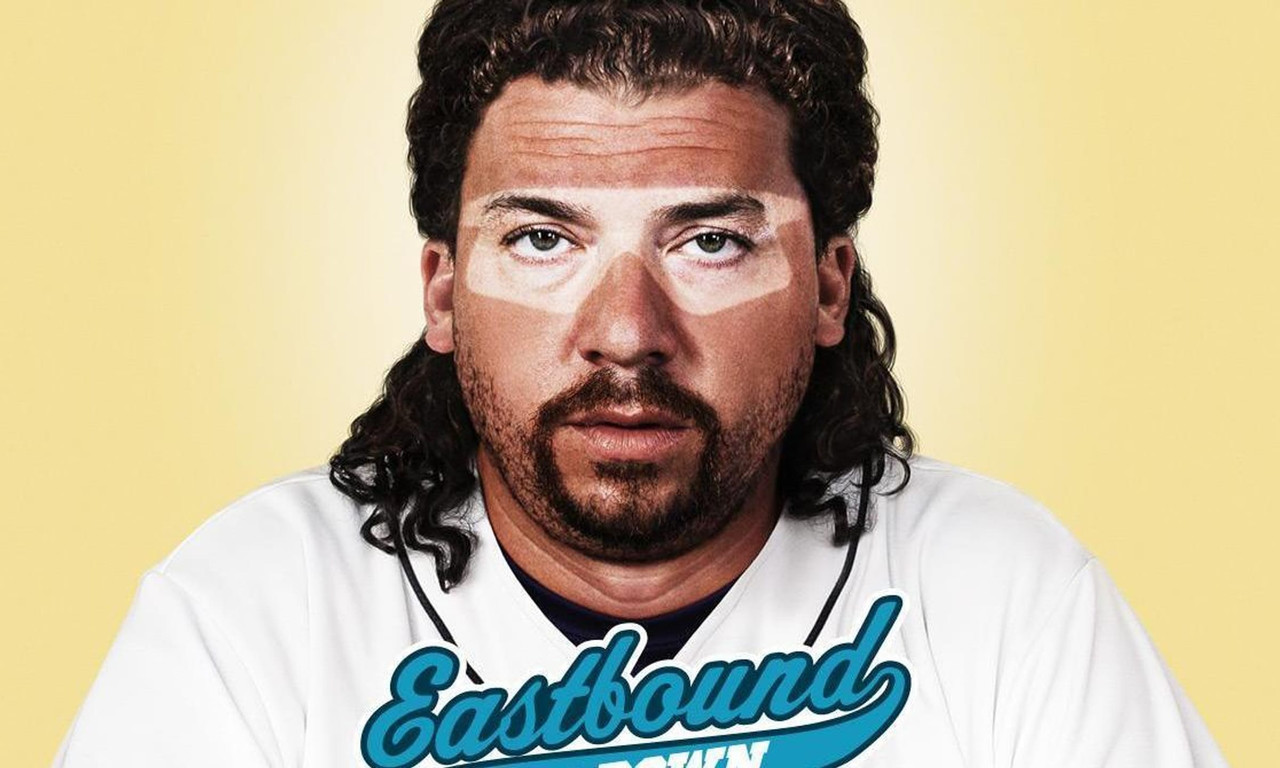

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

I have a question on Fire Insurance Coverage and being dropped

Posted on 1/11/25 at 5:50 pm

Posted on 1/11/25 at 5:50 pm

Numerous news reports talking about lots of people in the LA fire area having been dropped by their insurance companies recently.

So my question is this, if they were dropped several months ago, why did they not purchase insurance elsewhere? I realize that the market may have very few companies willing to take a new policy, but they have the California FAIR Plan, who has to take everyone.

California FAIR Plan is similar to Louisiana Citizens, who takes homeowners policies when someone cannot get it in the general market.

Again, why did these folks not purchase another policy when they were dropped? I have been dropped before and had 60 days written notice of the cancellation, giving me plenty of time to find coverage.

Also, if there is a mortgage on the home, the mortgage company will force a purchase or they will place a policy on the property and add it to your mortgage bill. Why did this not happen?

If those in question do not have a mortgage, then they should be in a financial position to purchase insurance with all of the monies not going towards a mortgage.

Did these folks not want to pay for the policy because it’s expensive, so they decided to take their chances?

So my question is this, if they were dropped several months ago, why did they not purchase insurance elsewhere? I realize that the market may have very few companies willing to take a new policy, but they have the California FAIR Plan, who has to take everyone.

California FAIR Plan is similar to Louisiana Citizens, who takes homeowners policies when someone cannot get it in the general market.

Again, why did these folks not purchase another policy when they were dropped? I have been dropped before and had 60 days written notice of the cancellation, giving me plenty of time to find coverage.

Also, if there is a mortgage on the home, the mortgage company will force a purchase or they will place a policy on the property and add it to your mortgage bill. Why did this not happen?

If those in question do not have a mortgage, then they should be in a financial position to purchase insurance with all of the monies not going towards a mortgage.

Did these folks not want to pay for the policy because it’s expensive, so they decided to take their chances?

Posted on 1/11/25 at 5:52 pm to Skippy1013

If it wasn’t insurable before it’s not going to be after, so what is the point of rebuilding at peak inflation and interest rates?

Posted on 1/11/25 at 5:52 pm to Skippy1013

Quit talking all this common sense.

Something, something, insurance companies are evil

Something, something, insurance companies are evil

Posted on 1/11/25 at 5:54 pm to Skippy1013

quote:

California FAIR Plan is similar to Louisiana Citizens, who takes homeowners policies when someone cannot get it in the general market.

The CA Fair Plan sucks and doesnt cover everyone

Plus it would be like 30k + a mnth on those homes of they did cover

Posted on 1/11/25 at 5:56 pm to Tiger Prawn

I don’t blame insurance companies pulling out. That state has its head up its arse and they knew at a point it wasn’t worth it. It’s not like they stayed and then didn’t cover it. This is all on the government not taking care of the issue and letting many things get out of hand.

Posted on 1/11/25 at 6:11 pm to Skippy1013

They were non-renewed at their renewal date and given the opportunity to go buy insurance elsewhere. Just like in Louisiana, California has a Fair Plan for anyone who can’t find insurance on the open market.

Posted on 1/11/25 at 6:14 pm to momentoftruth87

quote:

don’t blame insurance companies pulling out. That state has its head up its arse and they knew at a point it wasn’t worth i

Louisianas DOI used to be the biggest pain in the arse in the US but that’s been blown by by CA.

Insurance companies saw the wildfire risk, the cuts to the fire dept, the lack of wildfire prevention and tried to adequately price their risk, but the DOI wouldn’t let companies charge the right price, along with a bunch of other bs regulations they had to abide by. Many companies pulled out over this. CA politicians and their DOI fricked its residents, not insurance companies.

Posted on 1/11/25 at 6:17 pm to Slickback

Elections at all levels have consequences and the amount of idiots in leadership the last 10 years is showing.

Posted on 1/11/25 at 6:20 pm to Skippy1013

It’s convenient to blame insurance companies. I would venture some libel lawsuits will come of these fires. News outlets and celebrities are spreading false information that will no doubt cause financial harm.

The truth is these people had notice from 2023 that they would be non-renewed. State Farm non-renewed 29,000 homeowners, but they still insure 2 MILLION homes in CA. People love to live based on emotion and not fact

The truth is these people had notice from 2023 that they would be non-renewed. State Farm non-renewed 29,000 homeowners, but they still insure 2 MILLION homes in CA. People love to live based on emotion and not fact

Posted on 1/11/25 at 6:24 pm to Skippy1013

Calibrate states they can’t drop a costumer mid policy without cause (non payment or fraud)

Because Cali would not let insurers raise rates. They stopped renewing policies and writing new ones. Like in coastal regions from hurricanes. Big writers left and smaller ones remained and had extremely high rates. So a lot opted not to get coverage because it was “too expensive”

Because Cali would not let insurers raise rates. They stopped renewing policies and writing new ones. Like in coastal regions from hurricanes. Big writers left and smaller ones remained and had extremely high rates. So a lot opted not to get coverage because it was “too expensive”

Posted on 1/11/25 at 7:03 pm to Skippy1013

From my understanding, insurance companies knew the fire risk was high, so they wanted to get high premiums. The state of California told them no, so they canceled policies.

I don’t think there are any other insurance options available.

I don’t think there are any other insurance options available.

Posted on 1/11/25 at 7:16 pm to Skippy1013

Well this is the first time there’s ever been a crazy wildfire in Cali so they didn’t know the risk.

Oof.

Oof.

Posted on 1/11/25 at 7:41 pm to tigeraddict

Exactly. Insurance companies will cover anything as long as they can get their price. When state DOI’s refuse to approve insurers being able to raise rates to cover the risk they pull out of the market.

It’s price fixing by regulation that always resorts in shortages.

It’s price fixing by regulation that always resorts in shortages.

Posted on 1/11/25 at 8:06 pm to Skippy1013

I live in Florida and my Homeowner's insurance was dropped. It is a big problem here. I was given options in the declaration letter to renew with another group before drop deadline. I was given 3 options..............all cost much more.

Posted on 1/11/25 at 8:14 pm to Gondor

quote:

It is a big problem here. I was given options in the declaration letter to renew with another group before drop deadline. I was given 3 options..............all cost much more.

Florida has Citizens as an option of last resort. Just because it’s more expensive doesn’t mean it’s not priced properly. The issue with the companies leaving Florida was due to insolvency, they weren’t charging the correct premium and when big storms came they didn’t have reserves to cover.

You’re saying it’s a big problem in Florida but you had 3 options

Posted on 1/11/25 at 8:22 pm to Skippy1013

There’s a lot of misinformation out there. A simple Google search brings up many articles with all the necessary information. I just completed my continuing education for insurance and have nearly 20 years of experience in the industry. You cannot cancel a policy without proper notification. These individuals were notified, and any mortgage company with an interest in the property would have been informed as well. They could have—and should have—purchased insurance. They were literally playing with fire, and while it's easy to blame the "big, bad" insurance companies, the reality is that, in a valued policy state, they will promptly receive limits up front and can submit claims for personal property. Those who gambled by not getting insurance will be bailed out with taxpayer money, and that frustrates me.

People often mock those who live in hurricane-prone areas, but there's little criticism directed at those living in fire-prone areas like California, where homes are often overvalued and the risk is just as high.

I hope every single insurance company will subrogate against the state for the documented mismanagement.

California insurance crisis: Why are home insurance companies leaving California?

State Farm statement

People often mock those who live in hurricane-prone areas, but there's little criticism directed at those living in fire-prone areas like California, where homes are often overvalued and the risk is just as high.

I hope every single insurance company will subrogate against the state for the documented mismanagement.

California insurance crisis: Why are home insurance companies leaving California?

State Farm statement

Posted on 1/11/25 at 8:28 pm to DCtiger1

quote:

The truth is these people had notice from 2023 that they would be non-renewed. State Farm non-renewed 29,000 homeowners, but they still insure 2 MILLION homes in CA. People love to live based on emotion and not fact

Another emotional issue is the over-valuing of RE.

The market is undefeated, and while people have a home with book value x, they can't afford to pay market insurance rates for it, because insurers can't afford to cover the current inflated values of RE.

My comments also are in the aggregate and not towards any specific individual. It's more a plea for people to start understanding this and seeing the impact of their home value going brrrrr

Posted on 1/11/25 at 8:29 pm to DCtiger1

quote:

Just because it’s more expensive doesn’t mean it’s not priced properly.

The insurance contract is priced properly, but that's based on a property that is not priced properly (but insurance would have to pay that inflated price if a claim was made).

Posted on 1/11/25 at 8:41 pm to Slickback

You guys obvious haven’t ever dealt with insurance. I just litigated 5 cases this year that they denied with an average settlement value of over million. I am working on one ad d s bunch of zeros, a bunch.

Repeat for you insurance dick ducking mfers, they paid over million in every case they denied. Why I am a bad mfer lawyer they just caved.

Maybe many years ago, but simple truth is because they really had no defense to any of them. BTW punitive damages were not available in any of these cases we litigated all for over 2 years and these sorry mfer greedy clients included two church’s, and a low income housing complex.

This is how the game is played and I have played it with the mfers 100s of times .

In any significant claim, let’s say over 1 million they will deny 95% of the time. They will claim, Act of God, preexisting storm damage, improper construction, etc etc. They will just pull it out their arse if needed. They will hire essential criminal engineering companies like Rimkus, Hagee, the mfer pos in New Orleans that spun off, that give 90% or more of their business to insurance companies and they produce these 60 page reports that look great but are really cookie cutter bullshite and say whatever they need to say to deny the claim. This gets them out of extra contractual damages in most all states. (Not Louisiana, Florida, Nevada or California and I think maybe Illinois or Washington)

Then you are forced to get a lawyer etc but only about 15-20 % of people do. -and only 5% or so hire the right lawyers.the rest settle cheap or go away. So they are already saving billions.

Then you litigate cases for years and get lucky with some get them thrown out for some bullshite, Daubert challenge

Etc and run up the expenses and time on rest of them and 80% settle cheap. Then you have my cases which are like 10% or so of those filed, they knock our extra contractual damages and even in these cases after years of litigation and expenses we still end up settling because we can’t get attorneys fees or extra contractural damages and clients can’t risk it and Federal Courts want it to go away. So even in those cases handled by good competent lawyers with plenty of experience and funding they win as in best case scenario they are paying what they owe 2-3 years later. Then they pay their lobbyist to get your tax dollars for a payout. They spend billions a year on lobbyist. There will be a huge fire bailout . So they have never ever ever ever and never will pay more than 50% of the actual damage from any major catastrophe event. And most all of their exposure is covered by reinsurance with Lloyds of London. (The Rothchilds of alleged Illuminati's fame)

These mfers don’t deal in billions but trillions. At one time they controlled 40% -60% of wealth in America. I don’t give a flying frick if you are richest mfer in New Orleans etc, they can smash u like a mfering bug. Elon and tech Billionaires hate them and are scared to death of them. They and their cousins in Investment banking can make countries fall. You see insurance is really about investments but that’s a different story.

So if you feel sympathy for these mfers I hope and prey one day your home or business or live is destroyed and you or your family has to deal with them for years seeking to simply get what you owe. Any Christian that loves or supports them is definitely going to hell, and I will be holding the door for you

Repeat for you insurance dick ducking mfers, they paid over million in every case they denied. Why I am a bad mfer lawyer they just caved.

Maybe many years ago, but simple truth is because they really had no defense to any of them. BTW punitive damages were not available in any of these cases we litigated all for over 2 years and these sorry mfer greedy clients included two church’s, and a low income housing complex.

This is how the game is played and I have played it with the mfers 100s of times .

In any significant claim, let’s say over 1 million they will deny 95% of the time. They will claim, Act of God, preexisting storm damage, improper construction, etc etc. They will just pull it out their arse if needed. They will hire essential criminal engineering companies like Rimkus, Hagee, the mfer pos in New Orleans that spun off, that give 90% or more of their business to insurance companies and they produce these 60 page reports that look great but are really cookie cutter bullshite and say whatever they need to say to deny the claim. This gets them out of extra contractual damages in most all states. (Not Louisiana, Florida, Nevada or California and I think maybe Illinois or Washington)

Then you are forced to get a lawyer etc but only about 15-20 % of people do. -and only 5% or so hire the right lawyers.the rest settle cheap or go away. So they are already saving billions.

Then you litigate cases for years and get lucky with some get them thrown out for some bullshite, Daubert challenge

Etc and run up the expenses and time on rest of them and 80% settle cheap. Then you have my cases which are like 10% or so of those filed, they knock our extra contractual damages and even in these cases after years of litigation and expenses we still end up settling because we can’t get attorneys fees or extra contractural damages and clients can’t risk it and Federal Courts want it to go away. So even in those cases handled by good competent lawyers with plenty of experience and funding they win as in best case scenario they are paying what they owe 2-3 years later. Then they pay their lobbyist to get your tax dollars for a payout. They spend billions a year on lobbyist. There will be a huge fire bailout . So they have never ever ever ever and never will pay more than 50% of the actual damage from any major catastrophe event. And most all of their exposure is covered by reinsurance with Lloyds of London. (The Rothchilds of alleged Illuminati's fame)

These mfers don’t deal in billions but trillions. At one time they controlled 40% -60% of wealth in America. I don’t give a flying frick if you are richest mfer in New Orleans etc, they can smash u like a mfering bug. Elon and tech Billionaires hate them and are scared to death of them. They and their cousins in Investment banking can make countries fall. You see insurance is really about investments but that’s a different story.

So if you feel sympathy for these mfers I hope and prey one day your home or business or live is destroyed and you or your family has to deal with them for years seeking to simply get what you owe. Any Christian that loves or supports them is definitely going to hell, and I will be holding the door for you

Posted on 1/11/25 at 8:46 pm to TutHillTiger

All of that said, it’s incredible that the decline letters aren’t required to include information on the state programs and contact information.

And California is very fricked up but that’s because in an insurance crisis years ago the voters did a referendum that requires public hearings on any rate increase over 6 % a year and the commissioners are elected and even with all the non-Christians in LA, insurance companies are hated on

the west coast for a bunch of shite they pulled in 80s and 90s.

And California is very fricked up but that’s because in an insurance crisis years ago the voters did a referendum that requires public hearings on any rate increase over 6 % a year and the commissioners are elected and even with all the non-Christians in LA, insurance companies are hated on

the west coast for a bunch of shite they pulled in 80s and 90s.

Popular

Back to top

13

13