- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Posted on 11/26/25 at 8:01 am to Jax-Tiger

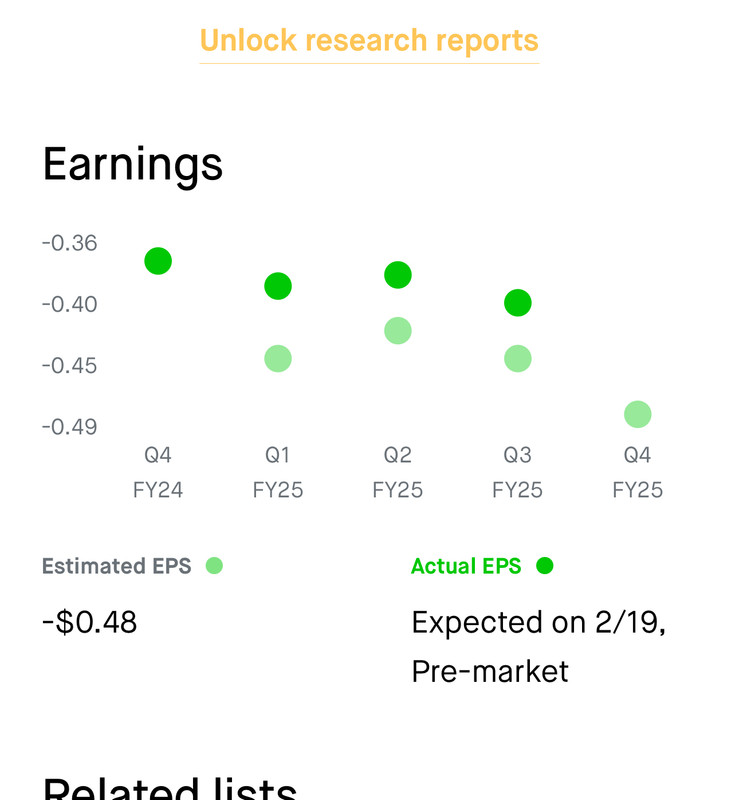

Why is there such a dropoff in expected earnings next quarter for both nbis and iren?

Posted on 11/26/25 at 8:05 am to LChama

Where did you see a drop off?

Posted on 11/26/25 at 8:08 am to LChama

quote:

Why is there such a dropoff in expected earnings next quarter for both nbis and iren?

That's what happens when you dilute your stock by 20% over the last 1.5 months and add a lot of additional capital expenses for expansion

Posted on 11/26/25 at 8:12 am to Jax-Tiger

This is from robinhood. Not sure how accurate. -.54 on zacks also.

This post was edited on 11/26/25 at 8:32 am

Posted on 11/26/25 at 8:49 am to LChama

quote:

This is from robinhood. Not sure how accurate. -.54 on zacks also.

Okay. Fidelity doesn't show next quarter estimates, at this time.

Posted on 11/26/25 at 8:51 am to Jax-Tiger

Sold off everything here around $95-$95.10, will wait for a dip to buy back. What a great morning!

Posted on 11/26/25 at 9:07 am to IT_Dawg

Le sigh. Hope it holds

This post was edited on 11/26/25 at 9:08 am

Posted on 11/26/25 at 9:20 am to meeple

Hoping it dips a little bit more back into the $91 range, then I will load back up for an afternoon rally

loaded back up around $92, looking for a fun run back up to $95 this afternoon.

loaded back up around $92, looking for a fun run back up to $95 this afternoon.

This post was edited on 11/26/25 at 11:28 am

Posted on 11/26/25 at 1:18 pm to IT_Dawg

It's not wanting to get much above $93...

Posted on 11/26/25 at 1:48 pm to Jax-Tiger

Pretty low volume day.

Just glad to see recovery here in some of my names.

Indexes barely sold off. Some individual names like NBIS got whacked.

Just glad to see recovery here in some of my names.

Indexes barely sold off. Some individual names like NBIS got whacked.

Posted on 11/26/25 at 2:16 pm to LSUcam7

Woohoo!! Another great NBIs day!

LFG.

LFG.

Posted on 11/26/25 at 2:31 pm to LChama

quote:

One piece of info left before industry changing announcement by data one?

I suspect this has to do with power consumption. If they can significantly cut power consumption, that would make their parameter cheaper and eliminate some of the bottlenecks.

Could mean a lot of things. Maybe they are renewable or maybe generating power using the heat from the GPUs. Will be interesting to see if this produces a competitive advantage over competitors.

Posted on 11/26/25 at 8:25 pm to Jax-Tiger

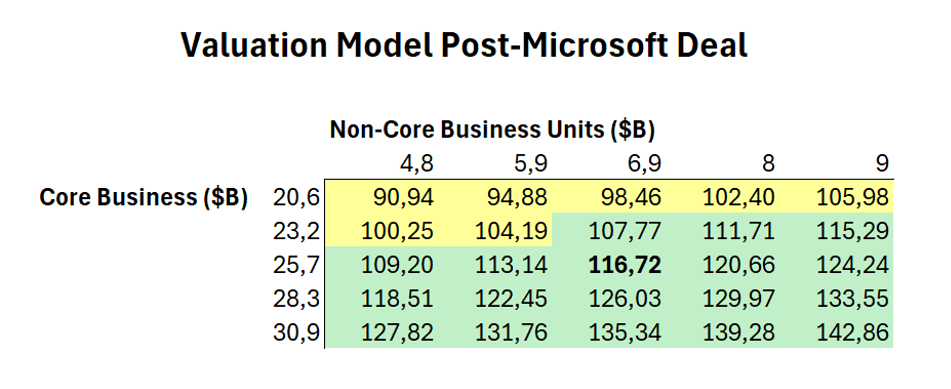

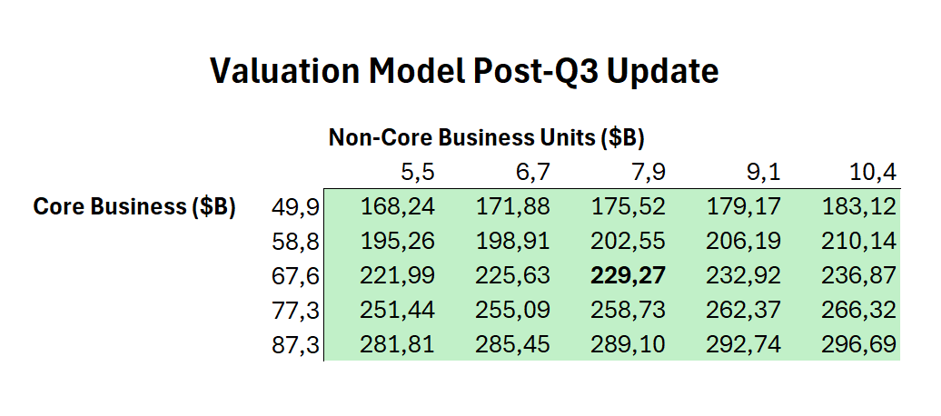

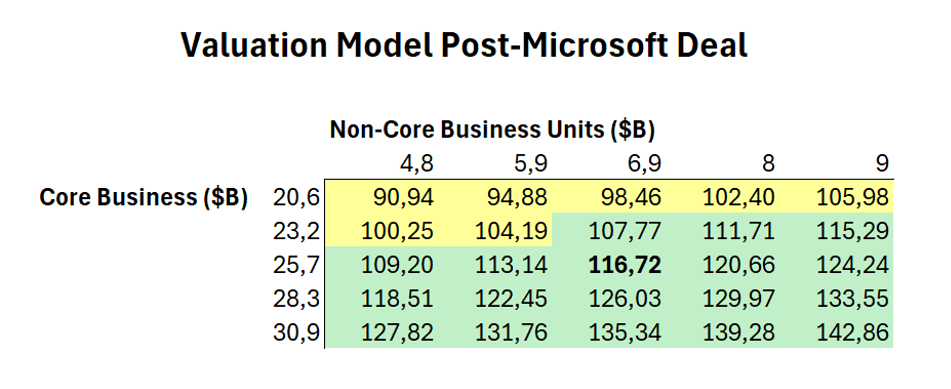

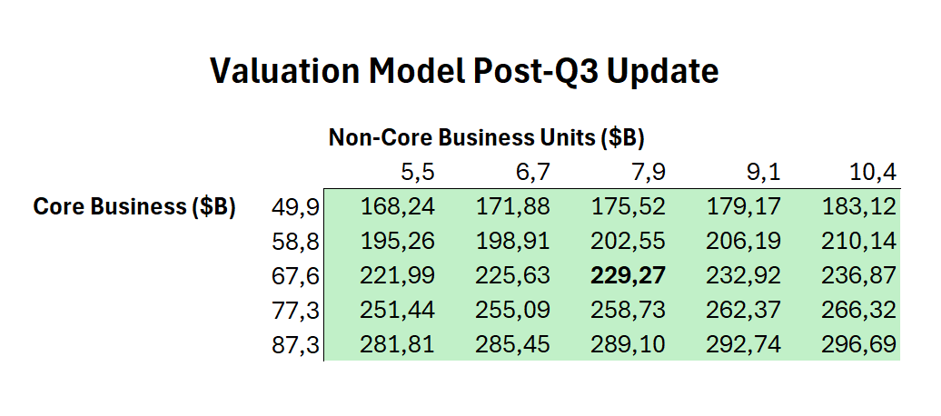

M.V. Cunha Updated NBIS Valuations

His 2026 model-

Even in his bear case.. $168. Let’s hope he’s got 2026 figured out as well as he did this year.

quote:Should be noted that he took the valuations up at some point. Originally had it modeled for roughly $12.5B market cap in March 2025.

Before we begin, it’s worth revisiting my previous valuation model, which focused on YE2025.

His 2026 model-

Even in his bear case.. $168. Let’s hope he’s got 2026 figured out as well as he did this year.

quote:

Here, it’s important to clarify two points:

1) The “bear case” I’m presenting doesn’t mean the stock can’t finish the year well below that level. My scenarios assume a relatively stable market backdrop. A true bear case would require a broader disruption in AI compute demand, and if that happened, every AI-exposed company would miss expectations and sector-wide valuations would compress sharply. As I’ve said since the beginning, this is a high-risk, high-volatility business, and investors must be prepared for that.

2) Despite the subjectivity involved and the dependency on AI market conditions, I truly believe most of my base assumptions remain conservative, especially considering the quality of this team. The $235.39 figure is NOT a Price Target. Execution will evolve, new data will emerge, and assumptions will need to be updated accordingly (just like I’ve been doing throughout the year). It’s simply a benchmark to illustrate that, even under what I consider reasonable inputs, the potential upside remains meaningful, even after my position has appreciated nearly 300%.

Posted on 11/26/25 at 8:31 pm to LSUcam7

quote:

Even in his bear case.. $168. Let’s hope he’s got 2026 figured out as well as he did this year.

This has all been known by many and actually higher by a lot of analysts. The problem isn't traditional valuation and stock trading, but the forces that control the market and force this down.

That is the reason I have switched my strategy from holding calls to day trading. I shite you not, its a lot more work, but damn it pays off when you watch it.

You can buy the stock or LEAPs and it will pay off, but day trading this stock will make you a millionaire right now.

Posted on 11/26/25 at 8:48 pm to IT_Dawg

It can also blow your account up in a few sessions.

One news headline. One tweet. A lot of scenarios. The leverage can make you and break you.

One news headline. One tweet. A lot of scenarios. The leverage can make you and break you.

Posted on 11/26/25 at 10:02 pm to LSUcam7

quote:

It can also blow your account up in a few sessions.

One news headline. One tweet. A lot of scenarios. The leverage can make you and break you.

Absolutely - thats why you set stop limits and when day trading, only hold when you have ability to observe and trade...

I have also been trading both calls and puts throughout the day...so, if there was a "blow up your account" moment, I could be holding puts

This post was edited on 11/26/25 at 10:04 pm

Posted on 11/27/25 at 10:14 am to IT_Dawg

Happy Thanksgiving Nebs! Never take a day off i guess.

Can anyone give a synopsis of the base and bear cases as it relates to the possible dillution? Bullish signals everywhere with this stock and now talk of s&p 8000 in 2026 (i know we are nq). But ive been a bagholder too many times so want to be able to answer this acceptably to myself. Is the only real safety net owning puts at all times?

I read an iot post that there are max nbis shares shorted right now. so either we’re set up for a massive squeeze or the opposite. @ITdawg or Lsucam7

Can anyone give a synopsis of the base and bear cases as it relates to the possible dillution? Bullish signals everywhere with this stock and now talk of s&p 8000 in 2026 (i know we are nq). But ive been a bagholder too many times so want to be able to answer this acceptably to myself. Is the only real safety net owning puts at all times?

I read an iot post that there are max nbis shares shorted right now. so either we’re set up for a massive squeeze or the opposite. @ITdawg or Lsucam7

This post was edited on 11/27/25 at 10:15 am

Popular

Back to top

1

1