- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Has anyone shifted to Medishare or similar sharing plans?

Posted on 12/14/25 at 8:27 am to Demonbengal

Posted on 12/14/25 at 8:27 am to Demonbengal

I have a few friends that use it

One’s wife was diagnosed with cancer

Medishare has done a great job over last 10 years or so

The other hasn’t had any issues either for the last 5 years or so

Think of it this way, If they weren’t doing it right, the democrats would have been able to shut similar programs down which they really really wanted to do to monopolize with Obamacare

One’s wife was diagnosed with cancer

Medishare has done a great job over last 10 years or so

The other hasn’t had any issues either for the last 5 years or so

Think of it this way, If they weren’t doing it right, the democrats would have been able to shut similar programs down which they really really wanted to do to monopolize with Obamacare

Posted on 12/14/25 at 8:31 am to Spankum

quote:

As such, they are not regulated by federal and state laws covering coverage, not regulated as to how much profit they can make. There is also no recourse if they don’t pay when they are supposed to.

Just hopefully they are not run by some megachurch pastors that live in 67 room patronages, have private jets, wear expensive clothes, and travel around the world hunting exotic animals.

I know where your Medi ”share” is going and it is not going to cure your cancer.

Posted on 12/14/25 at 8:55 am to Misnomer

quote:

putting $500- $1k a month into a HSA for potential emergencies and look into direct primary care memberships in your area.

How are you able to contribute monthly to an HSA without being enrolled in a qualified high deductible health insurance plan?

Posted on 12/14/25 at 9:05 am to tigerforever7

quote:

How are you able to contribute monthly to an HSA without being enrolled in a qualified high deductible health insurance plan?

Just like OP, my husband is insured through his work and it is cheap to cover him, but very expensive to cover me. He funds the HSA and is allowed to use it on my healthcare.

Posted on 12/14/25 at 10:06 am to TDTOM

quote:

I looked at it, but both of my kids have scoliosis. They said it was pre-existing condition and would t be covered. I couldn’t take the risk if it progressed and needed surgery.

You’re in my same circumstance. I pay the full cost of BCBSLA for our daughter because she had scoliosis and now has developed other issues from that. It’s expensive, but she has to go physical therapy and sees doctors at least 12 times a year.

Posted on 12/14/25 at 10:07 am to DeltaTigerDelta

quote:

Why not just put her on your plan?

For perspective it might cost him $160 a pay period for self only but it jumps to $1200 - $1400 when adding dependents. This is a common problem.

Posted on 12/14/25 at 10:15 am to Misnomer

This is exactly the same as us. $160 for me and I have my daughter on there which makes it $910 a month for the two of us. If I added my wife I think it would jump to $1800 a month.

Posted on 12/14/25 at 10:30 am to Demonbengal

Yep. And my husband and I have $1000+ a month each in student loans. It's interesting that a lot of healthcare professionals in the $120K/year range go uninsured because they have to choose between student loans or health insurance.

Posted on 12/14/25 at 11:09 am to Misnomer

Insane. I hope at some point in the next few years the pressure will force changes in healthcare and the insurance side. Sadly, we’re not there yet.

Posted on 12/14/25 at 4:10 pm to Demonbengal

quote:

I have my daughter on there which makes it $910 a month for the two of us. If I added my wife I think it would jump to $1800 a month.

Ouch.

Posted on 12/14/25 at 6:57 pm to Demonbengal

quote:

Insane. I hope at some point in the next few years the pressure will force changes in healthcare and the insurance side. Sadly, we’re not there yet.

It’s in the process of collapsing.. by design. We will likely go to a single pay health coverage option in the next 3-5 years, like it or not.

That being said, the health share options are not as “taboo” as they once were. If you can qualify through underwriting they’re absolutely worth looking it and learning about.

This post was edited on 12/14/25 at 6:58 pm

Posted on 12/14/25 at 7:02 pm to Misnomer

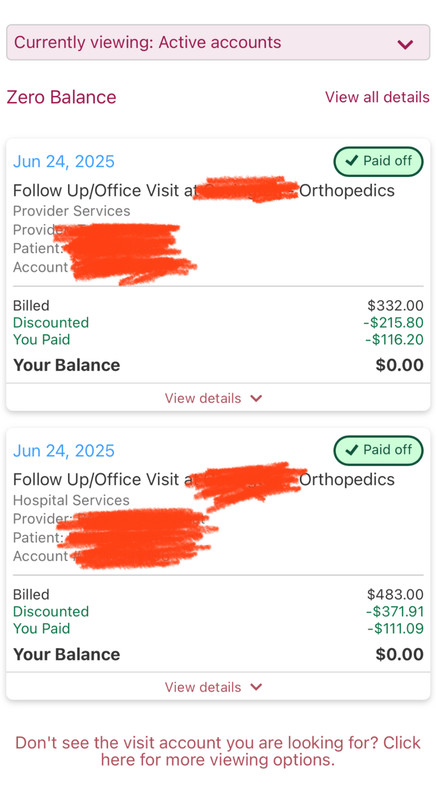

When you say “what they would have charged insurance”, is that the contractual amount insurance pays or the billed charges? Those are two vastly different amounts,

Posted on 12/14/25 at 7:14 pm to Demonbengal

I have it and love it. It is basically health insurance before Obama Care. As long as you don't have pre-existing conditions you are good. It was one third of the cost of my companies health plan.

Posted on 12/14/25 at 7:33 pm to Macavity92

quote:

When you say “what they would have charged insurance”, is that the contractual amount insurance pays or the billed charges? Those are two vastly different amounts,

True, and if you have a high deductible plan the patients often end up paying the ludicrous billed charges, not the secret contractual amount between the clinic and insurer that kicks in after a high deductible is met.

Here is an actual bill in mychart for my trigger finger injection. The billed charge represents what they'd have charged insurance if I had it. It doesn't reveal what the insurance would have actually paid them back, but if insured, I'd have paid that egregious amount more if deductible wasn't met. The cash patient discount is better than insurance.

It's a scam

Posted on 12/14/25 at 9:10 pm to Misnomer

quote:

True, and if you have a high deductible plan the patients often end up paying the ludicrous billed charges, not the secret contractual amount between the clinic and insurer that kicks in after a high deductible is met.

This secret contract must end.

The price what you pay cash or your portion should be based on the true cost of services and not an inflated amount only to collect a small portion because that is what the contract calls for for Medicare, Medicaid, Insurance company A, insurance company B, or cash pay.

I wonder if on the Explanation of Benefits that says your insurance paid X is a lie and really they only paid a lesser amount because that is what the contract called for.

Posted on 12/14/25 at 9:44 pm to Shepherd88

quote:

It’s in the process of collapsing.. by design. We will likely go to a single pay health coverage option in the next 3-5 years, like it or not.

I’m afraid you’re right. I was dead set against single payer, but after going from $320 a month for a family in 2008 to where I am today it’s not looking as bad. The result will be like Canada where, middle class and up, will all have a rider plan. We will all be taking that pain pill soon.

Popular

Back to top

0

0