- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

BancorpSouth and Cadence merger

Posted on 5/3/21 at 8:36 am

Posted on 5/3/21 at 8:36 am

Only just noticed this, happened a few weeks ago.

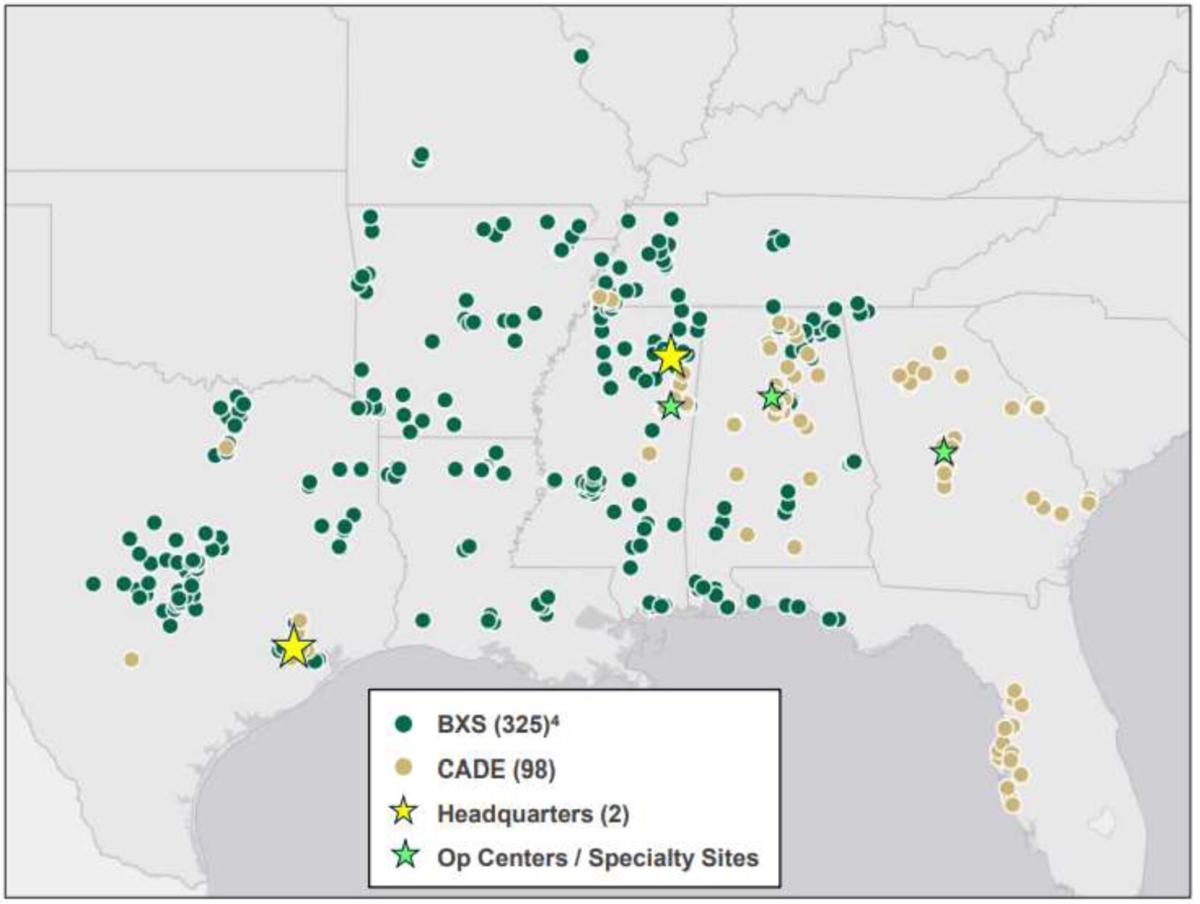

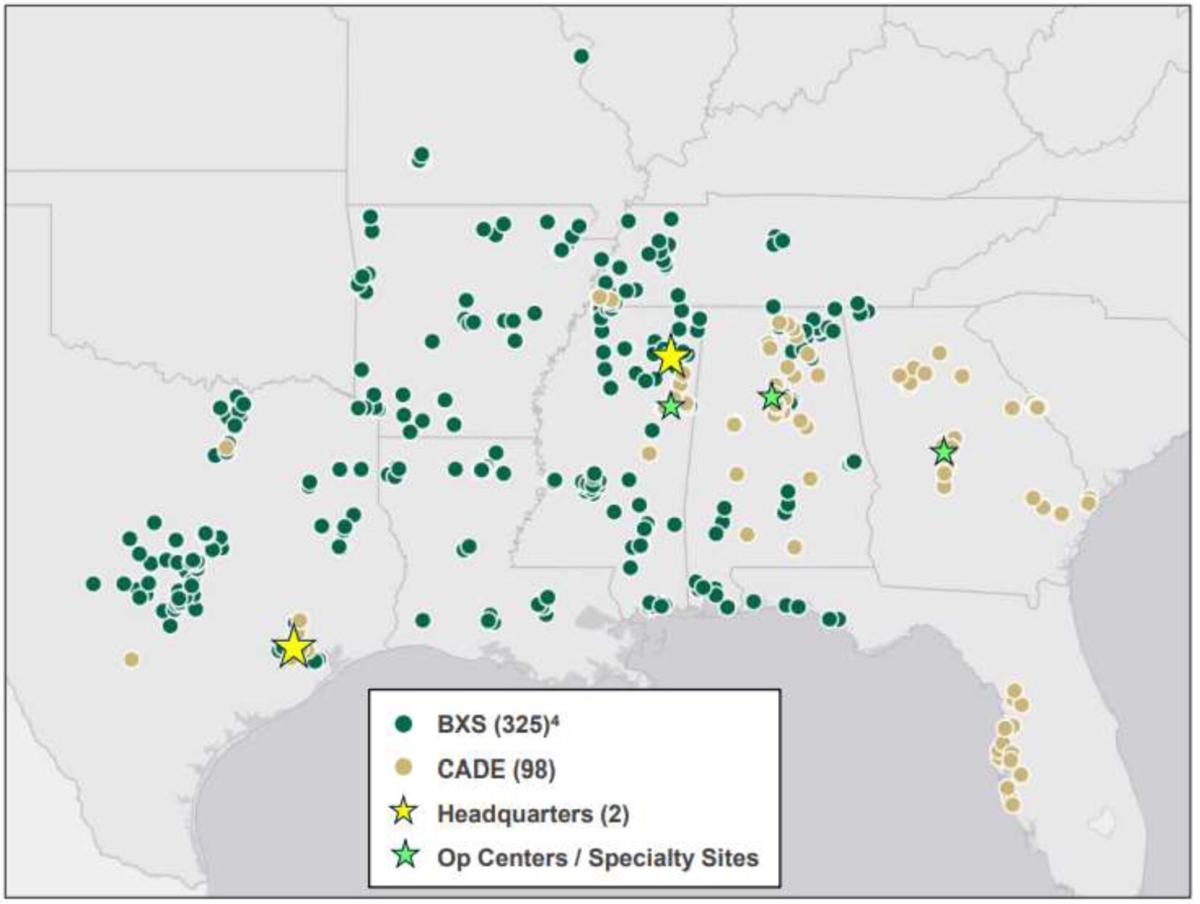

It'll push the combined business over 400 branches in the Southeast. It seems to be being presented as a merger as opposed to an acquisition despite BCS clearly being the larger of the two. If it was a sheer acquisition it would push BCS into new some markets like GA, FL and portions of AL. Funny to note when you look at the new organisations footprint, they've got a clear hole in the New Orleans area. Interesting timing as well given the Iberia/First Tennessee merger last year with a very similar footprint and number of locations.

It'll push the combined business over 400 branches in the Southeast. It seems to be being presented as a merger as opposed to an acquisition despite BCS clearly being the larger of the two. If it was a sheer acquisition it would push BCS into new some markets like GA, FL and portions of AL. Funny to note when you look at the new organisations footprint, they've got a clear hole in the New Orleans area. Interesting timing as well given the Iberia/First Tennessee merger last year with a very similar footprint and number of locations.

Posted on 5/3/21 at 9:23 am to ronnie mo

quote:

It seems to be being presented as a merger as opposed to an acquisition despite BCS clearly being the larger of the two.

They're also adopting the Cadence name

Daily Journal article

quote:

While BancorpSouth will be the surviving entity, its brand and logo will disappear. The combined company will operate as Cadence Bank, with dual headquarters in Tupelo and Houston, Texas.

This post was edited on 5/3/21 at 9:26 am

Posted on 5/3/21 at 9:31 am to SonicAndBareKnuckles

Interesting. Does BancorpSouth sound too regional for a corporation ultimately wanting to expand beyond the south? Looks like they've started to move beyond the traditional south and into metros like St. Louis.

Posted on 5/3/21 at 10:00 am to ronnie mo

quote:

Does BancorpSouth sound too regional for a corporation ultimately wanting to expand beyond the south?

I think that's the idea. At least they'll stick with a decent and recognizable name unlike the BB&T and SunTrust weirdos that threw away all brand recognition only to give themselves the baffling Truist Bank name.

Posted on 5/3/21 at 11:14 am to ronnie mo

quote:

Interesting timing as well given the Iberia/First Tennessee merger last year with a very similar footprint and a number of locations.

The Iberia/First Tenn merger was not about Louisiana at all. In fact, Iberia's Louisiana holdings were a negative in that transaction because of the oil & gas holdings it had on the books. What made Iberia attractive was its North Carolina, South Carolina, Georgia, and more importantly its Florida footprint that it had picked up over the years from the FDIC. First Tenn is going to be significantly cutting back its presence in Louisiana in the years to come.

This post was edited on 5/3/21 at 11:15 am

Posted on 5/3/21 at 12:15 pm to MrLSU

quote:

The Iberia/First Tenn merger was not about Louisiana at all. In fact, Iberia's Louisiana holdings were a negative in that transaction because of the oil & gas holdings it had on the books. What made Iberia attractive was its North Carolina, South Carolina, Georgia, and more importantly its Florida footprint that it had picked up over the years from the FDIC. First Tenn is going to be significantly cutting back its presence in Louisiana in the years to come.

Do you think they'll be closing branches here?

The LA banking sector is tiny now. I couldn't even tell you who is the biggest bank based in the state now that Iberia and even Mid South have been bought out, maybe B1 or Home? MS by comparison has four banks with over 150 branches in its footprint HQ'd there.

This post was edited on 5/3/21 at 12:17 pm

Posted on 5/3/21 at 12:34 pm to ronnie mo

quote:

Do you think they'll be closing branches here?

The LA banking sector is tiny now. I couldn't even tell you who is the biggest bank based in the state now that Iberia and even Mid South have been bought out, maybe B1 or Home? MS by comparison has four banks with over 150 branches in its footprint HQ'd there.

Yes I do see them closing more branches in Louisiana over the next 36 months. Louisiana needs to fix its draconian banking laws to allow more national banks to come in because it has hampered the growth of the state by forcing them to buy existing banks instead of letting companies come in to open up branches.

Posted on 5/3/21 at 12:43 pm to ronnie mo

In Louisiana and these numbers might be off since there has been a lot of bank branch closures the last two years.

Top 10:

Chase 118 offices in 48 cities

Hancock Whitney 116 offices in 56 cities

Capital One 98 offices in 57 cities.

Regions 95 offices in 44 cities

IberiaBank/First Horizon 63 offices in 28 cities

Sabine State Bank 47 offices in 38 cities (Louisiana based)

HomeBank 35 offices in 19 cities (Louisiana based)

BancorpSouth 28 offices in 15 cities

First American Bank 25 offices in 22 cities (Louisiana based)

Red River Bank 23 offices in 11 cities (Louisiana based)

I'll be shocked if those four Louisiana based banks aren't acquired within the next 4 years by Texas or Alabama based banks.

Top 10:

Chase 118 offices in 48 cities

Hancock Whitney 116 offices in 56 cities

Capital One 98 offices in 57 cities.

Regions 95 offices in 44 cities

IberiaBank/First Horizon 63 offices in 28 cities

Sabine State Bank 47 offices in 38 cities (Louisiana based)

HomeBank 35 offices in 19 cities (Louisiana based)

BancorpSouth 28 offices in 15 cities

First American Bank 25 offices in 22 cities (Louisiana based)

Red River Bank 23 offices in 11 cities (Louisiana based)

I'll be shocked if those four Louisiana based banks aren't acquired within the next 4 years by Texas or Alabama based banks.

Posted on 5/3/21 at 12:44 pm to MrLSU

Do you see any of the banks here still as a target for acquisition? Even if just by bigger regional banks as opposed to national names.

Its weird, so many of the big banking players in this country have next to no presence in Louisiana AFAIK. BoA, Wells Fargo, US Bank, PNC, Fifth Third etc. Only really Chase have a footprint here.

Its weird, so many of the big banking players in this country have next to no presence in Louisiana AFAIK. BoA, Wells Fargo, US Bank, PNC, Fifth Third etc. Only really Chase have a footprint here.

Posted on 5/3/21 at 12:50 pm to MrLSU

quote:

In Louisiana and these numbers might be off since there has been a lot of bank branch closures the last two years.

Top 10:

Chase 118 offices in 48 cities

Hancock Whitney 116 offices in 56 cities

Capital One 98 offices in 57 cities.

Regions 95 offices in 44 cities

IberiaBank/First Horizon 63 offices in 28 cities

Sabine State Bank 47 offices in 38 cities (Louisiana based)

HomeBank 35 offices in 19 cities (Louisiana based)

BancorpSouth 28 offices in 15 cities

First American Bank 25 offices in 22 cities (Louisiana based)

Red River Bank 23 offices in 11 cities (Louisiana based)

I'll be shocked if those four Louisiana based banks aren't acquired within the next 4 years by Texas or Alabama based banks.

Yeah I'd agree. I could see the likes of Frost Bank, Simmons, Renasant, Trustmark, Synovus trying to hoover up some of the banks here if the bigger national names aren't interested.

Posted on 5/3/21 at 1:10 pm to ronnie mo

BancorpSouth just recently bought my bank, FNB Bank, based in Scottsboro, AL. So, I guess I will actually be Cadence Bank.

Posted on 5/3/21 at 7:07 pm to ronnie mo

I worked a summer at the Bawcomville branch

Ask me anything

Ask me anything

Posted on 5/3/21 at 7:30 pm to ronnie mo

I like banking w them. But weary of change and hate the name cadence bank. Wish they would just keep BancorpSouth name

Popular

Back to top

5

5