- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Precious metals: A cautionary tale

Posted on 12/5/25 at 4:26 pm

Posted on 12/5/25 at 4:26 pm

So the Scottsdale mint and SD Bullion have teamed up to release the commanders series. Every release they release a poster, a 5 oz silver coin, a 1 oz gold coin, and a 1/10 oz gold coin for each commander.

Today they released the George Washington set. The first release was 2 years ago in Napoleon Bonaparte.

They promised to release 3 commanders a year for 4 years and 12 in total.

2024:

Napoleon

Patton

Cortes

2025:

Caesar

Grant

Charlemagne

2026:

Washington

Sadly there are still 5 more releases to get through but the costs are becoming prohibitive.

My first 5oz silver coin & poster combo cost $179.11

The George Washington version cost: $372.34

That's an over doubling in 2 years. I do want to complete the set but my god how much are the 2027 releases going to cost? Please note the complete set is defined as 12x posters, 12x 5 oz silver coins, 12x 1/10 oz gold coins, and 12x 1 oz gold coins.

Will we be in the $7,500 range? I'm going to need a new job lol

Today they released the George Washington set. The first release was 2 years ago in Napoleon Bonaparte.

They promised to release 3 commanders a year for 4 years and 12 in total.

2024:

Napoleon

Patton

Cortes

2025:

Caesar

Grant

Charlemagne

2026:

Washington

Sadly there are still 5 more releases to get through but the costs are becoming prohibitive.

My first 5oz silver coin & poster combo cost $179.11

The George Washington version cost: $372.34

That's an over doubling in 2 years. I do want to complete the set but my god how much are the 2027 releases going to cost? Please note the complete set is defined as 12x posters, 12x 5 oz silver coins, 12x 1/10 oz gold coins, and 12x 1 oz gold coins.

Will we be in the $7,500 range? I'm going to need a new job lol

Posted on 12/5/25 at 7:23 pm to Pimphand

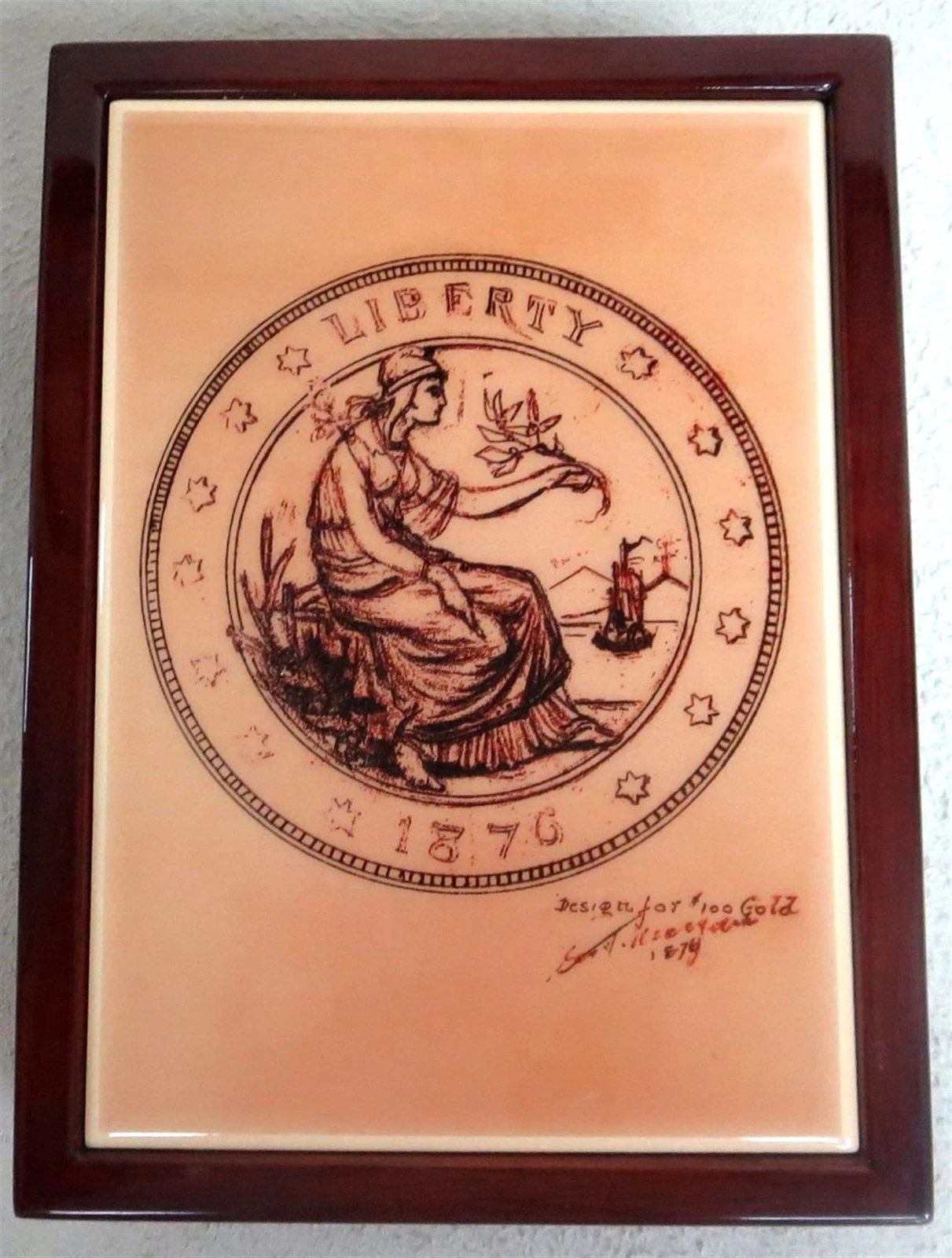

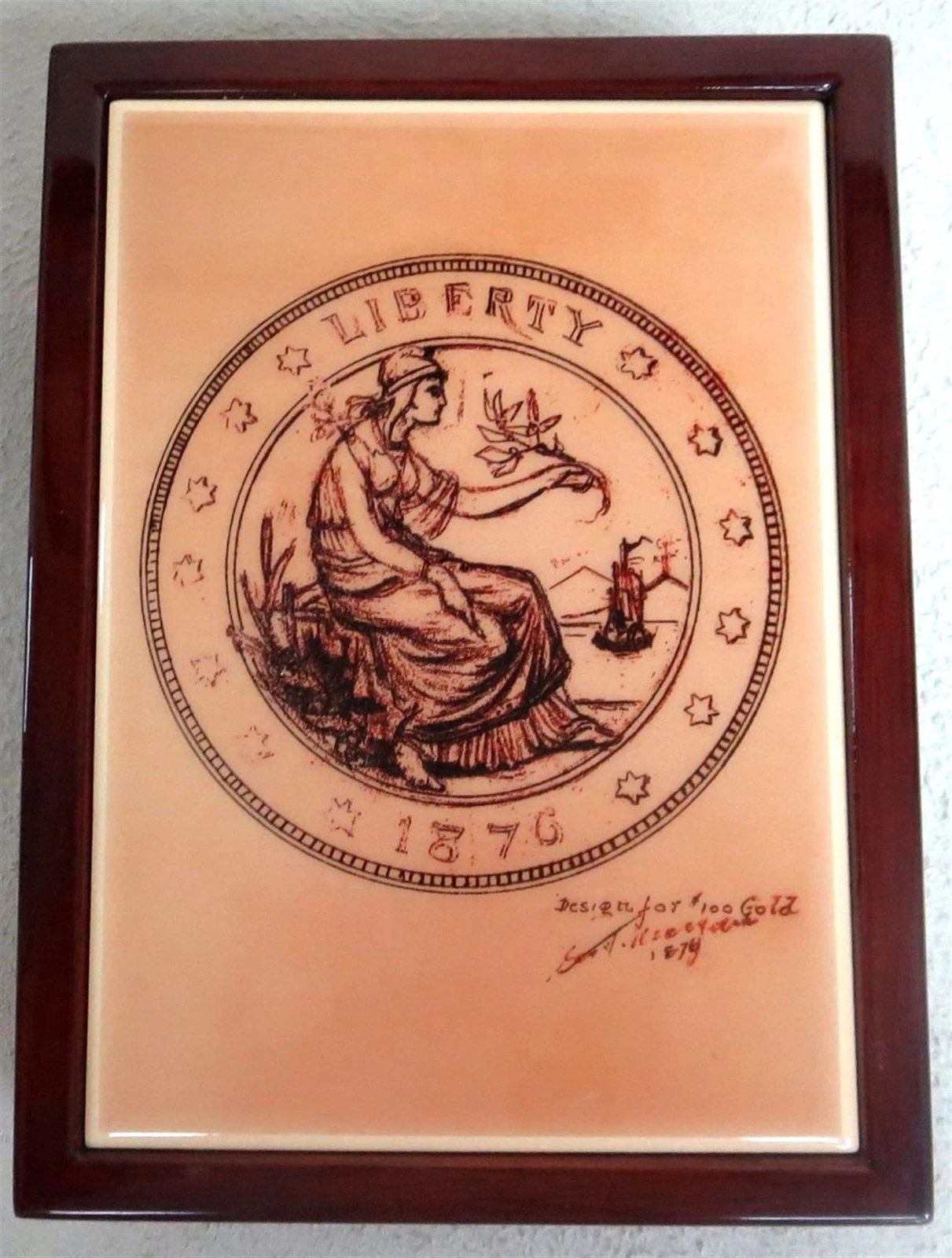

I only have one "specialty" coin in gold. Morgan designed it in 1876 but nobody got around to minting it until 2002. It is not make by the US government, but is 1 Troy oz. gold.

It came in a fancy little box

It came in a fancy little box

Posted on 12/6/25 at 9:06 am to Pimphand

Metals go up; metals go down. Been dabbling with shiny for over a decade now.

What’s happening currently is unlike anything I’ve seen before. The last pricing surge was 2008-12’. This was during the global financial crisis and Great Recession. Housing prices tanked, a lot of people lost their asses and the stock market had two years of negative or breakeven performance.

The current surge in pricing is exponentially greater than the last and nobody wants to say aloud why that is. The stock market has been on a tear. So it’s not that. There’s no recession as of yet. So gold/silver pricing is clearly decoupled from the market and stated economic fundamentals.

So what’s prompting the surge? It’s a few things. The election of one Donald J Trump is one. Gold was at $2,600 in October of last year. The month before he was elected. Still at a historic high to be clear; but, only a few hundred dollars above the previous surge high a decade earlier. It’s hovering around $4,300 today. Things changed after Election Day. It’s widely believed that his economic policies are going to torpedo the US and global economy so people worldwide invest in metals as a historic hedge. At a broader level; foreign countries which have historically invested in US Treasuries are worried that our countries debt is unsustainable, may choose to not buy for political reasons and have undoubtedly taken note that the $USD has lost 10% of its value in the past year. So these foreign governments and institutions are shifting to gold too. At the same time; you’ve got crypto bros shifting from meme coins to metals. Silver in particular. There’s entire wallstreetbets type groups devoted to physical and or options trades. So there’s concerted manipulation going on too. Think GameStop version 2.0 particularly with silver.

When will prices stop climbing? I have no idea. I think it’s entirely possible; if not likely, that prices will continue to climb. Particularly if the R-word (recession) becomes a thing.

What’s happening currently is unlike anything I’ve seen before. The last pricing surge was 2008-12’. This was during the global financial crisis and Great Recession. Housing prices tanked, a lot of people lost their asses and the stock market had two years of negative or breakeven performance.

The current surge in pricing is exponentially greater than the last and nobody wants to say aloud why that is. The stock market has been on a tear. So it’s not that. There’s no recession as of yet. So gold/silver pricing is clearly decoupled from the market and stated economic fundamentals.

So what’s prompting the surge? It’s a few things. The election of one Donald J Trump is one. Gold was at $2,600 in October of last year. The month before he was elected. Still at a historic high to be clear; but, only a few hundred dollars above the previous surge high a decade earlier. It’s hovering around $4,300 today. Things changed after Election Day. It’s widely believed that his economic policies are going to torpedo the US and global economy so people worldwide invest in metals as a historic hedge. At a broader level; foreign countries which have historically invested in US Treasuries are worried that our countries debt is unsustainable, may choose to not buy for political reasons and have undoubtedly taken note that the $USD has lost 10% of its value in the past year. So these foreign governments and institutions are shifting to gold too. At the same time; you’ve got crypto bros shifting from meme coins to metals. Silver in particular. There’s entire wallstreetbets type groups devoted to physical and or options trades. So there’s concerted manipulation going on too. Think GameStop version 2.0 particularly with silver.

When will prices stop climbing? I have no idea. I think it’s entirely possible; if not likely, that prices will continue to climb. Particularly if the R-word (recession) becomes a thing.

This post was edited on 12/6/25 at 10:31 am

Posted on 12/6/25 at 11:47 am to Pimphand

If you don’t want it, don’t buy it.

I’m not sure what the cautionary part is

I’m not sure what the cautionary part is

Popular

Back to top

3

3