- My Forums

- Tiger Rant

- LSU Score Board

- LSU Recruiting

- SEC Rant

- SEC Score Board

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Posted on 2/11/25 at 11:47 am to cgrand

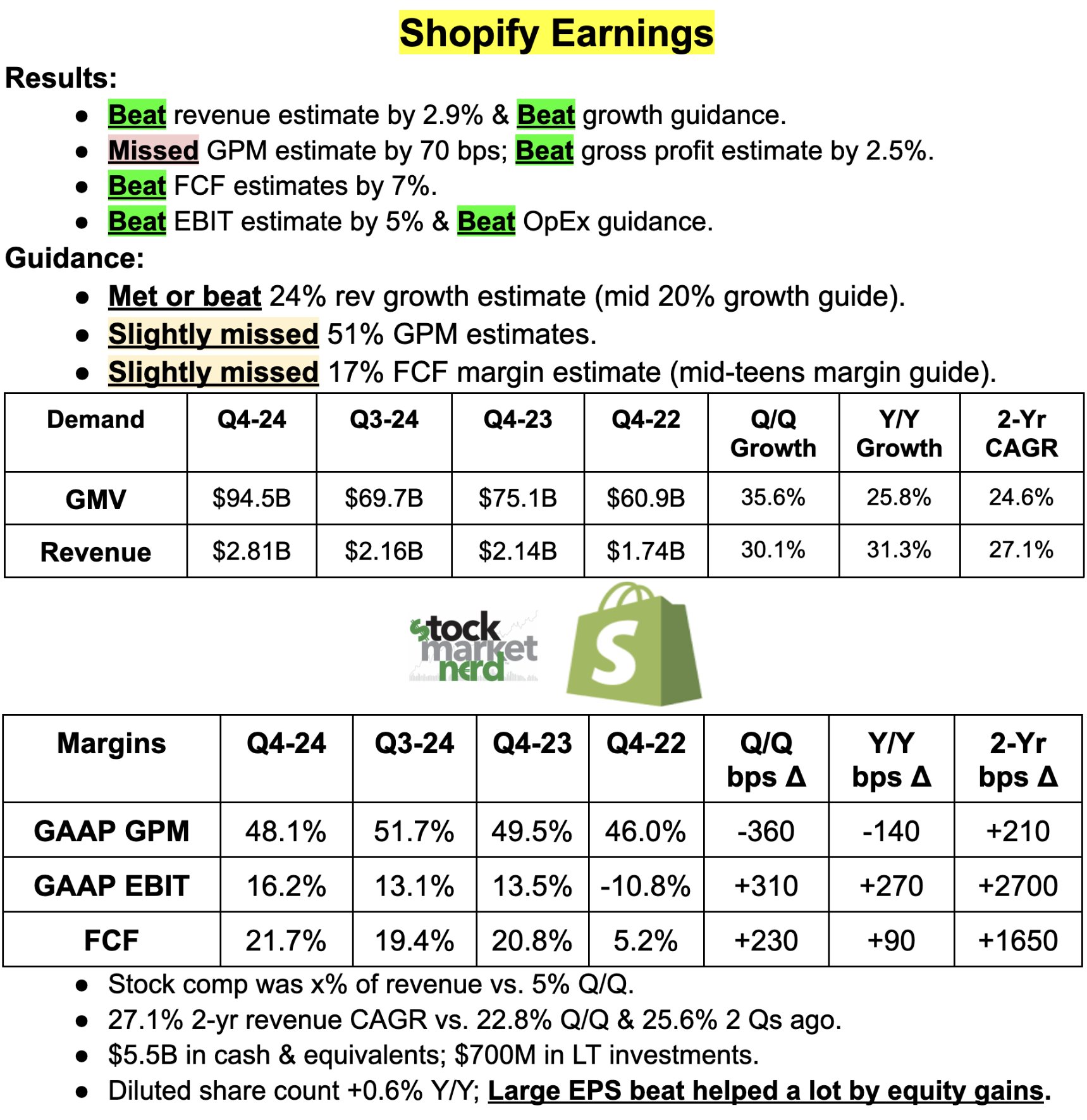

Citigroup maintains Shopify at Buy and raises the price target from $143 to $175

Citigroup maintains Walmart WMT at Buy and raises the price target from $98 to $120

Citigroup maintains Walmart WMT at Buy and raises the price target from $98 to $120

Posted on 2/11/25 at 12:38 pm to cgrand

Canaccord Genuity Raises $SHOP PT to $140 from $125; 'Not Just Taking a Larger Piece of the Pie, But Growing the Pie'

"There are a lot of things going right for Shopify, but it is without a doubt an expensive stock to own. Larger brands are increasingly moving to Shopify given the flexibility of the model at the high end (Plus, headless/Hydrogen, Composable, etc.); international continues to go well, as GMV growth outside of North America outpaced by 10 points, and the firm continues to localize the platform for new markets. Payment penetration continues to increase, up 4 points year over year, and Shop Pay is now 38% of GPV—a positive sign of continued share gains.

Newer efforts like POS and B2B continue to put up healthy growth rates, signaling that Shopify is having success opening up new growth vectors. We thought management said it well: 'we’re not just taking a larger piece of the pie, we’re growing the pie as well.'

Bottom line, if you put valuation aside for the moment, there’s not a lot of areas to poke holes in the Shopify story or recent execution. This is a firm that has put up 7 consecutive quarters of pro-forma revenue growth over 25%, and they crossed into delivering Rule of 50 metrics in Q4, which is pretty impressive.

In our experience, owning category-leading firms in large secular growth markets (Shopify still has only 12% North American e-commerce share and far less on a global commerce basis) is generally a good play in software. High valuations can obviously make stocks susceptible to swings on seemingly minute changes in key metrics, but if you can manage that volatility, this is a growth name that we believe investors should continue to own. Reiterate BUY."

Analyst: David Hynes

"There are a lot of things going right for Shopify, but it is without a doubt an expensive stock to own. Larger brands are increasingly moving to Shopify given the flexibility of the model at the high end (Plus, headless/Hydrogen, Composable, etc.); international continues to go well, as GMV growth outside of North America outpaced by 10 points, and the firm continues to localize the platform for new markets. Payment penetration continues to increase, up 4 points year over year, and Shop Pay is now 38% of GPV—a positive sign of continued share gains.

Newer efforts like POS and B2B continue to put up healthy growth rates, signaling that Shopify is having success opening up new growth vectors. We thought management said it well: 'we’re not just taking a larger piece of the pie, we’re growing the pie as well.'

Bottom line, if you put valuation aside for the moment, there’s not a lot of areas to poke holes in the Shopify story or recent execution. This is a firm that has put up 7 consecutive quarters of pro-forma revenue growth over 25%, and they crossed into delivering Rule of 50 metrics in Q4, which is pretty impressive.

In our experience, owning category-leading firms in large secular growth markets (Shopify still has only 12% North American e-commerce share and far less on a global commerce basis) is generally a good play in software. High valuations can obviously make stocks susceptible to swings on seemingly minute changes in key metrics, but if you can manage that volatility, this is a growth name that we believe investors should continue to own. Reiterate BUY."

Analyst: David Hynes

Posted on 2/11/25 at 2:40 pm to cgrand

BofA Securities analyst Brad Sills increased the price target on $SHOP to $140 from $134, while reiterating a Buy rating on the shares.

SHOP hit 52 week high today. If you own it you are happy

SHOP hit 52 week high today. If you own it you are happy

This post was edited on 2/11/25 at 2:47 pm

Posted on 2/11/25 at 2:56 pm to cgrand

I finally opened a small position in it today. So you baws get ready to buy the dip.

Posted on 2/12/25 at 8:51 am to HogPharmer

quote:i bought your dip at 117. appreciate you

I finally opened a small position in it today. So you baws get ready to buy the dip.

Posted on 2/12/25 at 9:02 am to LSUA 75

4129 posts

Back to top

Posted on 1/31/25 at 11:09 am to DawgCountry

“ the economy isn’t binary,it’s possible some people think it’s good,and some don’t”

Well,mortgages /rent are up.Automobiles are up and food prices are up.

Wife and I haven’t been affected by the economy but we rarely go to restaurants,keep our cellphones til they die,don’t get tattoos,don’t patronize vape shops (which seem to be everywhere).Never been to Starbucks in my life,keep our automobiles for years,etc,etc.

We do have a very good income also.

From what I observe many people spend too much money on non-essentials which in turn puts them in a bind to pay for essentials.

The number of people I see with mutiple tattoos is mind boggling,they aren’t cheap I’m sure.

_________

Keep doing what you are doing. The #1 lesson I try to ingrain into my young adult kids is "Spend less than you make".

Posted on 2/13/25 at 9:57 am to HogPharmer

quote:touched 128 today

I finally opened a small position in it today

Popular

Back to top

0

0