- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Nebius - NBIS - AI Infrastructure Company

Posted on 2/12/25 at 7:44 am to LChama

Posted on 2/12/25 at 7:44 am to LChama

CPI came in hot. Most everything will be on sale. Sucks that it has nothing to do with NBIS, but it has shown excellent relative strength outside of DeepSeek. We’ll see if it can hold $40 today.

Glad my Roth is 15% cash right now.

Glad my Roth is 15% cash right now.

Posted on 2/12/25 at 7:58 am to bayoubengals88

Buying some at open at this price in case it pops. If it dips I’ll add more.

Posted on 2/12/25 at 8:33 pm to bayoubengals88

NBIS is now the fourth largest holding for Robert Citrone’s Discovery Capital, representing 3.6% of the hedge fund’s value.

The filing just came in today.

The filing just came in today.

Posted on 2/12/25 at 8:36 pm to bayoubengals88

Hmmmm….he too bought at 27.67…

The last three large purchases (over one million shares) that were filed this week were ALL bought right at $27.70.

The last three large purchases (over one million shares) that were filed this week were ALL bought right at $27.70.

Posted on 2/12/25 at 9:29 pm to bayoubengals88

What does all of this mean for us minnows?

Posted on 2/12/25 at 9:31 pm to bayoubengals88

Good sign. If Pelosi takes a position I’ll feel even better.

Posted on 2/12/25 at 9:37 pm to meeple

Banks and funds buying drives price higher and also stabilizes share price. Retail (us) is more reactionary. This would not have gone down 40% in one day if it was 80% owned by institutional investors.

You want to have your money where banks and funds invest their money. Especially before they’ve caught on. They’re still catching on…

I added 55 shares today. Probably done for a while.

Edit: I actually added 65.5 shares. All Roth.

You want to have your money where banks and funds invest their money. Especially before they’ve caught on. They’re still catching on…

I added 55 shares today. Probably done for a while.

Edit: I actually added 65.5 shares. All Roth.

This post was edited on 2/12/25 at 9:51 pm

Posted on 2/12/25 at 9:57 pm to bayoubengals88

Did you hit 500 shares yet

Posted on 2/12/25 at 10:12 pm to LChama

750 now, plus four long calls.

Posted on 2/12/25 at 10:17 pm to bayoubengals88

Added 80 shares today, half of which is a starting position in my Roth

Brokerage is 160 shares at 33. Like I said before, a minnow here.

I guess I’m going to start working on my Roth now that I’ve freed up some cash in there.

Brokerage is 160 shares at 33. Like I said before, a minnow here.

I guess I’m going to start working on my Roth now that I’ve freed up some cash in there.

This post was edited on 2/12/25 at 10:18 pm

Posted on 2/13/25 at 6:38 am to bayoubengals88

quote:

750 now,

I see you big balla!!!

Posted on 2/13/25 at 2:14 pm to sonoma8

haha^

- - - - - -

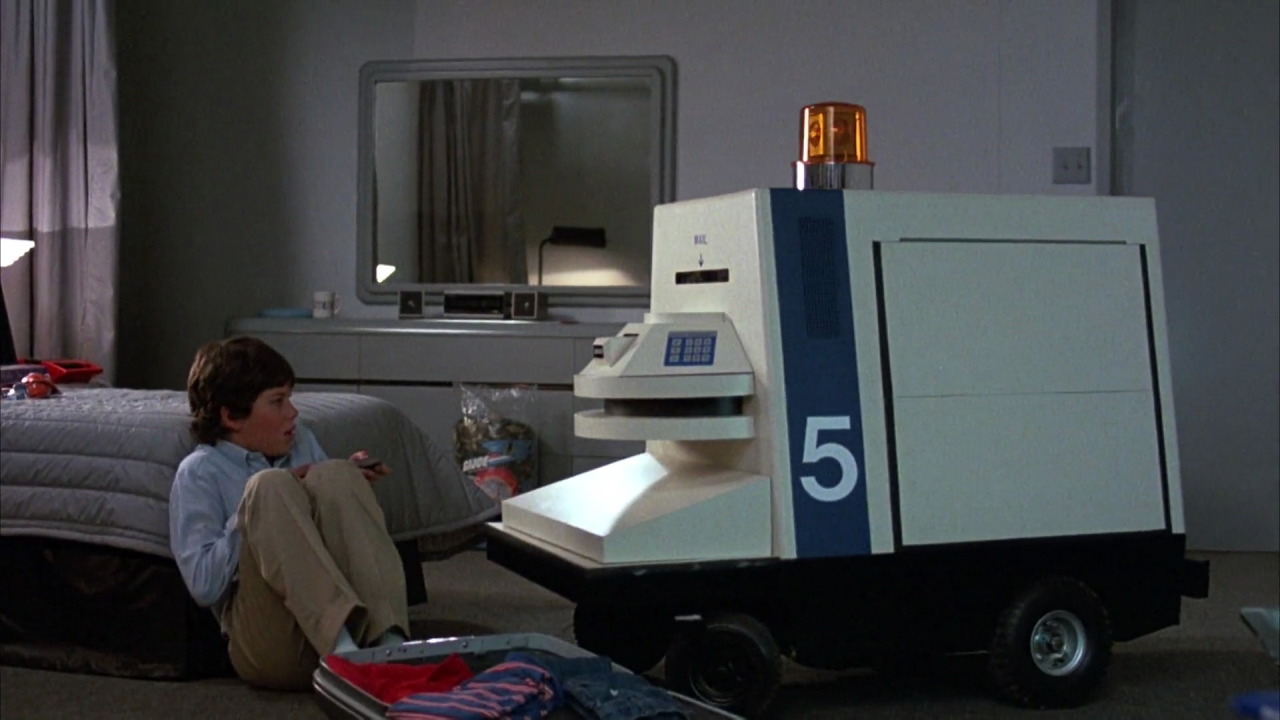

Uber Eats has enlisted Avride sidewalk robots to deliver food as part of a multiyear partnership. This is the first location on the east coast to get started. Other locations include Austin, TX and Ohio State University.

Newspaper Article

- - - - - -

Uber Eats has enlisted Avride sidewalk robots to deliver food as part of a multiyear partnership. This is the first location on the east coast to get started. Other locations include Austin, TX and Ohio State University.

Newspaper Article

This post was edited on 2/13/25 at 2:16 pm

Posted on 2/13/25 at 2:16 pm to bayoubengals88

Posted on 2/13/25 at 2:30 pm to bayoubengals88

quote:

Avride sidewalk robots to deliver food

This post was edited on 2/13/25 at 4:15 pm

Posted on 2/13/25 at 3:57 pm to bayoubengals88

wow Uber is a big name.

how many robots can they sell like these?

how many robots can they sell like these?

Posted on 2/13/25 at 4:12 pm to astonvilla

quote:I can't find any numbers at all. Avride is private, and their blog isn't specific at all. Uber mentioned this in its recent earnings:

how many robots can they sell like these?

quote:

Michael Morton -- Analyst

Hi. Thanks for the questions. I appreciate the new remarks on AVs. If I could follow up on a question -- on a comment that you made earlier in just general business models with AV.

When you talk about securing supply from OEMs, are you speaking about Uber buying cars directly? And then when you're thinking over the long term about potential business models with AVs, could you talk about an agency model versus a merchant model of renting AVs for the day? And then a question we get from investors is, how much of your global mobility business do you see being addressable by autonomous vehicles due to different driver costs in certain markets compared to the AV costs? Thank you so much.

Dara Khosrowshahi -- Chief Executive Officer

Yeah, absolutely, Michael. So in terms of the business model, I think there are gonna be -- there's gonna be a ton of experimentation around the business models. I think early on, we've got a big balance sheet, and we can buy cars. I think eventually, it's gonna turn into the fleet partners that we have essentially buying cars and getting financing from third parties that you see right now with electric vehicles.

A lot of our fleet partners actually are able to finance these EVs, etc.. In the early days, you're not gonna have kind of a financing construct in place and clarity regarding what residual values are for these cars. So I think that will put up some balance sheet risk. Our fleet partners will put up some balance sheet risk over a period of time.

I think that most of the ownership will be a combination of fleet partners. You might see some financial players, kind of infrastructure players, just like they -- there are entities REITs that own hotels, you will have kind of fleet entities as well. And then hopefully, there'll be some kind of individual ownership as well of people, small businesses putting up these cars and these fleets and taking care of the car, sort of small business fleets that, again, we see around the world for ourselves operating an SMB fleet model as well. So there's gonna be a ton of experimentation.

But early on, we will take some balance sheet risk in order to get -- catalyze the industry, so to speak. But ultimately, we think all of it is gonna be financialized. In terms of AV, I think a couple of things in terms of the addressable market. First of all, I think early on -- right now, the cost of AVs don't even come close to the cost of drivers.

So I think the first markets that are gonna be penetrated are gonna depend on regulation, first of all. And again, the regulatory environment is pretty complicated. And second is kind of the revenue per mile in the markets. This would tend to be U.S.

markets or European markets where the revenue per mile is higher and will tend to be in the center of cities. The operational domain for many of these AV deployments is very, very limited and over a period of time is gonna expand. So I think in the next 5 years, the addressable market is gonna be probably in the order of 10% to 15% of the overall marketplace and then gradually is gonna expand over a period of time over the next 15 years or so.

Posted on 2/13/25 at 4:34 pm to bayoubengals88

positive is they sell in US and Europe both wherever this is adapted faster

Posted on 2/13/25 at 6:43 pm to bayoubengals88

If you all want a comp for food delivery robots, read about SERV

1.29b mc, closed at 22.92 a share today

I hold positions in both nbis and SERV. And RR. And TSLA. Big fan of investing in robots

1.29b mc, closed at 22.92 a share today

I hold positions in both nbis and SERV. And RR. And TSLA. Big fan of investing in robots

This post was edited on 2/13/25 at 6:47 pm

Posted on 2/13/25 at 7:13 pm to jefforize

I like em too. Held some SERV before, but too expensive for me now.

If I can generate substantial consistent cash in my Roth, I’ll buy 100 shares.

Currently own 90 RR but thinking of going for quite a bit more tomorrow.

Looks like one hell of a cup and handle, and still a largely unknown stock.

If I can generate substantial consistent cash in my Roth, I’ll buy 100 shares.

Currently own 90 RR but thinking of going for quite a bit more tomorrow.

Looks like one hell of a cup and handle, and still a largely unknown stock.

Popular

Back to top

1

1