- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Putting the massive fiscal into perspective

Posted on 9/9/21 at 10:12 pm

Posted on 9/9/21 at 10:12 pm

I came across this statistic today and it really got the macro wheels turning in terms of understanding just how large the trillions in US stimulus is.

The electricity industry is the most capital intensive industry on the planet, with global capex of $780 billion. Oil and gas is second, with global capex of $760 billion. (source: A Question of Power, by Robert Bryce).

The 2020 US deficit alone (which is just the deficit, not total spending) was $3.1 trillion. Thus, the US deficit spending alone (again, not total spending) was akin to all capex for the electricity industry AND the oil and gas industry across the ENTIRE world, times TWO.

And yet we are just now back to sniffing out the pre-COVID trend line in terms of nominal GDP (in real terms, it’s even worse), even though in 2020 we spent enough money to maintain the equivalent of multiple global electric grids and oil and gas complexes …

We will never pay off the debt.

The electricity industry is the most capital intensive industry on the planet, with global capex of $780 billion. Oil and gas is second, with global capex of $760 billion. (source: A Question of Power, by Robert Bryce).

The 2020 US deficit alone (which is just the deficit, not total spending) was $3.1 trillion. Thus, the US deficit spending alone (again, not total spending) was akin to all capex for the electricity industry AND the oil and gas industry across the ENTIRE world, times TWO.

And yet we are just now back to sniffing out the pre-COVID trend line in terms of nominal GDP (in real terms, it’s even worse), even though in 2020 we spent enough money to maintain the equivalent of multiple global electric grids and oil and gas complexes …

We will never pay off the debt.

This post was edited on 9/9/21 at 10:16 pm

Posted on 9/9/21 at 10:27 pm to RedStickBR

Don't worry, the current admin has plans to get spending under control.

ETA: HAHA JK, but don't worry, we will just tax the billionaires.

ETA2: HAHA JK, the billionaires only have like 4 trillion in total wealth, a 100% tax in everything they own wouldn't do shite to our debt.

ETA: HAHA JK, but don't worry, we will just tax the billionaires.

ETA2: HAHA JK, the billionaires only have like 4 trillion in total wealth, a 100% tax in everything they own wouldn't do shite to our debt.

This post was edited on 9/9/21 at 10:31 pm

Posted on 9/9/21 at 10:28 pm to RedStickBR

quote:there has never been any interest in paying off the debt. The federal reserve and dollar currency only works if debt continues to build. There are many good youtube videos that explain this. the house of cards would collapse if we paid off the debt.

We will never pay off the debt.

Posted on 9/9/21 at 10:34 pm to arcalades

It also only works if you grow your gdp. Instead we are doing everything possible to hinder gdp while surging debt. Everyone loses in the end of this story.

This post was edited on 9/9/21 at 10:42 pm

Posted on 9/10/21 at 8:31 am to arcalades

quote:

the house of cards would collapse if we paid off the debt.

Jeez dude you don't even have to take it that far. Pull back spending and it collapses

Best part is that may happen in 2022

Posted on 9/10/21 at 8:52 am to wutangfinancial

That PPI report  And we are basically beyond the y/y base effect comps at this point, yet Core y/y PPI just accelerated by 260bps compared to the first base effect month (May report for Apr month).

And we are basically beyond the y/y base effect comps at this point, yet Core y/y PPI just accelerated by 260bps compared to the first base effect month (May report for Apr month).

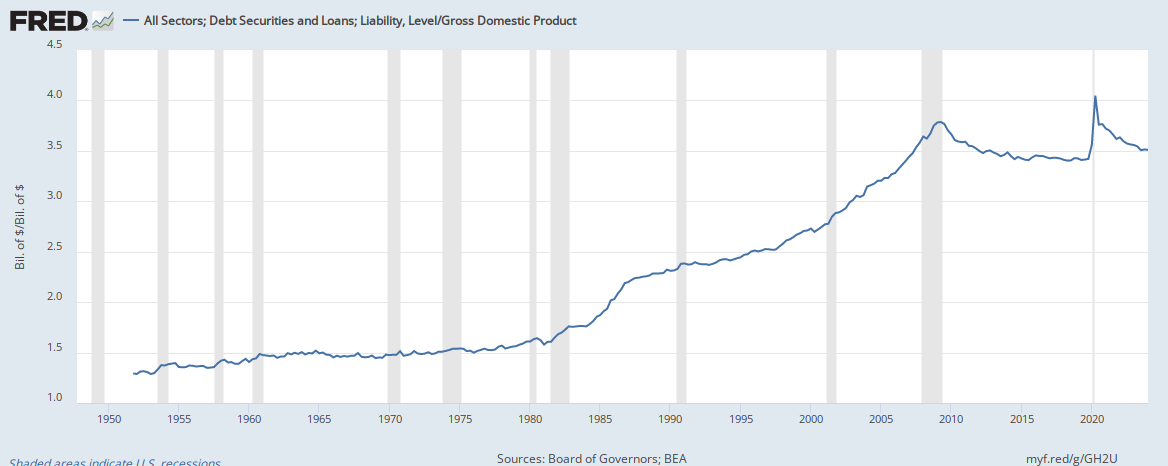

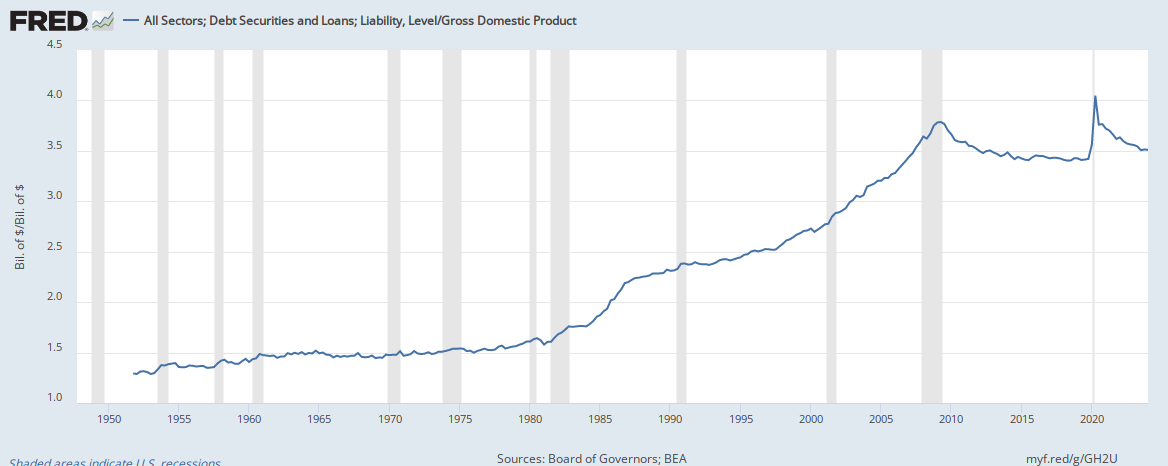

That fiscal and monetary and unemployment benefit and eviction moratorium cliff we are about to see should go overly splendidly in a 350%+ Debt to GDP economy.

That fiscal and monetary and unemployment benefit and eviction moratorium cliff we are about to see should go overly splendidly in a 350%+ Debt to GDP economy.

Posted on 9/10/21 at 10:24 am to RedStickBR

quote:

We will never pay off the debt.

What happens when a critical mass start to believe this...?

Posted on 9/10/21 at 10:34 am to RedStickBR

Plus we have an administration that is actively sabatoging economic recovery ala Covid policy

Posted on 9/10/21 at 10:55 am to RedStickBR

quote:

We will never pay off the debt.

There is no intention to do so. We will continue to refinance the debt at low interest rates. It works as long as US treasuries remain the relative safest place to invest. And thankfully... as irresponsible as our fiscal management has been in the US... the rest of the world is just as bad, if not worse.

Posted on 9/10/21 at 11:47 am to LSUFanHouston

I’m not referring to paying it off entirely. Of course we shouldn’t do that. I could have been clearer on that point.

I’m referring to even getting Debt to GDP down to a meaningful level short of financial repression, Fed monetizing the debt and then effectively writing it off, defaults and restructurings, or some sort of economic growth miracle.

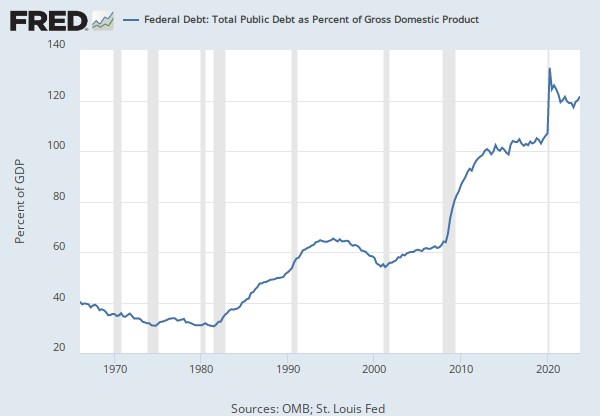

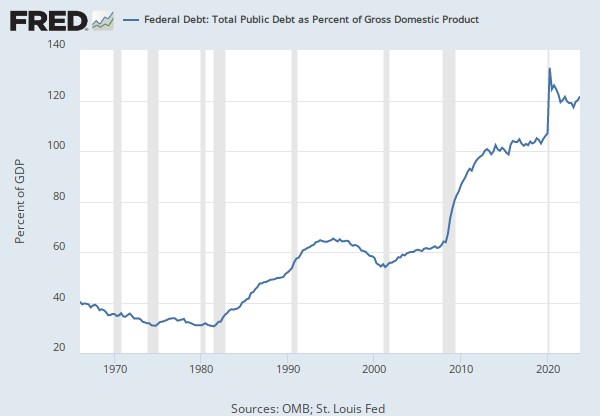

Even the MMTers recognize inflation as a constraint on deficit spending. Absent financial repression, how will we ever get back to, say, pre-COVID debt to GDP levels? Or do we not need to because interest rates are low? In which case, are we admitting the Fed will never be able to raise rates again? Because refinancing this at higher rates will be a bitch:

I’m referring to even getting Debt to GDP down to a meaningful level short of financial repression, Fed monetizing the debt and then effectively writing it off, defaults and restructurings, or some sort of economic growth miracle.

Even the MMTers recognize inflation as a constraint on deficit spending. Absent financial repression, how will we ever get back to, say, pre-COVID debt to GDP levels? Or do we not need to because interest rates are low? In which case, are we admitting the Fed will never be able to raise rates again? Because refinancing this at higher rates will be a bitch:

This post was edited on 9/10/21 at 11:57 am

Posted on 9/10/21 at 3:07 pm to RedStickBR

quote:We dont need to. We need to cancel the debt and send the bill to China for the virus. Period

We will never pay off the debt.

Popular

Back to top

5

5